The place of the gas industry in the energy security system of Russia on foreign markets

Скачать PDF | Загрузок: 33

Статья в журнале

Экономическая безопасность (РИНЦ, ВАК)

опубликовать статью | оформить подписку

Том 6, Номер 2 (Апрель-июнь 2023)

Эта статья проиндексирована РИНЦ, см. https://elibrary.ru/item.asp?id=54166224

Аннотация:

In this paper, special attention paid to the leading position of the gas industry in the system of economic and energy security of Russia. The system-forming role of the gas industry for the Russian economy considered the main problems of the gas sector and its development trends identified in order to increase the competitiveness of the domestic fuel and energy complex and develop the gas market. Based on the results of the study, conclusions drawn about the instability of export prices for natural gas and the tendency to increase the volatility of natural gas exports over previous years, with a relatively stable domestic consumption of \"blue fuel\" at the level of 2% of Russia\'s GDP. The volume of natural gas exports to the FSU countries in 2015-2021 tended to decrease with the growth of demand in non-CIS countries, at the same time, the average gas sales price for the FSU countries turned out to be less volatile with the non-stationarity of average gas sales prices from Russia to other countries. Thus, the gas industry for Russia not only of strategic importance, the creation of a single gas market between the Russian Federation and the FSU countries a priority at the present stage in order to increase the protection of the Russian economy from internal and external threats, which will also ensure a stable demand for gas in the participating countries regional natural gas market, followed by an increase in natural gas consumption and a reorientation of Russian gas exports towards more stable and reliable supplies.

Ключевые слова: energy security, natural gas, natural gas export

JEL-классификация: Q34, Q35, Q38

Introduction. The purpose of this study is to identify priority areas for the development of the Russian gas industry, both from the standpoint of ensuring strategic interests and protecting the national economy from internal and external threats, and if it is possible to stimulate economic development and the reliability of gas supplies.

To achieve the goal, the following tasks solved in the work: the strategic importance of the gas industry and its place in the system of economic security of the Russian Federation was determined; an analysis was made of the dynamics of domestic prices for natural gas, the dynamics of export prices and the volume of exports of natural gas, the dynamics of export LNG from Russia non-CIS countries and FSU countries, considered the nature of price volatility and the value of exports for non-CIS countries and FSU countries was established, the trend of these indicators was revealed, an analysis was made of the structure of natural gas exports for a number of leading importers of Russian natural gas and LNG, the authors present recommendations for reorienting Russian natural gas exports to improve the reliability of supplies and stimulate the economic development of Russia. The object of the study is the gas component of Russia's energy security. The subject of the study is the role of the gas component of Russia's energy security in ensuring economic security and the possibility of stimulating economic development at the present stage of the gas market functioning. Research methods is comparison, analysis, synthesis, induction, deduction, and special analysis methods graph analysis, static analysis of data on natural gas export volumes, analysis of natural gas price dynamics. The information base of the study the works of domestic and foreign authors on the subject of energy security and determining the place of the gas industry in its structure (Urazgaliev V.Sh., Bridge G., Le Billon, F.), the study of the impact of the gas industry on economic development of Russia (Karibov A.P., Volynkina G.V., Vasilyeva V.D.). The study also uses the Energy Strategy of the Russian Federation for the period up to 2035, official statistics from the Bank of Russia and the Federal State Statistics Service (Rosstat), as well as Gazprom's reporting. The practical significance of the study lies in the possibility of using the results obtained in updating the Energy Strategy of the Russian Federation for the period up to 2035, and in developing the export policy of PJSC Gazprom. The scientific novelty of the study lies in the study of the issue of reorientation of export deliveries of natural gas by Russia to a region with less volatile indicators of demand and average prices for natural gas as well as in substantiating such a reorientation in order to increase the economic security of the Russian Federation and protect its strategic interests and the interests of the FSU countries. The creation of a single gas market between Russia and the FSU countries may result in less volatility in prices and supply volumes in this region as well as stimulate a steady growth in demand and consumption of natural gas.

Main

part. Energy in the structure

of the Russian economy is much more important than in a number of developed

countries. There are important preconditions for this. As V.D. Vasilyeva,

Russia has a huge resource potential with 2.4% of the population and 13% of the

world's territory; it has 12–13% of forecast fuel and energy resources

including more than 12% of proven oil reserves, more than 30% of gas reserves,

more than 11 % of explored coal reserves. The energy sector, therefore,

occupies a pivotal position in the country's economy [7, p. 27] (Vasileva,

2019, р. 27).

The Russian energy sector is of regional importance. Entire cities

and towns are being formed near energy sources and industry is developing. The

significant role of the country's energy complex makes it necessary to have a

developed infrastructure, main high-voltage lines and pipelines for the

transport of crude oil and natural gas.

Energy in many ways determines not only the indicators of social

production of other industries, but also reflects the regional economic

specialization of the regions. In territories with large reserves of natural

resources and mainly with extractive industries, broad economic specialization

is possible [12] (Lev, 2023). The fuel and energy complex today not

only performs an infrastructural function, but is also the main complex of the

national economy, as it provides a huge part of the country's income, 2/3 of

export revenues, more than 40% of tax revenues of the budget and about 30% of

GDP [10] (Karavaeva,

Lev, 2021).

According to V.D. Andrianov, the energy sector in Russia has a

powerful production, technological and human potential;

it is able to meet the necessary needs of consumers in energy products

and services [3, p. 75–103] (Andrianov, 2017, p. 75–103). In addition,

it the energy sector that is the leading link in ensuring economic security and

national security in general determining the main indicators of economic

security.

Leading in the energy complex of Russia is the oil and gas industry.

However, it is the gas industry, according to many researchers [13, 16] (Morgunov,

2006; Urazgaliev, Titkov, 2018), in the future will be the most promising

industry. The accumulated reserves of natural gas are generally sufficient for

use both domestically and for export until 2040. As E.V. Morgunov, “these

reserves and resources are sufficient for at least 80–100 years to ensure a

constant gas production in the amount of 700 billion cubic meters per year” [13, p. 130] (Morgunov,

2006, p. 130). It is also important to note that special attention paid to

capital investments in the unique gas fields of Eastern Siberia and the

northern regions of the country that will increase gas exports to foreign

markets.

Having determined the leading position of energy security in the

system of economic security of Russia we can conclude that the gas industry,

its state and dynamics to a decisive extent determine the combination of

conditions and factors, key areas of activity in the development and

implementation of strategic decisions that in the long term will allow ensure

the independence and protection of the national economy from internal and

external threats, production efficiency and sustainable growth, the

competitiveness of the domestic energy sector and the Russian industry as a

whole.

In the first half of the 21st, the problem of reforming the Russian

gas industry becomes the most urgent that is also due to the growing risks and

threats in the field of ensuring the energy security of the Russian Federation.

The export of natural gas (including liquefied natural gas) plays a special

role in ensuring security providing 10% of foreign exchange earnings from

exports in the federal budget and 8–12% of Russia's total exports (Fig. 1).

According to A.P. Karibov and G.V. Volynkin, significant problems in the gas

industry are [11, p. 26] (Karibov, Volynkina, 2006, p. 26):

1) high degree of depreciation of fixed assets;

2) lack of investment resources and their irrational use;

3) decrease in labor productivity in the gas industry;

4) the inefficiency of state regulation as well as the problems of organizing

the industry in connection with the formation of a competitive gas market.

Also, one of the most important problems in the gas industry is

cross-subsidization that does not stimulate the modernization of the gas

sector. Gas supply by the leading oil and gas corporation PJSC Gazprom to the

domestic market in the early 2000s accounted for more than 60% of the total

volume of marketable gas. The proceeds from its sale on the domestic market

turned out to be equal to only 20–22% of the total proceeds from the sale of gas; most of the

proceeds were generated by the sale of gas to the external market. Due to

export earnings, subsequently, internal corporate cross-subsidization of

operations related to gas supplies to the domestic market carried out [11, p. 26–27] (Karibov,

Volynkina, 2006, p. 26–27). In order to develop a competitive gas market

PJSC Gazprom is currently striving to introduce market principles for setting

prices for natural gas through participation in organized trading at JSC St.

Petersburg International Commodity and Raw Materials Exchange [15]. In

2021 PJSC Gazprom supplies through the stock exchange amounted to 5.6 billion

cubic meters, which in relative terms is equivalent to 2.2% of the annual

export of natural gas from Russia [5] (Brakk, Leshchenko, 2023).

Figure 1. Share of natural gas exports by Russia in total

exports 2010–2021, %

Source: compiled by the authors based on materials [4].

Figure 1 shows the positive trend of increasing the average

selling price of gas in Russia in 2015–2021. So if in 2015 the average selling price of gas in the domestic

market of PJSC Gazprom was RUB 3,641.3/1,000 cubic meters, by 2019 it reached 4,118.2 rubles/1000 cubic meters an increase of

13.10% compared to the base year [14], and by 2021 increased to 4,369.3 rubles/1000

cubic meters m. that turned out to be 19.99% more than in 2015. Growth rates of

domestic gas prices in 2018 and 2019 were higher than the inflation rate for

the period under review. This fact testifies to the improvement of both PJSC

Gazprom's positions in the domestic market and greater security in the gas

industry from the position of the main supplier of natural gas implementing

large gas investment projects.

An analysis of the dynamics of gas prices is especially important. G.

Bridge and F. Le Billon defined energy security as “ensuring a reliable supply

at prices affordable for consumers and sufficient to justify investments in new

fields” [6] (Bridzh,

Le Biyon, 2015). In Russian realities gas prices for domestic consumers are

quite low, and investments are unjustified or insufficient. The dynamics of

domestic prices for natural gas for the period 2015–2021 shows positive

developments with a moderate increase in average gas sales prices in the

Russian Federation by 3–4% per year.

Figure 1. Share of natural gas exports by Russia in total

exports 2010–2021, %

Source: compiled by the authors based on materials [4].

Figure 1 shows the positive trend of increasing the average

selling price of gas in Russia in 2015–2021. So if in 2015 the average selling price of gas in the domestic

market of PJSC Gazprom was RUB 3,641.3/1,000 cubic meters, by 2019 it reached 4,118.2 rubles/1000 cubic meters an increase of

13.10% compared to the base year [14], and by 2021 increased to 4,369.3 rubles/1000

cubic meters m. that turned out to be 19.99% more than in 2015. Growth rates of

domestic gas prices in 2018 and 2019 were higher than the inflation rate for

the period under review. This fact testifies to the improvement of both PJSC

Gazprom's positions in the domestic market and greater security in the gas

industry from the position of the main supplier of natural gas implementing

large gas investment projects.

An analysis of the dynamics of gas prices is especially important. G.

Bridge and F. Le Billon defined energy security as “ensuring a reliable supply

at prices affordable for consumers and sufficient to justify investments in new

fields” [6] (Bridzh,

Le Biyon, 2015). In Russian realities gas prices for domestic consumers are

quite low, and investments are unjustified or insufficient. The dynamics of

domestic prices for natural gas for the period 2015–2021 shows positive

developments with a moderate increase in average gas sales prices in the

Russian Federation by 3–4% per year.

Table 1

Dynamics of average selling prices of gas by PJSC Gazprom in Russia

(excluding VAT, including excise and customs duties)

|

Index

|

2015

|

2016

|

2017

|

2018

|

2019

|

2020

|

2021

|

|

Average selling price in Russia

RUB/1000 cubic meters

|

3641,3

|

3815,5

|

3808,3

|

3981,3

|

4118,2

|

4176,9

|

4369,3

|

|

Annual absolute increase, RUB/1000

cubic meters

|

110,4

|

174,20

|

-7,20

|

173,00

|

136,90

|

58,7

|

192,4

|

|

Chain price growth rate (in rubles), %

|

3,13%

|

4,78%

|

-0,19%

|

4,54%

|

3,44%

|

1,43%

|

4,61%

|

|

Inflation rate, %

|

12,91

|

5,39

|

2,51

|

4,26

|

3,04

|

4,91

|

8,39

|

|

Base price growth rate (in 2015

prices, rubles), %

|

-

|

4,78%

|

4,59%

|

9,34%

|

13,10%

|

14,71%

|

19,99%

|

|

USD*/1000 cubic meters

|

59,4

|

57,1

|

65,3

|

63,3

|

63,7

|

58,1

|

59,3

|

|

Euro*/1000 cubic meters

|

53,6

|

51,6

|

57,7

|

53,7

|

56,9

|

50,9

|

50,1

|

As

noted in the annual statistical compilation of the Analytical Center for the

Government of the Russian Federation "Fuel and Energy Complex of Russia

2019", in 2019 gas exports from Russia increased by 5.2% compared to 2018

and reached 260 cubic meters (Fig. 2).

However, in 2020 there was a significant decrease in exports and production of

natural gas by 21.5% and 6.32%, respectively (excluding associated petroleum

gas).

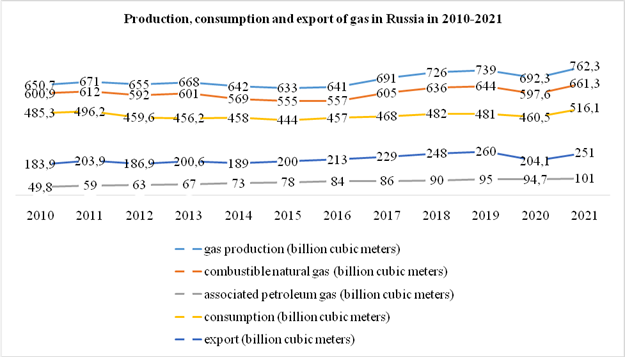

Figure 2. Production, consumption and export of gas in

Russia from 2010 to 2021

Source: compiled by the authors based on materials [2, 18].

Total natural gas exports in 2019 amounted to 41.8 billion dollars,

while 82.7% of exports in monetary terms accounted for non-CIS countries and

only 17.3% for the CIS countries [2]. In 2021 the value of natural gas exports

increased to $55.5 billion, but mainly due to an increase in export prices for

Europe and non-CIS countries by 2.24 times and for the FSU countries by 1.35

times compared to 2020. In turn, the physical volume of natural gas exports

increased by only 4.1% for Europe and other countries and by 6.1% for the FSU

countries. However, despite the fact that in 2020–2021 the physical volume of

natural gas exports to both regions increased (due to the post-pandemic

recovery of the economies), in general, from 2015 to 2021 there was a clear

trend towards a decrease in the physical volumes of exports of natural gas

(including LNG) to the FSU countries by an average of 1.56 billion cubic meters

annually and the growth of natural gas exports to Europe and other countries by

an average of 7.93 billion cubic meters per year (Table 2).

Figure 2. Production, consumption and export of gas in

Russia from 2010 to 2021

Source: compiled by the authors based on materials [2, 18].

Total natural gas exports in 2019 amounted to 41.8 billion dollars,

while 82.7% of exports in monetary terms accounted for non-CIS countries and

only 17.3% for the CIS countries [2]. In 2021 the value of natural gas exports

increased to $55.5 billion, but mainly due to an increase in export prices for

Europe and non-CIS countries by 2.24 times and for the FSU countries by 1.35

times compared to 2020. In turn, the physical volume of natural gas exports

increased by only 4.1% for Europe and other countries and by 6.1% for the FSU

countries. However, despite the fact that in 2020–2021 the physical volume of

natural gas exports to both regions increased (due to the post-pandemic

recovery of the economies), in general, from 2015 to 2021 there was a clear

trend towards a decrease in the physical volumes of exports of natural gas

(including LNG) to the FSU countries by an average of 1.56 billion cubic meters

annually and the growth of natural gas exports to Europe and other countries by

an average of 7.93 billion cubic meters per year (Table 2).

Table 2

Dynamics of volumes and average prices of PJSC Gazprom gas sales abroad in 2015–2021 (including customs duties)

|

Year

|

Europe and other countries

|

FSU countries

| ||

|

Average price, rub./thous. cube m

|

Volume in billion cubic meters

|

Average price, rub./thous. cube m

|

Volume in billion cubic meters

| |

|

2015

|

15 057,3

|

184,4

|

11 911,0

|

40,3

|

|

2016

|

11 763,3

|

228,3

|

10 263,1

|

33,2

|

|

2017

|

11 670,5

|

242

|

9 237,0

|

35

|

|

2018

|

15 499,50

|

243,3

|

10 225,9

|

38,1

|

|

2019

|

13 613,0

|

232,4

|

10 175,90

|

38,7

|

|

2020

|

10 355,9

|

219

|

9 899,80

|

31,2

|

|

2021

|

23 187,20

|

227,9

|

13 328,4

|

33,1

|

Source: compiled by the authors based on materials [15]. However, as the results show, there is a more pronounced trend towards increasing exports of Russian natural gas to non-CIS countries than a decrease in exports to the FSU countries, which characterizes this region as more stable in the supply of "blue fuel". The dynamics of natural gas export prices for the FSU countries also turned out to be more stable and predictable – on average, prices in 2015–2021 increased annually by 156.65 rubles/1000 cubic meters, while the dynamics of natural gas prices in Europe characterized by increased volatility, especially after 2017–2018 – the average annual absolute increase in prices amounted to 640.13 rubles/1000 cubic meters. m., with a higher variation of the indicator, although not statistically significant (the coefficient of variation of average prices for gas sold to Europe and other countries was 26% that is less than 33.33%). In 2019, Kazakhstan and France increased Russian gas imports among major consumers (Table 3). Turkey's share in the total structure of Russian natural gas exports has significantly decreased from 24 billion cubic meters m in 2018 up to 15.1 billion cubic meters in 2019 In general, for 2019–2021. There are no fundamental changes in the main importing countries of Russian natural gas and LNG. It can also be noted that in the structure of exports from the Russian Federation by country for 2019–2021. LNG importing countries (Great Britain, Japan) as well as some FSU countries (for example, Kazakhstan) were subject to the greatest volatility. An analysis of the dynamics of export shares by individual countries shows a relative decrease in the shares of exports of leading importers from Europe (Germany, Italy, France) in the total exports of natural gas and LNG by Russia, with a relatively stable dynamics of natural gas exports to Belarus, albeit with a slight decrease, but stable in absolute terms (19–20 billion cubic meters annually). Thus, in order to increase the reliability of gas export supplies, Russia should strive to increase the share of the FSU countries in total supplies while increasing the physical volume of supplies, which can be implemented by integrating the FSU countries and Russia into a single gas market with a developed infrastructure while jointly implementing large investment gas projects to stimulate demand in the unified gas market. Table 3

Structure of Russian gas exports (including LNG) by country in 2019–2021

|

Direction of gas export (including LNG export)

|

2019

|

2020

|

2021

|

2019

|

2020

|

2021

|

|

(billion cubic meters)

|

(% of total gas exports)

| |||||

|

Germany

|

54,7

|

45,8

|

50,6

|

21,96

|

22,44

|

20,16

|

|

Belarus

|

20,3

|

18,8

|

19,8

|

8,15

|

9,21

|

7,89

|

|

Turkey

|

15,1

|

16,4

|

26,3

|

6,06

|

8,04

|

10,48

|

|

Italy

|

14,3

|

20,8

|

25

|

5,74

|

10,19

|

9,96

|

|

France

|

18,8

|

12,4

|

11,5

|

7,55

|

6,08

|

4,58

|

|

Kazakhstan

|

12,8

|

3,4

|

9,3

|

5,14

|

1,67

|

3,71

|

|

United Kingdom

|

12,3

|

6

|

7,26

|

4,94

|

2,94

|

2,89

|

|

Japan

|

6,3

|

6,14

|

9

|

2,53

|

3,01

|

3,59

|

|

Other

|

94,5

|

74,36

|

92,24

|

37,94

|

36,43

|

36,75

|

|

Total

|

249,1

|

204,1

|

251

|

100,00

|

100,00

|

100,00

|

As can be seen from Table 3, in general, the share of Russian natural gas and LNG exports to the Republic of Belarus is more stable, for example, than to Italy or France that is explained by the peculiarity of the agreements concluded with these countries. For the EU countries contracts with gas price pegged to spot quotations for a month or two months in advance prevail [3] (Andrianov, 2017), while for the FSU countries, long-term export contracts pegged to oil prices prevail that currently ensures greater reliability and stability of export supplies from Russia and stable cash flows from FSU countries from natural gas exports.

Conclusion

The considered structure of natural gas exports testifies to the constantly changing volumes of exports of the Russian gas industry in foreign markets. Against the backdrop of highly fluctuating export prices for natural gas and in an unstable economic and political situation, with a relatively stable volume of domestic gas consumption (about 2% of GDP), the gas industry plays an increasingly important role in ensuring foreign economic security of Russia, as a strategically important sector of the national economy Russia, accounting for an average of 11.6% of the total export of the Russian Federation in monetary terms. The current economic and political situation, especially after the introduction of the natural gas price ceiling, makes the issue of gas export supplies from Russia relevant in the development and implementation of the Energy Strategy of the Russian Federation, including in conditions of increased instability and volatility of the global gas market, despite the growing demand from European countries, it is necessary to reorient gas exports in the direction of the FSU countries, the dynamics of export deliveries for which during 2015-2021 remained relatively stable both in value terms and in physical volume of deliveries. In addition to the strategic importance of the gas industry for the country's economy, there are all opportunities to improve the security of supply while stimulating economic development on the basis of a single gas market in Russia and the FSU countries, with a subsequent focus on exports to the countries of the Asia-Pacific region. As a result of the study, it was found that export prices for natural gas in the FSU countries have less volatility; in addition, the demand for natural gas in these countries is more stable and less elastic in gas prices. Also, an important conclusion of the study is that the consumption of natural gas in the EU countries is more volatile for individual countries (for example, if the share of Italy in the total Russian gas export in 2019 was 5.74%, then in 2020 it increased to 10.19% , and in 2021 it decreased again to 9.96%, the share of France in total Russian exports was permanently decreasing during 2019–2021 from 7.55% to 4.58%), while gas exports to the FSU countries are more stable in terms of certain countries (exports to Belarus are stable and account for 7–9% of all-Russian exports, which in absolute terms is not inferior to exports to many EU countries) that allows us to focus on more reliable long-term export contracts for the FSU countries and, in the future, focus on creating FSU of the single gas market. In the context of the spread of liquefied gas technologies, structural changes in energy consumption are also intensifying, while domestic gas production in Russia exceeds consumption by 1.8 times that allows increasing exports. In the future as the gas market develops and stable cash flows from natural gas exports to the FSU countries the creation of a single gas market with the FSU countries and the transition to a competitive market, it is possible to form petrochemical clusters and increase the production of liquefied natural gas by 2.4–3.4 times with subsequent export orientation to the countries of the Asia-Pacific region. The main conclusion of the study is the need to create a single gas market and integration with the FSU countries with the subsequent formation of petrochemical clusters and their sustainable financing, since prices and supplies to the FSU countries are more reliable and in the future – “the expansion of natural gas and LNG supplies to the east will strengthen the competitive advantages of the Russian Federation in foreign natural gas markets and increase its economic security” [8] (Karavaeva, Lev, 2019).

Источники:

2. Аналитический центр при Правительстве Российской Федерации. Режим доступа: https://ac.gov.ru/publications/topics/topic/13700 (дата обращения 17.01.2023).

3. Андрианов В.Д. Актуальные проблемы и перспективы развития топливно-энергетического комплекса России / В.Д. Андрианов // Общество и экономика. – 2017. № 6. – С. 75–106.

4. Банк России. Режим доступа: https://www.cbr.ru/ (дата обращения 17.01.2023).

5. Бракк, Д. Г. Анализ показателей функционирования Группы ПАО «Газпром» в контексте воздействия на экологическую систему арктической зоны России / Д. Г. Бракк, Ю. Г. Лещенко // Развитие и безопасность. – 2023. – № 1(17). – С. 59-73. – DOI 10.46960/2713-2633_2023_1_59.

6. Бридж, Г., Ле Бийон, Ф. Нефть / пер. с англ. Н. Эдельмана; науч. ред. перевода Т. Дробышевская. — М.: Изд-во Института Гайдара, 2015. — 344 с.

7. Васильева В.Д. Топливно-энергетический комплекс России: проблемы и перспективы развития // Научное обозрение. Педагогические науки. – 2019. № 2-2. – С. 26-31.

8. Караваева, И. В. Развитие стратегии экономической безопасности (итоги проведения ежегодной международной научно-практической конференции "Сенчаговские чтения") / И. В. Караваева, М. Ю. Лев // Вестник Института экономики Российской академии наук. – 2019. – № 4. – С. 194-204. – DOI 10.24411/2073-6487-2019-10055.

9. Караваева, И. В. Итоги проведения IV международной научно-практической конференции "IV Сенчаговские чтения. Cоциально-экономическая безопасность: сфера государственного регулирования и область научного знания" / И. В. Караваева, М. Ю. Лев // Экономическая безопасность. – 2020. – Т. 3, № 4. – С. 549-578. – DOI 10.18334/ecsec.3.4.111150.

10. Караваева, И. В. Итоги проведения V Международной научно-практической конференции "Сенчаговские чтения" "Новые вызовы и угрозы экономике и социуму России" / И. В. Караваева, М. Ю. Лев // Экономическая безопасность. – 2021. – Т. 4. – № 3. – С. 853-887. – DOI 10.18334/ecsec.4.3.112368.

11. Карибов А.П. Особенности стратегического реформирования газовой отрасли в России / А.П. Карибов, Г.В. Волынкина // Известия ВолгГТУ. – 2006. № 7. – С. 26-29.

12. Лев, М. Ю. Современные ценовые тренды экономической безопасности мобилизационной экономики: монография. – Москва: Издательско-торговая корпорация «Дашков и К°», 2023. – 86 с. DOI 10.29030/978-5-394-05419-8-2023.

13. Моргунов Е.В. Современное состояние и прогноз развития газовой отрасли России / Е.В. Моргунов // ЭКО. - 2006. №5. – С. 130-134.

14. ООО «Газпром экспорт». Режим доступа: https://gazpromexport.ru/ (дата обращения 25.01.2023).

15. ПАО «Газпром». Режим доступа: https://www.gazprom.ru/about/marketing/russia/ (дата обращения 17.01.2023).

16. Уразгалиев В.Ш. Газовая составляющая энергетической безопасности России / В.Ш Уразгалиев, М.В. Титков // Вестник Санкт-Петербургского университета. Экономика. -2018. № 2. – С. 176-216.

17. Федеральная служба государственной статистики. Режим доступа: https://rosstat.gov.ru/statistics/price (дата обращения 25.01.2023).

18. Центральное диспетчерское управление топливно-энергетического комплекса. Режим доступа: https://www.cdu.ru/ (дата обращения 25.01.2023).

Страница обновлена: 29.12.2025 в 20:10:38

Download PDF | Downloads: 33

The place of the gas industry in the energy security system of Russia on foreign markets

Agashin A.V., Novikov A.V.Journal paper

Economic security

Volume 6, Number 2 (April-June 2023)

Abstract:

In this paper, special attention paid to the leading position of the gas industry in the system of economic and energy security of Russia. The system-forming role of the gas industry for the Russian economy considered the main problems of the gas sector and its development trends identified in order to increase the competitiveness of the domestic fuel and energy complex and develop the gas market. Based on the results of the study, conclusions drawn about the instability of export prices for natural gas and the tendency to increase the volatility of natural gas exports over previous years, with a relatively stable domestic consumption of "blue fuel" at the level of 2% of Russia's GDP. The volume of natural gas exports to the FSU countries in 2015-2021 tended to decrease with the growth of demand in non-CIS countries, at the same time, the average gas sales price for the FSU countries turned out to be less volatile with the non-stationarity of average gas sales prices from Russia to other countries. Thus, the gas industry for Russia not only of strategic importance, the creation of a single gas market between the Russian Federation and the FSU countries a priority at the present stage in order to increase the protection of the Russian economy from internal and external threats, which will also ensure a stable demand for gas in the participating countries regional natural gas market, followed by an increase in natural gas consumption and a reorientation of Russian gas exports towards more stable and reliable supplies.

Keywords: energy security, natural gas, natural gas export

JEL-classification: Q34, Q35, Q38