Reforming the banking sector in Iraq in light of the Corona pandemic (remedial plan)

Israa Gatea Fayyadh1, Baydaa Jawad Kadhim1

1 College of Administration and Economics, University of Wasit, ,

Скачать PDF | Загрузок: 30

Статья в журнале

Экономические отношения (РИНЦ, ВАК)

опубликовать статью | оформить подписку

Том 14, Номер 1 (Январь-март 2024)

Эта статья проиндексирована РИНЦ, см. https://elibrary.ru/item.asp?id=65634617

Аннотация:

The durability of the banking sector in any developing or developed country is one of the key issues to ensure the continuation of the country\'s economic system in a stable and secure manner. And working to develop this sector is the starting point for developing the local economic infrastructure. There is no doubt that the Corona pandemic has different effects in various fields, including the banking and economic fields, and given the outbreak of this epidemic since 2019 and the period of preparation of the research, and given the difficulties and problems facing the Iraqi banking sector like other Arab and international banking sectors, our current research came to assess the impact and challenges of the sector. This paper presents a proposed treatment plan to overcome the crisis he is suffering from The Iraqi banking sector in the period following the Corona pandemic.

Ключевые слова: banking sector, Corona pandemic, Cash credit, non-performing loans

JEL-классификация: F01, F02, F62, F64, G21

1- Introduction

The banking sector has an important and major role to play in alleviating the economic and financial shock caused by the Corona pandemic worldwide in general and by the Iraqi banking sector in particular. However, the global banking system has been more balanced than it was during the 2008 global financial crisis, owing to the implementation of a series of banking reforms to cope with the crisis. Nevertheless, the delays and pressures on the banking system have been exacerbated by the low level of liquidity and structural problems affecting the banking system. The Central Bank of Iraq has therefore initiated immediate relief for the affected borrowers to maintain sufficient liquidity in the banking system through a series of immediate measures during the period of the Corona pandemic and during the curfew. As we know, the banking system is at the heart of the living organism, so any defect or weakness in the system leads to detailed damage to the Iraqi financial system and economy, thus causing economic activity and a lack of diversity in terms of GDP and depriving the product itself of the added value that the banking sector itself can achieve. Hence, the importance of writing began when the search for reform of the Iraqi banking sector under the Corona pandemic began.

2- Review of Literature

Sundus gave multiple recommendations about what the Iraqi government should do to overcome the crisis [17,pp.7876-7892], such as: A strategy for setting financial guidance and investing in personal and economic growth in addition to diversification to enhance employment.

Sultan [19,pp.2910-2926] showed the economic effects of the coronavirus outbreak on economic activity in Iraq with reference to some internal procedures in Iraq and the necessity of implementing them to contribute to moving the Iraqi economy forward and overcoming the crisis.

Amis in his paper offers a unique and critical discussion of the knowledge gap between the economic sciences and the public's awareness of the topic, with a focus on the banking sector's recovery following the pandemic. It also has implications for the recovery of various economic sectors in Iraq following COVID-19 [18,pp.1-15]..

Xueli employed time series and cross-sectional data analysis to examine issues related to women's status, work, poverty, food security, and international trade during the epidemic [20,pp. 68251–68260].

3- Methodological framework

3,1 The research Problem

The Iraqi banking sector has witnessed the last two years of major successive developments due to the Corona pandemic: global oil price instability, low oil revenues, less bank liquidity, less financial inflows from abroad, and finally a higher dollar exchange rate. Here, we must point to the major ongoing efforts of the bankers and economists to reform the Iraqi economic sector, represented by the reform of the banking sector since the 1980s and 1990s. These efforts, although they have sought to reform certain aspects of this important sector, have given rise to other causes of reform, particularly the possibility that the banking sector will be affected by the actions of Corona for many years, and that, in our knowledge of and follow-up to the Iraqi banking sector under the Corona pandemic, we have found that this vital and important sector suffers from a number of crises, difficulties, and problems, some internal, such as laws and legislation, and others external, such as successive changes in global markets due to the exposure to the Corona pandemic .So in our study, we're trying to devise remedial solutions to the problems and imperatives of the Iraqi banking sector in the hope of avoiding bankruptcy in the coming years.

3,2 Purpose of the research

The current research seeks to examine the reality of Iraq's banking sector in the last two years with the emergence and spread of the Corona pandemic, as well as the most important challenges and crises that stand in the way of its development and reform, and highlight the remedial proposals that will enable it to move forward.

3,3 Importance of research

The importance of the present research can be summarized as follows:

1- Banking reform is one of the fundamental economic variables on which countries rely to develop their economic structure and ensure continuity in domestic development.

2- A strong banking structure has become essential for building a prosperous economy based on modernity and sound, sustainable development. The development of banking procedures and awareness of the importance of developing banking facilities to ensure a national savings base and the development of the financial resources needed to build the economy have become priorities for decision-makers.

3- Interest in the banking sector means resuscitating local markets, gaining good momentum in domestic and foreign investment, and contributing in one way or another to strengthening local banking realities and increasing its ability to cope smoothly with crises.

4- Increasing the effectiveness of the banking system is capable of generating new sources of savings and capital financing for the investment process, thus addressing the imbalances in the production sectors and improving the structure of the national product.

3,4 The theory of the research.

Can technology be used, the scientific approach be used to cope with and treat crises, and a precise, procedural, and practical strategy be developed that is consistent with Iraq's banking and economic potential? To cope with crises and obstacles in Iraq's banking sector.

4- Theoretical framework

4,1 The concept of banking reform

Bank reform is defined as "a banking process leading to a series of radical and fundamental changes in the detailed aspects associated with the banking sector, which include laws and legislation and banking policy in its various forms and types, which clearly reflect improved banking performance with changes in the Arab and international arena" [1].The concept of bank reform could also include a set of characteristics

* Restructuring banks in accordance with the administrative structures of global banks as required by modern banking.

*development of systems of banking operations with a view to incorporating all the procedures in which global banks operate.

* The use of modern techniques that are appropriate to the circumstances of the banking system crisis and disaster.

*The introduction of an advanced bank accounting system that accommodates all banking services and businesses helps to conduct checks, detect errors when they occur, and facilitate internal control.

On the other, the concept of banking reform can be referred to as "large and continuous comprehensive processes, which include the development of regulations, legislation, and laws relating to banking and which contribute to the development of lending and deposit arguments and the development of banking services, all of which directly affect the sectors of the domestic economy."

4,2 Objectives for the reform of the banking sector.

We also know that there is no uniform model for the banking reform process. Thus, the reform process depends on the nature and structure of the economy, the degree of structural reforms followed, and the objectives to be achieved, so it can be said that the main objective of banking reform is to create sound financial and banking systems that promote macroeconomic stability under the pandemic. The reform of the banking sector in any country has a range of objectives for which we seek:

First, the balance between the public and private sectors, as well as allowing the private sector to evolve and advance, is a fundamental sanction of any existing banking reform.

Second, to reduce the financial costs to the state of certain projects that have proven to be ineffective or underutilized, and to channel funds and resources towards important, detailed, and vital sectors that contribute to community development.

Third: To develop savings and to ensure that they are properly employed and exploited as projects and investments that achieve the major goals of the state.

Fourth, work to create balanced and stable banking and economic systems that will make it possible for the economy to continue well without hindrance.

V: Making the market more transparent by reducing credit costs and making greater use of them [10:pp1- 39].

4,3 Areas of the banking sector

In order to achieve the objectives of bank reform, it must be through the reform areas, and we mention [13, pp.22-26] :

1-. The independence of monetary policy and the Central Bank.

Monetary policy is a knowledge entity designed to achieve monetary stability by controlling the supply of money through various means made available by science in theory and practice. Monetary policy is therefore an independent entity from economic policies such as balance-of-payments policy, productive policy and fiscal policy. The main objective of such independence is to achieve monetary stability.

Monetary policy is defined as the procedures planned by the Monetary Authority of the Central Bank of the Monetary Supply Administration and the interest rate to achieve full operation without inflationary pressures [14] Monetary stability is one of the most important objectives of monetary policy, and the monetary authorities of the Central Bank achieve this goal.

2-banking supervision and international standards.

Oversight is defined as an administrative function. It is a continuous and renewed process in which the performance of the growth set by the goals and standards set by measuring the degree of success of the actual performance for the purpose of correction is verified. Through banking supervision, we seek to make sure that the results achieved correspond to the goals set out in the plan. In the final analysis, it is the process of observing the results of the planned actions in advance, thus reducing the gap between the results achieved and the objectives we seek to achieve, and taking corrective action to fill this gap [15]

4,4 Banking reform procedures.

Comprehensive banking reform requires a clear reform of fiscal and monetary policies in preparation for the start of banking reform. Economic reform cannot be corrected without financial and monetary reform. The World Bank and IMF focus on the need to set a timetable, economic indicators, and targets for bank reform through the use of all financial and monetary instruments in order to balance supply and demand .

Bank reform in this context means determining the real cost of lending and providing banking services similar to those provided in developed countries in an efficient and return-oriented manner. In addition, lending may be expanded only within the framework of the International Fund's reform program.

The most important procedures for banking reform can be summarized in the following broad outlines -

1, The policy of reducing the state budget deficit, resulting in a reduction in public expenditure;

2. Liberalization of interest rates to suit inflation, growth rate, profitability, and output growth rate.

3. The policy of price liberalization, cost liberalization, and reduction of subsidies for some sectors so that domestic prices converge with world prices.

4. The liberalization of wages to bring them closer to levels of social costs and the prompting of government institutions to set wages commensurate with competence and experience.

5. Reducing the role of the state in the ownership of public companies and the tendency to sell or invest in some enterprises.

These procedures, in their entirety, constitute a recipe for bank reform, which cannot be separated from each other.

4,5 Conditions for successful bank reform

There are four basic conditions for successful banking reform [11, pp. 36-38):

1.General economic stability

One of the most important pillars of general economic stability is a low inflation rate, whose rise leads to currency depreciation and higher interest rates, which impede economic growth and contribute to the weakening of banking, thus affecting the banking reform process.

2. Availability, transparency, and coordination of information

This is information on the liquidity of financial institutions for depositors and investors, and information on the management of financial institutions helps to identify investment risks and expected returns. When the coordination of information is to determine the relationship between the interest rate and the degree of risk, on the one hand, and the expected interest rate and profits, on the other hand, because the most dangerous projects with high interest rates are the most profitable,.

3. Follow the sequence and system in the stages of bank reform.

The stages of banking reform are five that must take into account the proper sequence of these stages in order to save the economy from significant losses on the banking side during the process of economic reform and the transition to a free economy.

4. Supervision of financial institutions and markets

The supervision of financial institutions and markets is aimed at avoiding increased risk to financial institutions as a result of their activities and ensuring transparency through attention to financial conditions and the implementation of the requirements of the Basel Committee in capital adequacy and banking oversight.

5- A remedial plan for banking reform

Since 2003, the domestic economy has suffered from persistent problems and successive insistences, which has contributed to placing the Iraqi economy in a situation that is entirely dependent on its oil resources in order to ensure that the economy, As well as the country's finances. The fact that the fragile situation remains unchanged and the domestic economy is exposed to sudden internal or external shocks, particularly with regard to world oil markets, because, as we have said, the Iraqi economy is dependent on oil, as well as a range of other variables that have clearly contributed to the weakness of Iraq's banking sector, including weak reliance on the private sector, widespread political and financial corruption in state joints, and the flight of domestic and foreign capital. So we'll look into this chapter To present the most important challenges to Iraq's banking situation in the context of the corona pandemic and then to present a remedial plan for certain items linked to Iraq's banking reality in the context of the corona pandemic and its many repercussions, as follows:

5,1 Challenges

1. The rapid and progressive technological development in the global and Arab banking sectors has eliminated the spatial aspect and facilitated communication between banking institutions around the world through modern means of communication.

2. The interest of the Major banking institutions in the information, the speed with which it is dealt with, and the quality of information, other than the local banking reality in Iraq, is based on a traditional and routine method of obtaining information.

3. Note that many non-bank financial institutions have entered the area of banking services and have become fiercely competitive with civil banks in their provision of banking services.

4. Possession of innovative and sophisticated banking and financial instruments, leading to a variety of banking services that are not clearly available in traditional and local banks in Iraq.

5. Attention to the efficiency and continuous development of human resources for the global banking sectors, ensuring that available and up-to-date technologies and information systems in the global banking sector are properly utilized, contrary to reality in the banking sector.

6. Attention to the consolidation of banking and insurance services as well as those of financial and investment institutions and insurance companies, currently known as the Global Bank.

Major commitments for global banks with respect to international conventions such as the BAL ratio (the Basel Capital Efficiency Standard) as well as the WTO-related international conventions, particularly in the area of banking services.

8. The ongoing volatile security, economic, and political stability in Iraq, as well as the weak investment in the Iraqi banking sector,.

9. External debt, where the greatest burden has been on these challenges for the development of the Iraqi banking sector.

10. Some banks, such as Al-Rasheed and Al-Ravadin, have been tired of paying retiree salaries, which is a function of the retirement bank and not of these banks. 11. The financial and monetary outlook in Iraq is not clear, especially with the economic disruption caused by the Corona pandemic.

5,2 Legislative reform

The legislative reform of the banking sector consists of the following detailed aspects:

1. The need to promulgate the Central Bank of Iraq Act No. 56 of 2004, which gave the Central Bank considerable autonomy away from government decisions through Article 2, since the Central Bank of Iraq, in accordance with this article, is fully independent in its decisions and procedures from the government. On the other hand, it receives no instructions from the government and has no authority to control it. Article 26 of the same Act stipulates that the Central Bank shall not lend directly or indirectly to any state public or governmental authority other than open market operations [4, 255-267]. Thus, the process of independence of the Central Bank of Iraq is protected by the Constitution, and any change in the policy of the Central Bank of Iraq requires the approval of the legislature [3, pp.2-7].

2. Recommendation that the Iraqi Commercial Banks Act No. 94 of 2004 should be promulgated. This Act represents a fundamental step in establishing an efficient banking system operating in accordance with international standards. This Act gives citizens the right to transfer funds through the banking system and its various channels by providing documentation indicating the objectives of such transfers, consistent with the conduct of universally accepted economic and accounting relations .

3. The importance of recommending the enactment of the law on combating money laundering, No. 93 of 2004, is an important step forward in modifying the structure of the financial and banking systems. The most important reasons for the promulgation of this law are that money laundering in Iraq is a highly prevalent phenomenon. On the other hand, this phenomenon is linked to the crime of supporting terrorism and terrorist operations. This phenomenon is also linked to the growing role of technology and the development of the private sector. This law allows the Bank of the Republic to be free and independent in monitoring the movement and financial behavior of financial institutions .

4. To affirm the Investment Act No. 13 of 2006, which is the report on the financial stability of Iraq for 2010. By carefully reading the chapters and articles of the Act, we can identify the most important areas of concern to the Act, as follows:

أ.the overall right of foreigners to own property, where a foreign investor has the right to own 100 percent of the economic sector without any particular exception.

.the great freedom of the movement of capital and profits from Iraq to the outside, as well as the simple tax on the income of the foreign investor.

.The foreign investor right to hold securities of companies that are part of Iraq securities market without any restriction or condition and in accordance with the Iraqi Investment Act, the presence of foreign banks in the country is as follows:

A. A subsidiary of the original company.

B. An independent capital tracking company.

C. Partnership with another Iraqi bank.

5. The promulgation of the Islamic Banks Act No. 43 (2015) saw the establishment this year of the first Islamic State Bank of Iraq, which coincided with the promulgation of the Act, namely, the Bank of the Islamic Rivers, as well as eight other private banks and two other Arab and Agnbi banks. It should be noted that there were 94 Islamic banks operating in Iraq at the end of this year. These branches were distributed among 63 branches in the governorates, the rest being 31 banks in the Baghdad capital [2].

5,3 Reform of old banks

1.The Ministry of Finance is to bear the debts of the state, where all the restrictions on outstanding arrests are on records, as well as all the amounts indicated by the old banks, which are placed under the heading of war damage, because these banks do not pay for these expenses.

2. Ministry Finance and the Central Bank, on an equal footing, make all false signs, observe that banks were in major administrative problems because of the lack of clear instructions, and, of course, exclude cases of investigation or conviction.

3. Trying to promote the career cadre in banks by offering them multiple offers (retirement, rewarding compensation, referral to the Ministry of Finance, or any other government agency).

4. Contact the Ministry of Finance to compensate banks whose balances have been transferred to Iraq's age fund on a documented basis.

5. The banks give up the pension payment process, hand over the branches that hand over the payroll to the pension board, and then think of the electronic bank to pay the pensioner's salaries.

6. Establishing modern branches and merging them with other branches, as well as exchanging experiences between old banks and Arab, Gulf, and international banks, so old banks can reduce their size on the one hand and, on the other hand, reduce losses on the other.

5,4 Administrative reform

The banking sector can be reformed by:

1. Development of contexts and mechanisms for coordination between financial and operational policies.

2. Activate and stimulate the supervision, proactive control, and electronic control of banks in accordance with the preparation and issuance of new directives, guidelines, and operational regulations.

3. The establishment of investment funds and the participation of banks in them to finance large-scale and strategic projects.

4. Focusing on increasing credit, financing, and concessional loans, stimulating the employment of deposits in the areas of investment, reconstruction, and driving economic development.

5. Development of information technology and modern banking techniques in all their forms, with emphasis on disclosure and transparency in the financial statements of banks and customers.

6. Establish instructions and mechanisms that contribute to the development of banking human resources, in particular the protection of banking expertise or leadership as national economic expertise, thereby contributing to the stability and development of banking.

7. Develop a plan to address the financial collapse of some private sector banks due to the current conditions of liquidity shortages and financial and material damage, especially in the hot spots that have been exposed to terrorism.

8. To develop the role of the government in eliminating the phenomenon of administrative and bureaucratic domination that is prevalent in all aspects of the Iraqi banking sector and to work towards the development of modern machinery adapted to the current situation, which requires a social divergence between auditors and clients.

9. Developing the work of specialized government banks such as industrial, agricultural, and real estate banks and their transformation into specialized inclusive banks, the aim being to accelerate the process of economic growth and its effective contribution to their establishment and to seek the idea of bank integration.

10. Re-screening of administrative staff in the Iraqi banking sector and attention to seminars, studies, and conferences, as well as training courses that develop the administrative aspects of administrative personnel in the context of the corona pandemic.

11. Development of banking control systems, bringing them close to international standards, so that the banking system and its components can exchange information with other international global banks.

12. Development of new standards for the classification of private banks according to international standards

13. Reconsider the controls on the selection of board members and accredited directors, define the duties of the board for planning and non-interference in the executive management of banks, focus on the specialization and economic and banking expertise of members, reduce the number of board members to only five members, and accredit specialized advisers and banking experts to provide advice and expertise to the board and executive management.

5,5 Cash and pledge credit reform

1. To encourage banks to expand credit services.

2. Actively pursue the development of guidance regulations that contribute to the credit classification process and make allocations for all items compatible with certain risks.

3. Seeking to form a deposit and loan security company

4. To make provision for a proportion of the funds allocated for the import of private banks by the public sector.

5,6 Measures taken by the Central Bank of Iraq to deal with the pandemic [Ramy, 20].

The Central Bank of Iraq has taken a number of immediate and emergency measures during the period of the curfew, which lasted until April 2020. The partial ban has been lifted, and 25 percent of the bank staff are allowed to remain on duty. The private sector has also been targeted to work with as few employees as possible. These measures include the following:

1. Maintenance of the payment system on a daily basis.

2. The resumption of the investment window of the central bank's open banks.

3. Reduction of the legal reserve by 2% for six months to provide the liquidity necessary for banks to cope with the withdrawal of deposits and the continued granting of credit.

Postponement of loan repayments is a three-month initiative of the Central Bank of Iraq to ease the burden on borrowers.

5. The delay in penalties and fines imposed on banks for three months, from 1/4/2020 to July of the same year.

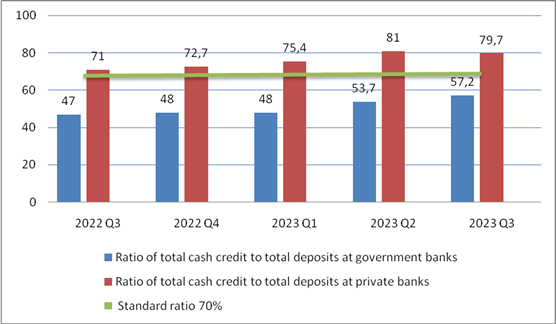

Fig.1 Percentage ratio of total cash credits to total deposits with public and private banks [21]

The ratio of total cash credit to total deposits to private banks shown in figure 1 exceeded the 70% set by the Central Bank of Iraq, which was 79.7% in the third quarter of 2023, so it became necessary for banks to adhere to this ratio in order to avoid financial default for private banks. For public banks, it was not more than. It is worth mentioning that central government and public institution deposits accounted for 63.4% of total government bank deposits at the end of the third quarter of 2020, while central government and public institutions at private banks accounted for 3.1% of total private bank deposits.

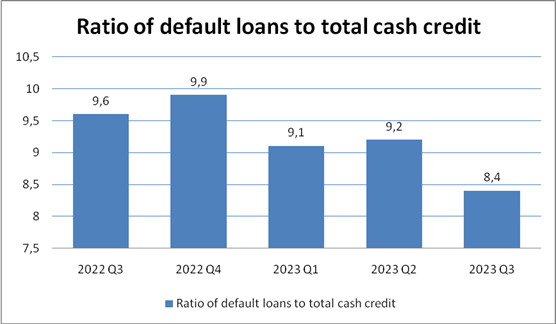

Disruptive loans/total cash credit: this indicator is measured by the method of dividing the defaulted loans into the total cash credit, and figure (2) illustrates this

Fig.2 Ratio of default loans to total cash credit (percentage) [21]

The ratio of defaulted loans to total cash credit in the third quarter of 2023 fell to 8.4% after being 9.6% for the same class in 2022, with a negative growth rate of n representing the entire working bank and its decline being positive for a-% (12.5%) for the safety and stability of the banking sector. But back to the bank breakdown in terms of ownership, there is an increase in the ratio of default loans to total bank cash credit, and figure 3 shows this.

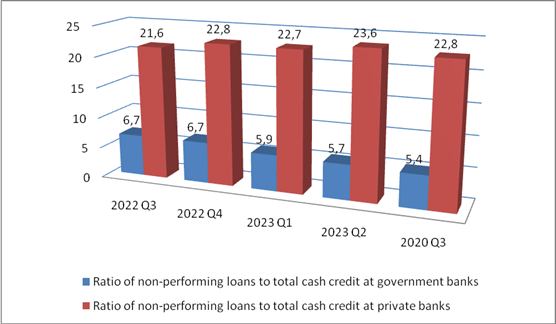

Fig.3 Ratio of non-performing loans to total cash credit at government and private banks [21]

The ratio of default loans to the total cash credit of private banks increased from 21.6 percent in the third quarter of 2022 to 22.8 percent in the same quarter of 2023, with a growth rate of 5.5 percent. The volume of default loans by private banks constitutes more than five percent of the cash credit granted to them. For public banks, this proportion decreased from 6.7 percent in the third quarter of 2022 to 5.4 percent in the same quarter of 2023, with a negative decline of 24 percent. This increase in the debt stock of private banks is bound to be properly controlled in the credit process by the client survey, the economic feasibility of the project, and others. Banks are required to allocate sufficient amounts to debt distress, with reference to the allocation of debt to private banks.

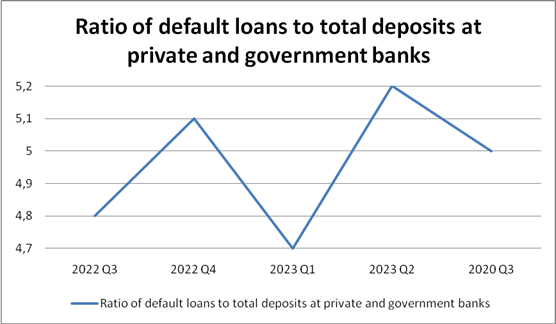

Unresolved loans/total deposits:This indicator is measured by the way loans to banks are divided, and figure 4 illustrates this:

Fig.4 Ratio of default loans to total deposits at private and government banks [21]

The ratio of loan defaults to total deposits rose from 4.8% in the third quarter of 2022 to 5.2% in the second quarter of 2023, up from 3.7% in bank deposits in the third quarter of 2019 to the 3rd quarter of 2020, owing to public reluctance to banks due to unstable conditions in the country due to the Corona pandemic.

6-Conclusions

On the basis of all the above, the researcher can draw the following conclusions :

1. In recent years, the banking sector has witnessed a series of steps and actions that have attempted to repair some of its financial, monetary, credit, and administrative aspects, but they have not been completed for many political and administrative reasons.

2. Though the capital in Iraqi banks has risen in recent years, the issue of granting credit continues to suffer from apparent disillusionment because of the volatile security and political situation.

3. With regard to the phenomenon of dollarization, the Central Bank has embarked on a number of innovative and effective drugs to reform the banking sector on this side, thus helping to significantly undermine this phenomenon.

4. A clear decline in the role of the private sector in the area of banking finance, represented by weak deposits to the private sector in addition to the credit it provides.

5. Double the bank density, which means a small number of banks and their branches spread across the country.

6. Many banks are reluctant to grant credit, which means that weaknesses and imbalances in banking activity persist without treatment.

7. Although many banking institutions have adopted some modern banking systems, they are still unable to attract individual deposits, increase the number of clients, improve banking activity, and support the quality of banking services.

7-Recommendations

1. Despite the reform measures undertaken by the Central Bank, it is the accumulated legacy of weakness, reclining, and other problems that require radical and rapid reforms, which, of course, require a serious desire for reform and substantial government support.

2. To encourage banks and financial institutions to take their role in implementing the Central Bank of Iraq strategies for the years 2016–2020, especially as they seek to achieve greater financial and monetary stability, as well as to develop the organizational structure of the Central Bank of Iraq.

3. Seek to provide a stable security environment for banking as well as legislation that contributes to the protection of clients of the Iraqi banking system in order to develop confidence and a culture of microfinance.

4. Increased efficiency in domestic financial institutions through increased competition and improved quality of banking service.

5. . The privatization of banks, since the privatization and privatization of banks from public ownership to the private sector, is a complementary step to financial reform, as the reform of the financial system to open up competition between banks and their freedom to determine bank interest and direct their bank credit is not complete without the transfer of bank ownership to the private sector.

Источники:

2. Central Bank of Iraq, General Directorate of Statistics and Research, Annual Report on Financial Stability for the Years 2010–2012, 2014–2015.

3. Thuyne Falah Hassan Independence of the Central Bank of Iraq and Economic Policy // Iraqi Journal of Economics, Ensteer University. – 2009. – № 21.

4. Hussein Hendrin Hussein Independence of the Central Bank of Iraq and its role in reducing inflation // Baghdad College of Inclusive Economics Journal. – 2014. – № 38.

5. Shakji, Bashar Muhammad, Akhron Reform and Financial Liberalization in Iraq with Reference to the Egyptian Experience // Rafidain Development Journal, Mosul University. – 2008. – № 30(19). – p. 1-25.

6. Ali Kanaan Syrian Banking Reform, Syrian Economic Sciences Society, 2005. [Электронный ресурс]. URL: https://syrianeconomy.com/ (дата обращения: 11.01.2024).

7. Mona Qasim Economic Reform. - Egypt House, Cairo, 1997.

8. Moses Sands Hamid Central Bank and course in economic balance with special reference to Iraq. / unpublished masters dissertation. - School of Administration and Economics, Cove University, 2009.

9. Kemal Al-Aziri, Mashar al-Sabahi Public Banking Sector: The Reality and Policy of Reform. - Iraqi Institute for Economic Reform, 2012.

10. Hudoud Mayeh Shabib The financial and banking sector between the problems of reality and the prospects for reform, a study in selected Arab countries // University of Kufa, Al-Ghari Journal of Economic and Administrative Sciences. – 2008. – № 2(10). – p. 37-69.

11. Al-Jabar Privatization of Banks in Arab Countries. / Ph.D. Thesis, School of Administration and Economics. - Emeritus University, Baghdad, 2005.

12. Ibsam Ali Hussein Ways to Reform and Develop the Banking Sector in Iraq // Baghdad College of Inclusive Economics Journal. – 2019. – № 58. – p. 257-278.

13. Naji Ardis Abdul Alikhan The Good Banking System and its Role in Attracting Foreign Direct Investment, masters dissertation. - School of Commerce, Ain Shams University, 2014.

14. Al-Mamouri Amjad Fakhri Obaid Monetary policy trends in Iraq after 2003 and its role in directing the currency selling window and international needs. / masters dissertation, Karbala University of Economic Sciences., 2018.

15. Mohammed Ahmed Abdel-Nabi Banking Supervision. - Zam Zamzam Publishing, Jordan, 2010.

16. Rami Yusuf Obaid Report on the efforts of Arab central banks and monetary institutions to reduce the financial stability implications of the Corona virus. - IMF, 2020.

17. Sundus Jasim Shaaibith The economic impact on the world crisis during the Covid-19 pandemic using Iraq as a case study // Palarch’s Journal Of Archaeology Of Egypt/Egyptology. – 2020. – № 17(9).

18. Al-Karawi Amis Mohammed Bahjat The impact of corona virus pandmic on the Iraqi economy // International journal of professional Business Review, Miami. – 2022. – № 7(5).

19. Alnasrawi Sultan Jasem Impact of COVID19 Outbreak on The Global Economy: A Case of Iraq // International Research Association for Talent Development and Excellence. – 2022. – № 12(2s).

20. Xueli Wei The impact of the COVID-19 pandemic on socio-economic and sustainability // Environmental Science and Pollution Research. – 2021. – № 28.

21. Central Bank of Iraq, General Directorate of Statistics and Research, Annual Report for the Years 2022-2023.

Страница обновлена: 06.11.2025 в 08:54:23

Download PDF | Downloads: 30

Реформирование банковского сектора Ирака в условиях пандемии коронавируса: план восстановления

Israa G.F., Baydaa J.K.Journal paper

Journal of International Economic Affairs

Volume 14, Number 1 (January-March 2024)

Abstract:

Надежность банковского сектора в любой развивающейся или развитой стране является одним из ключевых вопросов обеспечения стабильного и безопасного функционирования экономической системы государства. И работа по развитию этого сектора является отправной точкой для развития местной экономической инфраструктуры. Нет никаких сомнений в том, что пандемия коронавируса имеет различные последствия в различных секторах, включая банковскую и экономическую сферы.

В условиях вспышки пандемии COVID-19, начавшейся в 2019 г., банковский сектор Ирака и других арабских стран (и даже международные банковские системы) столкнулись с серьезными трудностями и проблемами.

Данное исследование направлено на оценку влияния пандемии коронавируса на банковский сектор Ирака и выявлении возникших проблем в банковской сфере. В статье представлены авторские рекомендации для преодоления кризиса в банковском секторе Ирака в постпандемический период.

Keywords: банковский сектор, пандемия коронавируса, овердрафт, просроченный кредит

JEL-classification: F01, F02, F62, F64, G21

References:

Al-Jabar (2005). Privatization of Banks in Arab Countries

Al-Karawi Amis Mohammed Bahjat (2022). The impact of corona virus pandmic on the Iraqi economy International journal of professional Business Review, Miami. (7(5)).

Al-Mamouri Amjad Fakhri Obaid (2018). Monetary policy trends in Iraq after 2003 and its role in directing the currency selling window and international needs

Ali Kanaan Syrian Banking Reform, Syrian Economic Sciences Society, 2005. Retrieved January 11, 2024, from https://syrianeconomy.com/

Alnasrawi Sultan Jasem (2022). Impact of COVID19 Outbreak on The Global Economy: A Case of Iraq International Research Association for Talent Development and Excellence. (12(2s)).

Bailey Hassani (2012). Possibility of Enhancing the Functioning of the Algerian Banking System under Contemporary Economic and Banking Changes

Hudoud Mayeh Shabib (2008). The financial and banking sector between the problems of reality and the prospects for reform, a study in selected Arab countries University of Kufa, Al-Ghari Journal of Economic and Administrative Sciences. (2(10)). 37-69.

Hussein Hendrin Hussein (2014). Independence of the Central Bank of Iraq and its role in reducing inflation Baghdad College of Inclusive Economics Journal. (38).

Ibsam Ali Hussein (2019). Ways to Reform and Develop the Banking Sector in Iraq Baghdad College of Inclusive Economics Journal. (58). 257-278.

Kemal Al-Aziri, Mashar al-Sabahi (2012). Public Banking Sector: The Reality and Policy of Reform

Mohammed Ahmed Abdel-Nabi (2010). Banking Supervision

Mona Qasim (1997). Economic Reform

Moses Sands Hamid (2009). Central Bank and course in economic balance with special reference to Iraq

Naji Ardis Abdul Alikhan (2014). The Good Banking System and its Role in Attracting Foreign Direct Investment, masters dissertation

Rami Yusuf Obaid (2020). Report on the efforts of Arab central banks and monetary institutions to reduce the financial stability implications of the Corona virus

Shakji, Bashar Muhammad, Akhron (2008). Reform and Financial Liberalization in Iraq with Reference to the Egyptian Experience Rafidain Development Journal, Mosul University. (30(19)). 1-25.

Sundus Jasim Shaaibith (2020). The economic impact on the world crisis during the Covid-19 pandemic using Iraq as a case study Palarch’s Journal Of Archaeology Of Egypt/Egyptology. (17(9)).

Thuyne Falah Hassan (2009). Independence of the Central Bank of Iraq and Economic Policy Iraqi Journal of Economics, Ensteer University. (21).

Xueli Wei (2021). The impact of the COVID-19 pandemic on socio-economic and sustainability Environmental Science and Pollution Research. (28).