The ways of developing the customer base of a bank in the current conditions of global financial integration

Imambayeva R...1

1 Almaty Management University, ,

Скачать PDF | Загрузок: 50

Статья в журнале

Global Markets and Financial Engineering ()

Аннотация:

In the conditions of international economic integration, the banking sphere of The Republic of Kazakhstan becomes more and more attractive for foreign financial structures. New market players are attracted by a higher margin in comparison to the markets of the developed countries. Eventually it leads to a competition strengthening and changes in the market structure.

The article is dedicated to studying progressive instruments for forming and retaining client bases by banks for the purpose of determining the prospects of maintenance of competitive advantages over foreign companies.

The study has resulted in the creation of a system of instruments of an efficient customer-centric strategy including not only the newest information technologies, but also the technologies of personal interaction.

Ключевые слова: global integration, customer base of a bank

General globalization, the world market formation, intensive development of the information technology, free circulation of resources, goods, information and capital are becoming the main features of the current economic environment. These trends contribute to the bank capital consolidation, reduction of the share of the traditional banking operations in favor of the increase of the new ones that meet customer requirements which have significantly changed recently.

The developing market of banking services in the CIS countries provides quite a high margin compared to the markets of the developed countries and, therefore, it is very attractive to Western financial institutions. The appearance of Western players in the banking sector of Kazakhstan leads to increased market concentration, and, as a consequence, to the increase of competitive pressures.

At the beginning of 2014, the banking sector of Kazakhstan was represented by 38 banks 17 of which were with foreign participation, including 14 subsidiary banks (Fig. 1).

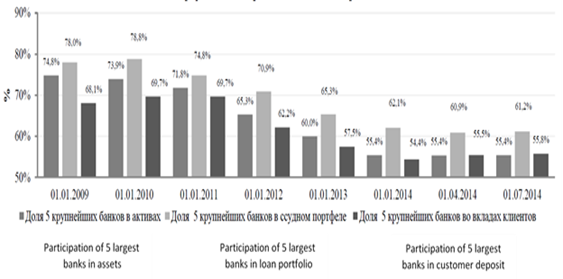

Figure 1. Concentration of banking capital in the Republic of Kazakhstan

(source - compiled by the author)

In the period from 2009 to 2014, the dynamics of the concentration of banking capital in the Republic of Kazakhstan was characterized by reduction of the largest banks’ share in total assets by 19.4%, in the loan portfolio - by 16.8% and in the customers’ deposits - by 12.3% [1].

In our opinion, in the near future, upon the accession of Kazakhstan to the World Trade Organization (WTO), there will be further changes in the financial market of the Republic, because the WTO member countries are obliged to adopt liberal economic policies that will maximize the enhancement of competition and accelerated growth of the member states’ economies.

Under these circumstances, Kazakhstan’s banks face a serious challenge to remain competitive and survive in harsh economic realities. Obviously, in order to achieve these objectives, it is necessary to gain traction and ensure a higher level of professionalism in management.

Competition enhancement of increasingly requires the use of tools that can form and maintain competitive strengths of commercial banks in the highly concentrated and rapidly growing markets. In this regard, most commercial banks nowadays face the problem of finding ways of more efficient banking, new organizational structures, methods of work with customers, quality improvement, as well as the problems of the active use of strategic management principles, the necessity to create a development strategy and to use modern tools for its successful implementation, to perform an effective marketing and to strengthen the work in order to enhance the customer base.

The key to solving this kind of problems consists in a scientific approach to the study of the behavior of the domestic financial markets, identification of the key tendencies and development peculiarities of banking services for the purpose of determining the prospects of banks in maintaining competitive advantages over foreign companies.

As is known, the specifics of banking lie in the concentration of financial resources with their subsequent redistribution. Usually, the only finances that the banks own is equity capital, and for rendering basic banking services they use borrowed funds belonging to the customers and creditors. Due to the specific character of the banks’ functioning there is a need to organize close and effective work with prospective customers who form the basis of bank funding (depositors, buyers of bank securities, users of various banking services, etc.), and with the borrowers of the bank’s funds (consumers of loans and bank guarantees, etc).

This article describes some methods of attracting and retaining customers. These methods are actively used both in Kazakhstan and abroad and, in our opinion, can be considered the most progressive ones to the present date.

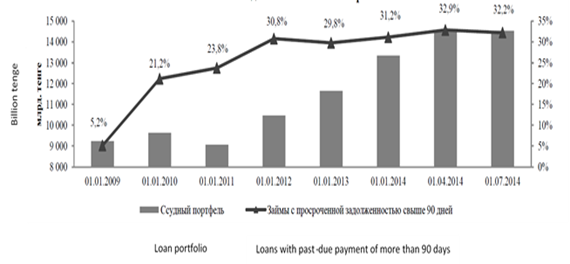

At the moment, there are significant problems with the total loan portfolio of the banks in the country. Its considerable part does not work because of the impossibility of the borrowings repayment (by the mid-2014 there had been more than 30% of unrecovered loans).

Figure 2. Dynamics of the loan portfolio and loans with overdue debt of more than 90 days in the banking sector of the Republic of Kazakhstan

(source - compiled by the author)

As seen in Figure 2, there has been a brisk growth of the loan portfolio with a concurrent increase of troubled loans, since the beginning of 2009. At the same time, the crisis events of 2011-2012 did not have a positive impact on the quality of the loan portfolio. [1]

With the availability of funding, the banks of Kazakhstan experience a deficit in investment projects supported by sufficient financial soundness for the repayment of borrowings. In this regard, we believe that the tasks of improving the banks’ work with numerous prospective and actual customers and the increase of their number (business diversification) can be considered very pragmatic.

Inter alia, the position of Kazakhstan’s leading banks is strengthened through capital concentration. In the beginning of 2014, several Kazakhstan banks announced their merger which finds support in the eyes of the state regulator. These processes contribute to the country markets’ stabilization and create favorable conditions for the development of domestic business, strengthening of the state sovereignty and also increase customers’ confidence in the banking system.

The integration processes in the commercial banks’ activities inevitably lead the top managers to understanding of the importance of enhancing competitiveness through the application of innovative technologies within the framework of the strategy of developing a customer-oriented banking business model. In our opinion, the most promising activities of banks in this model are the ones that are aimed at enhancement of the set of services to meet the needs of customers’ business, as well as the ones aimed at rendering of permitted non-banking services [2].

The strategies in the field of patterns of communication with customers have been developing in four main directions of impacting on customers. From the point of view of commercial bank activities, these four directions may be designated as: the product strategy; the pricing strategy; the strategy of banking products distribution; a package for stimulating consumers. The main purpose of the strategy is to ensure the bank value growth by creating a value for customers and new opportunities for the bank.

Using an advanced information technology of management, a bank collects the information about its customers at all stages of their life and uses it as a tool for the implementation of a customer-oriented strategy and preparation of mutually beneficial proposals that form (stimulate) the need of customers to be serviced in this particular bank.

The study of the specificity of businesses is carried out by means of the marketing analysis which allows the bank managers to understand the suitability of a product for a certain category of customers, the volume of potential sales, the efficiency of the business, the level of funding requirements and other relevant aspects [3].

The main instrument of the marketing analysis is segmentation [3, 4]. Segmentation allows dividing the inhomogeneous market into smaller homogeneous segments, singling out groups of customers with identical interests and needs. To begin with, it is logical to separate groups of customers in accordance with the business volume: large, medium-sized and small enterprises. Depending on the information received and the interests of the bank, these categories can be divided into smaller ones, for example, on the basis of the economic sector, areas of activity, the profitability level, territoriality, etc.

Possessing information on all large and medium-sized customers of a specific region, it is possible to calculate the overall potential and the share of providing specific customer segments with the main banking products (loans, fund raising, payroll programs, and other products through statistically determined ratios). Upon the conducted segmentation, it becomes possible to identify the groups of significant customers that have dominant influence on the bank’s business (achieving planned targets) and to distinguish the target segments of customer management (from the perspective of promising sectors and territories) in accordance with the criteria approved in the bank.

Then follow the analysis of the companies within each segment in order to point out the most attractive segments (in terms of interesting and profitable cooperation) and, finally, the assessment of the extent of relationships with potential customers.

For each area that has the highest priority for the bank it is necessary to prepare a special proposal that includes the most developed services tailored to the companies’ actual needs. The information about the company’s profitability, sales volume, number of personnel, etc. will help to formulate such a proposal. Based on these data, it is possible to determine which banking services the customer needs and in what amounts. The information on the company’s assets and business seasonality will help to understand what amount of credit resources (or other forms of financing on optimally favorable terms) it is necessary to attract. It will also help to understand where the available resources are invested during the quiet periods of business activities.

Having identified peculiarities of the ownership structure and internal connections within holdings, consortia, syndicates, the bank becomes able to structure the proposed transactions more objectively and to assess the customers’ businesses comprehensively in order to provide exclusive offers. For this purpose it is necessary to analyze payment chains of the bank’s significant customers (for subsequent stimulation of “bringing” the financial flows of customers themselves and their contractors into the bank), using the intra-bank database in which the payments of certain companies are filtered automatically with analytical sorting.

Forming a package proposal for a customer, it is important to remember about achieving economic benefits at his servicing, first of all, for the purposes of competent management of the bank’s liquidity.

The final step in assessing the potential of consumer banking includes the analysis of the parameters of servicing a company in the bank and the estimation of the bank’s share in servicing the customer’s business (or a group of related customers).

Based on the information studied, the “Sales Packaging” is proposed. It implies comprehensive mutually beneficial proposal of services to the customers and customer segments with account of the sectorial and other specifics. Comprehensive service allows the bank to provide preferential conditions of services (discounted rates, granting deferrals of payments, etc.). Eventually it turns into a benefit for the customers, and the bank, in turn, receives the profit of the total volume of services provided.

This strategy also opens up the possibility of attracting customers by a method based on the financial and economic ties of the already existing customers with potential ones (linear-related attraction). It enables to organize cross-selling of products and services. For example, factoring program, reduced rates for the transaction banking on current accounts within the bank, etc. can be proposed to raw material suppliers and finished product manufacturers on the condition that they agree to use services of this particular bank only [5].

Under conditions of a significant customer base growth, bankers are able to get clear image of the needs of every potential buyer of their financial products and create marketing campaigns with account thereof with the help of the above practices. In result, the competitiveness and profitability of the bank increase and can be maintained through establishing an exclusive relationship with the most eminent entrepreneurs. These relationships can be based on trust in the interaction of the bank’s managers and the customers. For instance, impressing the CEOs with deep knowledge and expertise in their business is a good way to establish such relationships. Therewith it’s important to be aware of the specific features of the industry, market or region in which the customers work or intend to work, as well as of the adjacent areas in which the entrepreneurs themselves may not be well versed. For instance, finished product manufacturers may not be aware of the possibilities of commercial use of the production wastes, the availability of preferential tax treatment or state preferences for such activities in the neighboring region. However, let us not forget that the majority of the bank’s employees have economic education. In this regard, the use of modern information technologies by the bank that are capable to perform business analysis makes the bank’s work unique in the eyes of potential customers. Besides, the net cost of banking services gets significantly reduced, since there is no need to involve expensive field experts.

To enhance the relationships with customers, the managers should actively use automated analysis tools, starting from their first contact with a customer. This will give company representatives the opportunity to find comprehensive information about the product of interest and potential options of the required services momentarily and independently [6].

The optimization of business processes will improve the efficiency of the customer service, thus leading to a substantial saving of the bank’s resources. The dialogue of consumers and bank specialists becomes more substantive thanks to the quick access of the latter to all the necessary data on popular products and services. Implementation of the above-mentioned tools enables a significant reduction of the administrative costs of printing, storage and dispatch of the information about the products and services. At the same time it spares the time and effort usually spent on “paperwork”, which can affect not only the quality and scope of services, but also their future cost which is of no lesser importance for the customer in choosing the bank.

For the effective application of the above methods the bank needs to provide automated systems of the information storage which will enable to perform quick on-line estimates of profitability/cost-efficiency in each particular situation. Such “storages” are used by the bank managers as an information guide and allow them to lead a competent dialogue.

Assigning a personal manager to the customer and communication at all levels of the bank are very important in establishing a permanent contact with the customer. This gives personal significance to the service processes. As a result, not only the level of the customer’s satisfaction with the bank services increases, but maximum flexibility of the bank’s management to meet the customers’ market demands is achieved. Those are important advantages in today’s rapidly changing competitive environment. At the same time, there is a certain “successive” control over the personal managers’ activities on the part supervisors and staff at all levels of the bank hierarchy in order to minimize the risk of “conflicted interests”.

In addition, optimization of the bank’s business processes for ensuring a prompt response to the needs and requirements of the customers is also of paramount importance in attracting and retaining customers. On the one hand, it increases the satisfaction of the customers with the banking services, on the other hand, reduces the costs caused by unproductive interaction between the units.

In order to retain the desired customers and promote the good image of being a bank which provides exclusive services, it is advisable to conduct additional (non-financial) work.

The additional services may be:

1. counseling, training, parnership commercial connections, etc .;

2. invitation of existing and potential customers (including suppliers, contractors and the existing customers) to participate in those activities;

3. establishment of friendly contacts during these additional activities;

4. planning and conduction of negotiations on services.

If additional, non-core forms of interaction are well chosen and evoke interest among consumers, an influx of potential customers from the persons whose acquaintances have already appreciated the service quality of your bank can be expected. High quality of these additional activities is to be ensured through the participation of highly-qualified specialists.

Summarizing the above-said and having analyzed the practice that has been applied over the last ten years, we have come to conclusion that the implementation of the customer-oriented strategy by financial institutions is one of the fundamental factors in enhancing the competitiveness of the banks of Kazakhstan in today’s globalized world economy. The efficiency of this strategy directly depends on proper, intelligent use of the following tools:

1. advanced information technology of management with the help of which a bank can collect the information about customers, identify particularly profitable ones and analyze the obtained information to create targeted mutually beneficial proposals;

2. marketing analysis allows to make accurate predictions about the amount of potential sales, to determine the efficiency of business, the level of demand in different banking services and other important aspects. The analysis of the obtained information will help to develop a banking product for a specific category of customers;

3. segmentation is a division of an inhomogeneous market into a number of smaller homogeneous segments with subsequent distinguishing of a group of customers with identical interests and needs. Segmentation results are used in the development of banking products for the customers from the same market segment or adjacent segments and for determining the bank’s strategy in attracting the most promising customers.

4. linearly-related attraction involves the analysis of payment chains of the bank customers and consists in use of the information about financial and economic connections of the already existing customers with their counterparties for subsequent stimulation of “bringing” the financial flows of the customers themselves and their partners into the bank and for cross-selling products through the use of the services provided by the bank, i.e., development of banking products specifically for the group of interacting entrepreneurs;

5. automation of analytical tools and information storage systems is used for quick on-line calculations (including those of profitability indicators) in order to provide full information about the bank capabilities and services. The above facilitates a competent dialogue with potential customers and increases the bank’s efficiency, allows personnel to realize their core competencies;

6. exclusive relationship allows providing a proposal specifically adjusted to the interests of specific customers through the use of automated systems and information technology. This instrument allows to maintain and develop customers’ loyalty, thus allowing to build trust-based relationships by means of providing services through various channels of interaction with regard to the customers’ personal needs;

7. “Sales Packaging” means mutually beneficial complex proposal of services to the customers and customer segments with regard to the sectorial and other specifics. Comprehensive servicing contributes to the development of preferential policy of servicing by the bank (discounted rates, granting deferrals of payments, etc.). This eventually turns into a benefit for the customer, and the bank, in turn, receives the profit of the total volume of the services provided;

8. provision of additional non-banking services. Given rapid development of entrepreneurship, the banks have got a considerable potential in creating their image as unique and providing exclusive services such as teaching market laws, consulting on financial and tax issues, informing on the current international practice and the use of new technologies.

The customers of a bank always require attention, advice and individual approach. Using the whole complex of these methods, you can become a trusted advisor to your customers, help them to increase the amount of assets at their disposal and reduce administrative costs.

Future belongs to the banks that are oriented towards individual work with the customer.

Страница обновлена: 20.02.2026 в 08:21:33

Download PDF | Downloads: 50

The ways to expand the customer base of a bank under conditions of global financial integration

Imambayeva R...Journal paper

Global Markets and Financial Engineering

Abstract:

In the conditions of international economic integration, the banking sphere of The Republic of Kazakhstan becomes more and more attractive for foreign financial structures. New market players are attracted by a higher margin in comparison to the markets of the developed countries. Eventually it leads to a competition strengthening and changes in the market structure.

The article is dedicated to studying progressive instruments for forming and retaining client bases by banks for the purpose of determining the prospects of maintenance of competitive advantages over foreign companies.

The study has resulted in the creation of a system of instruments of an efficient customer-centric strategy including not only the newest information technologies, but also the technologies of personal interaction.

Keywords: global integration, customer base of a bank