The analysis of the shifts in prevalence of the banking and market components on the Russian financial market

Khestanov S...1,2

1 The Russian Presidential Academy of National Economy and Public Administration, ,

2 Brokerage house “OTKRYTIE”, ,

Скачать PDF | Загрузок: 20

Статья в журнале

Global Markets and Financial Engineering ()

Аннотация:

World’s financial systems of different countries are, in most cases, characterised by a combination of two factors – prevalence of the banking capital (banking system) and the capital attracted into the market (market system). The goal of the present study is to study the shifts in prevalence of the banking and market components on the Russian market. It has been concluded that the development of the market model of the financial market prevails at rapid economic growth rates, while in case of decreasing economic growth rates, major banks begin to play the key role. The study results imply that in the nearest year or two, the tendency to increase of the banks’ role is most likely to preserve.

Ключевые слова: Russian financial market, banking capital, market capital

Although financial systems are diverse, they all may be reduced to two main types – the ones with prevailing banking capital (sometimes called “banking system”) and the ones with market capital prevalence (i.e. the capital that has been attracted into the market; sometimes this financial system is called “market system”). The USA is a vivid example of the second type, while Germany – of the first type. Naturally, any financial system of any country in the world includes both components, only in different proportions. Given that capital may be attracted from abroad (by crediting and listing on foreign stock markets), the analysis truly becomes not an easy task. Nevertheless, for the purposes of this article it will be sufficient to consider only the shifts in prevalence of the banking and market components on the Russian financial market, while all other aspects will be excluded from the analysis.

The Russian capital of large enterprises, unlike that of similar Western companies, has not been attracted in result of IPO, it has appeared in result of voucher privatisation that took place during the 1990-s. The privatisation process itself that was performed through the so-called loans-for-share auctions has been repeatedly subjected to harsh criticism (informed criticism, to some extent). However, it has solved the tasks of replacing the socialist ownership with private ownership. In many industries, the share of state’s participation in the capital (now as a shareholder) of strategically important enterprises is still high, but the massive privatization has formed a satisfactory developed stock market. By the moment of exchange trade establishment in Russia, IT-technologies in the sphere of Internet development and end-customer computerisation had been already developed and, therefore, the market infrastructure was forming with account of the best foreign practices. Thus, classical advantage of catching-up development has fulfilled. In terms of the technology level (and we are speaking exactly about technology, not about market liquidity or capitalisation…), DMA (direct market access), Russian market looks quite advanced.

It is notable that Russian stock exchange market has reached the end of the Asian economic crisis of 1997-98 (the time the world economy began recovering) with an already formed infrastructure: the presence of DMA, appearance of automated systems of accounting brokers, depositees, registrars and exchange markets themselves, traded securities became uncertificated ("paperless"). Certain large-sized enterprises have entered the external markets – a listing has been conducted on foreign platforms of trade and depositary receipts. Many foreign investors preferred to buy Russian securities on foreign stock markets, i.e. in customary legal environment.

As soon as the post-crisis economic upswing increased the prices on raw material (especially, in the petroleum sector), Russian stock exchange market has come into notice of the investors, causing a long-term (1998-2009, to be precise) growth of Russian stock exchange market, including the growth of capitalisation, number of participants and, to a much lesser degree, the number of issuers.

The popularity of the stock market has been promoted by a considerable growth of quotations (and, consequently, a considerable profitability of the “buy-and-run” strategy) and by “national IPOs” conducted with a great state support (these were, actually, “national SPOs”; however, the name IPO has caught on and become customary).

The coming of major, mostly foreign investors (some of them were de facto Russian, preferring to invest in Russia from more legally favourable jurisdictions) has moved capitalisation up, the coming of small-time speculators has increased liquidity. A combination of high capitalisation and good liquidity of the shares has prompted many enterprises to use shares as a pledge subject in obtaining bank credits. At that, the preference was given to western banks due to the low rate and long-standing tendency of rouble strengthening (1998–2008). When income growth rates exceeded the interest rate, this strategy worked nicely.

But after the acute phase of the economic crises began in 2008, this very strategy almost caused a large-scale wave of defaults and bankruptcies. The downturn of petroleum prices caused both the decrease of export incomes and great capital outflow, leading to a sharp depreciation. Capitalisation of many companies dropped 3-5 times. The hypothecary value declined, and many banks (especially, the foreign ones!) demanded additional loan securities. The threat of massive margin calls became credible.

When it became clear that market mechanisms would fail, the government involved (the end of 2008 – beginning of 2009). The Central Bank of The Russian Federation unfolded the programme of unsecured lending of the banking industry, Bank for Development and Foreign Economic Affairs performed massive cornering of the market. Many strategically important companies received state support (in the form of government contracts and various state benefits). The impending catastrophe was avoided. However, this “salvation” resulted in banks’ becoming prevalent over the stock exchange market (not only Russian!).

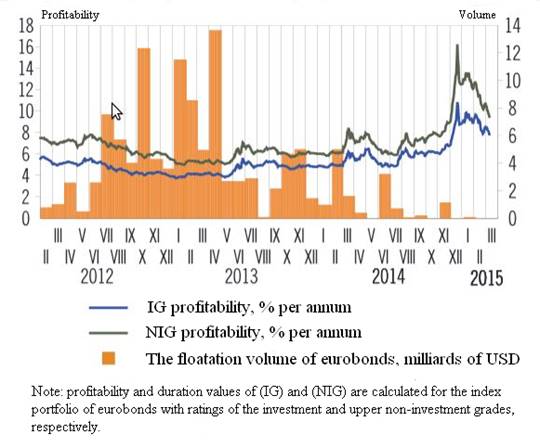

A particular increase of the banks’ role occurred in spring of 2014. Following recent geopolitical events, most Russian companies, with the exception of a limited number of large banks, lost access to the external debt market. The profits of both corporate and state shares increased significantly.

Figure 1. The effective yield and the floatation volume of eurobonds of Russian corporate borrowers.

The Source: cbr.ru

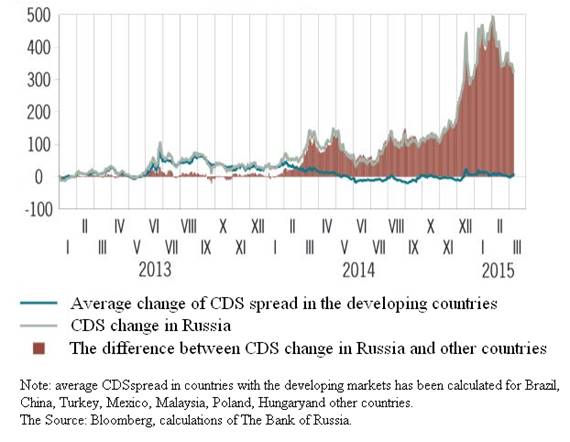

The risk premium increased, thus, making receipt of a loan even less available.

Figure 2. The change of risk premium in Russia and in the countries with developing markets since 01.01.2013.

The Source: cbr.ru

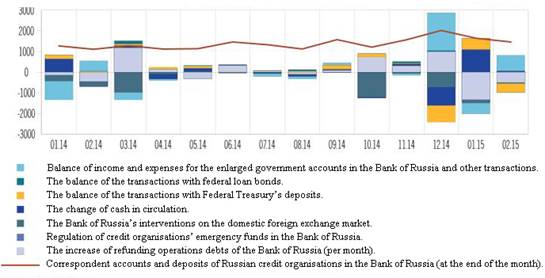

The Central Bank of the Russian Federation responded to this with strong growth of the liquidity provision to commercial banks, which partially compensated the absence of the access to external debt market.

(The Bank of Russia Report on the monetary policy № 1 March, 2015)

Figure 3. Liquidity dynamics of the banking sector.

The Source: cbr.ru

However, there was a blessing in disguise in replacing the external loans with the internal ones – lesser dependence on the external creditors. The immunity of the financial sector to various sanctions increases.

The decreasing supply of liquidity has made banks turn to such an instrument as currency repo. First, when this instrument was introduced into the market, it was not in demand, but, however, starting from December, 2014, it became much more popular. By March, 2015, the volumes had reached 18 milliard USD for repos with maturity date of 12 months, and 9 milliard USD for repos with maturity date of 28 days. Due to a considerably increased demand, the Central Bank had to raise the rate in order to cool down the banks' demand a bit.

An extended use of such an instrument as currency repo has both advantages and disadvantages. The main advantage in comparison to simple sale of currency is the absence of the monetary base contraction. The disadvantage lies in possible recurrence of the Japanese scenario of the beginning of the 1990-s, when the Central Bank had to extend the loan terms of the core banks on and on to avoid their bankruptcy and, thus, suspended “bad assets” on the banks’ balance sheets.

As of March, 2015, the use of currency repo seems to be reasonable enough (the amount of the concluded transactions is not large). Currency repo use itself resembles a certain specific form of quantitative easing. As an unorthodox crisis response measure the use of this mechanism (given that this use will be reasonably restricted) can be only beneficial, at least, until re-accession to external debt markets.

Summarising the above-said, we come to a conclusion that prevalence of the market model of the financial market is typical of rapidly growing economies (i.e. of the phase of growth of the economic cycle), while at decreasing growth rates (especially, in the downturn phase of the economic cycle), major banks (especially, the ones with the large share of government in the capital) begin to play the leading role. Taking into account the period of mid-term economic cycles (Juglar cycle) – 7-12 years – we can assume that in the nearest one or two years, the tendency to growing importance of the banks is likely to preserve.

Страница обновлена: 20.02.2026 в 11:41:32

Download PDF | Downloads: 20

.

. ....Journal paper

Global Markets and Financial Engineering

Abstract:

.

Keywords: .