Peculiarities of strategies and strategic planning in large russian companies with state participation

Vaganov D.1

1 Lomonosov Moscow State University, ,

Скачать PDF | Загрузок: 38

Статья в журнале

Global Markets and Financial Engineering ()

Аннотация:

This Article is devoted to reviewing strategic planning practices in Russian companies with state participation. A system of state strategies and guidelines, developed by public authorities and public administration bodies, as to strategic planning is analyzed. With regard to peculiarities of the state as the main owner, business-model and strategy characteristics typical of companies with state participation are distinguished.

Ключевые слова: strategical planning, state-owned companies, large-sized enterprises

Studying the strategic planning process and the peculiarities of strategies in large companies with state participation has a significant relevance in view of decisions of the Government of the Russian Federation to oblige such companies to prepare long-term development programs [1]. In accordance with field-specific guidelines a long-term development program is a program document containing lists of means and certain measures (with indication of volumes and sources of their financing) that would provide timely achievement of strategic aims determined by company development strategies [2]. Taking into account the absence of well-developed strategies in companies with state participation, it is fair to say that the given governmental initiative involves in fact not only the development of strategies, but also the introduction of business-processes for their implementation into company activities [3].

Previously taken attempts of the system implementation of long-term planning practices in the public-corporate sector have not led to a desired result. For increasing the quality of the implementation of “new wave” initiatives it is necessary to take into account the peculiarities of the object and the subject of management and also strong and weak points of previously implemented regulating and controlling actions. This would facilitate the fullest realization of the potential of the decision-making horizon extension in companies with state participation.

To form a system vision of the situation in which these initiatives will be realized, special attention should be paid to the description of the system of state strategies being a basis for developing long-term documents in the public-corporate sector.

At the present time a huge number of strategies of different levels are approved in the Russian Federation:

• All-federal (doctrines, strategies, policies, road maps)

• Industrial (strategies and their conceptions, government programs, FTPs (Federal Target Programs))

• Regional (RTPs, strategies of region development, programs)

• Municipal (urban development strategies, long-term development plans, long-term city development plans)

They have a medium degree of interrelatedness within one class (for instance, federal) and a low correlation between levels (between federal and regional strategies as well). This interrelatedness is provided either by concentration of functions of their developer in one public authority or by one and the same wave of political environment. It also should be noted that the state strategies do not have any common horizon of planning. Therewith, the most useable time periods are the following:

• Boundaries of the current political cycle (until 2018, for instance [4])

• From the moment of approval to 2015 (for example, the “old” wave of strategies which was developed mostly in 2007-2208 [5])

• From the moment of approval to 2020 (development documents (or, at least, the documents of the beginning of development) of 2010, 10-year long horizon is chosen, for instance [6])

• From the moment of approval to 2030 (the development began in 2010, 20-year long horizon is chosen) [7], [8]

• Other variants (until 2017 [9], 2022 [10], 2025 [11], 2035 [12], etc.)

A fundamental choice of one or another horizon of planning is poorly justified and can differ as inside the selection of related sectors (for instance, oil and gas production in a shelf area and shipbuilding) and strategies of one and the same type (state programs).

The strategies of the public-corporate sector (i.e. joint-stock companies with state participation, government corporations and state-owned companies, FSUEs (*Federal State Unitary Enterprises)) are, for the most part, not developed.

Therewith, it is noteworthy that at the government level there are documents allowing to implement a unified strategic planning; thus, a long-term forecast of social and economic development until 2030 is prepared annually, mid-term scenario conditions are actualized 2-3 times a year; in January, 2014, a long-term forecast of scientific and technological development of the Russian Federation until 2030 was approved [13].

The state has been making more or less systematic attempts to streamline the strategic planning both at the level of public authorities, and at the corporate level of state-owned companies.

In such a way, the project of the Federal Law “On State Strategic Planning” [14] assumes structuring of the state strategies and programs in accordance with levels and types, and also stipulates the procedure of their preparation and coherence.

Attempts to streamline the strategic planning are also made at the level of separate federal executive authorities (FEA). Thus, Minpromenergo’s initiatives concerning a raft of sectoral strategies (which are fairly well adjusted for one another) to be formed in 2004-08 and generally oriented at one time horizon (2015 with a perspective up to 2020) should be noted [15].

Rosimushchestvo and The Ministry of Economic Development can be considered to play a special role in coordination of the strategic planning. From the beginning of the 2000s they have been conducting several “waves” of development of long-term planning processes, their introduction into the practice of state-owned companies and realization of strategies. Strong points of these initiatives are the following:

• Clear connection with the actual state of the state property management system (including the maturity of business-processes);

• Taking into account (at least, partial) of the role of large companies with state participation as instruments for achieving the multiplicative effect for the economy;

• Inner consistency of each specific procedure.

However, a considerable amount of weak points of the developed methods and administrative actions has significantly leveled down the results of the taken measures. The following drawbacks can be pointed out in the conducted work:

• Poor time coordination of measures in relation to one another;

• Lack of orientation on sequential solution of the task (from the upper level down to the following ones), a tendency to address separate problems at the level of functional areas until a consensus on the backbone issues is achieved;

• Intersection of areas which are to be regulated by guidelines/recommended practices and the related inconsistency of resulting documents;

• Failure to create targeted recommendations/guidelines with due regard for the size of business of companies with state participation;

• Superfluity of public authorities regulating the implementation of the proposed measures in the absence of well-established communications between them and complexity in intercoordination of actions;

• Poor coordination of the planning horizon which resulted in simultaneous introduction of notions “strategy”, “program”, “long-term development program”, “road map”, “mid-term strategy”, “mid-term plan of program implementation”, etc.

• Procedural ill-preparedness of government bodies for work with the long-term planning horizon together with the necessity to fulfill previously made decisions preconditioned a “creative approach” to the formation of the hierarchy of strategic and mid-term documents.

The realization of the initiatives on implementation of the strategic planning practices in the public-corporate sector has resulted in the following:

• Required strategies, programs and functional policies are officially prepared;

• Allocation of company resources, introduction of the processes for their actualization and for the preparation of reports regarding the implementation have been successfully conducted;

• Official connection with the national strategies which served as grounds for directives given to executive and non-executive authorities governing companies with state participation has been provided;

• Strategies are not always implemented. Therewith, the complexity of the review procedure prevents their actualization;

• Internal ambiguity/conflict of managerial decisions, indefinite status of the document called “strategy” due to the presence of other long-term and medium-term programs and plans approved by the board of directors;

• Consideration of lower-level management problems (such as approval of local statutory documents and functional plans, for instance) by the board of directors.

Before analyzing the development strategies of state-owned companies it is reasonable to touch on the peculiarities of the State as the main owner since it significantly influences on goal-setting, and on business-processes of strategy realization management.

In this case the state and public authorities (as representatives of its interests) act as the regulator of activities and as the company’s shareholder.

Absence of a balanced tree of objectives results in fragmentation of the state’s position which becomes dependent on the particular public authority that represents its interests in a certain situation. Theoretically, there can be a situation of conflict of objectives set forth by different state representatives functioning as owners of companies with state participation. Moreover, such situations often occur in practice. This conflict results in impossibility to maximize the added value derived from management solutions made and increases the benefit loss.

It should be emphasized that the structure of public authorities is optimized and adjusted for the implementation of regulatory functions, so the chain of decision-making on managing business-units becomes more complicated, and its duration increases. This, in its turn, increases formalization of the process, thus making business document support more important in the interaction of the state and companies with state participation. Considerable amounts of the document flow (which will take some time for public authorities (regulators) to make sense of) become more difficult to manage, making the interaction with the state-owner more resource-consuming than with other types of shareholders.

A specific characteristics of the state as a shareholder is that it is little interested in the increase of the companies’ cost unless it has plans to sell the assets in the mid-run (inside the budgetary/electoral cycle). Consequently, top-management of state-owned companies also has little motivation to increase the shareholder value unless certain provisions are made for incentive compensations for such increases in the motivation system of those companies. Rosimushchestvo has developed guidelines on formation of the upper level KPI list (Key Performance Indicator) which include TSR (total shareholder return) as a mandatory factor for public JSCs with state participation. The developed guidelines partially eliminate the problem of goal-setting in terms of business costs. However, the problem of setting a particular quantitative target value arises in connection with this KPI. Given the lack of the state’s interest in increasing the value of net assets that belong to it and are located on its territory, it is fair to say that the solution of this problem reduces itself to benchmarking and planning made with regard for actual achievements.

It also should be noted that state has a significant influence on criteria and the procedure of making decisions on the implementation of investment projects, profitable from political or social perspective, but risky enough from the economic point of view. Functioning of companies with state participation (especially those in the fuel and energy complex) in the capacity of an economic instrument for carrying out the state-owner’s foreign policy and in the capacity of an agent for financing and realization of social programs is not specific to Russia. It is also a common practice in many foreign national oil companies [17]. State’s decisions on realization of investment projects by such companies are compulsory, but in some cases they bear risks for the sustainable development of these companies. Often such projects contradict internal orientations as for investment profitability and payback periods.

Before analyzing how the strategies of companies with state participation are formalized, let us distinguish the types of strategies from the viewpoint of the information they reflect:

• More or less detailed set of measures aimed to achieve long-terms goals of the company.

• A set of decision-making principles facilitating the achievement of long-term goals.

• A description of one or several consecutive states of the company within the long-term time horizon.

From the perspective of cardinality of the review of strategies, corporate models of strategy implementation can be classified as follows:

• Consistent implementation of a strategy within the frames of its horizon of planning, review of the strategy in case any substantial changes occur in the current or perspective environment

• Cardinal review of the strategy with regard to internal and external changes, substantial or not from the perspective of the main business; implementation of the reviewed principles for the period before the next similar change.

The choices of the long-term behavior model and the type of the document called “strategy” are determined by the dynamics and intensity of changes on the markets on which the company acts, by the owner type and management psychology.

In terms of the planning horizons, several approaches can be pointed out:

• Orientation on the planning horizon of the higher-level strategy.

• Determination of an individual horizon on the basis of the lifespan of a typical investment project in the industry in which the company has its business.

By nature, the strategies of Russian companies with state participation are documents which describe planned measures for achievement of strategic goals and which can be cardinally reviewed if changes that are substantial for some types of stakeholders occur. There seem to be no consensus in choosing the strategic planning horizon.

Although strategic planning attracts a lot of attention on the part of top managers, not all companies with state participation, even those from the Top 20 of the largest ones, have official approved strategies. The approved strategies are of different quality and intended for meeting different objectives.

It is necessary to point out common features:

• Orientation on official fulfillment of the upper level instructions. The strategies of the companies with state participation are full of references to higher-level state strategies. Therewith, it should be noted that the references do not necessarily reflect all essential moments of those strategies. The strategies developed only to fulfill the instructions of the Government/the President of the Russian Federation are lengthier and, consequently, leave more room for interpretations. So, there is no need in corrections regarding the reports on fulfillment;

• A reflection of the role of the strategy as an integration document unifying several fields of the company’s activities. Strategic Development Program of AK Transneft, OJSC, which was developed for the period until 2020 can serve as a “polar” example of this [18].

• Funds of federal/regional budget and public foundations are considered as possible resources for financing of the developed initiatives. This situation is typical of all companies regardless their financial standing.

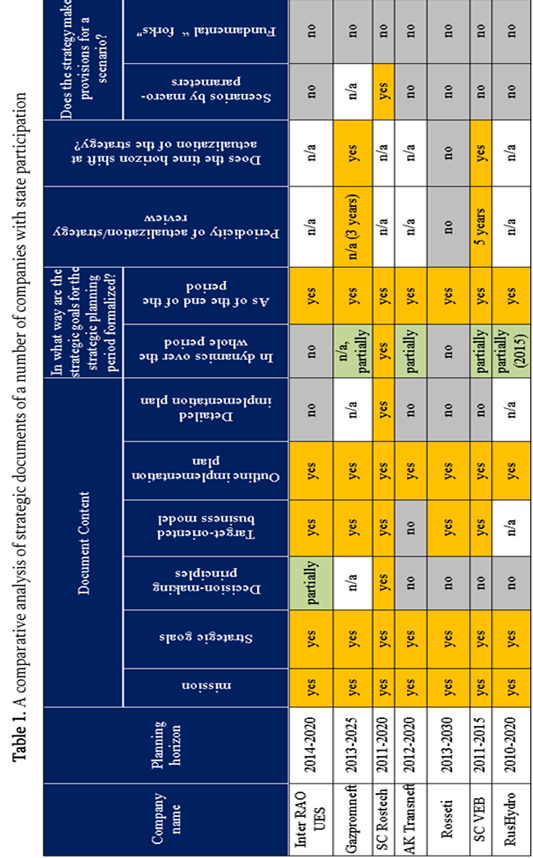

Therewith, all the strategies contain a mission, strategic goals, a target-oriented business model, and an outline plan of implementation as officially required. The strategic goals are expressed quantitatively for the end of the upcoming reporting period. The strategies of state-owned companies leave no room for “fork” in fundamental decisions.

Below are the differences in the strategies of the companies with state participation:

• The planning horizon – the most “popular” years are 2018, 2020 and 2030; therewith, grounds for choosing one or another horizon are also different and based on different methodological approaches.

• Abundance of quantitative indicators. Some documents contain quantitatively expressed goals for each of the company’s business activities (or, at least, for the main ones) while in other strategies only higher-level goals are expressed quantitatively, although their dynamics in the target period may not be disclosed.

• The relation to the analysis, forecast and goal-setting. Due to the poor methodological framework used by the producers of documents, and also to multiple abridgements of the finished documents before their approval for market goals, standard blocks of the document can contain absolutely different information. Thus, there are cases when the detalization of goals is accompanied by the description of the current portfolio, and the company’s forecast performance is considered goal-oriented.

In order to analyze the structure/standard content of the state-owned companies’ strategies, the analysis of those strategies which are available to the public has been performed. The analyzed list included INTER RAO UES, OJSC [19], Gazprom Neft, OJSC [20], SC Rostech [21], AK Transneft, OJSC [18], Rosseti, OJSC [22], SC VEB [23] and RusHydro, OJSC [25]. The results are presented in Table 1 (source – compiled by author).

When considering business-models of companies with state participation, it is necessary to identify several peculiarities.

Firstly, consolidation of the company’s standing occurs owing to the formation of a holding structure with other companies with state participation. It should be noted that an intensive creation of integrated holding structures with predominant (in general, 100 %) state participation was, along with privatization, the main tendency in managing the state-owned companies in the Russian Federation in the 2000s. The reasons for this are the following:

• A great number of companies with direct state participation. Given the size of such companies and scantiness of resources allocated by the state for managing thereof, the quality of management substantially decreases. Multiple decrease of the management objects (when most of responsibility for the results of activities rests with the managers of parent companies of holdings) allows to resolve the above problems partially.

• Multidirectional character of activities of companies with state participation which operate within the same production chain. Creating the integrated structures means reconstruction of the production cooperation and an increase of the competitive ability of the chain end product in this case.

• Competition between companies with state participation which operate on the same market, and especially the competition in the international business activities. At the same time, the size of such market actors prevented them from competing with other companies in developing and launching new products on the market because of the high capital intensity of such endeavors. The continuing competition not followed by product innovations led to intensification of the price competition which, in its turn, decreased total “consolidated” income of the portfolio of such state assets. Weak mechanisms of supra-corporate coordination conditioned the consolidation of the companies into a holding with delegation of authorities to conduct a unified marketing policy to the parent company. Vivid examples of such holdings are OSK, OJSC; OAK, OJSC; ODK, OJSC; Russian Helicopters, OJSC [25].

• Enhancement of administrative and political influence of the management of companies with state participation due to the consolidation of social obligations. Seeing political influence as a resource, top-managers of companies with state participation competed for obtaining state resources (both directly, through FTPs/FTIPs (*Federal Targeted Investment Program), and indirectly, through obtaining tax benefits, compensation of interest payments on external debt financing, etc.).

The above tendency resulted in the appearance of the finite amount of quite large companies with state participation whose integrated assets have constituted a sizeable share among all economic actors of this industry in the Russian Federation.

Holding companies with state participation which were formed on the basis of restructured ministries can be considered as a separate type. Several companies can be named as examples of this type: Gazprom, OJSC; Russian Railways, OJSC; SC Rosatom. These companies not only do business in the respective industries, but de-jure (as in case with state corporations and state-owned companies) or de facto run those industries. A distinctive feature of such companies is a clear declaring of non-financial goals as essential in their activities or flexible “manoeuvring”/switching between the tree of business objectives and the tree of state objectives when necessary (grounding for initiation of an investment project, extension of access to resources, management efficiency assessments, political environment, etc.).

It should be noted that the holding companies established through redistribution of the state’s shares in joint-stock companies’ charter capitals often implement the strategy of maximizing an assets synergy placed under their management.

The most important component of the business-model of companies with state participation is the use of the state’s resources in one form or another as an instrument for development. In case of the military-industrial complex companies it can be attributed to the state’s being the main consumer of the produced goods and rendered services (here, the planned value of the defense procurement is the most important variable determining the enterprises’ investment policy). However, it should be noted that direct and indirect state financing is also used by companies which operate in industries providing profitability sufficient for investments. Here the oil-and-gas companies actively lobbying the inclusion of a part of the investment outlay (of the infrastructural character, for instance) into the Russian Federation’s state programs and composing their federal target programs should be noted. Similar work is performed at the level of federal constituent entities when regional target programs include construction and reconstruction of objects being a part of the production chain of companies with state participation. Support of short-tem stability can be another goal of the state financing use.

But let us not forget that investments in the charter capital of companies with state participation which operate in the tax-burdened economic sectors are profitable for the state as the owner, given that not only the dividend flow but also the tax flow is taken into account in evaluating the prospective return. In particular, the investments in the oil and gas sector possess this feature. At present, this criterion is not widely used in the assessment of the economic attractiveness of such state-funded measures, but the investment foundations, established with the money of state funds (National Welfare Fund, RDIF (*Russian Direct Investment Fund)), take into account the prospective tax flows in evaluating the projects proposed for co-investment.

However, this idea seems to be “devaluated” in terms of maximizing the total effect for the state as a shareholder when the development of prospective business-models for a company with state participation involves using the initiatives on more extensive application of tax benefits to the activities of such a company. Therewith, this is one of the cornerstones as to the oil and gas companies with state participation which receive MET benefits (*Mineral Extraction Tax), export duties at the federal level, and also income tax and property tax benefits at the regional level.

Interaction with the public authorities for defending or, at least, expressing their position is significantly less resource-intensive for the companies with state participation than for other market actors. In some cases large companies with state participation even de facto act as subjects of a legislative initiative. Close nature of cooperation with public authorities gives companies with state participation more opportunities to influence the activities of collegial advisory bodies under federal executive authorities/regional public authorities. The above-said peculiarities enable a mid-term mitigation of regulatory risks borne by large companies with state participation. Some companies develop this competitive advantage, making it the basis of their business-model.

It is worth mentioning that the holding companies with state participation which have resources for investments often choose diversification as a portfolio development strategy. Aside from minimization of risks of market environment changes, this has a fundamental basis arising due to existence of the electoral cycle which is most important for the state. With that, the degree of influence of this cycle on the strategy of companies with state participation can be evaluated by comparing the electoral cycle duration and the mean duration of the investment cycle in the respective industry.

The point concerning the connection of the electoral cycle with the strategic planning horizon is indirectly corroborated by methodological documents on development of the strategies/long-term development programs of companies with state participation. The planning horizon recommended by public authorities in guidelines and best practices to companies with state participation (3-5 years) coincides with the “effective” electoral cycle in the Russian Federation (The period during which the elected officials discharge their functions in accordance with the results of elections is 4-6 years less one year for election campaigning (since the decisions of public authorities become more timeserving and populist to the detriment of long-term social interests during the pre-election, last year of their being in authority).

Given that the processes of integration, diversification, searching for synergy and maximization of the total effect for the state are the imperatives of the strategies of companies with state participation, it should be expected that using the instruments for quantitative assessment of the multiplicative effect of companies’ activities in the segments in which those companies operate and in the allied industries will find wide application in the strategic planning practices. However, at the present time the instruments for quantitatively assessing the multiplicative effect of the decisions made are rarely used, being replaced by different-scale expert assessments (through achievement of consensus in a randomly chosen expert community).

In the public-corporate sector, decisions on prioritization of certain activity segments in a diversified holding’s portfolio are made with regard to the current environmental conditions and partially on the basis of quantitative analysis. For coordinating strategic plans as for different activity segments, the instruments for internal communications between separate groups of developers of segment parts are applied. Therewith, a wide use of quantitative procedures both at the corporate level and at the national level is limited by the lack of “omnipresent” common scenario conditions. It should be noted here that such a time-consuming and resource-intensive process as bringing segment/functional strategic documents into compliance with one another (which is indispensable when it comes to preparing a company-wide strategic document) takes a long time to accomplish, and often becomes a source of a corporate conflict at large companies.

The following problems related to using quantitative procedures of long-term forecasting and strategic planning in the public-corporate sector should be pointed out:

• Underestimation of the complexity of the scenario modeling by the participants – they often reduce the process to varying macro-parameters and calculation of sensitivity of the main internal parameters, reflecting the financial result, to those changes. Application of the real options method and modeling of multiple-choice situations in making “internal” decisions are reduced to assessing particular investment projects.

• Development of the corporate financial model by means of “direct summation” of models of separate components of the investment portfolio. Therewith, synergy is taken into account only at the level of financial flows.

• Use of the non-quantitative format of the technological foresight. The important thing to be noted here is that using the technological foresight per se indicates greater maturity.

Being an aspect of business-models of companies with state participation, the maturity of business-processes as such is greatly influenced by the state as the main owner. The crucial factors here are the following:

• The intensity of communications with public authorities which entails certain requirements to formalization of the process and the amount of reporting. The amount of reports which in this case are made for an external user does not have a significant influence on the quality of the process management.

• Constant attempts to re-engineer the business-processes in several functional directions upon the initiative of the state as the main owner. With that, those initiatives are often implemented by a FEA (*federal executive authority)-source as an initiator with excessive detalization thereof and regarding no specific features of the industry and also the best practices.

• Overflow of the KPI (*Key Performance Indicators) system with indicators regardless their significance for the company’s business. The initiatives on changes in the business-processes of companies with state participation are developed by a FEA-functional leader without presenting the business-model in its entirety. The work of a FEA-officer superintending the company does not make much difference in the process of interdepartmental consideration of these initiatives (if such considerations are held at all), and is confined only to conveying the respective instructions to the company’s managers. Therewith, because of the current popularity of the KPI as a management instrument (and due to a number of other reasons), the results of the implementation of each initiative need to be reflected in the top-management KPI system.

The specified factors have the following effects on the strategic planning process in companies with state participation:

• The processes of preparing reports become crucial for preserving stability of the top-management team in the conditions of constant official control. In order to present “better” reports, the companies “refine” their corporate strategic documents and eliminate the details and particularities;

• The development of strategic documents involves a long chain of internal and external coordination;

• The documents are furnished with references to all the guidelines/recommendations of public authorities that are known (or convenient) to the team developing the documentation. However, inspections on the subject of compliance between companies’ strategies and the system of the state strategic documents are conducted poorly because the latter is quite imbalanced itself, and also because of the lack of control in the strategic planning process (such inspections are, as a rule, limited to superficial harmonization, but the process of performing such inspections is not formalized and is of sporadic nature);

• Process-orientation of the company’s strategic planning – “process for the sake of process”. Development of the document “strategy” becomes a goal while practical realization of the initiatives set out in it may not begin at all. At the same time, the responsibility for the achievement of the target-oriented result specified in the strategy diffuses up to the point of vanishing.

At the same time, favorable role of the “state micro-management” for companies with highly passive internal environment should be noted. Regulative actions of FEA become one of the main sources of innovations (of the organizational nature, mostly) for companies with state participation which become the core of crystallization of the bottom-up initiatives in the organizational environment.

The analysis of strategies and strategic planning in companies with state participation has shown that the change of the state’s approaches should be based on several higher-level considerations which have been reflected in the State Program “Management of Federal Property” [4] and, as regards the fuel and energy complex, in the project “Energy Strategy of the Russian Federation for the period up to 2035” [26]:

• Management of the complex of the state assets as a portfolio;

• Increase in efficiency (in its broadest sense – with regard to the functions imposed on the company by the state and its role in the portfolio) of realization of the target function at companies with state participation;

• Maximization of the useful effects for the economy which result from the activities of companies with state participation (dividends, taxes, social effect, multiplicative effect for the related industries).

Unification of the scenario conditions for forecasting market environment and strategic planning can become the first important step to implementation of the portfolio approach [13], [27], [28].

As regards the realization of the target function of state-owned companies, it is important to keep in mind that the criteria of financial and economic efficiency are not the only ones used in formation of the company’s investment portfolio. It makes sense to introduce a categorization of the investment projects which is based on purposes of their realization. According to this criterion they can be classified in the following way:

• Development projects aimed at maximization of the shareholder value;

• “Special” projects aimed at achieving strategic goals of the state as the main owner and at maximizing the shareholder value (or utility) of the portfolio of the state assets.

In general, such processes as the tendency to constant improvement of the quality of the strategic planning processes at companies with state participation, extension of the planning horizon to the period fundamentally determined by the industry specifics, and also attention to the problem of strategic planning in the public-corporate sector at the level of managers of public authorities testify to the fact that gradual improvement of the situation in this area can be expected in the near future. A dialog between the scientific-expert society and regulators which is based on communication platforms of the collegial and advisory bodies also facilitates the solution of the specified problem. There is every likelihood that this dialog will help to overcome the problems which arise, first of all, in the process of developing the methodological component of the system of strategy implementation management at the state-owned companies.

Страница обновлена: 23.02.2026 в 12:26:33

Download PDF | Downloads: 38

Peculiarities of strategies and strategic planning in large russian companies with state participation

Vaganov D.Journal paper

Global Markets and Financial Engineering

Abstract:

This Article is devoted to reviewing strategic planning practices in Russian companies with state participation. A system of state strategies and guidelines, developed by public authorities and public administration bodies, as to strategic planning is analyzed. With regard to peculiarities of the state as the main owner, business-model and strategy characteristics typical of companies with state participation are distinguished.

Keywords: rating, rating agency, scale correlation, regulator