The role of real time reporting to limiting the creative accounting practice

Aqeel Salim Mohammed1, Aws Saeed Mirdan2, Nawfal Hussien Abdullah2

1 Wasit University, Ирак, Эль-Кут

2 Wasit University, College of Administration and Economics, Ирак, Эль-Кут

Скачать PDF | Загрузок: 73

Статья в журнале

Вопросы инновационной экономики (РИНЦ, ВАК)

опубликовать статью | оформить подписку

Том 10, Номер 4 (Октябрь-декабрь 2020)

Эта статья проиндексирована РИНЦ, см. https://elibrary.ru/item.asp?id=44491721

Аннотация:

The aim of this study is to investigate the role of real-time reporting in limiting creative accounting procedure and to answer the fundamental question of what role real-time reporting can play in limiting creative accounting procedure.

This research is in the form of a library in which several review articles and authoritative journals have been used. This is descriptive and describing creative accounting and real-time reporting, and then addressing the issue at hand.

The results showed that real-time reporting components such as business intelligence, technology and information technology, business process management, architecture and organizational integration can all have a positive and effective effect on limiting creative accounting procedure.

Ключевые слова: creative accounting, reporting, real-time reporting

JEL-классификация: M41, M49, O31, O33

Introduction

Financial statements are used to communicate the business, expressed in figures, to all interested stakeholders. The main objective of financial reporting is to provide a fair and objective picture of the business, taking into account the fundamental accounting principles and assumptions. However, accounting standards often allow and require various accounting estimates, which can lead to manipulation of financial information.

Creative accounting can be described as a process in which managers exploit “loopholes” and ambiguities.

In accounting standards are used to demonstrate financial success in a biased manner. Looking at the short-term, manipulating financial information can have a positive impact on business. But in the long run, it usually results in a fall in stock prices and bankruptcy.

Most often, managers are the ones responsible for manipulating financial information, as it is they who provide guidance to their subordinates regarding financial reporting. The main motives for this are obtaining personal gain, attracting investors by presenting a false image of their business, struggle with the competition and economic conditions, increasing capital, buying time because of unpaid overdue liabilities, and beating analysts’ forecasts regarding business performance so as to achieve overall benefit for the company.

In order to present business in a positive light, companies use various methods of creative accounting.

The basis for manipulative procedures lies in accounting estimates that are permitted within accounting standards. The techniques used in creative accounting relate to manipulation of off-balance sheet financing items, changes in accounting policies and depreciation methods, manipulation of other income and expense items, changes in the value of money, overestimation of revenues by recording fictitious sales revenues, manipulation of receivables write-offs, and manipulation of accruals.

If it is implemented in a minimal scope and with positive intent, creative accounting can be considered good practice. But since it is often misused, it is necessary to insist on measures that will minimize the practice of manipulating financial statements in order to prevent false financial reporting. Such measures include adaptation of accounting standards in the sense of limiting the use of accounting estimates, and establishing consistency in the application of accounting methods. It is necessary to recognize the role of internal and external audit in identifying and reporting unfair estimates, and preventing accounting manipulations. Moreover, it is desirable to use services of different auditing companies in different accounting periods. Additionally, it would be good for companies to hire independent directors and members of the audit committee, establish effective corporate governance controls, persist in developing a whistleblower policy and continuously work on raising employees’ awareness of the code of ethics. It is also necessary to raise awareness of investors about the application of creative accounting practices and persist in the development and application of forensic accounting. Furthermore, national authorities should consistently enforce penalties.

Nowadays, some accounting activities face special concerns that represent serious challenges. Of course, the implementation success of an accounting information system depends on technological issues, but other dimensions should be considered, like the people and the organizational dimensions. Yet, new technological solutions deserve closer attention and may provide answers to the accounting challenge of real-time reporting.

1. Creative Accounting

1.1. The Concept of Creative Accounting

Accounting is one of the basic functions of each company. The financial information that it provides is very important for both managers and decision makers outside the company. The basic objective of financial reporting is to provide a fair and objective picture of the business to all interested stakeholders.this can often lead to a conflict of interest.namely, on the one hand, investors expect reliable and credible financial information so that they can make the right decisions. On the other hand are the companies that, due to increasing competition and economic conditions, are seeking to attract investors, because of which they often resort to unethical methods of creative accounting, that is, management of earnings.

There are various definitions of creative accounting in the literature, but they all boil down to the same idea. Bhasin M.L. [3] (Bhasin, 2016) describes creative accounting as an accounting practice that may (or may not) adhere to accounting principles and standards, but deviates from what those principles and standards intend to achieve, in order to present the desired business image.in other words, creative accounting is the process of transforming accounting information from what it actually is to what the company wants it to be, using the benefits (or loopholes) in the existing rules or by ignoring part of the rules.

Creative accounting can also be described as a series of actions initiated by the company’s management that affect the reported business result, which, however, do not bring true economic benefits to the company, but can instead result in great damages in the long term [9] (Merchant, Rockness, 1994). Shah A.K. [11] (Shah, 1988), in turn, defined creative accounting as a process in which managers utilize the so-called loopholes and ambiguities in accounting standards to demonstrate financial success in a biased manner.

Since creative accounting often does not violate legal rules, the question is whether it is good or bad.this depends on the basic purpose for which it is used and the manner in which it is applied. Bhasin M.L. [3] (Bhasin, 2016) describes it in a very picturesque way: creative accounting is like a double-edged sword – management can either use it in a positive sense, or it can abuse it. Thus, the idea to present the business in a better light can ultimately result in a total loss of company image.

The use of creativity in financial reporting can be described as playing with the elements of financial statements. Doing so may result in overestimation of the value of assets, high inventory levels, reduction in expenditures, changes in depreciation methods, showing provisions as assets, etc. [12] (Shahid, Ali, 2016). The techniques of creative accounting follow the changes of accounting standards, which are modified with the aim of reducing accounting manipulation. However, well-intended changes in accounting standards often result in opening up of new opportunities for accounting manipulations. Although companies apply accounting standards, at the same time they use “loopholes” to enhance the key indicators [7] (Karim, Shaikh, Hock, Islam, 2016).

Creative accounting can have a positive impact on a company’s business in the short term, but in the long run it may result in decreased stock prices, insolvency, and even bankruptcy. It is the root of numerous accounting scandals, as well as many accounting reforms, which is why doubts in the transparency and honesty of financial reporting arise. For this reason, Bhasin M.L. [3] (Bhasin, 2016) emphasizes the role of forensic accounting. Moreover, he points out that forensic accounting will be on the list of 20 most important and sought-after professions of the future.

1. 2. Motives, Techniques and Methods of Limiting Creative Accounting

The basic idea of creative accounting is based on finding the so-called loopholes in laws and accounting standards with the intention of enhancing financial statements and presenting the business in a positive light. Creative accounting can have a positive impact on business, but only when it is applied in a positive sense and in a minimal scope. However, it often happens that companies cross boundaries of minimalism and abuse such practice, which can lead to fatal consequences. One thing is certain, creative accounting most often has a negative effect on financial reporting.

In most cases, company management is responsible for the manipulation of financial reporting, as their instructions are followed by the employees responsible for financial reporting. The main motives for applying creative accounting are:

•• obtaining personal gain;

•• competition;

•• attracting investors;

•• increasing or maintaining the level of capital;

•• buying time for not settling debts;

•• beating analysts’ forecasts about future company performance.

In order to present their business in the best possible light, companies use various techniques to manipulate financial information. Manipulations usually occur where accounting standards require accounting estimates. The most widely used creative accounting techniques are:

•• manipulation of off-balance sheet financing items;

•• changes in accounting policies and depreciation methods;

•• manipulation of other income and expense items;

•• changes in the value of money;

•• overestimation of revenues by recording fictitious sales revenues;

•• manipulation of receivables write-offs;

•• manipulation of accruals.

Since creative accounting is increasingly being used in a negative sense, resulting in numerous accounting scandals with huge consequences, it is necessary to establish efficient methods that will limit or minimize manipulation of financial information. Efficient techniques for preventing creative accounting include:

•• adaptation of accounting standards in terms of limited use of estimates and consistency in the application of accounting methods;

•• recognizing and insisting on the role of internal and external audit in identifying and reporting unfair estimates, and preventing accounting manipulations;

•• change of audit service providers from one accounting period to another;

•• hiring independent directors and members of the audit committee;

•• establishing effective corporate governance controls;

•• company persistence in developing a whistleblower policy;

•• continuously making employees aware of the code of ethics;

•• placing emphasis on the development and application of forensic accounting;

•• making investors aware of the practice of manipulating financial information;

•• consistent enforcement of penalties by national authorities.

2. Accounting’s Real-Time Reporting Challenge and Technological Answers

Today, computer systems bring us a new meaning to “real-time”. With computerized systems, real-time happens when input data is processed within milliseconds so that it is available virtually immediately as feedback to the process from which it is coming. A good example is a missile guidance system where the system directs and controls the missile along its entire course from its launch until it reaches its final objective [10]. Within an organization, the real-time reporting can be seen as something with a similar purpose. Along the organization life, the real-time reporting in accounting gives complete and instantaneous information about key dimensions of the organization allowing the management to decide the better direction and actions to take in each moment.

Actual information technologies, characterized by large computing power and huge data storage capacity, allow the production of reports combining different views of the organization, contributing to its competitiveness increase.

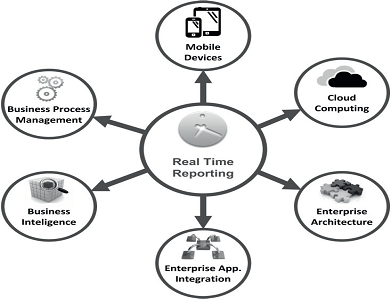

Figure 1 shows the main technological answers to the real-time reporting accounting challenge identified by Belfo F., Trigo A., which are business process management, mobile devices, cloud computing, business intelligence, enterprise architecture and enterprise application integration [2] (Belfo, Trigo, 2013).

Figure 1. Main technological answers to real-time reporting

Source: adapted from [2] (Belfo, Trigo, 2013).

2.1. Business Process Management

Business process management (BPM) like accounting has lately been focusing one real-time issue to provide managers and business leaders the possibility to monitor and optimize business processes.

Business process management suites (BPMs) have been progressing into a new era the era of intelligent BPMs, which include a new module the business activity monitoring (BAM), which offers the ability to deliver real-time dashboards for monitoring all kinds of business processes.

The term bam was originally coined by analysts Atgartner [8] (Mccoy), and refers to the aggregation, analysis, and presentation of real-time information about activities inside organizations and involving customers and partners. Bam is an enterprise solution primarily intended to provide a real-time summary of business activities to operations managers and upper management.

Real-time accounting is connected to the need of continuous assessing of what is going on within business operations and processes in order to allow management to react promptly. In this sense BPM through the usage of bam seems to be one of the best technologies for real-time reporting and continuous auditing implementations. BPM allows controlling internal organization internal processes allowing the establishment of internal controls that enable the automatically generation of financial and non-financial reports to be used by managers in the decision making process.

The implementation of BPM and bam to produce metrics/inputs for accounting is a challenging process. Both domains share a set of key concepts like business processes, activities, task, transactions and events but with different perspectives, while accounting is focused on and identifying, measuring, and communicating economic information to management, BPM refers to the same concepts with the purpose of planning, implementing, and controlling how work is done in an organization.

2.2. Mobile Devices

Smart phones and other mobile devices are here to stay and entered both in our everyday lives and in our professional life. In terms of business the great precursor of using mobile devices was blackberry in 2001 with its mobile e-mail solution that allowed people that were on the go to access their professional e-mail without having to find a computer. Later apple popularized smart phone concept with its i phone among common people that began to take them to theirs jobs, starting a new revolution, the use of personal mobile devices within enterprises. As more and more professionals start using smart phones and other mobile devices to keep up to date with business information, as it is the case for financial and non-financial reports, the convergence between business reporting and mobility with special emphasis in real-time reporting seems obvious

In order to provide business reporting in mobile devices the reporting format has to be different from the one accountants used to. Information needs to be more focused on metrics, like key performance indicators (KPIs), and shown in more graphical way, which allows managers to assess the most important facts be it financial or nonfinancial.

Moreover, nowadays, companies providing business intelligence solutions, for instance like micro strategy, offer business analytics and reports on mobile phones and iPods (mobile-bi product) allowing top executives to follow in real-time their company performance from the mobile phone. Mobile devices have another one important feature which is the possibility to receive notifications be it through mobile texting or e-mail. This is a very important feature in the context of real-time reporting since it provides managers alerts about their business operations allowing them to quickly react to business changes

2.3. Cloud Computing

Cloud computing has recently emerged as one of the key technologies for enterprises to adopt. It embraces a wide range of technologies but can be simply viewed as the services delivered by internet and the technologies, software and hardware, that support them [1] (Armbrust, Fox, Griffith, Joseph, Katz, Konwinski, et al., 2010).

According to cloud offers many benefits to businesses as more modern user experiences, embedded analytics to support more effective real-time business decisions, embedded social collaboration tools to increase collaboration and productivity, pervasive mobile access to application services, ease of finding and sharing information to support collaborative decision making and increase productivity, user self-service to simplify provisioning and system administration, ability to more effectively tie back-office systems into the front office to support the company's customer experience strategy, eliminating data and people silos to make more effective business decisions more quickly, improve and shorten the financial close process through better access to data and embedded collaboration, balance the company's financial needs between capital and operating budgets [6] (Fauscette, 2013). Besides, cloud computing allows enterprises to have solutions with faster return on investment (ROI) and lower implementation costs [4]. Cloud computing has also the merit to allow small and medium enterprises to access accounting information systems, something that before was only affordable to large enterprises.

Among the several advantages of cloud computing like flexibility, scalability and lower upfront and maintenance costs the one advantage that is more interesting from the real-time reporting perspective is the possibility of anytime access from anywhere there’s an internet connection to different types of stakeholders to accounting reports.

There are numerous products in the market. Some examples are oracle fusion financials, net suite financials, intact financials and accounting system, SAP ERP financials, Microsoft dynamics group, EPCOR financial management or sage. Like in-house accounting software systems, the web-based accounting information solutions may vary according to the components they offer. According to oracle, their oracle fusion financials cloud service is a complete and integrated financial management solution with automated financial processing, effective management control, and real-time visibility to financial results.

2.4. Business Intelligence

Hans Peter Luhn, an IBM researcher, used the term "business intelligence" for the first time in a 1958 article. He defined intelligence as “the ability to apprehend the interrelationships of presented facts in such a way as to guide action towards a desired goal” [5]. According to a Gartner’s survey made to 1,400 CIOS, the business intelligence (BI) projects were the first technology priority for 2007 [15] (Watson, Wixom, 2007). Traditionally, business solutions are only affordable for large enterprises, but with cloud computing smaller business can also access to this technology.

Bi includes two main activities. The first activity consists of getting the data in, which is also known as data warehousing. It comprises extracting data from several source systems into an integrated data warehouse. The second activity consists of getting data out from the system. It is usually associated to the traditional concept of business intelligence. It covers features like enterprise reporting, OLAP, querying, and predictive analytics. Yet, the accounting intelligence (AI), a new term that has recently emerged, differs from classical bi solutions in the way information is extracted. At classical bi solutions, information is extracted through a data warehouse or OLAP cube. On the contrary, at AI, information is directly extracted from the ERP at the time that a query is run.

2.5. Enterprise Architecture and Enterprise Application Integration

Enterprise architecture can be defined as the fundamental organization of an enterprise embodied in its components, their relationships to each other, and to the environment, and the principles guiding its design and evolution [13] (Stelzer, 2009). Enterprise architecture (EA) provides an integration framework that sits above the individual architectures and to provide the guidelines to define and establish interoperability requirements]. Ea is closely related with enterprise application integration (EAI). The integration of various applications that coexist in the organization, the sharing of their information and processes, usually known as enterprise application integration strongly influences the design of enterprise architecture. The accounting information systems should not work alone, but adequately integrated with other information systems in order to be more effective. "The ability to share information and services", usually referred as interoperability, allows the integration and embedding among information systems [14]. The classic architecture approaches are based on DMBs or rule engines. Yet, other architecture possibilities may combine these with other principles in order to ensure a real-time reporting system. Likewise, ea and EAI should consider modern approaches like the specific and powerful reporting languages or the integration capabilities of ERP systems, but also system performance aspects which may influence real-time reporting answers.

3. The Role of Real-Time Reporting in Limiting Creative Accounting Procedures

As mentioned, creative accounting can be defined as a set of actions initiated by the company's management, and these actions will affect the reported business results, which may not be to the benefit of the company; but if left unmanaged, they can create a lot of problems in the long run; of course, the opposite may also be true, in which management uses ambiguities in accounting standards to demonstrate financial success in biased ways. What has been found is that creative accounting can have a positive impact on the company in the short term, but in the long run it can cause many problems for the company, which may even lead to the bankruptcy of the company. Now the question is how to limit this creative accounting; as mentioned, creative accounting is done using special techniques that include changes in accounting policy, manipulation of other items of income and cost, changes in the value of money, estimating and overestimating revenues, manipulation of accounts receivable and manipulation of accruals. In this regard, various methods for limiting creative accounting were mentioned in this article; now the key question is what effect does real-time reporting have on limiting creative accounting?

Through business process management, it can help limit creative accounting by allowing managers to monitor and optimize business processes and this is in line with the hiring of independent managers and members of the audit committee, who have previously mentioned ways to limit creative accounting and through business process management, creative accounting can be restricted.

Using mobile devices, information such as key performance indicators are more focused on criteria, allowing supervisors and managers to assess the most important facts financially or non-financially. This can be achieved by establishing effective control over corporate governance, using technology that both examines corporate governance and can judicially oversee accounting.

Transparency can be made better and better by using cloud computing; this means that using this technology, access to accounting information systems will be the same for all companies, individuals, auditors and managers, which can have a great impact on preventing creative accounting procedure. With this, the disclosure of companies and organizations is increasing day by day, and investors can also be fully aware of the performance of financial information manipulation, which in itself limits the creative accounting procedure. Architecture and organizational integration in accounting real-time reporting can play a special role in limiting creative accounting procedure; this can be attributed to the controls affecting corporate governance, the change of audit service providers, the constant notification of employees to ethical principles, etc., all of which can have an impact on architecture and organizational integration.

4. Conclusion

This paper presents contemporary main technological answers to one of the current concerns in accounting: the real-time reporting. The challenge of implementing real-time reporting in accounting information systems may be partially addressed by some technological answers like business process management and business activity monitoring (for instance, by supporting more extensive accounting reporting with several process metrics), mobile devices (for instance, by using the possibility of receiving immediate notifications), cloud computing (for instance, with different stakeholders accessing anytime or anywhere to accounting reports), business intelligence (for instance, by selecting the best visual option to represent the data and achieve goals), enterprise architecture and enterprise application integration (for instance, by using specific and powerful reporting languages, like the XBRL, which provide a method to tag financial information).

Although these issues are complex, deserving a more detailed research in the future, this paper presents a reflection about several aspects and practical considerations regarding real-time reporting implementation. Moreover, this is a theme in development and other fresh technologies could be cumulatively considered, like the involvement of big data architectures, already being used to perform real-time analysis. We hope this work can contribute to enlighten practitioners and managers for the technological options that exist for the implementation of real-time reporting in accounting.

Источники:

2. Belfo F., Trigo A. Accounting Information Systems: Tradition and Future Directions. Procedia Technology. 2013;9:536-46.

3. Bhasin M.L. (2016), “Survey of Creative Accounting Practices: An Empirical Study”, Wulfenia Journal, Vol. 23, No. 1, Pp. 143-162.

4. Birst. Why Cloud Bi? The 9 Substantial Benefits Of Software-As-A-Service Business Intelligence 2010 [Cited 2014]. Available From: Http://Dc.Virtorg.Net/Whitepapers Industry/Files/Why_Cloud_Bi_Benefits_Of_Saas_Bi.Pdf.

5. Cebotarean E. Business Intelligence. Journal of knowledge Management, Economics And Information Technology. 2011;1(2).

6. Fauscette M. ERP In The Cloud And The Modern Business. Idc, 2013.

7. Karim A.M., Shaikh, J. M., Hock, O. Y., Islam, M. R. (2016), “Solution Of Adapting Creative Accounting Practices: An In Depth Perception Gap Analysis Among Accountants And Auditors Of Listed Companies”, Australian Academy Of Accounting And Finance Review, Vol. 2, No. 2, Pp. 166-188.

8. Mccoy D.W. Business Activity Monitoring: Calm before the Storm Gartner; 2002. Available From: Http://Www.Gartner.Com/Resources/105500/105562/105562.Pdf.

9. Merchant K.A., Rockness J. (1994), “The Ethics Of Managing Earnings: An Empirical Investigation”, Journal Of Accounting And Public Policy, Vol. 13, No. 1, Pp. 79-94.

10. Oxford University. Definition of "Real Time": Oxford University Press; 2014 [Cited 2014, April 06.

11. Shah A.K. (1988), “Exploring The Influences and Constrains of Creative Accounting In The Uk”, Europeanaccounting Review, Vol. 7, No. 1, Pp. 83-104.

12. Shahid M., Ali H. (2016), “Influence of Creative Accounting on Reliability and Objectivity Of Financial Reporting (Factors Responsible For Adoption Of Creative Accounting Practices in Pakistan)”, Journal Of Accounting And Finance In Emerging Economies, Vol. 2, No. 2, Pp. 75-82.

13. Stelzer D. Editor Enterprise Architecture Principles: Literature Review and Research Directions. Service-Oriented Computingicsoc/Servicewave 2009 Workshops; 2010: Springer.

14. The Open Group T. The Open Group Architecture Framework (TOGAF) Version 9. The Open Group; 2009.

15. Watson H., Wixom B. The current state of business intelligence. Computer. 2007;40(9):96-9

Страница обновлена: 07.01.2026 в 14:44:47

Download PDF | Downloads: 73

The role of real time reporting to limiting the creative accounting practice

Aqeel S.M., Aws S.M., Nawfal H.A.Journal paper

Russian Journal of Innovation Economics

Volume 10, Number 4 (October-December 2020)

Abstract:

The aim of this study is to investigate the role of real-time reporting in limiting creative accounting procedure and to answer the fundamental question of what role real-time reporting can play in limiting creative accounting procedure.

This research is in the form of a library in which several review articles and authoritative journals have been used. This is descriptive and describing creative accounting and real-time reporting, and then addressing the issue at hand.

The results showed that real-time reporting components such as business intelligence, technology and information technology, business process management, architecture and organizational integration can all have a positive and effective effect on limiting creative accounting procedure.

Keywords: creative accounting, reporting, real-time reporting

JEL-classification: M41, M49, O31, O33

References:

Armbrust M., Fox A., Griffith R., Joseph Ad., Katz R., Konwinski A., et al. (2010). A View of Cloud Computing Communications of the ACM. (53(4)). 50-58.

Belfo F., Trigo A. (2013). Accounting Information Systems: Tradition and Future Directions Procedia Technology. (9). 536-546.

Bhasin M.L. (2016). Survey of Creative Accounting Practices: An Empirical Study Wulfenia Journal. (1). 143-162.

Cebotarean E. (2011). Business Intelligence Journal of knowledge Management, Economics and Information Technology. (1(2)).

Definition of "Real Time"Oxford University Press. Retrieved November 13, 2020, from http://www.oxforddictionaries.com/definition/english/RealTime

Fauscette M. (2013). ERP in the Cloud and the Modern Business

Karim A.M., Shaikh J. M., Hock O. Y., Islam M. R. (2016). Solution of Adapting Creative Accounting Practices: An In Depth Perception Gap Analysis among Accountants and Auditors of Listed Companies Australian Academy Of Accounting And Finance Review. (2). 166-188.

Mccoy D.W. Business Activity Monitoring: Calm before the StormGartner, 2002. Retrieved November 13, 2020, from Http://Www.Gartner.Com/Resources/105500/105562/105562.Pdf

Merchant K.A., Rockness J. (1994). The Ethics of Managing Earnings: An Empirical Investigation Journal of Accounting and Public Policy. (1). 79-94.

Shah A.K. (1988). Exploring the Influences and Constrains of Creative Accounting In the UK Europeanaccounting Review. (1). 83-104.

Shahid M., Ali H. (2016). Influence of Creative Accounting on Reliability and Objectivity of Financial Reporting (Factors Responsible for Adoption of Creative Accounting Practices in Pakistan) Journal of Accounting and Finance In Emerging Economies. (2). 75-82.

Stelzer D. (2009). Enterprise Architecture Principles: Literature Review and Research Directions

Watson H., Wixom B. (2007). The current state of business intelligence Computer. (40(9)). 96-99.

Why Cloud Bi? The 9 Substantial Benefits Of Software-As-A-Service Business Intelligence 2010Docplayer. Retrieved November 13, 2020, from Http://Dc.Virtorg.Net/Whitepapers Industry/Files/Why_Cloud_Bi_Benefits_Of_Saas_Bi.Pdf