Methodological aspects of assessing regional investment attractiveness

Pakhalov A...1

1 “National Rating Agency”, ,

Скачать PDF | Загрузок: 49

Статья в журнале

Global Markets and Financial Engineering ()

Аннотация:

The article is devoted to a number of methodological aspects related to the assessment of regional investment attractiveness. The concept of “regional investment attractiveness” as a broad economic category covering the whole complex of external factors which influence the risk and return of investment projects under implementation in the region is considered. The author presents a list of the stages of investment attractiveness assessment and analyzes methodological difficulties encountered in each of these stages. Special attention is paid to the process of weighing investment attractiveness factors. This process is one of the key stages of assessment, and the correctness of such weighing influences the quality of the integral index of regional investment attractiveness.

Ключевые слова: regional investment attractiveness, regional investment climate, assessment stages, weighing coefficients, integral index

The concept of “regional investment attractiveness”

The term “regional investment attractiveness” is rather often used in contemporary Russian and foreign economic literature. Nevertheless, no universally accepted definition for this economic category has been proposed so far.

According to the most common point of view, the regional investment attractiveness is considered as a set of properties of the region which affect the investment inflow. These properties are often referred to as factors of regional investment attractiveness. The broad definition of investment attractiveness as a combination of factors that affect the intensity of the investment inflow can be applied not only to the region but also to the industry or a particular company. The main distinctive feature of the concept of regional investment attractiveness is that a set of factors under consideration is not limited to the financial and economic ones, but also includes political, social, institutional, legal and other aspects. Some researchers specify: investment attractiveness is not just a set of factors, but the region’s ability to attract investment flows by using a combination of factors [1]. This clarification emphasizes the vigorous activities of the region administration and business community to attract investments by creating a favorable investment climate and providing potential investors with relevant information.

The subject of debate in the Russian economic literature is the ratio of the concepts of the regional investment attractiveness and the regional investment climate. Some authors consider the investment attractiveness and investment climate as synonyms [2], or regard the investment attractiveness as a characteristic of the investment climate [3]. There is also a fundamentally different point of view which assumes that the investment climate determines the investment attractiveness [4].

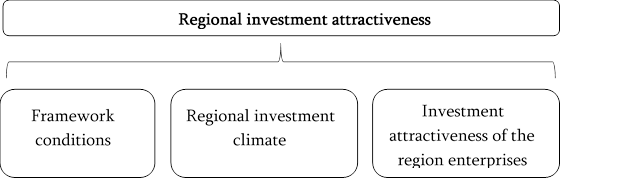

A well-defined understanding of the relationship between the territorial investment climate and investment attractiveness has been established in the world practice. The publications of the World Bank and the OSCE define the investment climate as “an institutional, political and regulatory environment in which enterprises operate [5] “. Aside from the regulatory and institutional aspects, the investment climate includes macroeconomic and infrastructure factors, as well as the state of the financial and labor markets. All these factors have one thing in common: they can change under the influence of government policy - this is emphasized in another definition of the investment climate as a “set of measures to reduce the political and economic investment-related risks [6]”. As for the factors such as the region's natural resources and geographical location, they cannot be changed by reforms and therefore are regarded as basic preconditions [7] which are considered separately from the investment climate. Another aspect of the regional investment attractiveness, which is not included in the notion of the investment climate, is the presence of profitable and competitive investment objects, namely, business undertakings attractive for investment. Thus, the region’s investment attractiveness is formed by the basic conditions, the investment climate and investment attractiveness of the enterprises located in its territory (see Figure 1). The regional investment attractiveness includes the entire set of “benefits for the investor which are associated with the territory” [8], and, thus, it is an exceedingly wide concept being of greatest interest from the point of view of a comprehensive assessment of the region as a potential place for investment projects.

Figure 1. Regional investment attractiveness

(source - compiled by the author)

Assessment of regional investment attractiveness is an essential tool in study, forecast and control of investment flows. In the current research, investment activity is considered as an observed and quantitatively measured parameter of the inflow of investments into the region. Investment attractiveness, in its turn, is regarded as a combination of features, factors and conditions affecting the investment inflow intensity. Consequently, the investment activity can be considered an indicator that is directly dependent on the investment attractiveness level [9]. However, while the methods of measuring the investment activities are obvious enough (they can be, for example, investment in fixed assets in the region or foreign direct investments in the region), the assessment of regional investment attractiveness is a rather time-consuming multi-step process.

The stages of the assessment of regional investment attractiveness

In the most general form, the process of evaluating the regional investment attractiveness can be represented as a series of six interrelated stages:

1) Statement of the purpose of the study;

2) Makingof a list of the investment attractiveness factors;

3) Selection of proxy variables for each of the selected factors;

4) Determination of the weights of individual factors and proxy variables in the final assessment (final integral indicator of the investment attractiveness level);

5) The collection of data on each proxy variable for each region under study;

6) Calculation of the final integral index of the investment attractiveness for each region under discussion, ranking.

In evaluating the regional investment attractiveness, the top priority is to determine the purpose of the study. The overall objective of all similar studies is to evaluate the factors forming the investment environment, but the list of these factors and their relative importance depend on the type of investors. For example, the World Bank’s international ranking «Doing Business» evaluates primarily the institutional aspects that form the conditions for establishment and development of small and medium-sized business [10] In turn, the “Confidence index of direct foreign investors”, calculated by the consulting company A.T. Kearney [11], includes the assessment of the political, economic and regulatory systems affecting the inflow of foreign direct investment. A number of fundamental economic factors equally affect both small business and large foreign investors, but many of the environment parameters for these subjects vary considerably. There are some differences between the needs of groups of rating users. In particular, potential investors are interested in the whole range of factors that affect the risk and return on investments, while regional authorities need only the evaluation of the factors related to the area of their direct responsibility (e.g., convenience of the investment portal or the quality of work of the regional organization responsible for the work with investors).

The second stage of assessment of investment attractiveness - making of a list of investment attractiveness factors – follows directly from the first one. If assessment of the regional investment attractiveness in a broad sense is stated as the purpose of the study, the set of factors will be sufficiently large: from the availability of natural resources to the quality of the regional governance. For example, in the rating of investment attractiveness of Russian regions “Expert RA”, 15 different factors were identified. 9 of them assess the region’s potential, and other 6 correspond to different types of investment risks [12]. The study may also have a much narrower purpose - for instance, to assess the effectiveness of the regional authorities in improving the investment attractiveness. The National rating of the investment climate state, published by the Russian “Agency of strategic initiatives”, can serve as the most striking example. This ranking is aimed at assessing the performance of particular policy documents - the “road maps” of the National Business Initiative (NPI) and the Regional Investment Standard [13]. The list of rating factors and criteria is dictated by the content of these documents, and, as a result, the study is not intended to be a “universal” investment attractiveness assessment.

In the third phase, it is necessary to generate a set of proxy variables - quantitative and qualitative indicators the totality of which determines the state of the factor for each of the selected factors. For example, the economic activity and educational levels of the population, labor costs (average salary) may serve as proxy variables for the region’s labor potential. The indicators used to evaluate any of the factors of the regional investment attractiveness can be divided into three groups: statistics, expert opinions and the results of surveys of the business communities. Each of these indicators has its own advantages and disadvantages. The statistic data are the most objective indicator of the regional investment attractiveness, but they are published with a certain time lag and do not cover a number of important aspects of the investment attractiveness (e.g., quality of institutions and the level of social and political stability). Expert opinions are a common way to assess the parameters that cannot be evaluated statistically. At the same time, expert opinions are highly subjective. Surveys of the business community can act as substitutes for expert evaluation, since they allow to replace private expert opinions with aggregated appraisals by entrepreneurs and chief executives who work directly in the region under study. Unfortunately, surveys of the business community are rarely used in the assessment of the regional investment attractiveness, as they involve significant costs for the researchers. In addition, survey of the business community may in some cases be distorted due to the fact that entrepreneurs refuse to give honest appraisals of the most “painful” aspects of the investment climate (especially such as corruption and other informal relationships). According to the study of the regional business climate “SUPPORT index”, conducted in 2012, in some regions of Russia, more than half of the respondents did not respond to the questions about the level of corruption in their regions [14]. It should be noted that many modern methods of assessing regional investment attractiveness are combined: they use statistical data to evaluate quantifiable factors, and expert opinions or polling survey results for other factors.

Weighing factors (assignment of weighting coefficients that determine the contribution of individual factors and indicators to the integrated assessment of investment attractiveness) is the fourth step in evaluating the regional investment attractiveness. In its complexity, this task is comparable to the step of forming the list of factors and proxy variables. The approaches to weighting factors of investment attractiveness will be discussed in more detail in the next section of this article.

The fifth stage of assessment of the regional investment attractiveness - data collection - poses a number of challenges (of both technical and substantive nature) before the researchers. The main technical difficulty is to fill the gaps in the data. The emergence of gaps is caused by unavailability of indicator values in one or more regions under evaluation. If gaps are rare, their filling can be carried out using various methods designed for this purpose: the replacement of a gap by the mean value in the sample, interpolation, etc. However, in cases when no values of several essential proxy variables for a specific region are available, it is advisable to exclude the region from the selection. Substantial difficulties in collecting the data consist in the need to check their relevance. In particular, there are cases where the indicators of the investment climate quality, which were obtained from different sources, varied considerably within the same country [15] .

In the sixth stage – during the calculation of the integral indicator of investment attractiveness – the researchers mainly face technical difficulties associated with the need to process large data sets correctly. In addition, at this stage it is necessary to decide on the form in which the final assessment result should be presented. Both letter grades and quantitative index (ranking) can be used for it. Moreover, in some cases, the researchers do not calculate the integral indicator, confining themselves to verbal and visual analysis of the collected primary data.

Approaches to the calculation of weighting coefficients of the factors of regional investment attractiveness

Table 1 provides a description of the weighting mechanisms used in various Russian and foreign (including international) methods of assessment of the regional investment attractiveness.

Table 1. Weighting mechanisms used in the Russian and foreign methods of evaluation of investment attractiveness of the regions

|

Study

|

Method of assigning weighing coefficients

|

|

The

investment attractiveness rating of Russian regions “National Rating Agency”

[16]

|

Investment attractiveness is defined as a set of seven factors. The

weight of each factor is determined based on a survey of experts – “representatives

of the investment and scientific communities (experts in the field of direct

and portfolio investments who have sufficient experience of investment

projects in the Russian regions).”

|

|

The

investment attractiveness rating of Russian regions “Expert RA” [17]

|

The investment attractiveness in the rating is estimated by 2 parameters:

the investment potential and investment risk. The total potential consists of

9 private potentials, the integrated risk - of 6 private risks. The

contribution of each particular risk or potential to the final indicator is

evaluated on the basis of questioning representatives of the expert,

investment and banking communities.

|

|

“The

national rating of the investment climate in the Russian Federation” Agency

for Strategic Initiatives [18]

|

The rating is based on the comparison of regions with one another by

54 indicators combined in 4 directions. The method of aggregating the

indicators into assessment by directions and the method of calculating the

integral index have not been published yet.

|

|

The

composite index of investment attractiveness of the Ministry of Regional

Development of the RF [19]

|

For drawing up these indices, the data provided by the Ministry of

Regional Development of Russia in accordance with the order of the Government

of the Russian Federation (№806-p dated June 15, 2009) are mainly used. The

investment attractiveness index is based on 6 indicators the weighting

coefficients of which vary from 10% to 20%. The principles for determining

the specified weighting coefficients are not available in the public domain.

|

|

“The

investment attractiveness rating of the Indonesia regions” of the KPPOD

Center and The Asia Foundation [20]

|

Five factors of investment attractiveness are identified in the study,

two to four parameters (subfactors) are singled out within each of the five

factors. An expert survey with use of the technique of analytical

hierarchical process has been conducted to determine the weights of

individual subfactors and investment attractiveness factors. Economists,

investors and representatives of large-sized enterprises have taken part in the survey.

|

|

The

study of investment attractiveness of the territorial units of Poland [21]

|

Several dozens of indicators, combined in ten groups, are used. The

investment attractiveness of all regions is evaluated in the context of three

aggregated sectors: industry, services and advanced technologies. When

calculating the aggregate rating indicator of investment attractiveness for

each industry, different weight coefficients are used for each of the

factors. For example, at the assessment of the investment attractiveness in

heavy industry, the indicators of the development level of the social

infrastructure are not taken into account, while at calculation of the

composite indicator of theinvestment attractiveness in high-tech industries,

this group of factors gives 10% of the grade.

|

|

The

investment attractiveness rating of the regions of the Czech Republic [22]

|

The investment attractiveness index is calculated with the help of the

data on unemployment, the number of registered firms, the volume of foreign

direct investment and a number of other indicators. A weighing coefficient

obtained on the basis of expert judgments and adjusted through dividing by

the standard deviation index, calculated on the basis of statistics, is

assigned to each of these indicators. Thus, the indicators characterized by

smaller standard deviation have greater weight in the final rating.

|

The table above demonstrates two basic approaches to weighting factors of the regional investment attractiveness. The first approach involves assigning weighing coefficients based on the subjective opinions of the authors of the techniques. In such cases, authors rarely propose any rationale for the selected weighing coefficients. The proponents of the second approach use the results of the expert surveys with participation of the representatives of investment, business and scientific communities as a tool for weighing. This approach shows seeking of objectivity, but there are a number of problems related to the work of experts, namely: the experts’ competence, representativeness of the poll sample and the quality of the questionnaire which is offered to the experts.

Regional ratings of investment attractiveness have existed for a significantly shorter period of time than the ratings assessing the investment risks and investment climate at the level of sovereign states. The methodological apparatus of country rating is elaborated much better, and in many aspects these ratings can serve as best practices for the regional ones. Nevertheless, the authors of country ratings have no generally accepted method of weighting factors and indicators. In particular, in calculation of the final index (the index of easiness of doing business), the ranking techniques of “Doing Business” use the principle of the simple averaging of percentiles obtained on various parameters by a country participating in the rating [23]. The developers of the techniques indicate that this principle was chosen primarily because of its simplicity, transparency and ease of perception.

However, four alternative methods of weighing the components of the integral index were also considered in the process of developing the project “Doing Business”: the method of principal components, the method of unobservable components, the regression analysis, weighting based on the surveys of business [24]. The first two methods were rejected for the reason that they not only complicate calculations, but also give final results almost identical to the calculations based on a simple average. Business surveys had to be abandoned because of the complexity of the representative and objective measurement of relative importance of the factors for business representatives. The regression analysis gave mixed results, as the choice of the dependent variable for building regression (it can be the value added per worker, the unemployment rate or the size of the black market) is not obvious.

Nevertheless, the principle of equal weights of the factors chosen by the authors of the project has been seriously criticized by experts. Upon the evaluation of the “Doing Business” technique [25] conducted at the request of the World Bank, the independent expert group stated that there is a necessity to abandon the existing method of the integral index calculation. One of the alternative options proposed in the report of the expert group is the complete refusal to create any integrated indicators. This approach is already used in another project of the World Bank which is called “Enterprise Survey” (World Bank Enterprise Surveys, BEEPS). Based on the acquired results of the international studies, conducted in the framework of this project, primary data for each of the studied indicators of the investment climate are published, but the integral index is not calculated.

Striving for transparency and openness is the current trend in the field of country rating. The primary data used for evaluating the investment attractiveness and the investment climate quality becomes open, as well as the techniques used for aggregating these data. Under such conditions, the rating users get an opportunity to assess the accuracy of the conducted evaluation independently and form an opinion about the potential of this approach. It is very likely that such an approach will turn out to be practical in the study of the regional investment attractiveness. An open and substantiated procedure for evaluating investment attractiveness will increase confidence in the investment ratings, rankings of regions and will allow investors to use the assessment results in making the investment decisions.

Страница обновлена: 24.02.2026 в 07:29:59

Download PDF | Downloads: 49

Methodological aspects of assessing regional investment attractiveness

Pakhalov A...Journal paper

Global Markets and Financial Engineering

Abstract:

The article is devoted to a number of methodological aspects related to the assessment of regional investment attractiveness. The concept of “regional investment attractiveness” as a broad economic category covering the whole complex of external factors which influence the risk and return of investment projects under implementation in the region is considered. The author presents a list of the stages of investment attractiveness assessment and analyzes methodological difficulties encountered in each of these stages. Special attention is paid to the process of weighing investment attractiveness factors. This process is one of the key stages of assessment, and the correctness of such weighing influences the quality of the integral index of regional investment attractiveness.

Keywords: integral index, regional investment attractiveness, regional investment climate, assessment stages, weighing coefficients