Global financial crisis and industrial upgrading of emerging economy

Shevchenko D.A.1![]() , Zhao Weili1,2

, Zhao Weili1,2![]()

1 Southern Federal University, Россия, Ростов-на-Дону

2 Henan University of Economics and Law, Россия, Ростов-на-Дону

Скачать PDF | Загрузок: 51 | Цитирований: 1

Статья в журнале

Экономические отношения (РИНЦ, ВАК)

опубликовать статью | оформить подписку

Том 12, Номер 1 (Январь-март 2022)

Эта статья проиндексирована РИНЦ, см. https://elibrary.ru/item.asp?id=48095602

Цитирований: 1 по состоянию на 07.08.2023

Аннотация:

With the spread of coronavirus, unprecedented supply and demand disruptions crippled the economy. To a large extent, it predicts the advent of financial crisis. Different from previous literatures which mainly focus on the negative impact of novel coronavirus on the word economy and specific industries, this paper researches on the problem under the context of pandemic what an emerging economy should do to undertake the world industrial transfer thus promoting domestic industrial upgrading and improving its position in global value chain. Dissecting the evolution process of the Southeast Asian financial crisis of 1997-98 and the American subprime crisis of 2008-09, this paper provides the introduction to a special issue concerning the relation between global financial crisis and industrial upgrading of emerging economy. Through historical analysis, summarizing experiences and lessons given by previous financial crises, this paper concludes with some revelations and puts forward recommendations for emerging economies. This research also gives the authorities from emerging economies a precise overview of the current emerging issues, therefore they can implement appropriate policies to respond timely to the current circumstances.

Ключевые слова: financial integration, emerging economy, industrial transfer, industrial upgrading

JEL-классификация: F01, F63, F68, F36

Introduction

Health disasters not only have global health impacts but, at the same time causing wide-ranging socioeconomic disruptions and losses. The sudden outbreak of novel coronavirus has brought serious disasters to the world. The global economy faces its biggest challenge since the global financial crisis from 2008 [1, p. 18–24] (Boshkoska, Jankulovsk, 2020, p. 18–24). There are many researches exploring the impact of pandemic on Global Economy, but they mainly focused on specific industries. According to the conception of three economic sectors, the economy can be divided into three group sectors. The primary sector deals with the extraction of raw materials, the secondary sector deals with manufacturing, and the tertiary sector deals with services [2, p. 24–38] (Fisher, 1939, p. 24–38).

In an attempt to understand the turmoil effect of COVID-19 on individual aspects of the world economy, many researchers well adopt the three-sector theory and integrated this theory in explaining the key influences of coronavirus pandemic [3, p. 2033–2987] (Vujanovic, Lebeaut, Leonard, 2021, p. 2033–2987). For instance, in the primary sector, social disruptions caused by the pandemic could cause problems with food security and food supply chain [4, p. 1689–1701] (Zuber, Harald Brüssow, 2020, p. 1689–1701). Following the onset of COVID-19, volatility of oil price increased [5, p. 13683] (Devpura, Narayan, 2020, p. 13683). In the secondary sector, it is remarkable that the manufacturing industry business is vigorously affected by the pandemic. Manufacturing industry in a country is the main pillar of industrial development. The amount of manufacturing production is much reduced [6, p. 104–125] (Paul, Chowdhury, 2020, p. 104–125). Coronavirus disease affects the manufacturing supply chains most significantly especially for the manufacturers of high-demand and most essential items [7, p. 172–175] (Sulistiyani, Riyanto, 2020, p. 172–175). In the tertiary sector, dental practices, hospitals and healthcare workers are also facing financial challenges in this difficult time [8, p. 791–792] (Farooq, Ali, 2020, p. 791–792). World tourism are facing a loss of 850 million to 1.1 billion international arrivals and loss of US$910 billion to US$1.2 trillion in export revenues of tourism in 2020 [9].

Different from pre-existing studies which mainly research on the negative impact of pandemic on specific industries, this paper regards the three economic sectors as a whole and focuses on the structure between them, namely, industrial structure. This paper holds that while the pandemic causes damage to the world, it also brings some opportunities. This paper adopts historical analysis as research method. Dissecting the evolution process of the Southeast Asian financial crisis of 1997–1998 and the American subprime crisis of 2008–2009, this paper demonstrates that the root of financial crisis lies in industrial structure. Its manifestation is the imbalance of industrial structure. Every outbreak of global financial crisis will lead international capital to look for new investment opportunities on a global scale. With the flow of international capital, it also comes with advanced technologies and industries. Therefore, every shift in industrial allocation (industrial transfer) across the world is in company of a financial crisis. If any emerging economy can seize this opportunity and undertake industrial transfer, it will be helpful with its domestic industrial upgrading and economic growth. The pandemic has brought a great loss to the world economy. At a large extent it predicts the advent of a new round of financial crisis. So, this paper will try to explore what should an emerging economy do to undertake the world industrial transfer thus promoting domestic industrial upgrading and improving its position in global value chain under the context of pandemic.

The research part

Financial crises can occur in all market economies, not just emerging markets, but also in developed countries [10, p. 43] (Gorton, 2018, p. 43). In the modern global monetary system dominated by the US dollar, on the surface the financial crisis can be divided into two types: One is the global liquidity crisis caused by the hike of the Fed's interest rate and the returning-back of the US dollar, such as the Latin American debt crisis and the Japanese crisis in the late1980s; the Mexican crisis from 1994 to 1995; the Southeast Asian financial crisis in 1997; and the Argentine and Turkish financial crisis in 2018. Another is the financial bubble crisis triggered by the US financial bubble, such as the collapse of US stocks caused by the Internet bubble in 2001, and the subprime crisis triggered by the US real estate bubble in 2008 [11]. However, only Southeast Asian financial crisis in 1997 and the American subprime crisis in 2008 are on a global scale and have the far-reaching impact on industrial transfer across the world.

1. The root cause of contemporary global financial crisis.

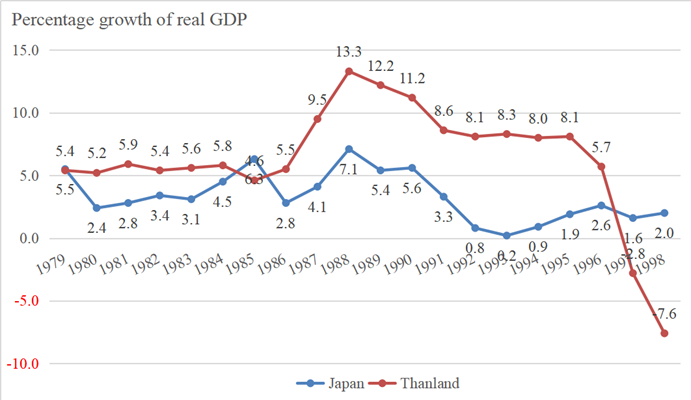

In 1980s, with the collapse of the Japanese real estate market, international capital began to withdraw from Japan and find new investment opportunities all over the world. At this time, Southeast Asian countries set off a wave of financial integration, so a large number of international capitals rushed into Southeast Asian countries. Overseas funds such as US dollars swarmed into Southeast Asian countries with very low interest rate. With the inflow of international capital, Southeast Asian countries such as Thailand also undertook the industrial transfer and realized economic take-off by taking place of Japan (Figure 1).

Figure 1. Thailand and Japan growth percentage of real GDP from 1979 to 1998

Source: compiled by the authors in accordance with [12].

On the surface, Southeast Asian financial crisis is a currency crisis. In 1995, the US dollar appreciated, which also led to the decline of export competitiveness and the expansion of trade deficit in Thailand because of the appreciation of real foreign exchange rate. Furthermore, the appreciation of US dollar also trapped Southeast Asian economies in debt service problems so that their huge non-performing loans exacerbated their vulnerabilities [13, p. 572] (Rasiah, Cheong, Doner, 2014, p. 572). Meanwhile, the real estate bubble burst in Thailand and hit banks and other financial institutions. With the deterioration of the balance of payments, in the international financial market, speculators noticed the pressure of devaluation of the Thai baht and began to Sell Thai baht for US dollars. In order to maintain the exchange rate system pegged to the US dollar, The Central Bank of Thailand had to consume foreign exchange reserves. On July 2, 1997, due to the depletion of foreign exchange reserves, Thailand had to abandon the fixed exchange rate system and implement a managed floating exchange rate system instead. The Thai baht depreciated significantly. Such a financial storm quickly spread to other countries. With the rapid withdrawal of foreign capital from Southeast Asian countries, the currencies of Malaysia, Singapore, Indonesia, and other countries depreciated to varying degrees, and the financial crisis broke out. In this financial crisis, international speculators launched repeated attacks to the currencies of Southeast Asian countries and achieved great success, making the foreign exchange reserve accumulated in Thailand, Malaysia, Indonesia and other countries for decades disappear in an instant.

In October 1997, taking advantage of the surging financial crisis in Southeast Asia, speculators sold a large number of Hong Kong dollars at low prices in the Hong Kong foreign exchange market in order to force the Hong Kong dollar to be depreciated, hoping to compel the Hong Kong government to release the US dollar to maintain the exchange rate, thus reducing the liquidity of the Hong Kong dollar in the market and raising interest rates, so as to attack the stock market meantime. But international speculators did not succeed this time. On the one hand, the Hong Kong government used sufficient foreign exchange reserves to sell a large number of US dollars to maintain the stability of the exchange rate. On the other hand, the government used the huge amount of Hong Kong dollars accumulated to buy a large number of stocks and futures. This strategy has promoted the continuous rise of the stock market index. As a result, international speculators haven’t achieved their goals and even lost money in the future and stock market.

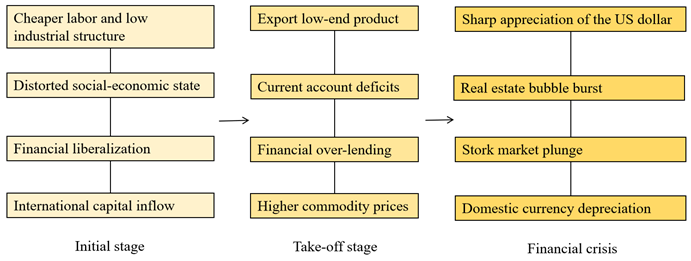

During Southeast Asian financial crisis, Thailand and other countries have very different results from Hong Kong. On the surface, it is because they do not have enough foreign exchange reserves as Hong Kong due to current account deficits in the confront of international speculators and foreign debt in the forms of foreign-currency denominated liabilities. In essence, it is because of their different level of industrial structure. Although both Hong Kong and Southeast Asian countries have realized financial integration, but the level of industrial structure in Hong Kong is far more advanced than in Southeast Asian countries. Before the outbreak of the financial crisis in 1997, the economic growth of Southeast Asian countries was excessively dependent on the export of low-end products because of their low industrial structure. Furthermore, at that time the social-economic conditions of these countries have many structure distortions, especially in financial and banking sectors, such as: lax supervision and weak regulation; low capital adequacy ratios; outright corrupt lending practices; non-market criteria of credit allocation; insufficient expertise in the regulatory institutions [14, p. 305] (Corsetti, Pesenti, Roubini, 1999, p. 305). Nevertheless, these countries have completed financial opening already and realized the financial integration too early. The adverse consequences of these distortions were crucially magnified by premature financial integration, which increases the supply-elasticity of funds from abroad. That means at that time under background of the poor social- economic conditions, the marginal cost of financial opening is greater than marginal benefit. Because of the mismatch between low industrial structure and premature financial integration, together with distorted social-economic conditions, even though the international capital flowed into these countries, these capital could not enter to the real economy to promote domestic industrial structure but to enter the real estate, finance and consumption fields to generate financial bubbles. As a result, these countries had a lot of current account deficits and insufficient foreign exchange reserve. Examining the industrial development model of these countries at that time, it can be found that all these countries have adopted a very similar economic development mode (Figure 2).

Figure 2. Economic development model of Southeast Asian countries

Source: compiled by the authors according to the research data.

The U.S financial subprime crisis broke out in 2008. On the surface, the subprime crisis originated from the collapse of credit of homebuyers, which is essentially caused by American industry hollowing out. The essence of economy is a set of value system, including material price system and asset price system. Different from the material price system which is mainly determined by cost and technologies in real sector, the asset price system is a special price system determined by capitalized pricing, which is adopted in financial sector. However, the asset price system of financial sector is based on material price system of real sector. The separation of asset price from material price will lead to financial bubble and result in financial crisis. After the two oil crises in the 1970s, the United States, guided by the neoliberal economic theory, under the context of economic globalization, began to adjust the industrial structure on a large scale, and gradually transferred a large number of manufacturing industries to developing countries. For instance, the proportion of American steel output in the world's total amount decreased from 47% in 1956 to 6.8% in 2007; since the 1980s, with the rise of the Japanese automobile industry, the competitive advantage of the American automobile industry has also lost, and the market share has declined sharply. After a long period of deindustrialization adjustment, the proportion of American secondary industry has decreased sharply, while the proportion of tertiary industry increased significantly. Trade, finance and other service industries have become the main body of American economy. By 2007, the year before the outbreak of the subprime crisis, the proportion of primary, secondary and tertiary industries in the United States was 1.2%, 20.9% and 77.9% respectively [15, p. 41–42] (Shaohui, Yingyu Huang, 2012, p. 41–42). Such an industrial structure means a great imbalance: over developed financial sector and too hollowing-out manufacturing industries. The huge imbalance in the industrial structure is the inevitable result of deindustrialization, and it has also buried the root of the financial crisis.

Whether the Southeast Asian financial crisis in 1997 or the American subprime crisis in 2008, the fundamental reason lied in the industrial structure. The former is the mismatch between their low industrial structure and premature financial integration. The latter is the contradiction between over developed financial sector and too hollowing-out manufacturing industries. In essence, financial crisis actually is industrial crisis. Therefore, to solve financial crisis, it is necessary not only to interfere in financial sector but also to adjust industrial structure.

2. The relation between global financial crisis and industrial upgrading of emerging economy.

Industrial transfer is the inevitable rule of economic development. In the current background of globalization, undertaking world industrial transfer is the most important way for industrial upgrading of emerging economies. With industrial transfer, it also comes with international capital and advanced technologies. As long as an emerging country can undertake world industrial transfer, it will have a great opportunity to promote domestic industrial upgrading and realize economic take-off.

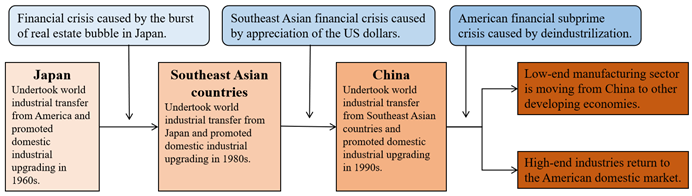

So far, the world has completed three large-scale industrial transfers. The first world industrial transfer took place in the 1960s. The United States transferred its traditional labor-intensive industries mainly to Japan through direct investment. Japan quickly became a world economic power by undertaking the industrial transfer of the United States. The second world industrial transfer took place in the late 1980s. Developed countries such as the United States and Japan transferred their labor-intensive industries to Southeast Asia. Southeast Asian countries seized this opportunity, completed the transformation to export-oriented emerging economies in the world. The third world industrial transfer took place in the late 1990s. Developed countries transferred their labor-intensive and some low-end technology industries (mainly automobile, electronics and other industries) to the southeast coast of China [16, p. 309] (Xing, Han, 2020, p. 309).

Throughout the history of industrial transfer in the world, every shift was under the background of financial crisis. In the late1980s, with the burst of the Japanese financial bubble, international capital began to flow to Southeast Asia, and Southeast Asia took over the transfer of world industries. At the end of 1990, with the emergence of the Southeast Asian financial crisis, international capital began to flow to China and China undertook the transfer of world industries. With the outbreak of the U.S subprime crisis in 2008, under the appeal of American reindustrialization strategy, the global value chain was being rearranged all over the world in the past decade (Figure 3).

Figure 3. The relation between global financial crisis and industrial upgrading of emerging economy

Source: compiled by the authors according to the research data.

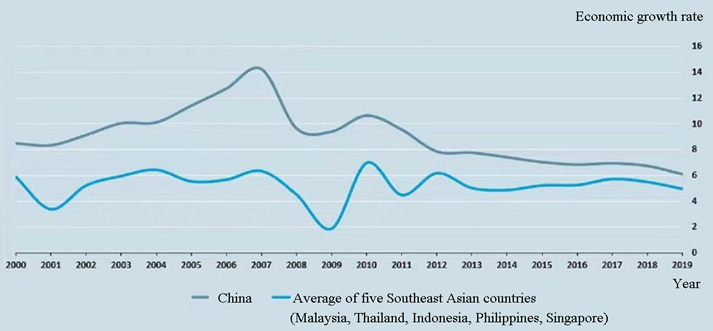

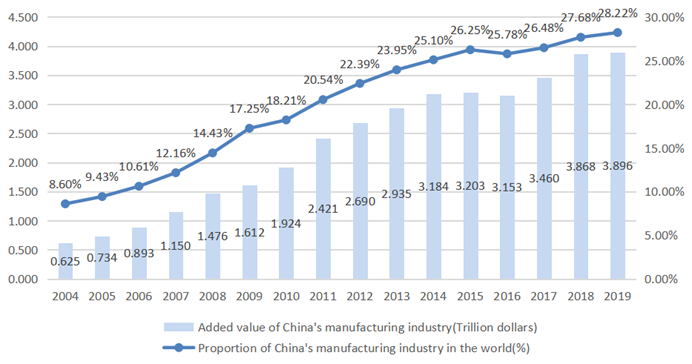

In the 1990s, the mismatch between low industrial structure and premature financial integration in Southeast Asian countries has buried the root of the financial crisis. In the same period, China chosen the strategy of developing industrial structure first and then gradually implemented financial opening. While realizing the free convertibility of current account, the government strictly supervised the capital account, created a good business environment, and focused on attracting foreign direct investment. All of these strategies were to improve social-economic conditions better for China's opening to the outside world. Since China's financial market was not fully opened at that time, RMB could not be freely exchanged. With sufficient foreign exchange reserves and small amount of foreign debt thanks to current account surplus, China was one of the few East Asian countries that were not directly involved in the Southeast Asian financial crisis. The stability of the value of RMB not only saved the currencies of Southeast Asian countries from a new round of depreciation but also made a positive contribution to the stability of the world financial system. Subsequently, after the Southeast Asian financial crisis, international capital began to pour into China. So, China began to undertake world industrial transfer and china’s economy developed rapidly by taking place of Southeast Asian countries (Figure 4). Since then, the proportion of china’s manufacturing industry in the word continually increased over the period (Figure 5). Moreover, China’s manufacturing industries played a very important role in sectors ranging from machinery, electrical parts, furniture and apparel parts [18, p. 73] (Ahmad, Haroon, Baig, Hui, 2020, p. 73). Gradually, with industrial upgrading, China has formed a developed manufacturing chain along the eastern coast and is known as the world factory.

Figure 4. Economic growth rate of China and five Southeast Asian countries from 2000 to 2019

Source: compiled by the authors in accordance with [12].

Figure 5. The proportion of China’s manufacturing industry in the world from 2004 to 2019

Source: compiled by the authors in accordance with [17].

During the 2008 subprime crisis, China adopted the famous "4 trillion plan" to stimulate the economy. The four trillion is also mainly used in the construction of transportation infrastructure so as to improve social-economic conditions. The construction of transportation can reduce transaction costs and be conducive to accumulation of factor endowment, thus promoting industrial structure upgrading [19, p. 5] (Lin, 2017, p. 5). Therefore, china’s industrial structure continued to upgrade after subprime crisis. At the end of 2011, the employment in the primary industry accounted for 34.8%, in the secondary industry accounted for 29.5%, in the tertiary industry accounted for 35.7%. By the end of 2020, the employment in the primary industry has accounted for 23.6%, in the secondary industry has accounted for 28.7%, and in the tertiary industry has accounted for 47.7% [20]. The proportion of employee in the tertiary industry has increased significantly. The employment in the first two industrial sectors is decreasing and has been concentrated in the tertiary industry.

After the outbreak of the financial crisis in 2008, the Obama administration took a series of economic policy measures. In order to promote economic recovery, America started the adjustment of industrial structure and implemented "Reindustrialization". The strategy of Reindustrialization of the United States will rearrange the industrial value chain on a global scale again. The country that the Reindustrialization policy will affect most is China, which has undertaken the world industrial transfer after the Southeast Asian financial crisis. One impact of Reindustrialization strategy is to find the cheapest production factors in the world for medium and low-end industries. Since 2009, due to the gradual increase of China's labor cost and resource cost, part of the low-end manufacturing sector is moving from China to other developing economies (Myanmar, India, and Vietnam). Another impact of the United States' Reindustrialization is that medium and high-end industries are returning to the American domestic market, thus occupying the high end of global value chain.

3. The strategy for emerging economy to promote domestic industrial upgrading under the context of pandemic.

The precursors of the financial crisis generally have three characteristics: first, the existence of asset price bubbles; second, the rising of debt default rate; third, the downturn of overall economy. The sudden outbreak of novel coronavirus has brought serious disasters to the world. Under the impact of the epidemic, the world economy has experienced a deep decline. According to the latest IMF World Economic Outlook Report in October 2021, the world economy declined by 3.1% year-on-year in 2020. Among them, developed economies fell by 4.5%, and emerging and developing economies fell by 2.1%. Under the influence of the epidemic, the extremely loose monetary policy of developed economies has led to a general sharp rise in the price of risky assets. The global stock market has seen a super rebound since its lowest point in late March 2020. As of December 16, 2021, the Dow Jones, NASDAQ and S & P 500 indexes in the US stock market have increased by about 17%, 20% and 25% respectively, and the index of European stock market has also increased by 10% ~ 25%. In addition, under the background of novel coronavirus and global recession, the total amount of global debt reached a record of $226 trillion in 2020, according to IMF global debt data. 2020 has become the year with the largest increase of global debt since the Second World War. The ratio of total global debt to gross domestic product (GDP) has increased by 28% to 256%, among which public debt accounts for 99%. The total global fiscal expenditure hedging against the novel coronavirus pneumonia was as high as 10790 billion US dollars from January 2020; the ratio of debt to GDP in both developed and emerging market economies has reached the highest record [21]. All these phenomena are consistent with the characteristics of financial crisis precursors, predicting the advent of financial crisis to a large extent.

From the perspective of historical analysis, the essence of the financial crisis is the industrial crisis. To get out of the financial crisis it is imperative to adjust the industrial structure in time at the root. Each global financial crisis provides an opportunity to rearrange the global industrial chain. Under the global loose monetary environment system caused by the epidemic, facing the advent of a new round of financial crisis, how emerging economies can undertake industrial transfer and promote the upgrading of domestic industrial structure is an urgent problem. Dissecting the evolution process of previous global financial crises, summarizing experiences and lessons, the following strategies should be paid attention by emerging economies:

1. Re-examine their domestic financial integration policies, matching their financial openness with their current industrial structure, and strengthen financial supervision. Emerging economies tend to be in the middle or low-end of the global industrial value chain and domestic industries tend to be labor-intensive, with imperfect laws, poor business environment and weak absorptive capacity to foreign capital. If financial integration is fully realized at this time, international capital will flow to the virtual economy, which will further promote the emergence of the domestic economic bubble.

2. Timely adjust the domestic industrial structure. Emerging economies should form an industrial pattern dominated by high-tech industries, supplemented by the financial and service industries, supported by manufacturing industries. Emerging economies should focus on developing medium and high-end manufacturing industries and encourage the development of high-tech industries such as green industries and digital industries. Furthermore, taking infrastructure construction and domestic demand consumption as the pinpoint, emerging economies can promote the country's long-term economic growth

3. Make the domestic social-economic conditions better thus improving the absorbing capability to international capital. Social-economic conditions mainly include business environment, government efficiency, legal system and so on. Countries with poor social-economic conditions usually attract international capital in forms of debts and with shorter maturity terms. Because these countries have poor investor protection and high cost of law enforcement, so investment activities usually are in short-term.

Conclusion

Dissecting the evolution process and exploring the root cause of the Southeast Asian financial crisis of 1997–1998 and the American subprime crisis of 2008–2009, this paper indicates that the fundamental reason of both Southeast Asian financial crisis and subprime crisis lied in their industrial structure. The very difference is the USA industrial structure is too hollowing-out compared with its over developed financial system because of its deindustrialization policy; while the industrial structure of Southeast Asian countries is too low compared with their premature financial integration. Therefore, to solve financial crisis, it is necessary not only to interfere in financial sector but also to adjust industrial structure.

From the perspective of history, with every outbreak of global financial crisis, it will be followed with a world industrial transfer. With industrial transfer, it also comes international capital and technologies. Therefore, for an emerging economy it is important to seize this opportunity, thus promoting domestic industrial upgrading and realizing economic growth. Although Southeast Asian countries realized financial integration quickly and early, so they attracted international capital inflow and undertook the world industrial transfer first in 1980s, they buried the root of financial crisis because of the mismatch between their low industrial structure and premature financial integration. Different from Southeast Asian countries, in addition to highlighting on improvement of social-economic conditions, china implemented financial opening gradually and matched the level of financial openness with domestic industrial structure. Therefore, china was not involved in the Southeast Asian financial crisis. Furthermore, china has undertaken the world industrial transfer from Southeast Asian countries in 1990s. During 2008 financial subprime crisis, China has adopted "4 trillion plan" to stimulate the economy. Instead channeling the money into financial sector, china’s government used 4 trillion in the construction of transportation infrastructure thus improving social-economic conditions by taking this opportunity. Highlighting on the match between the level of financial openness and domestic industrial structure and the improvement of social-economic conditions has resulted in the upgrading of industrial structure in china during the previous two global financial crises.

The negative impact of pandemic on world economy predicts the advent of financial crisis. Under the pressure of current situation, the experiences from china will be helpful for the other emerging economies to seize the opportunity to undertake industrial transfer and promote domestic industrial upgrading. This paper also gives the authorities from emerging economies a precise overview of the current emerging issues; therefore they can implement appropriate policies to respond timely to the current circumstances.

Источники:

2. Fisher A. G. Production, primary, secondary and tertiary // Economic Record. – 1939. – № 15. – p. 24-38.

3. Vujanovic A., Lebeaut A., Leonard S J. Exploring the impact of pandemic on global economy: perspective from literature review // Pertanika Journal of Science & Technology. – 2021. – № 3. – p. 2033-2087.

4. Zuber S., Harald Brüssow COVID 19: challenges for virologists in the food industry // Microbial Biotechnology. – 2020. – № 6. – p. 1689-1701.

5. Devpura N., Narayan P. K. Hourly oil price volatility: The role of COVID-19 // Energy Research Letters. – 2020. – № 1. – p. 13683.

6. Paul S. K., Chowdhury P. A production recovery plan in manufacturing supply chains for a high-demand item during COVID-19 // International Journal of Physical Distribution & Logistics Management. – 2020. – № 2. – p. 104-125.

7. Sulistiyani, Riyanto S. The Impact of the Covid-19 Pandemic on the Manufacturing Industry // International Journal of Research and Innovation in Social Science. – 2020. – № 5. – p. 172-175.

8. Farooq I., Ali S. COVID-19 outbreak and its monetary implications for dental practices, hospitals and healthcare workers // Postgraduate Medical Journal. – 2020. – № 96. – p. 791-792.

9. World-Tourism-Organization. 100% of global destinations now have covid-19 travel restriction. (2020). [Электронный ресурс]. URL: https://www.unwto.org/news/covid-19-travel-restrictions (дата обращения: 07.02.2022).

10. Gorton G. Financial crisis // Annual Review of Financial Economics. – 2018. – № 10. – p. 43-58.

11. Sohu news. Taking history as a mirror, several liquidity crises in history. 2020 (in Chinese). [Электронный ресурс]. URL: https://www.sohu.com/a/381702338_791909 (дата обращения: 07.02.2022).

12. The World Bank. [Электронный ресурс]. URL: https://databank.worldbank.org/home.aspx (дата обращения: 17.01.2022).

13. Rasiah R., Cheong K. C., Doner R. Southeast Asia and the Asian and global financial crises // Journal of Contemporary Asia. – 2014. – № 44. – p. 572-580.

14. Corsetti G., Pesenti P., Roubini N. What caused the Asian currency and financial crisis // Japan and the World Economy. – 1999. – № 11. – p. 305-373.

15. Shaohui W., Yingyu Huang On the rationality of the three industrial relations from the perspective of the international financial crisis // China Statistics. (In Chinese). – 2012. – № 2. – p. 41-42.

16. Xing L., Han Y. Finding the Worldwide Industrial Transfer Pattern Under the Perspective of Econophysics. / In: Barbosa H., Gomez-Gardenes J., Gonçalves B., Mangioni G., Menezes R., Oliveira M. (eds) Complex Networks XI. Springer Proceedings in Complexity. - Springer, Cham, 2020. – 309-321 p.

17. The world bank. [Электронный ресурс]. URL: https://databank.worldbank.org/home.aspx (дата обращения: 17.01.2022).

18. World Development Indicators. The World Bank. [Электронный ресурс]. URL: https://databank.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG/1ff4a498/Popular-Indicators (дата обращения: 17.01.2022).

19. Ahmad T., Haroon, Baig M., Hui J. Coronavirus Disease 2019 (COVID-19) Pandemic and Economic Impact // Pakistan Journal of Medical Sciences. – 2020. – № 36. – p. S73-S78.

20. Lin J.Y. Industrial policies for avoiding the middle-income trap: a new structural economics perspective // Journal of Chinese Economic and Business Studies. – 2017. – № 15. – p. 5-18.

21. Tencent news. In 2020, the human resources and social security statistical bulletin was released, and the number of employed people in China reached 750 million. 2021. (in Chinese). [Электронный ресурс]. URL: https://xw.qq.com/cmsid/20210604A02YOE00 (дата обращения: 07.02.2022).

22. Sohu news. How does the novel coronavirus pneumonia affect the world economy? 2021. (In Chinese). [Электронный ресурс]. URL: https://www.sohu.com/a/512039695_200224 (дата обращения: 07.02.2022).

Страница обновлена: 12.01.2026 в 05:58:23

Download PDF | Downloads: 51 | Citations: 1

Global financial crisis and industrial upgrading of emerging economy

Shevchenko D.A., Zhao W.Journal paper

Journal of International Economic Affairs

Volume 12, Number 1 (January-March 2022)

Abstract:

With the spread of coronavirus, unprecedented supply and demand disruptions crippled the economy. To a large extent, it predicts the advent of financial crisis. Different from previous literatures which mainly focus on the negative impact of novel coronavirus on the word economy and specific industries, this paper researches on the problem under the context of pandemic what an emerging economy should do to undertake the world industrial transfer thus promoting domestic industrial upgrading and improving its position in global value chain. Dissecting the evolution process of the Southeast Asian financial crisis of 1997-1998 and the American subprime crisis of 2008-2009, this paper provides the introduction to a special issue concerning the relation between global financial crisis and industrial upgrading of emerging economy. Through historical analysis, summarizing experiences and lessons given by previous financial crises, this paper concludes with some revelations and puts forward recommendations for emerging economies. This research also gives the authorities from emerging economies a precise overview of the current emerging issues, therefore they can implement appropriate policies to respond timely to the current circumstances.

Keywords: financial integration, emerging economy, industrial transfer, industrial upgrading

JEL-classification: F01, F63, F68, F36

References:

Ahmad T., Haroon, Baig M., Hui J. (2020). Coronavirus Disease 2019 (COVID-19) Pandemic and Economic Impact Pakistan Journal of Medical Sciences. (36). S73-S78.

Boshkoska M., Jankulovsk N. (2020). Coronavirus impact on global economy Annals - Economy Series, Constantin Brancusi University, Faculty of Economics. (4). 18-24.

Corsetti G., Pesenti P., Roubini N. (1999). What caused the Asian currency and financial crisis Japan and the World Economy. (11). 305-373.

Devpura N., Narayan P. K. (2020). Hourly oil price volatility: The role of COVID-19 Energy Research Letters. (1). 13683.

Farooq I., Ali S. (2020). COVID-19 outbreak and its monetary implications for dental practices, hospitals and healthcare workers Postgraduate Medical Journal. (96). 791-792.

Fisher A. G. (1939). Production, primary, secondary and tertiary Economic Record. (15). 24-38.

Gorton G. (2018). Financial crisis Annual Review of Financial Economics. (10). 43-58.

Lin J.Y. (2017). Industrial policies for avoiding the middle-income trap: a new structural economics perspective Journal of Chinese Economic and Business Studies. (15). 5-18.

Paul S. K., Chowdhury P. (2020). A production recovery plan in manufacturing supply chains for a high-demand item during COVID-19 International Journal of Physical Distribution & Logistics Management. (2). 104-125.

Rasiah R., Cheong K. C., Doner R. (2014). Southeast Asia and the Asian and global financial crises Journal of Contemporary Asia. (44). 572-580.

Shaohui W., Yingyu Huang (2012). On the rationality of the three industrial relations from the perspective of the international financial crisis China Statistics. (In Chinese). (2). 41-42.

Sohu news. How does the novel coronavirus pneumonia affect the world economy? 2021. (In Chinese). Retrieved February 07, 2022, from https://www.sohu.com/a/512039695_200224

Sohu news. Taking history as a mirror, several liquidity crises in history. 2020 (in Chinese). Retrieved February 07, 2022, from https://www.sohu.com/a/381702338_791909

Sulistiyani, Riyanto S. (2020). The Impact of the Covid-19 Pandemic on the Manufacturing Industry International Journal of Research and Innovation in Social Science. (5). 172-175.

Tencent news. In 2020, the human resources and social security statistical bulletin was released, and the number of employed people in China reached 750 million. 2021. (in Chinese). Retrieved February 07, 2022, from https://xw.qq.com/cmsid/20210604A02YOE00

The World Bank. Retrieved January 17, 2022, from https://databank.worldbank.org/home.aspx

The world bank. Retrieved January 17, 2022, from https://databank.worldbank.org/home.aspx

Vujanovic A., Lebeaut A., Leonard S J. (2021). Exploring the impact of pandemic on global economy: perspective from literature review Pertanika Journal of Science & Technology. (3). 2033-2087.

World Development IndicatorsThe World Bank. Retrieved January 17, 2022, from https://databank.worldbank.org/indicator/NY.GDP.MKTP.KD.ZG/1ff4a498/Popular-Indicators

World-Tourism-Organization. 100% of global destinations now have covid-19 travel restriction. (2020). Retrieved February 07, 2022, from https://www.unwto.org/news/covid-19-travel-restrictions

Xing L., Han Y. (2020). Finding the Worldwide Industrial Transfer Pattern Under the Perspective of Econophysics

Zuber S., Harald Brüssow (2020). COVID 19: challenges for virologists in the food industry Microbial Biotechnology. (6). 1689-1701.