Performance Analysis of Private Pension Funds and Collective investment trusts in the Russian Federation

Abramov A...1,2, Chernova M...1

1 The Russian Presidential Academy of National Economy and Public Administration, ,

2 National Research University - Higher School of Economics, Moscow, ,

Скачать PDF | Загрузок: 27

Статья в журнале

Global Markets and Financial Engineering ()

Аннотация:

This research has been carried out to study the factors enabling to improve the financial effect and to increase the efficiency of investments and management of portfolios of pension reserves and accruals in the Russian Federation. Key approaches to the analysis of various stages of the investment decision-making have been developed by the authors. The quality of arrangement of the investment decision-making process extensively determines reserves of the performance improvement in managing pension reserves and accruals. Using the sample portfolios managed by Russian participants, it is shown that the profitability of these assets depends to the great extent on the allocation of the assets. The authors have summarized scientific hypotheses explaining the impact of asset allocation on profitability and risks of institutional investors' portfolios on grounds of the data of pension portfolios managed by private pension funds and portfolios of collective investment funds in Russia. The role of asset allocation in profitability and risks of their portfolios has been evaluated.

Ключевые слова: pension savings, private pension fund, unit investment trust

Introduction

One of the obstacles on the way of pension system development in Russia is the problem of efficiency of pension portfolios and lack of studies in this field. The relevance of this work lies in the attempt to analyse main issues and in search for ways to increase the efficiency of portfolio management in the long-term outlook of profitability and risks.

The research is aimed to assess potential effects of various strategies of portfolio investments from the perspective of profitability and risks. At that, the main task is to appraise the role of strategies of active asset selection, market-timing and asset allocation in profitability and risks of pension funds and collective investments in Russia.

In our research we tried to estimate the role of asset allocation in performance of portfolios of Russian investors. For this purpose we have analysed best practices of return decomposition.

Previous studies accumulated in the field of analysis of return volatility of private pension funds and unit investment trusts have revealed several different approaches to the factor analysis of the efficiency of funds. One of them lies in decomposing the returns into internal elements, such as the active management, asset allocation, selection of securities, and market timing. Among such approaches there are the studies by Brinson, Hood, Beebower (1986), Brinson, Singer, Beebower (1991), Sharpe (1992), Ibbotson, Kaplan (2000). All these researches constitute the theoretical basis of return decomposition studies. Each of them applies similar approaches to factor analysis, each of them suggests a dominating role of asset allocation over all others components of the investment and decision-making processes.

Such unrealistic results of the first researches have been received with harsh criticism. Later criticism and scientific debates became the result of appearance of scientific papers by Hensel, Ezra, Ilkiw (1991), Vardharaj, Fabozzi (2007), Xiong, Ibbotson et al. (2010) and Aglietta, et al. (2012). They differ by the inclusion of another additional factor having influence on the total portfolio return of pension and unit investment trusts. This factor is the market itself and its fluctuation. It has been demonstrated that the return of funds only in half depends on decisions made during investment process.

The market component introduction raises a new question. Is the asset allocation the most important component of the investment process or, stated differently, does active management affect the result in the same or even greater scale? The first studies have shown that asset allocation prevails over the rest of activities. However, the use of new, improved and more precise methods and market component inclusion have proven that the above theory is inaccurate. In scientific papers written by Xiong, Ibbotson et al. (2010), the influences of active management and asset allocation turn out to be almost equal.

Thus, the performed overview of studies accumulated in the field of the return decomposition of pension and unit investment trusts investment portfolios has shown that asset allocation is an essential, but not dominating factor. Besides, funds’ return largely depends on market fluctuation and is to a great extent predetermined by them. As for the influence of internal investment-related decision-making, it can be said that asset allocation and active management are indispensable components, both being of equal importance for the resulting efficiency of funds.

The main task of these studies has been to assess the current state of the process of pension reserves and savings investment. In order to achieve this, the authors have considered investment returns and risks of this sector and also performed an analysis, comparing national practices of pension schemes implementation to the international ones. The analysis has revealed a relative weakness of the Russian pension system, enabling to summarize the main principles of investment.

After that the influence of asset allocation of pension savings and collective investments on the results of their activities has been analysed. For this purpose, the data on the 2013 performance of private pension funds’ investments have been analysed on the initial stage of our research. A decomposition of volatility of private pension funds returns has been performed to determine the impact of active management and long-term asset allocation. Active management is understood in this research as flexible adjustment of asset weights in private pension funds’ portfolios.

Final stage of our analysis involved studying of unit investment trust’ activities. The shares of unit investment trusts cannot be included in the portfolios of pension savings, but analysis of their activities has helped to reach a better understanding of the portfolio management possibilities in the Russian Federation.

Returns and Risks of the Portfolios of Pension Reserves and savings in Russia

Pursuant to Russian pension legislation, pension assets can assume the form of savings or reserves.

Pension savings are monetary resources accumulated in the pension system through compulsory insurance contributions allocated for the formation of funded component of the retirement pension, through contributions to co-financing of pension assets, the results of investments of these assets and also through certain other purpose-oriented allocations for replenishing pension assets. The portfolios of pension savings can be managed by a state management company, private management companies or private pension funds. State management companies allocate pension savings in two portfolios – the security portfolio and the so-called “extended portfolio”.

Pension reserves are the assets that the employers and employees choose to transfer as contributions to the pension schemes and incomes from investing thereof. Private pension fund functions, in this case, as a manager of the pension reserves.

From the standpoint of the pension system participants, pension savings in state management companies, private management companies and private pension funds are pension schemes with fixed contributions. A set of obligations of the these pension schemes implies that scale of pension is determined by the amount of contributions and results of investing thereof. At the same time, the state is the guarantee of invariability of the value of pension contributions. Any assumptions as to the share of contributions in total savings on the Russian citizens’ individual accounts after their retirement can presently be only speculative.

However, from the experience of one of the world’s largest pension funds CALPERS (headquartered in the USA) it is known that, given a twenty years’ period of paying the pension contributions, 30 cents of each payable dollar are provided by pension contributions and 65 cents – by the investment incomes. And that means that the actual guarantee of pension contributions safety covers, on average, only 30-35% of assets accumulated on individual pension accounts of Russian citizens. Hence, given the amount covered, this guarantee is purely a symbolic gesture.

Such a mechanism of forming a profile of obligations as for the funded pension is a source of potentially serious social conflicts in the future. Most citizens are not ready to accept market risks in the conditions of the strongly volatile Russian stock market. Presently, citizens bear the investment risks within funded pension schemes, which call for greater transparency and higher efficiency of pension assets management.

In 2014, upon European Commission‘s request, Better Finance has prepared a report on private pension funds operating in eight countries of the European union which covers the 2000-2013 period. Better Finance’s researchers have analysed average annual return of pension funds for a mid-range term (up to 9 years) and risk measure as a standard deviation of mean annual returns. In general, the comparative analysis has revealed a stable positive real return. The analysis of medium, minimum and maximum annual return of 31 foreign pension funds for 20 portfolios with various durations has been performed to reveal the periods of positive returns. Thus, profitability of CALPERS’s portfolios was always exceeding the profitability of highly reliable corporate bonds, which proves a high efficiency of portfolio management in this fund.

For assessing the efficiency of managing the portfolios of pension reserves and savings we have calculated the returns and risks of different portfolios of Russian private pension funds. The results of analysing the geometric mean of annual returns and standard deviation of the portfolios of pension reserves and savings in Russia have shown that during the 9-year period, starting from funded pension introduction from 2005 to 2013, annual mean real returns of both state management company’s “extended portfolio” and its portfolio of Government bonds were negative at the annual rate of -2.4% and -2.6% with standard deviations of 4.5% and 4.6% respectively. Average real returns in the sample of private management companies and private pension funds, managing the portfolios of pension savings, were also negative - -2.7% (per annum) and -2.6% (per annum) with standard deviations being 15.3% and 13.1% respectively. Average real returns during the same period were positive for five major portfolios of pension reserves in private pension funds - 0.1% with standard deviation being 4.7%. It can be assumed that a more liberal approach in the field of restrictions as for the content and structure of pension reserves in comparison to the pension savings has enabled to obtain a higher average return in the portfolios of pension reserves as compared to the real returns of various portfolios of pension savings.

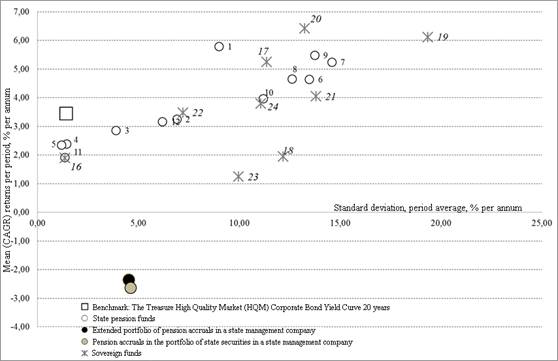

Fig. 1 shows real returns and risks of state management companies’ portfolios of pension savings as compared to the respective indices of sovereign and state pension funds abroad in 2005-2013. At the respectively moderate risks of the portfolios of pension savings, the returns of state management companies were still lower than those of the foreign sovereign and state pension funds. At that time period, the real returns of Russian portfolios of pension savings were 5-6 percentage points lower than those of foreign sovereign and state pension funds.

Figure 1. Real geometric mean returns and risks of state pension funds in 2005-2015 (% per annum)

Source: authors’ calculations based on the data of OECD statistics and the reporting of various pension funds

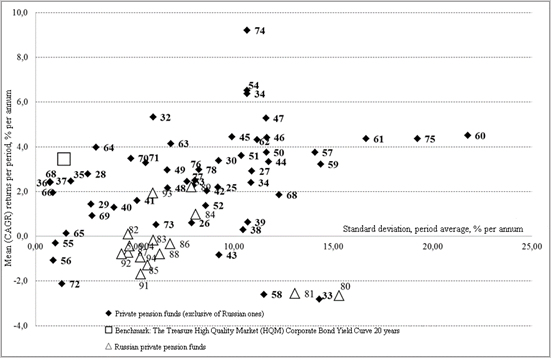

Fig. 2 shows real returns and risks of Russian private pension funds’ and private management companies’ portfolios of pension reserves and savings as compared to the respective indices of corporate and private pension funds abroad in 2005-2013. Real returns on Russian portfolios were lower than those of the respective foreign organizations. Real returns on Russian portfolios were approximately 5 percentage points lower than the respective indices of foreign pension funds.

Figure 2. Real geometric mean returns and risks of corporate and private pension funds in 2005-2013 (% per annum)

Source: authors’ calculations based on the data of OECD statistics and the reporting of various pension funds

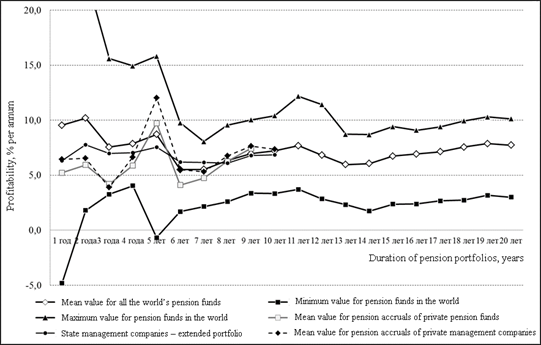

Low returns of Russian pension reserves and savings are greatly influenced by the country’s high inflation level in comparison to the countries whose pension funds were used for comparison. Fig. 3 shows the comparison of nominal returns (in local currencies) of Russia’s largest portfolios of pension savings to the respective indices of 31 foreign funds. The return indices of portfolios (those of the extended one managed by a state management company, mean values of the portfolios of pension savings in private pension funds and private management companies in the time-frame from 4 to 10 years) are quite close to an average nominal return in the sample consisting of 31 foreign pension funds.

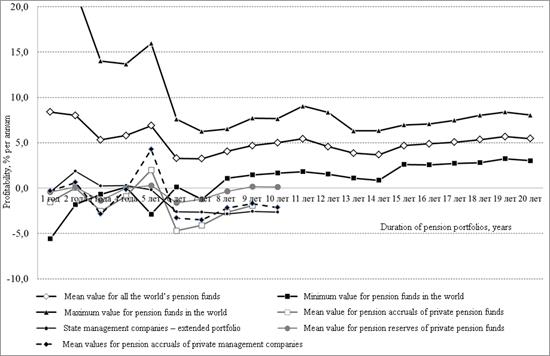

The comparison of real returns shown in fig. 4 reveals much weaker results of Russian portfolios of pension savings. The indices of Russian portfolios are equal to or worse than the minimum real return indices of foreign pension funds. This proves that the current domestic inflation level prevents Russia from achieving acceptable results (as for the returns on pension portfolios) comparable to those of foreign organizations. Moreover, the problem of reaching the positive return has still not been solved.

Figure 3. Nominal returns of portfolios with various durations, % per annum

Source: authors’ calculations based on the data of OECD statistics and the reporting of various pension funds

Figure 4. Real returns of portfolios with various durations (% per annum)

Source: authors’ calculations based on the data of OECD statistics and the reporting of various pension funds

The performed analysis has cast a doubt on the efficiency and viability of the current Russian requirements to the content and structure of the assets of pension savings and reserves. Many restrictions imposed on the content and structure are quite conditional and contradictory by their nature. Therefore, gradual repeal thereof followed by transition to a reasonable investor’s standards and introduction of strict mechanisms for information disclosure and performance evaluation would eliminate artificial barriers precluding investment decision-making with greater responsibility of the administrators of pension schemes.

Assumptions on minimization of risk-taking by private pension funds find confirmation in Table 1.

Table 1

The structure of private pension funds’ portfolio of pension savings, %

|

2007

|

2008

|

2009

|

2010

|

2011

|

2012

|

2013

| |

|

Monetary assets and

deposits

|

7,3

|

6,4

|

22,7

|

16,6

|

28,1

|

46,37

|

40,74

|

|

Government bonds of

the Russian Federation

|

5,6

|

2,0

|

3,3

|

2,5

|

5,4

|

2,62

|

4,33

|

|

Regional bonds

|

18,8

|

15,2

|

18,4

|

12,1

|

7,2

|

7,06

|

5,74

|

|

Corporate bonds

|

38,2

|

46,7

|

39,8

|

51,2

|

46,4

|

33,96

|

36,26

|

|

Shares

|

27,3

|

11,6

|

13,5

|

13,3

|

8,4

|

6,32

|

6,37

|

|

Mortgage-backed

securities

|

0,0

|

0,1

|

0,2

|

0,5

|

0,0

|

0,34

|

2,71

|

|

Participatory

interests of foreign index funds

|

0,0

|

0,0

|

0,0

|

0,0

|

0,0

|

0,00

|

0,00

|

|

The securities of international

financial institutions

|

0,0

|

0,0

|

0,0

|

0,0

|

0,4

|

0,30

|

0,28

|

|

Others

|

2,9

|

18,0

|

2,1

|

3,8

|

4,1

|

3,04

|

3,57

|

|

Total

|

100,0

|

100,0

|

100,0

|

100,0

|

100,0

|

100,0

|

100,0

|

In private pension funds’ structure of pension savings, equity investments have decreased from 27.3% (2007) to 6.37% (2013). At the same time, the share of deposits and monetary assets in the stated portfolios of pension savings has increased from 7.3% (2007) to 40.74% (2013). This is also connected with the popularity of the strategy of allocating the pension savings on the accounts of captive banks. This strategy allows using those schemes indirectly for financing non-transparent investment projects [1].

1. The Analysis of the asset allocation of Pension savings by Private Pension Funds

The empirical analysis of returns on pension savings in private pension funds involved cross-section regression models and their estimation. This analysis has been performed in line with the best international practices of analysing a decomposition of the returns into the main factors such as: market return, additional return from asset allocation and additional return from active management. For performing such analysis, a database containing annual returns and weights of the main asset classes of 120 Russian private pension funds in 2013 has been created. After that, index portfolios reflecting the volatility of each class have been selected and the data on their values in 2013 have been collected (Table 2).

Table 2

Asset classes included in the content of pension savings portfolios of Russian private pension funds and their index portfolios

|

Asset class

|

Index Portfolio

|

Ticker Bloomberg

|

|

Government bonds of

the Russian Federation

|

The Russian

Government Bond Index (Moscow Exchange)

|

RGBITR

|

|

Government bonds of

the federal subjects of the Russian Federation

|

The MICEX Municipal

Bond Index (Moscow Exchange)

|

MICEXMBT

|

|

Bonds of the Russian

issuers (aside from the bonds which are federal Government bonds and Government

bonds of the federal subjects of the Russian Federation)

|

The Micex Corporate

Bond Index (Moscow Exchange)

|

MIXCBITR

|

|

Shares of the

Russian issuers established as open-joint stock companies

|

The MICEX Index (Moscow

Exchange)

|

INDEXCF

|

|

Mortgage-backed

securities issued pursuant to Russian legislation on mortgage-backed

securities

|

Russia Moscow

Property Prices

|

RURRPRC

|

|

Monetary resources

in bank deposits

|

Average deposit rate

|

-

|

|

Monetary resources

on the accounts in credit organizations

|

Ruble OverNight

Index Average - RUONIA INDEX

|

RUONIA

|

|

The securities of

international financial institutions

|

MSCI World Index

|

MXWO

|

|

Other assets

|

-

|

-

|

Following the approach of Xiong, Ibbotson et al. (2010), it is not necessary to account for market fluctuation in order to perform a cross-section analysis. This can be demonstrated by the decomposition of private pension funds’ returns into three major components:

![]()

![]()

where:

![]() is the market return characterizing the basic return

resulting from the presence of the private pension fund i in the market in the

year t;

is the market return characterizing the basic return

resulting from the presence of the private pension fund i in the market in the

year t;

![]() is the actual historical return of the private

pension fund i in the year t;

is the actual historical return of the private

pension fund i in the year t;

![]() is the actual return of the private pension fund

i in the year t, net of market fluctuations;

is the actual return of the private pension fund

i in the year t, net of market fluctuations;

![]() is the return resulting from

an active portfolio management by the private pension fund i in the year t.

is the return resulting from

an active portfolio management by the private pension fund i in the year t.

Since our analysis focused only on data from the year 2013, and also taking into account that the market return is, by definition, the same for all funds, we will obtain the following:

![]()

We consider the active management as a flexible adjustment of the asset weights in the portfolio of private pension funds in this article. This process differs from other investment process components in the research such as the choice of a long term allocation of assets and the adjustment of the set of securities within the chosen asset class.

When estimating this model, the value of the obtained coefficient of determination characterizes the share of cross-sectional volatility of funds’ returns that can be attributed to differences in active asset management. Exclusion of market returns from the model will not eventually entail a change in the results. That is why for determining the connection between active asset management and actual return of funds’ investment portfolios an evaluation of the regression model has been performed, which is given by:

![]()

To determine the impact of asset allocation on the return volatility, a one-dimensional regression model has been assessed, given by:

![]()

A sample average portfolio that represents a set of assets and return “available” to all participants has been assumed as market return. Accordingly, averaged weights of the whole funds’ sample have been used as the weights of the asset classes included in the portfolio. Market return has been calculated by the formula:

where ![]() – sample average weight of

the asset class j in the year t, and

– sample average weight of

the asset class j in the year t, and ![]() is the index portfolio return

for the asset class j in the year t.

is the index portfolio return

for the asset class j in the year t.

The returns on active management of savings have been defined as return of the portfolio, consisting of the indices selected for each asset class, with historical weights in the actual portfolio of funds. Thus, the difference between the actual return and the created series reflects portfolios that are based on equal asset weights and differ by a set of securities. Additional returns resulting from active management can be determined as follows:

where

![]() is the actual weight of the class of assets j of

the fund i in the year t.

is the actual weight of the class of assets j of

the fund i in the year t.

Such an approach to return decomposition has been proposed due to the absence of sufficient time series and the impossibility to analyse a private pension fund’s style based on its historical activities. This is the main difference of the given research from the articles by Xiong, Ibbotson et al. (2010) and Aglietta et al. (2012).

The analysis of data statistics on the asset class weights among the whole sample of private pension funds has shown that, on average, bonds of Russian issuers, except for the state and Russian Federation subjects, have the maximal weight. Nevertheless, the revealed considerable standard deviations indicate that private pension funds use various investment strategies and approaches to active asset management.

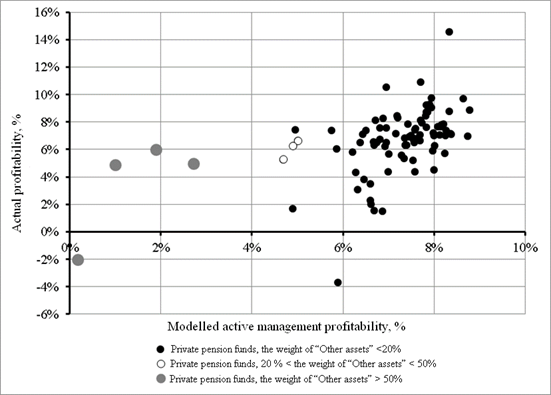

Fig. 5. shows the modelled return from active management and the actual return of private pension funds in 2013. It can be seen in this figure that the main profit cloud is located along the arm coming out of the origin of coordinates at an angle of 45 degrees with the exception of emissions. Private pension funds with the weight of the category “other assets” exceeding 30% and 50% respectively are marked separately. There is no respective index portfolio for this asset class, hence the funds with large investments in it will be considered within the general sample, and the assessments will be obtained with no account thereof.

Figure 5. Actual return and active management return in 2013, %

Source: authors’ calculations

The results of the regression models estimation can be seen in table 3. The first evaluated model included complete observations that remained after deletion of the missing data. The total amount of private pension funds included in the model is 89. Since there are funds with the weight of the class “Other assets” higher than 30% in the sample, a model with no account of such funds has been evaluated. Introduction of such funds involves index portfolio determination, but the content of other assets is unknown and hard to sort out. Hence the model has been appraised without the benchmark of this class. This can bias the results, especially when it comes to funds primarily investing in this class of assets. That is why only 82 funds have been included in the abridged model. The analysis of the model that includes only private pension funds with weight of the class “Other assets” less than 50% is not shown in the table, because evaluations of such a model have no significant differences from the abridged model with 82 funds.

Table 3

Cross-section analysis of the decomposition of private pension funds’ return in 2013

|

|

Total sample of

private pension funds

|

Private pension

funds, “Other assets”<30%

|

|

The amount of

complete observations after “purification”

| ||

|

|

89

|

82

|

|

Determination

coefficient value, %

| ||

|

Additional returns

from market active management of assets

|

24,29

|

25,32

|

|

Additional returns

from asset allocation

|

64,02

|

89,34

|

|

Interaction effect

|

11,69

|

-14,66

|

|

Total

|

100

|

100

|

The estimation results have shown that inclusion or exclusion of private pension funds whose portfolio is constituted by other assets by, at least, a third does not affect the results of researching active management influence. Approximately, a quarter of the volatility of private pension funds’ portfolio return can be attributed exactly to active management, i.e. to differences in the selection of the securities within asset classes, in mrket timing etc. The exclusion of the emission funds in accordance with the initial data has led to a slight increase of the coefficient of determination (from 24,29% in the extended model to 25,32% in the abridged), which proves the stability of the results obtained for this factor.

The asset allocation in these models is determined by the influence of the residual return net of the modelled return resulting from active management on private pension funds’ actual return after the exclusion of market influence. At that, the exclusion (“purification”) lies in subtraction of one and the same constant from a set of actual returns for each fund.

The distribution of assets according to the estimation of the complete model enables to explain about two-thirds of return volatility of private pension funds. Such a high performance can be explained by the importance of making decisions on long-term asset allocation in the field of pension resources investment. The specific nature of this process lies in long-term investment for the purpose of value preservation, not for earning short-term profit as it usually happens in case of private investors and unit investment trusts. Hence the importance of rational and well-grounded decision-making in the investment policy increases in case of private pension funds.

The interaction effect has not been calculated by the econometric analysis method. Similarly with the approach used in the article by Xiong, Ibbotson et al. (2010), it has been introduced as a value being additional for the equality of the sum of coefficient of detemination 100%. It shows that a combination of solutions on active management and asset allocation cannot always be obtained by summation. They sometimes produce a synergy effect and then the interaction effect is positive, and sometimes they contradict one another or have discrepancies, resulting in a negative interaction effect. Besides, the interaction effect value can include all the factors not taken into account and modelling errors.

Thus, it has been shown that making of a decision on long-term asset allocation and long-term investment strategy development play the main role for the portfolios of savings in private pension funds. Nevertheless, active management of assets, the selection of the securities within asset classes and market timing are also very important from the perspective of investments.

2. The empirical analysis of unit investment trusts’ retuns

Unit investment trusts cannot be acquired in the portfolios of pension savings. Nevertheless, studies thereof give better understanding of the portfolio management possibilities in the Russian Federation. Therefore, studying their experience in order to understand the main problems of the portfolio management conducted by pension funds better would be quite reasonable and necessary.

The empirical analysis of the return of Russian unit investment trusts was based on determining and studying of active management impact (the selection of securities within asset classes and market timing). Aside from the above-mentioned activities, active management includes the adjustment of weights of asset classes and justified deviation from the long-term weights stipulated in the long-term investment policy of the fund. To perform this analysis, a database consisting of annual returns and weights of the main asset classes of 310 Russian unit investment trusts for the period of 2009-2014 has been compiled. Thereafter, index portfolios have been selected to reflect the volatility of each asset class (Table 4).

Table 4

The content of Russian unit investment trusts’ investment portfolios and their index portfolios for each asset class

|

Asset class

|

Index portfolio

|

Ticker Bloomberg

|

|

Cash

|

Average deposit rate

|

RRDR1 CMPN Currency

|

|

Government bonds of

the Russian Federation

|

The Russian

Government Bond Index (Moscow Exchange)

|

RGBI Index

|

|

Government bonds of

the federal subjects of the Russian Federation

|

The MICEX Municipal

Bond Index (Moscow Exchange)

|

MICEXMBС Index

|

|

Municipal securities

| ||

|

Corporate bonds

|

The Russian

Government Bond Index (Moscow Exchange)

|

MIXCBITR Index

|

|

Ordinary shares and

depositary receipts

|

The MICEX Index (Moscow

Exchange)

|

INDEXCF Index

|

|

Shares of the

Russian issuers established as open-joint stock companies

| ||

|

Preferred shares

|

The compiled composite

index consisting of 6 preferred shares included in the RTS Index

| |

|

Participatory

interests of unit investment trusts

|

Average return of

participatory interests on the basis of the historical data for the year

under study.

| |

|

The securities of

international financial institutions

|

The MSCI World index

|

MXWO

|

|

Real estate

|

Russia Moscow

Property Prices Index

|

RURRPRC Index

|

|

Proprietary rights

|

Russia

GDP Real Estate Renting and Business Activities Index

|

RUGCREAL Index

|

|

Real estate objects

under construction

|

The

index of construction contracts of the Russian Federation

|

RUCCBRL Index

|

|

Mortgage-backed

securities

|

General

index GPR Russia

|

GGENRULC Index

|

|

Others (debts

receivable and other material values)

|

The MICEX Index (Moscow

Exchange)

|

INDEXCF Index

|

The return decomposition has been performed in a similar way. The difference lies in intertemporal analysis of a mutual fund’s style on the basis of its historical activities. The analysis of the statistics of weights of various asset classes in funds’ portfolios has revealed significant differences in investment strategies. For instance, the standard deviation for such asset classes as shares of Russian issuers, corporate bonds, securities of international financial institutions was 25% and higher for each year of the considered period. Volatility of the weight of international financial institutions’ securities, proprietary rights and state bonds was incrementing throughout the whole analysed period. At the same time, the spread of investments in participation interests of unit investment trusts and preferred shares was decreasing. This evidences that funds were reacting differently to the environment changes and were incrementing various parts of investments, adjusting the investment strategy in the process.

Market return is important in the performance of intertemporal analysis. Its changes enable to monitor “average” market fluctuation within the sample of funds. In case two or more years are covered by the model, it becomes necessary to “purify” unit investment trusts returns. Otherwise, a bias in the results will occur - namely, their overestimation, as in the work by Brinson et al (1986, 1991). Thus, to determine the influence of active asset management and security selection, it is necessary to consider a regression model given by:

![]()

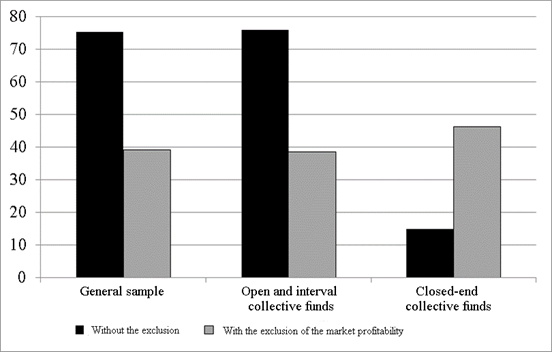

Adjustment for market return eliminates the estimation bias. Fig. 6 shows a comparative analysis of the coefficients of determination obtained after evaluation of the regression model for the whole sample and for open-end, interval mutual funds and closed-end unit investment trusts separately.

Figure 6. Comparative analysis of the impact of the adjustment of 2009-2014 actual profitability of unit investment trusts for market profitability unit investment trusts (coefficient of determination, %)

Source: authors’ calculations

It can also be noted that the use of such adjustment (or “purification”) for the whole sample and for open-end and interval mutual funds allows to decrease the influence of annual adjustments of the investment portfolio weights. This testifies to the fact that, on average, the returns of such mutual funds reflect the behaviour of the market in terms of dynamics. That is why, using market benchmarks, we have managed to model the returns of open-end mutual funds and interval mutual funds in such a way that its behaviour almost coincides with that of actual return. However, this is not true for closed-end unit investment trusts. Possible reason for this could be quite small number of observations within the sample.

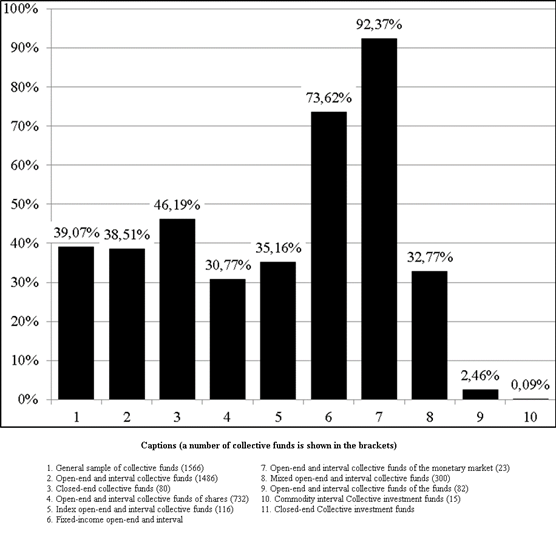

The results of estimation of the models of pool regression are presented in Fig. 7. Actual return of unit investment trusts net of market return has been used as a dependent variable. The figure shows assessments of coefficients of determination. On the first stage of the study, division of unit investment trusts according to the investment styles was performed based on the data provided by the funds themselves. After exclusion of the funds with incomplete observations, the regressions for 9 main categories have been assessed.

Figure 7. The analysis of the impact of the selection of securities on actual return of unit investment trusts in 2009-2014 (coefficient of determination, %)

Source: authors’ calculations

Generally, active management as an adjustment of weights of asset classes on an annual basis and subject to market conditions could explain about 39% of the historical return volatility within the sample of unit investment trusts for the whole studied period. This evidences that asset allocation and periodical change of asset class weights are, on average, very significant for Russian unit investment trusts in the changing market conditions. Adjustment of asset class weights explains about 73% and 92% as for fixed-income open-end and interval mutual funds and open-end and interval mutual funds of the monetary market, respectively. Such a high value means that flexible adjustment of the investment strategy is important in these funds. At the same time, interval commodity mutual funds and open-end mutual funds of funds did not change allocation of their assets between different classes, which reduced the importance of this type of investment activity almost to 0.

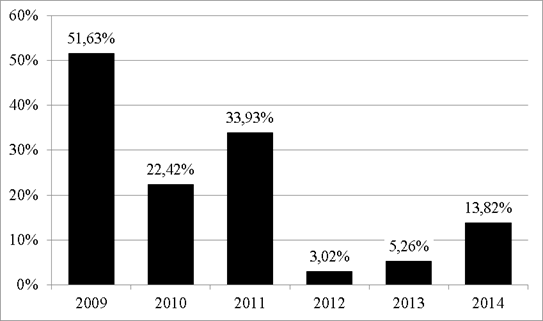

Time extension of the sample from 2009 to 2014 has enabled to perform an intertemporal analysis. The results of evaluation of cross-section regressions for each year are presented in Fig. 8. Each year, from 221 to 287 unit investment trusts were included in the sample.

Figure 8. Intertemporal evaluations of the importance of active adjustment of weights

Source: authors’ calculations

It can be clearly seen from the figure that in 2012 and 2013, redistribution of asset weights in the portfolio and similar active management had a comparatively lower weight. This can be regarded as evidence that no big changes were made by funds in their investment strategies, only redistributions of resources within each asset class separately. Meaning that during the “calm” (business-wise) years (when post-crisis years were already gone, and the new crisis of 2014 was only ahead), unit investment trusts avoided significant and sharp changes in their strategies in order to decrease their expenses. Presumably, they believed their strategies of weight redistribution chosen in 2011 to be still optimal and, to some, extent, long-term. However, in 2014 the economical balance was broken, and a certain increase in financial market volatility was observed at the time. This caused a whole wave of adjustments in assets belonging to different classes. In particular, as it was shown above, this caused a withdrawal of Russian issuers from share participation and diversification through international securities.

Thus, it has been shown that, on average, active management has quite a considerable explanatory capability when it comes to unit investment trusts. Still, in the period from 2012 to 2013, this process explained, at least, 5% of the portfolio return volatility. Besides, intertemporal analysis allows pointing out categories of funds whose active management is dominated by asset allocation. Over the last 3 years, the importance of active management has been decreasing, while long-term asset allocation and the development of long-term investment strategies have been gaining greater importance. The results obtained prove that each part of the investment process is inseparable.

Conclusion

The goal of the present research has been to study the factors enabling to improve the financial performance and to increase the efficiency of investments and management of portfolios of pension reserves and savings in the Russian Federation. The study has revealed the following.

Most pension funds abroad had positive real returns, which can, to a considerable extent, be attributed to a moderate inflation level in the countries under analysis.

As of this date, actual level of the disclosure of information about returns and risks of investing pension portfolios in the world remains low. This problem is especially acute for Russia and for pension reserves managed by private pension funds, in the first place. The actual level of the disclosure of information about the portfolios of pension savings and reserves precludes us from making well-grounded judgments about their efficiency.

An overview of studies dedicated to allocation of institutional investors’ assets has allowed us to presume that asset allocation and active management are an integral part and have approximately equal impact on funds’ resultant efficiency. Our empirical research has shown that allocation of assets according to the complete model evaluations in the sample of Russian private pension funds’ saving portfolios in 2013 allows explaining about two-thirds of the volatility of the return of these portfolios. The result so high compared to the expected one can be explained by the importance of making decision concerning long-term allocation of assets in the field of pension resources investments. This predetermines the special importance of two problems: 1) the problems of asset allocation in managing of pension savings portfolios 2) the problems of managers’ having sufficient rights to choose certain investment assets.

Alternative calculations in the sample of unit investment trusts in 2009-2014 have demonstrated that active management in form of an annual adjustment of long-term asset weights in the portfolio could explain about 40% of the volatility of historical profitability of these funds’ portfolios. In other words, active management and asset allocation of Russian unit investment trusts have, on average, equal influence for the whole period. Still, intertemporal analysis has shown that in the periods of relative economic stability (2012-2013), active management explained about 5% of the return volatility. This confirms the conclusions concerning private pension funds that have been obtained in 2013.

These results testify to the fact that the attention should be mostly paid to the approaches to asset allocation when forming the portfolios based on pension reserves and savings; i.e. it is necessary to provide the managers administering these portfolios with the rights necessary to operate various classes of the investment assets, which includes operating them in the global capital markets.

[1] Starting from 1 July 2014 the Bank of Russia has restricted the possibilities of using this scheme by reducing the number of banks available for depositing pension savings to 34 credit organizations. However, this measure cannot ensure that the organizations managing pension savings will abandon the off-the book investment schemes through deposits in the specified banks.

Страница обновлена: 23.02.2026 в 18:40:50

Download PDF | Downloads: 27

.

. ...., . ....Journal paper

Global Markets and Financial Engineering

Abstract:

.

Keywords: .