Use of currency risk management tools in foreign economic activity by the example of educational company

Bostandzhian K.R.1,2![]()

1 Plekhanov Russian University of Economics, ,

2 Symrise-Rogovo LLC, ,

Скачать PDF | Загрузок: 58

Статья в журнале

Экономика, предпринимательство и право (РИНЦ, ВАК)

опубликовать статью | оформить подписку

Том 10, Номер 6 (Июнь 2020)

Эта статья проиндексирована РИНЦ, см. https://elibrary.ru/item.asp?id=43811682

Аннотация:

For any company going internationally is not only a big step in the development and enlargement of a company’s structure, but it also incurs the acquisition of new risks. The main issues of such companies is the establishment of proper risk management system. There are many factors on foreign markets, which cause financial, time and other losses. However, one the most significant and harmful for a company is the foreign exchange rate risk (currency risk).

The point is that success and effectiveness of company’s operations depend not on the foreign counterparty or a type of deal, but first, the skills and professional competences of the risk management department in a particular company.

With evolving the international market operations and tightening the inter-country relations the risk management system has been highly developed. Today it includes a wide range of various risk reducing instruments. The present research paper will analyze the different options of derivative financial instruments, such as forwards and options, by the case of an educational company, the results of which can be used for the assessment of efficiency of any company operating internationally.

Ключевые слова: currency risk management, exchange rate, international trade, foreign economic activity, hedging

JEL-классификация: F31, G32, O23, O24

INTRODUCTION

Due to the rapidly increasing integration processes of many companies through different countries into the world economic system, the foreign economic activity of the enterprises becomes one of the most important aspects within their economic life. Nowadays the companies have the right for independent access to foreign markets in order to conduct foreign trade transactions, the range of which has recently broadened from single purchase and sale transactions to the establishment of joint ventures [5] (Pokrovskaya, 2015).

However, integration process has adverse consequences as well. It is well known, that today Russian foreign trade suffers from a number of significant negative features. Firstly, more than ¾ of the structure of Russian exports is represented by raw materials and energy sources. Consequently, it leads to the dependence of the domestic economy from fluctuations on global economic market. Thirdly, the experts make an emphasis on the non-diversified structure of imports, in which more than 50 percent belongs to the machinery and other equipment. About 15 percent goes to chemical industry and food supplies. Moreover, it is important to point out that a profitable part of the Federal budget is formed based on customs duties levied on export of oil and oil products [4].

All the mentioned factors create economic dependence on external market conditions. It means that the internal development of domestic economy is highly connected with the global prices, economic stability and other factors.

Management of the currency risks is a challenging task for any company because of high volatility of exchange rates [8] (Oxelheim, Alviniussen, Jankensgard, 2020). The exchange rates influence the financial indicators of a company: its revenues, incomes, losses etc. That is why the risk management policy plays the key role in the successful performance of companies in scope of international economic activity. The proper risk management system is an important advantage of any company, which can lead it to the level of highly competitive companies [6] (Hull, 2018).

The main purpose of the present research paper is to examine the theoretical, organizational, methodological and practical issues of derivative financial instruments as one of the key tools in risk management system.

In order to achieve the selected target the following tasks will help to determine the logic of the present paper and to set up the structure of the work:

· To study the types and specific features of currency exchange risks;

· To explore statistical database of recent year and highlight the actual trends;

· To demonstrate practical examples of derivatives implementation in different companies.

The hypothesis states that in order to reduce currency risk exposure of the company, the derivative financial instruments should be included in its risk management system.

The subject of the study reflects the existing types of financial derivatives used for efficient risk management systems.

The object of present paper is presented by a company involved in international economic relationships – educational company “ESU”.

The novelty of the research is that it elaborates an advanced model of financial risk instruments system, consisting of basic widely used financial tools but in different combinations in order to create an effective risk management process in an educational company of a developed country.

Results of the research: The present paper shows different options of using derivative financial instruments and their combinations. By the example of “ESU” company, the most effective scenarios are highlighted.

METHODOLOGY & LITERATURE REVIEW

The methodological base of the research is represented by systematic and dialectical approaches to the analysis of currency risk exposure. Systematic approach allows, firstly, to identify the potential risks that can occur for a company and, then, to investigate the possible options for these risks minimization or avoidance.

Besides, numerical analysis is used in the present paper. Method of analysis is also widely used, because it helps to explore different scenarios for usage of financial derivatives and to highlight their key details.

To conduct the study outlined in this paper, the following information resources were used:

• statistical database and publications;

• educational and scientific literature;

• periodical publications;

• global news.

Information bases of the research involve official documents, publications and databases of Bank for International Settlements, Integrated Foreign Economic Information Portal.

Theoretical concepts are based on the fundamental and applied research of domestic and foreign scientists in the field of foreign economic activity and risk management development: Karanina E.V, Khasbulatov R.I., Hull J.C., Oxelheim L.

For consistency and simplicity of the research paper, the structure includes five parts: introduction, methodology, findings, conclusion and bibliography.

FINDINGS

The exchange (currency) risk management is being developed over forty years. After the collapse of Bretton Woods system of fixed exchange rates in 1973 [3], the global economy faced a problem of significant fluctuations in currency exchange rates. Various risk management tools are being managed in order to reduce the potential losses and damages – in other words, to reduce the currency risk exposure.

The exchange risk is the risk that is caused by the uncertainty of future exchange spot rate [11]. Risk exposure shows the probability of potential loss in a company. It indicates the degree of influence of the unexpected changes in currency exchange rate by one unit of measure on the firm’s cash flows within the specific time period. Periodic changes in currency rates influence both present and future cash flows, and ultimately affect the value of the company.

In economic theory, there are two groups of currency exchange risks: economic risks exposure and accounting risk exposures.

As it is seen from the name of the first group, the economic risks reflects the impact of changes in currency rates on the economic firm value. The economic risk includes transaction risks and operating risks [7] (Miller, 2018).

Transaction risks occur in case when company’s accounts payable or receivable are determined before the changes of spot rate, but the payment or receipt of payment are supposed to be done after the changes.

Operating risks are the risks of real exchange rate’s changes, which affect the value of future cash flows and, as a result, firm’s value.

The second group of currency risks – accounting risks – measures the influence of exchange rate fluctuations on the company’s book value. They are also called translation risks, because they occur when the indicators of financial statements in one currency are converted into another currency [12]. Due to the changes in exchange rates, the financial result of the firm in domestic currency can be also changed, both to arise and to decrease.

The differences between each type of risk are demonstrated on the figure below.

|

|

|

Operating risks

| ||

|

|

Transaction risks

|

| ||

|

Translation risks

|

|

| ||

|

Date of last financial

reporting

|

|

Change of currency rate

|

|

Present time

|

Source: compiled by the author on the base of [10] (Zhdanov, 2016).

The basic difference between economic and accounting risk is that the latter one depends on the fixed real change in exchange rate, whereas the economic risk is connected with unexpected future risk.

In order to handle the currency exchange risks the financial derivatives are widely used [1]. A derivative is an instrument which allows one of the Parties of a deal to eliminate his contractual obligation in relation to the other Party through the payment or receipt of the difference in the given by him and adverse obligation, not breaching the contract terms.

Nowadays there is a wide range of many financial derivatives. The degree of derivatives’ implementation in different companies depends on the specific features of the particular region and country the company operates in:

- Level of development of national economy;

- Rate of advancement of national derivatives market;

- National legislation system level in this field.

As the first derivatives occurred in western developed countries, the most representative statistics we can find in these countries: more than 50% of production companies in developed countries use derivatives to hedge their risks [9] (Budaeva, Inyutin, 2016).

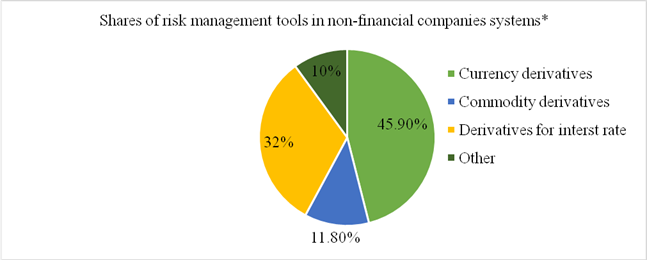

The currency derivatives occupy the biggest part in the whole scope of different methods – about 45% (Figure 2).

*for developed countries.

Figure 2. Shares of risk management tools in non-financial companies systems

Source: compiled by the author on the base of [13].

Currency derivatives include forwards, futures, options and swaps. The following example will represent different combinations of forwards and options use as the most popular in developed countries.

Here the example starts. ESU is an American based company, which was found in the USA in 1973. There are two main divisions in the company: Foreign division, which offers study abroad programs for American students and Travel division, which organizes educational travel abroad to local students.

ESU gains the core part of its revenue in American Dollars (USD), but because of the type of its activity, most of its expenditures are in other currencies such as Euros (EUR) and British Pounds (GBP).

ESU uses currency hedging in order to manage currency risk connected with the possibility of exchange rate fluctuations. The company’s prices are fixed in USD currency, and if, for example, pound appreciates against dollar, the company will face losses.

Thus, foreign exchange hedging is of a big importance for the ESU as the company faces different types of risk that occurs from its activity. In order to reduce these risks, the company needs to understand – what percentage of the risk is necessary to cover and in what proportions should ESU use forward contracts and put options to sell dollars.

It is assumed that the expected final sales volume is 25,000.00. There are three scenarios that should be analyzed: stable dollar (1.09 USD/EUR), strong dollar (0.90 USD/EUR) and weak dollar (1.29 USD/EUR). Three alternative strategies have been determined already – do not hedge, 100% hedging with forwards, 100% hedge with options.

1. NO HEDGE STRATEGY

If the company chooses not to hedge their risk, there are three possible outcomes. First one, if the dollar will be stable, the company will receive “impact zero” scenario with no lose and no gain. If the dollar strengthens, ESU will receive gain of $ 4,750,000.00 (1.09 x 25,000,000.00 – 0.90 x 25,000,000.00). However, if the dollar weakens, the company will face losses of $ 5,000,000.00 (1.09 x 25,000,000.00 – 1.29 x 25,000,000.00).

There is a likelihood for the company to make revenue, however, the possibility of exchange rate fluctuations is higher than the possibility that dollar will remain stable. Therefore, it is not advisable for the company to use “no hedge” strategy because of its great risk.

2. 100 % HEDGING WITH FORWARDS

Hedging with forwards means the purchase of foreign currency at a specific date in the future. It will allow ESU to fix the exchange rate at 1.09 USD/EUR today for the future payments of euro.

On the one hand, if the dollar remains stable at the level of 1.09 USD/EUR, the company will again make no profit or loss. If the dollar price will drop to 1.29 USD/EUR, ESU will gain the difference of $ 5,000,000.00, as they fixed their exchange rate at 1.09 USD/EUR and do not have to pay 1.29 USD/EUR.

However, exchange rate of 0.90 USD/EUR, which is lower than the price the company already locked it in, will minimize the company’s profits by $4,750,000.00, which could have been made without hedging with forwards.

“100% hedging with forwards” scenario is also not beneficial for ESU, as they do not have the possibility to change their policy when the spot rate is over 1.09 USD/EUR (the rate that they agree on) and face loss of possible profit.

3. 100 % HEDGE WITH OPTIONS

A currency option gives the buyer of the option the right, but not the obligation, to purchase or sell a currency at agreed exchange rate, which is 1.09 USD/EUR in case of ESU, The company can choose whether to sell or to buy the option. On the other hand, since this is a low-risk contract, ESU has to pay the option premium of 5%.

If the dollar remains stable at the level of 1.09 USD/EUR, the option contract will cost AIFS $1,362,500.00 ((1.09x1.05 – 1.09) x 25,000,000.00), but they will not exercise this option (which means the losses for the company of $1,362,500.00).

If ESU hedged at $1.09 at a cost of 105% ($1.14) and the cost of the euro declined to $0.90 then ESU would gain because of greater buying power of the dollar. In this case the company will pay $1,362,500.00 to obtain the option, but receive $ 3,387,500.00 (1.09 x 25,000,000.00 (basic price) – 0.90 x 25,000,000.00 (price for euro on the market) -1,362,500.00 (price for option)).

If dollar becomes weak, the company will exercise option, pay $1,362,500.00 for it, but the position in this case will be better by $3,637,500.00 if the company did not hedge (1.29 x 25,000,000.00 (price for euro on the market) – 1.09 x 25,000,000.00 (basic price) – 1,362,500.00 (price for option)).

It can be concluded, that 100% hedge with options strategy will limit ESU losses, but also limits the possible gains at the price of option premium.

4. 50% OPTIONS and 50% FORWARDS

The first option is to choose the strategy that uses 50% options and 50% forwards.

Let us consider that the total value is equal to $25,000,000.00. That means that the amount hedged by options and forwards will be $12,500,000.00 respectively.

If we suggest that there is a stable rate of 1.09 USD/EUR, then the option contract will cost $14,306,250.00.

If ESU hedged at the stable rate $1.09 at a cost of 105% ($1.14) and the dollar appreciates to the level of $0.90 then ESU would benefit. In this case the company will pay $681,250.00 to get the option, but receive $1,693,750.00. If the situation is opposite, and dollar depreciates, the company will exercise option, pay $681,250.00 for it, but the position in this case will be better by $1,818,750.00, if the company did not hedge.

Now we can move to forwards and analyze the situation, when the dollar remains stable at the level of 1.09 USD/EUR, the cost of the forward contract will account for $13,625,000.00. If the dollar price will drop to 1.29 USD/EUR ESU will gain the difference of $2,500,000.00, as they fixed their exchange rate at 1.09 USD/EUR and do not have to pay 1.29 USD/EUR.

However, in case of reaching the level of 0.90 USD/EUR, the company’s profits will be minimized by $ 2,375,000.00.

To calculate the total cost of this mix, we summarize the costs for using options and forwards: $14,306,250.00 (for option) + $13,625,000.00 (for forward) = $27,931,250.00.

5. 75% OPTIONS and 25% FORWARDS

The most beneficial and promising strategies are the strategies that are worked out based on the mix of different derivative financial instruments.

One of the potential mixed strategies is to combine options and forwards in the proportion of 75% and 25% respectively. It means that $18,750,000.00 will be hedged by options, and $6,250,000.00 will be covered by forwards.

At the stable rate of 1.09 USD/EUR the option contract will cost $24,459,375.00.

If ESU hedged at the stable rate $1.09 at a cost of 105% ($1.14) and the dollar appreciates to the level of $0.90 then ESU would benefit. In this case the company will pay $1,021,875.00 to get the option, but receive $ 2,540,625.00.

If dollar weakens, the company will exercise option, pay $1,021,875.00 for it, but the position in this case will be better by $2,728,125.00 if the company did not hedge.

Regarding the rest of the sum, which is covered by forward contract, we have the following situation.

In case when the dollar remains stable at the level of 1.09 USD/EUR, the cost of the forward contract will account for $6,812,500.00. If the dollar price will drop to 1.29 USD/EUR ESU will gain the difference of $1,250,000.00, as they fixed their exchange rate at 1.09 USD/EUR and do not have to pay 1.29USD/EUR.

However, in case of reaching the level of 0.90 USD/EUR, the company’s profits will be minimized by $1,187,500.00.

If we summarize the total costs the mix of option and forward contracts will account for $21,459,375.00 (for option) + $6,812,500.00 (for forward) = $28,271,875.00. Dividing this amount by the total sales volume $25,000,000.00, we get the euro cost per unit, which equals $1.13.

6. 25% OPTIONS and 75% FORWARDS

Another way of mixing two financial instruments is the proportion of 25% for options and 75% for forwards.

According to this statement, $6,250,000.00 will be hedged by options, and $18,750,000.00 will be covered by forwards.

At the stable rate of 1.09 USD/EUR the option contract will cost $7,153,125.00.

If ESU hedged at the stable rate $1.09 at a cost of 105% ($1.14) and the dollar appreciates to the level of $0.90 then ESU would benefit. In this case the company will pay $340,625.00 to get the option, but receive $846,875.00.

If dollar weakens, the company will exercise option, pay $340,625.00 for it, but the position in this case will be better by $909,375.00 if the company did not hedge.

In case of forward contracts when the dollar remains stable at the level of 1.09 USD/EUR, the cost of the forward contract will account for $20,437,500.00. If the dollar price will drop to 1.29 USD/EUR ESU will gain the difference of $3,750,000.00, as they fixed their exchange rate at 1.09 USD/EUR and do not have to pay 1.29 USD/EUR.

However, in case of reaching the level of 0.90 USD/EUR, the company’s profits will be minimized by $3,562,500.00.

As in previous option we need to sum up the total cost of the using of this mix, which accounts for $7,153,125.00 (for option) + $20,437,500.00 (for forward) = $27,590,625.00. The euro cost per unit equals $1.10. Both the total costs and the cost per unit are lower than in the case with mix of 75% option+25% forward. The figures show us, that the strategy consisting of 25% option + 75% forward is more cost effective for the company.

As we have already outlined in the present research paper, the company should chose an appropriate hedging policy which answers two main questions: how much to hedge, and in what proportions of forwards versus options. First, a description of the exposure of the company, particularly the three main risk factors: bottom-line risk, volume risk and competitive pricing risk is presented [2] (Karanina, 2015). Then, we set the “impact zero” scenario: sales volume of 25,000.00, a cost of €1,000.00 for every costumer and an exchange rate of USD 1.09/EUR. We consider three different exchange rate scenarios (weak, stable and strong dollar) and compare the costs for different alternatives of hedging. We reach the conclusion that the alternative that bares the minimum cost for the company is to hedge 25% of the costs using options and 75% - through forward contracts.

CONCLUSION

The use of financial derivative contracts has grown rapidly over the last decades. The topical question in this field concerns both how and for which purposes companies through the whole world use derivatives.

Integration of national economies into the international economic relations system increases the meaning of foreign transactions of domestic companies. New conditions and regulations of organizations’ performance on the international market demands for a wide range of problems’ solution, including the risk management tools usage.

The present research paper covers the study of currency risk exposure and ways to decrease the potential risks occurrence.

The most popular instruments that are used in international transactions to reduce the influence and dependence on currency exchange rates fluctuations are the hedging instruments. Within hedging policy such tools as forwards, futures and options are widely used. These instruments together with other different types of them comprise the group of financial derivatives.

Foreign exchange derivatives are one of the main tools of risk management, which allow diverse and precisely influence the currency risk. Despite the fact that the implementation of the derivatives itself is rather risky and can cause losses for a particular company, the number of contracts outstanding has been increasing throughout many years.

One of the advantages of use of derivatives is the possibility to combine different types of them and, hence, to minimize all potential risks as much as possible. The example with “ESU” company illustrates how a firm can gain or lose using one or another combination of options, forward and futures. The research sets three different exchange rates scenarios of weak, stable and strong dollar for the chosen company. The main findings are based on calculations when comparing company’s expenses on use or non-use of derivatives to establish the most cost-effective financial risk management system. Six different options are suggested for the management of ESU company to operate on the market: to proceed without any hedging strategy, to hedge 100% of risks with forwards or 100% with options, and to use three mix-strategies by hedging with options and forwards in proportions such as 50/50,75/25, 25/75 respectively. The result shows that the most beneficial way is to implement the mix of 25% options and 75% forwards strategy as the total costs of using this combination as well as the cost per unit are lower for the company and at the same time more risk-averse in comparison with others. The choice of risk management tools is time-consuming process, and the quality of results of it depends on a wide range of included factors. That is the reason why the study of this issue is of high importance both for big corporations and for small companies.

Источники:

2. Каранина Е.В. Управление финансовыми рисками: стратегические концепции, модели, профессиональные стандарты: Учебное пособие. - ВятГУ, 2015.

3. Мировая экономика в 2 ч. Часть 1.: учебник для вузов / Р. И. Хасбулатов [и др.]. — 2-е изд., перераб. и доп. — М.: Юрайт, 2019.

4. Мировая экономика и международные экономические отношения: учебное пособие / А.А.Баракин, Н.Т.Васильцова, Н.Г.Данилочкина, К.К.Кумехов, В.И.Флегонтов; под ред. Н.М.Ермолаевой. - М.: Аспект Пресс, 2018.

5. Покровская В.В. Внешнеэкономическая деятельность: Учебник. - М.: Юрайт, 2015.

6. Hull J.C., Risk Management and Financial Institutions, 5th Edition. - M.: Wiley, 2018.

7. Miller M.B., Quantitative Financial Risk Management. - M.: Wiley, 2018.

8. Oxelheim L., Alviniussen A., Jankensgard H., Corporate Foreign Exchange Risk Management. - M.: Wiley, 2020.

9. Будаева Л.С., Инютин С.А. Международный опыт использования финансовых деривативов для управления рисками в производственной деятельности. - [Электронный ресурс] / Май, 2016 – Электрон. дан. – Режим доступа: http://www.ipdn.ru/rics/pdf/905.pdf. (дата обращения 15.02.2020).

10. Жданов И.Ю. Финансовый риск предприятия. Методы и формулы оценки, 2015. - [Электронный ресурс] / Май, 2016 – Электрон. дан. – Режим доступа: http://finzz.ru/finansovyj-risk-predpriyatiya-klassifikaciya-metody-ocenka-upravlenie.html (дата обращения: 17.03.2020).

11. Exchange Rate Risk: Economic Exposure //URL: http://www.investopedia.com/articles/forex/021114/exchange-rate-risk-economic-exposure.asp (дата обращения: 31.03.2020).

12. Translation Exposure // URL: https://www.investopedia.com/terms/t/translationexposure.asp (дата обращения: 31.03.2020).

13. http://www.bis.org/statistics/index.htm - The Bank for International Settlements (дата обращения: 17.03.2019).

Страница обновлена: 17.02.2026 в 08:47:14

Download PDF | Downloads: 58

Use of currency risk management tools in foreign economic activity by the example of educational company

Bostandzhyan K.R.Journal paper

Journal of Economics, Entrepreneurship and Law

Volume 10, Number 6 (June 2020)

Abstract:

For any company going internationally is not only a big step in the development and enlargement of a company’s structure, but it also incurs the acquisition of new risks. The main issues of such companies is the establishment of proper risk management system. There are many factors on foreign markets, which cause financial, time and other losses. However, one the most significant and harmful for a company is the foreign exchange rate risk (currency risk).

The point is that success and effectiveness of company’s operations depend not on the foreign counterparty or a type of deal, but first, the skills and professional competences of the risk management department in a particular company.

With evolving the international market operations and tightening the inter-country relations the risk management system has been highly developed. Today it includes a wide range of various risk reducing instruments. The present research paper will analyze the different options of derivative financial instruments, such as forwards and options, by the case of an educational company, the results of which can be used for the assessment of efficiency of any company operating internationally.

Keywords: currency risk management, exchange rate, international trade, foreign economic activity, hedging

JEL-classification: F31, G32, O23, O24

References:

Mirovaya ekonomika i mezhdunarodnye ekonomicheskie otnosheniya [World economy and international economic relations] (2018). (in Russian).

Mirovaya ekonomika v 2 ch [World economy in 2 parts] (2019). (in Russian).

Baldin K.V. (2015). Upravlenie riskami v innovatsionno-investitsionnoy deyatelnosti predpriyatiya [Risk management in innovative and investment activity of the enterprise] (in Russian).

Exchange Rate Risk: Economic Exposure. Retrieved March 31, 2020, from http://www.investopedia.com/articles/forex/021114/exchange-rate-risk-economic-exposure.asp

Hull J.C. (2018). Management and Financial Institutions

Karanina E.V. (2015). Upravlenie finansovymi riskami: strategicheskie kontseptsii, modeli, professionalnye standarty [Financial risk management: strategic concepts, models, professional standards] (in Russian).

Miller M.B. (2018). Quantitative Financial Risk Management

Oxelheim L., Alviniussen A., Jankensgard H. (2020). Corporate Foreign Exchange Risk Management

Pokrovskaya V.V. (2015). Vneshneekonomicheskaya deyatelnost [Foreign economic activity] (in Russian).

The Bank for International Settlements. Retrieved March 17, 2019, from http://www.bis.org/statistics/index.htm

Translation Exposure. Retrieved March 31, 2020, from https://www.investopedia.com/terms/t/translationexposure.asp