Lessons from India on Insolvency and Bankruptcy Reforms for Uzbekistan

Binoy Joy Kattadiyil1, Bakhtiyor Anvarovich Islamov2

1 Westminster International University in Tashkent, Узбекистан, Ташкент

2 G.V. Plekhanov Russian Economic University Branch in Tashkent, Узбекистан, Ташкент

Скачать PDF | Загрузок: 188

Статья в журнале

Экономика Центральной Азии (РИНЦ, ВАК)

опубликовать статью | оформить подписку

Том 5, Номер 3 (Июль-сентябрь 2021)

Эта статья проиндексирована РИНЦ, см. https://elibrary.ru/item.asp?id=47312219

Аннотация:

The Insolvency and Bankruptcy Code (IBC) is considered as the major structural legal reform in the world. It is making a robust economy by reducing the amount of Non-Performing Assets and improving Ease of Doing Business (EoDB) ranking. It has attracted investors from abroad because they now seek each developing nation as a legible place for investment owing to the reasons as, smaller timeframe for resolution reduces risk of losing investment and flexible exit policy, even when company becomes insolvent the IBC gears towards maximum realisation of value of assets. It has given a new identity to the developing economy on the International platform. It seeks to create a single unified law for insolvency and bankruptcy. This research empirically studies IBC as an important tool in the growth of the developing economy and analyses the impact of re-engineering/ restructuring under IBC on the Central Asian economy.

Ключевые слова: Uzbekistan - Asia- Central Asia- South Asia- Non Performing assets- distressed assets- creditors -insolvency- reforms- FDI- restructuring- global- doing business

Introduction

Literature Review

· Kattadiyil, Binoy; Agarwal, Swati (2020): Fresh start process under IBC – a look forward to a new beginning; this research paper made a forward study on the anticipated fresh start process for micro, small, medium enterprises in the insolvency and bankruptcy regime elaborating its requirement and how it helps this MSME sector to turnaround.

· Kattadiyil, Binoy (2020): Pandemic priorities: increased insolvency threshold and its economic impact; this research article highlights the priorities the federal government to consider in the pandemic period in suspending and executing the IBC economic reforms in a staged manner so that the corporate in distress finds a breathing space during the period.

· Kattadiyil, Binoy; Manchanda, Nitika (2020): Liquidation as going concern, IVCRL Ltd, a case study analysis; this research article is a case study of the corporate insolvency resolution process happened with the public listed company IVCRL Ltd. The various processes involved in both pre and post CIRP are enumerated in the study.

· Kattadiyil, Binoy (2020): Tackling bankruptcy decision making, the impact of the code on the behavioral psychology of the stakeholders; this research article is a thought provoking master mind set of the various stake holders involved in IBC and how they reacts to various economic reforms under the system during the CIRP process.

· Kattadiyil, Binoy (2020): Phoenix from ashes, the impact of IBC on the distressed mergers & acquisitions market; this research elaborates the various mergers and acquisition process as part of re-structuring the business as an external process so as to bring the stressed business back in to operating condition.

· Kattadiyil, Binoy; Sisugoswami, Mrutyunjay (2020): Non-Performing Assets (NPA’s), How to convert in to Performing Assets and support the Economic Growth; this research elaborates the current status of Non-Performing Assets in the Indian economy and the various steps taken to convert such stressed assets to performing assets so as to support the economic development of the country.

· Kattadiyil, Binoy; Islamov, Bakhtiyor (2021): Commercial wisdom of creditors for value maximization; this paper highlights the working of committee of creditors and their valuation, approval process of the operational and financial credit claims, its approval etc. in the corporate insolvency resolution process. It takes in to consideration the information memorandum process, resolution plan approval etc. so as to bring value maximization for the IBC stakeholders.

· Kattadiyil, Binoy; Islamov, Bakhtiyor (2021): Insolvency and Bankruptcy Code and private equity; this research paper highlights the importance of private equity funding towards corporate insolvency resolution process so as to enable the company in going concern and make it turnaround back to track in running.

· Kattadiyil, Binoy; Islamov, Bakhtiyor (2021): COVID-19, insolvency and bankruptcy reforms round the world; this research paper highlights the steps taken by different federal government start and during the period of COVID-19 economic effects, so as to put some moratorium and supportive measures towards the stressed companies.

· Kattadiyil, Binoy; Islamov, Bakhtiyor (2021): Ruchi Soya, insolvency and bankruptcy economic reforms, a brief analysis; this research paper highlights the pre and post IBC operational aspects of the listed company Ruchi Soya. It elaborates the various stages of IBC process and the turnaround of the company with the help of IBC economic reforms bringing it back to the track.

· Kattadiyil, Binoy; Islamov, Bakhtiyor (2021): CIRP re-engineering and re-structuring under insolvency and bankruptcy reforms; this research paper concentrates on the business re-engineering and re-structuring aspects, i.e. both the internal and external management functions in the corporate insolvency resolution process so as to bring the stressed assets in non-performing nature to performing status.

· Kattadiyil, Binoy; Islamov, Bakhtiyor (2021): Insolvency and Bankruptcy Code, a need of the hour; this research paper elaborates the economic code and its regulations and why it is required to get implemented in order to convert the non-performing dead assets in the economy to performing assets and revive the business in going concern.

· Kattadiyil, Binoy; Islamov, Bakhtiyor (2021): Noah's ARC, Analyzing the role of IBC on asset reconstruction companies in NPA alleviation; this research paper highlights the need of asset reconstruction companies importance and how they help as a resolution applicant and the specialized re-engineering and re-structuring functions they performs in the corporate insolvency resolution process.

· Kattadiyil, Binoy; Islamov, Bakhtiyor (2021): A comparative study on corporate insolvency economic reforms in India and other countries; this research paper do a comparative study of the insolvency and bankruptcy process in different developed and developing economies around the world highlighting the major differences and the uniqueness in treatments of the transactional items.

· Kattadiyil, Binoy; Islamov, Bakhtiyor (2021): Cross border group insolvency, a study of Nortel case; this research paper do a case study analysis cross border insolvency process of the prestigious Nortel group of companies spread across different countries in the world.

· Kattadiyil, Binoy; Islamov, Bakhtiyor (2021): IBC as a major economic reforms for Uzbekistan; this research paper do a proper study of the current insolvency and bankruptcy system of Uzbekistan economy and suggest various steps to be taken so as to improve the ease of doing business of World Bank based on the implementation made in Indian economy, and its highlights.

· Kattadiyil, Binoy; Islamov, Bakhtiyor (2021): Management of business re-engineering and re-structuring under Insolvency and Bankruptcy Code: lessons from Indian experience; this research paper do an in-depth study of the various management aspects of turning around a stressed corporate back to its track in a revival process. It explains the re-engineering and re-structuring steps taken during the corporate insolvency resolution process in Indian economy.

· Kattadiyil, Binoy; Islamov, Bakhtiyor (2021): Analysis of outcomes of IBC on managing the economic development of India; this research paper do a detailed analytical study on the socio economic outcomes on the implementation of IBC with econometric models and how this economic reforms helps the nation in improving its Foreign direct investments and reducing the Non-performing assets as such.

· Kattadiyil, Binoy; Islamov, Bakhtiyor (2021): Outcomes and implications of CIRP under the Insolvency and Bankruptcy Code; this research paper do a complete econometric analysis of the outcomes and its implications in corporate insolvency resolution process under the IBC economic reforms in totality in Indian economy.

Table 1

Comparison of insolvency and bankruptcy framework in India and Uzbekistan

| Basis of Comparison | India | Uzbekistan |

|

Laws

governing Insolvency

|

Insolvency

and Bankruptcy Code, 2016 (IBC)

|

Law

of the Republic of Uzbekistan on Bankruptcy

|

|

Cross

Border Insolvency

|

Sections

234 and 235 of IBC contain details of cross border insolvency in India. It

gives power to the that the Central Government can make any agreements with

the foreign country to start with the insolvency proceedings

|

Recognizes

international and foreign agreements

|

|

Adjudicating

Authority

|

National

Company Law Tribunal (NCLT) is the Adjudicating Authority. The Appellate

Authority is National Company Law Appellate Tribunal (NCLAT)

|

The

hearing and the appeals for such insolvency cases happen in the economic

courts especially assigned for this purpose

|

|

Types

|

There

is Corporate Insolvency, Voluntary Liquidation and Liquidation which includes

schemes of arrangement

|

There

is supervision, sanation, external management, amicable agreement and

liquidation procedure

|

|

Moratorium

|

Moratorium

is imposed on all the proceedings other than insolvency and all the other

agreements of the company as soon as Insolvency Application is admitted by

the court. It continues either till a resolution plan is implemented or till

the company is liquidated

|

It

is suspension of fulfillment of pecuniary obligations by the debtor and

settlement of compulsory payments

|

|

Who

can trigger

|

Under

IBC, the debtor themselves, the creditors (financial or operational) can

trigger insolvency

|

A

debtor, a creditor, a prosecutor, a tax agency or other state authority. The

debtor and the creditor have the right to initiate the procedure for

restoring the solvency of debtor or liquidation proceedings

|

|

Control

|

The

control of the assets and management of the Corporate Debtor rests with the

Insolvency Professional/Liquidator appointed by the Court, once proceedings

start

|

The

control of the assets and management stays with the Debtor even after

insolvency is initiated against them

|

|

Role

of Insolvency Professional

|

Under

IBC, the Insolvency Professional is known as a officer of the court and plays

the role of taking over the Corporate Debtor, keeping it as a going concern,

managing claims, holding creditor meetings, preparing the Information

Memorandum etc.

On company undergoing liquidation, the IP has to hand over the company to the Liquidator |

The

economic court appoints an external manager or an authorized agent to take

over the external management of the debtor or liquidation proceedings

respectively

|

|

Decision

Making

|

Points

for decision taking are put to vote in the committee of creditors. The

insolvency professional cannot take decisions on his own

|

Points

for decision taking are put to vote in the committee of creditors. The

external manager or the authorized representative cannot take decisions on

his own

|

|

Fees

|

The

fees of Insolvency Professional is decided and ratified by the committee of

creditors and forms part of the CIRP cost

|

The

fees of external manager and authorized representative also is decided in the

creditor committee and is paid out of debtor’s property

|

|

Priority

of creditors

|

Section

53 of IBC lays done the priority of payment in cases of liquidation:

(a) The insolvency resolution process costs and the liquidation costs paid in full; (b) the following debts which shall rank equally between and among the following : (i) workmen’s dues for the period of twenty-four months preceding the liquidation commencement date; and (ii) debts owed to a secured creditor in the event such secured creditor has relinquished security in the manner set out in section 52; (c) wages and any unpaid dues owed to employees other than workmen for the period of twelve months preceding the liquidation commencement date; (d) financial debts owed to unsecured creditors; (e) the following dues shall rank equally between and among the following: (i) any amount due to the Central Government and the State Government including the amount to be received on account of the Consolidated Fund of India and the Consolidated Fund of a State, if any, in respect of the whole or any part of the period of two years preceding the liquidation commencement date; (ii) debts owed to a secured creditor for any amount unpaid following the enforcement of security interest; (f) any remaining debts and dues; (g) preference shareholders, if any; and (h) equity shareholders or partners, as the case may be |

Article

83 of the Law on Bankruptcy talks of the sequence of satisfaction of the

creditors demands secured by pledge:

(a) Out of turn payments: legal costs, the remuneration of the court manager, current utility and maintenance payments, expenses for insurance of the debtor’s property, payments related to debtor’s obligations that arose after introduction of bankruptcy procedure, payments to the individuals to whom the debtor bears responsibility for causing harm to life or health; (b) claims (certified by payment (executive) documents) on the issuance of wages, recovery of alimony and payment of remuneration under copyright agreements; (c) claims regarding mandatory obligations, compulsory insurance, bank loans and bank credit insurance, as well as claims of creditors secured by collateral in part of the debt which was not covered due to insufficient amount received from the sale of pledged property (subject of pledge) and claims not secured by collateral; (d) claims of shareholders on the accrued dividends; (e) other claims. The payments under one category of claims can only be made once all payments of previous category were satisfied |

|

Provisions

for avoidance transactions

|

Yes

|

Article

132 of Law on Bankruptcy talks of unlawful actions that lead to Bankruptcy

and this includes avoidance transactions as well

|

|

Approval

for Reorganization Plan

|

Creditor

approval needed

|

Creditor

approval needed

|

|

Regulations

for Group Insolvency of Companies

|

No

specific provisions

|

No

specific provisions

|

|

Time

limit

|

180

days for the process, not exceeding 330 days

|

The

term for bankruptcy proceedings is 1 month. (Until 2019, this period was 2

months). Through 2019 Amendment, judicial rehabilitation is introduced for a

period not exceeding 24 months

|

|

Dealing

with COVID-19

|

Increasing

the threshold for triggering insolvency as well as prohibiting legal proceedings

for non-payment during this pandemic

|

On

April 3, 2020, Uzbekistan released PD-5978 on additional measures to support

the population, economic sectors, and business entities during the

coronavirus pandemic. The decree provides for measures to ensure the stable functioning of economic sectors, as well

as providing support to individual economic entities. For example, for a

number of goods the customs duty and excise tax rates were removed until 31

December 2020; additional tax optimization for certain taxpayers; a

moratorium on initiating bankruptcy procedures and declaring enterprises

bankrupt has been introduced until 1 October 2020; accrual and collection of

rental payments for the use of state property has been suspended, etc.

|

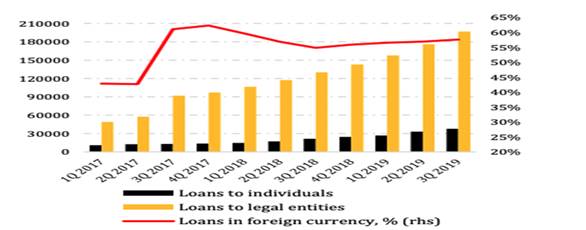

The problem of Non-Performing Assets (NPA) and India being one of the major contributors to the global accumulated NPAs is one that needs to be addressed by IBC to improve the economy. CRISIL estimates the banking sector’s gross NPA (aggregate) has declined to 10% in end March 2019 from 11.5% the year before on the same date. Primarily as a result of transparent recognition of stressed assets as NPAs, gross NPAs of PSBs, as per RBI data on global operations, rose from Rs. 2,79,016 crore as on 31.3.2015, to Rs. 8,95,601 crore as on 31.3.2018, and as a result of Government’s 4R’s strategy of recognition, resolution, recapitalization and reforms, have since declined by Rs. 89,189 crore to Rs. 8,06,412 crore as on 31.3.2019 (provisional data). Data on NPAs is regularly published by RBI as part of its Financial Stability Reports. [1] Net non-performing assets (NPAs) of all commercial banks reduced to 3.7 per cent in FY19 as against 6 per cent in FY18. Though the speedy resolution and recognition of defaults have been great contributors in reducing the amount in Non-Performing Assets, there is still scope for improvement in the relief for stressed asset framework in the country. This is made clear by the Financial Stability Report released by RBI every quarter.

The following Figure 1 shows the projection of NPAs (both Gross NPA and Net NPA) for the time period March 2017 – March 2019 [2].

Figure 1. The projection of NPAs (both Gross NPA and Net NPA) for the time period March 2017 – March 2019

As per the RBI Financial Stability Report (December 2019) [3], SCBs’ gross non-performing assets (GNPA) ratio remained unchanged at 9.3 per cent between March and September 2019. SCBs’ GNPA ratio may increase from 9.3 per cent in September 2019 to 9.9 per cent by September 2020 primarily due to change in macroeconomic scenario, marginal increase in slippages and the denominator effect of declining credit growth. The report, however, mentions that IBC is steadily making progress in the resolution of stressed assets.

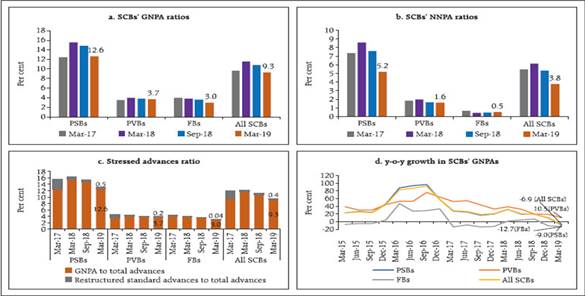

Due to the problems of bad loans or NPAs, the economic development of the country is affected. To measure the effects of bad loans/NPAs, we have to examine banking sectors performance with respect to the factors of economic development as shown in the following Figure 2. The resilience of the Indian banking system against macroeconomic shocks was tested through macro-stress tests for credit risk. These tests encompassed a baseline and two (medium and severe) adverse macroeconomic risk scenarios (Figure 2).

Figure 2. Macroeconomic scenarios’ assumptions

The baseline scenario assumed the continuation of the current economic situation in future(In terms of GDP growth, fiscal deficit to GDP ratio, CPI-combined inflation, weighted average lending rate, export to GDP ratio and current account balance to GDP ratio). The adverse scenarios were derived based on standard deviations in the historical values of each of the macroeconomic variables separately, that is, univariate shocks: up to one standard deviation (SD) of the respective variables for medium risk and 1.25 to 2 SD14 for severe risk (10 years historical data). The horizon of the stress tests is one year.

The stress tests indicate that under the baseline scenario, the GNPA ratios of all SCBs may come down from 9.3 per cent in March 2019 to 9.0 per cent by March 2020 (Figure 3).

Figure 3. Projection of SCB’s GNPA ratios (under various scenarios)

Source: RBI.

Among the bank groups, PSBs’ GNPA ratios may decline from 12.6 per cent in March 2019 to 12.0 per cent by March 2020 under the baseline scenario, whereas PVBs’ GNPA ratios may decline from 3.7 per cent to 3.2 per cent and that of FBs may come down from 3.0 per cent to 2.9 per cent. In view of the above figures and explanation, we have derived that NPAs are also the major factor which affect the economic development growth of India. Therefore, all aspects of IBC which would be rehabilitation of corporate debtor or time bound resolution, or recovery of stressed assets or liquidation.

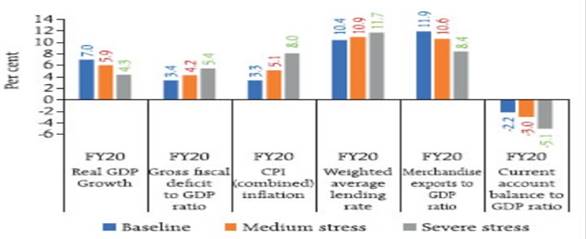

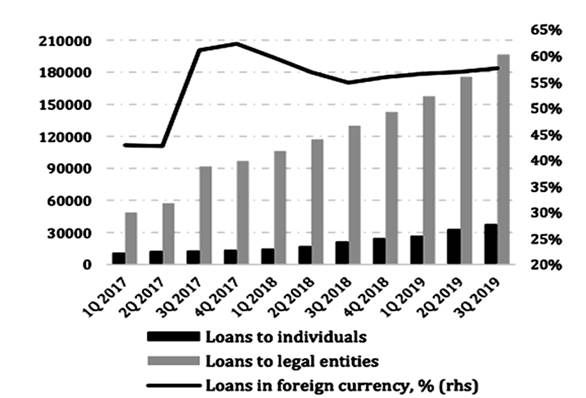

Concurrently, the NPAs in Uzbekistan have seen a steady rise since 2010. The percent of NPAs reflect the health of the banking sector as well as the economy. A higher percent of such loans shows that banks have difficulty collecting interest and principal on their credits. This will result to fewer profits for the banks in Uzbekistan. The rise in NPAs can be combated through reforms in restructuring loans via insolvency laws and protection to lenders as well as borrowers (Figure 4).

Figure 4. Loans dynamics and structure, USZ bn

Source: RAEX-Europe calculations based on data from CBU.Uzbekistan Economic Development

Till the COVID-19 pandemic set in, the economy of Uzbekistan in 2018 continued its sustainable growth and the government maintained macroeconomic and financial stability. The government initiated and continued a number of critical reforms, which, in general, resulted in some improvement of the business environment. The government’s economic policy became more transparent, and Uzbekistan was appreciative of assistance from the international expert community. However, the reform strategy remains not entirely formulated (Figure 5).

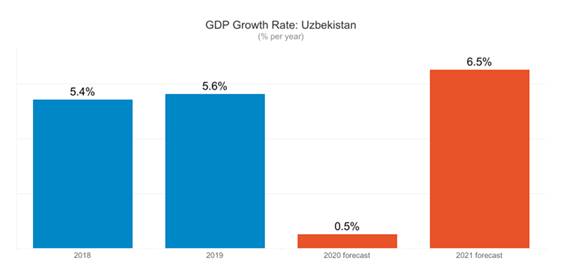

Figure 5. GDP growth rate: Uzbekistan, % per year

Source: Asian Development Bank. Asian Development Outlook (ADO) 2020 Update (September 2020).

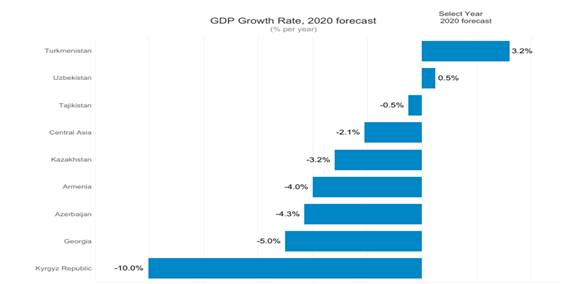

Figure 6. GDP growth rate, 2020 forecast, % per year

Source: Asian Development Bank. Asian Development Outlook (ADO) 2020 Update (September 2020).

Economic growth in Uzbekistan is projected (Figure 6) to further decelerate this year as a result of the corona virus disease (COVID-19) pandemic, weak demand, slowing industrial output, and a decline in services. [4] According to a Report of Asian Development Bank (ADB), there was forecasts Uzbekistan’s GDP growth at 0.5% in 2020, down from the 1.5% forecast in June. However, GDP is expected to rebound strongly to 6.5% in 2021.

Table 2

Foreign direct investment

|

Foreign Direct Investment

|

2017

|

2018

|

2019

|

|

FDI

Inward Flow (million USD)

|

1,797

|

625

|

2,286

|

|

FDI

Stock (million USD)

|

10,044

|

8,992

|

9,504

|

|

Number

of Greenfield Investments

|

10

|

55

|

45

|

|

Value

of Greenfield Investments (million USD)

|

1,384

|

5,177

|

4,843

|

Source: UNCTAD, latest available data.

To improve the business environment, the Government of Uzbekistan introduced in 2017 a number of legislative changes, including the cancellation of unscheduled, and seemingly arbitrary or punitive, inspections of businesses as of January 1, 2017; elimination of the requirement to convert certain percentages of hard currency export earnings at the official (artificially low) exchange rate; simplification of business registration procedures; creation of a Business Ombudsman office; and a Law on Countering Corruption that attempts to increase transparency in Government of Uzbekistan functions. By law, foreign investors are welcome in all sectors of the Uzbek economy and the government cannot discriminate against foreign investors based on nationality, place of residence, or country of origin. However, government control of key industries has discriminatory effects on foreign investors. For example, the Government of Uzbekistan retains strong control over all economic processes and maintains controlling shares of key industries, including energy, telecommunications, airlines, and mining. The government still regulates investment and capital flows in the raw cotton market and controls all silk sold in the country, dampening foreign investment in the textile and rug-weaving industries. Partial state ownership and government influence are common in many key sectors of the economy. The state still reserves the right to export some commodities, such as nonferrous metals and minerals. In theory, private enterprises may freely establish, acquire, and dispose of equity interests in private businesses, but in practice, this is difficult to do because Uzbekistan’s securities markets are still underdeveloped.

Table 3

Country comparison for the protection of investors

|

Country

Comparison For the Protection of Investors

|

Uzbekistan

|

Eastern Europe & Central Asia

|

United States

|

Germany

|

|

Index of Transaction Transparency*

|

8.0

|

7.0

|

7.4

|

5.0

|

|

Index of Manager’s Responsibility**

|

3.0

|

5.0

|

8.6

|

5.0

|

|

Index of Shareholders’ Power***

|

7.0

|

6.0

|

9.0

|

5.0

|

**The Greater the Index, the More the Manager is personally Responsible.

*** The Greater the Index, the Easier it Will Be For Shareholders to Take Legal Action.

Source: Doing Business, latest available data.

The natural strengths of Uzbekistan are vitiated by weaknesses in the policy and administrative regime governing business. [5] These weaknesses are major obstacles to accelerated FDI. Investment programs were launched in order to encourage big investments in the priority sectors. Programs include 86 foreign direct investment projects totaling 1.8 billion dollars, of which more than half is for the energy sector.

To encourage foreign investment, the Government provides tax incentives to joint stock companies for which foreign investment participation accounts for at least 15% of the authorized capital. Another key area to improve FDI with the inflow of foreign investors would be to strengthen the insolvency law and regime in the country to provide easy exit routes and safety net options that encourage foreign investors. The same was seen in the case of Indian ecosystem wherein FDI exponentially rose after the introduction of Insolvency and Bankruptcy Code (IBC) that provided for smaller stricter timelines and easy exit routes without lengthy litigation time. According to the Economic Survey 2020–2021 conducted in India, net FDI inflows of US$ 27.5 billion during April – October, 2020: 14.8% higher as compared to first seven months of FY2019-20. In comparison to pre-IBC insolvency proceedings, the code promises hope. The average time taken to close the case as highlighted in the Economic Survey has also come down drastically.

The relationship of the research work with the Republic of Uzbekistan

The mighty insolvency reform has nonetheless shown distinct positive changes in the insolvency framework in India. It facilitates reorganizing a viable but financially distressed business. After the implementation of IBC, the recovery rates under various regimes and IBC are compared and it can be distinctly seen that the IBC has all alone accounted for 42.5% of the recovery of NPAs in 2018–2019. After the implementation of IBC the creditors are making recovery at a much faster and higher rate of 44.70% and have realized maximum value of assets. The realization of the existing assets is made at 191% of the realizable value of the assets through the corporate insolvency resolution process. [6]

The exceptional progress made within 3 years in the rankings on the parameters of EoDB and Resolving Insolvency indexes is laudable and credited to the IBC. India’s overall ranking in 2016 was 130th out of 190 economies in the World Bank’s Index on the ease of doing business (EoDB) and 136th on the ease of resolving Insolvencies. [7] In 2018, India jumped to 100th position in the EoDB index and 103rd position in ease of resolving insolvency index. [8] Now as per World Bank’s EoDB Report 2020, India stands at 63rd position in the EoDB index and 52nd position in the index of ease of resolving insolvency. The World Bank also stated that now India takes 1.6 years to resolve insolvency cases. According to RBI, GNPAs declined to 9.3% in March 2019 and it was also estimated that GNPAs would go down to 8% by March 2020. [9] India received FDI worth USD 42 Billion in 2018. [10] In 2019, India was the ninth largest recipient of FDI and attracted USD 49 Billion of FDI in 2019. [11] The IBC has made India’s economic front emphatically powerful and hence, there is rise in the rate of FDI inflows because it has assured security to the foreign investors by recovering maximum value of the assets. In some fresh cases the creditors have realized 100% of their invested amount and hence have created history in India.

Though the current bankruptcy law in Uzbekistan is new as it was initially adopted in early 1990s but it has improved drastically over the last decades. The insolvency framework of Uzbekistan was upgraded significantly by redrafting the law several times and is still undergoing changes that are being introduced as a part of its economic reforms. The natural strengths of Uzbekistan are vitiated by weaknesses in the policy and administrative regime governing business. These weaknesses are major obstacles to accelerate FDI. A crucial key area to improve FDI inflows would be to strengthen the insolvency and bankruptcy laws in the country, to provide easy exit routes to the failing and unviable businesses and to provide safety net options that will enhance foreign investments by encouraging foreign investors.

The unparalleled results are evident from the Indian ecosystem wherein FDI inflows in India exponentially rose after the advent of the Insolvency and Bankruptcy Code, 2016 as it provided for smaller stricter timelines, easy exit routes without undue delays and wearisome litigation time. Uzbekistan is a country that has the potential to become one of the robust economies in the post-Soviet area and to become the largest economy in Central Asia. Amongst the ten factors that determine the ranking of Uzbekistan, “resolving insolvency” remains the only factor to not have shown any improvement or contributed to the EoDB (is at 100th position in “resolving insolvencies”) as per Doing Business Report, 2020. The rise in the rate of NPAs every year in Uzbekistan can be combated through reforms in restructuring loans via insolvency laws and protection to lenders as well as borrowers. Therefore, for developing a sound insolvency framework the insolvency and bankruptcy laws should seek rehabilitation of the corporate debtor, time bound resolution and recovery of stressed assets or liquidation. The Insolvency reform and this research work would not only benefit the Uzbekistan’s economy for the purpose of improving its EoDB ranking, but will also be a step towards future liberalization and growth.

Econometric Analysis of India Pre and Post IBC Implementation

The purpose of this research work is to empirically find out the outcomes and implications of the management of business re-engineering and re-structuring tools under the insolvency and bankruptcy reform with special reference to Economic Development of India. The research work aims to help Uzbekistan and also the Under-Developed and Developing Economies in laying a strong base of Insolvency Law on which robust edifice of a well-built economy can be made.

Null Hypothesis: H10 – THE IBC HAS NOT BEEN INSTRUMENTAL IN THE INDIAN ECONOMIC GROWTH BY NOT SHOWING ANY DECLINE IN NPAs, INCREASE IN FDI INFLOWS AND NOT IMPROVING EoDB RANKING.

Alternate Hypothesis: H11 – THE IBC HAS BEEN INSTRUMENTAL IN THE INDIAN ECONOMIC GROWTH BY SHOWING DECLINE IN NPAs, INCREASE IN FDI INFLOWS AND IMPROVING EoDB RANKING.

(1) The data of the amount of recoveries made from the insolvency cases, the rate of GNPAs of the Indian Banking Sector and the amount of FDI flows in India are compared over the years – 2012–2020 to see whether the IBC has been instrumental in creating a positive impact on the Indian economy by helping in the reduction of NPAs.

Prior to the implementation of the IBC:

Table 4

Amount recovered in the insolvency cases (under various forums) prior to the implementation of the IBC

(Amount in Crore)

|

Years

|

Total Cases

|

Amount Involved in the Cases

|

Amount Recovered

|

Recovery made (in % of the amount involved)

|

|

2012–2013

|

1,044,636

|

105,700

|

23,300

|

22

|

|

2013–2014

|

1,859,922

|

173,800

|

32,000

|

18

|

|

2014–2015

|

3,155,672

|

248,200

|

30,800

|

12

|

|

2015–2016

|

4,654,753

|

221,400

|

22,800

|

10

|

|

2016–2017

|

2,261,873

|

285,976

|

27,954

|

10

|

Table 5

Amount recovered in the insolvency cases (under NCLT) after the implementation of the IBC

(Amount in Crore)

|

Years

|

Total Cases

|

Amount Involved in the Cases

|

Amount Recovered

|

Recovery made (in % of the amount involved)

|

|

2017–2018

|

22

|

4,405

|

3,070

|

70

|

|

2018–2019

|

72

|

168,954

|

71,427

|

42

|

|

2019–2020

|

127

|

211,077.7

|

102,176.7

|

48

|

Table 6

Paired t-test of the amount recovered in the insolvency cases from 2014–2020

|

Paired Samples Statistics

|

Variables

|

IBC Amount Received

| ||

|

Pre-Test

|

Post-Test

| |||

|

Mean

|

27,184.7

|

58,891.2

| ||

|

N

|

3.0

|

3.0

| ||

|

Std. Deviation

|

4,055.1

|

50,728.6

| ||

|

Std. Error Mean

|

2,341.2

|

29,288.2

| ||

|

Paired Differences

|

Mean

|

-31,706.6

| ||

|

Std. Deviation

|

53,040.7

| |||

|

Std. Error Mean

|

30,623.1

| |||

|

95% C.I Difference

|

Lower

|

-163,466.9

| ||

|

Upper

|

100,053.8

| |||

|

T-test

|

-1.0

| |||

|

Sig. (2-tailed)

|

0.041

| |||

|

Tolerance Limit of Sig

|

<=0.05

| |||

Table 7

GNPAs in the Banking Sector at a glance

(Amount in billion)

|

Years

|

Amount

|

Rate

of GNPAs to total advances

|

|

2012–2013

|

1,941

|

3.2%

|

|

2013–2014

|

2,644

|

3.8%

|

|

2014–2015

|

3,233

|

4.3%

|

|

2015–2016

|

6,119

|

7.5%

|

|

2016–2017

|

7,918

|

9.3%

|

|

2017–2018

|

10,397

|

11.2%

|

|

2018–2019

|

9,364

|

9.1%

|

|

2019–2020

|

8,998

|

8.5%

|

Table 8

Paired t-test of the rate of NPAs from 2016–2020

|

Paired Samples Statistics

|

Variables

|

Rate of NPAs

| ||

|

Pre-Test

|

Post-Test

| |||

|

Mean

|

0.092

|

0.098

| ||

|

N

|

2.0

|

2.0

| ||

|

Std. Deviation

|

0.0

|

0.0

| ||

|

Std. Error Mean

|

0.0

|

0.0

| ||

|

Paired Differences

|

Mean

|

0.0

| ||

|

Std. Deviation

|

0.0

| |||

|

Std. Error Mean

|

0.0

| |||

|

95% C.I Difference

|

Lower

|

-0.2

| ||

|

Upper

|

0.2

| |||

|

T-test

|

-0.5

| |||

|

Sig. (2-tailed)

|

0.007

| |||

|

Tolerance Limit of Sig

|

<=0.05

| |||

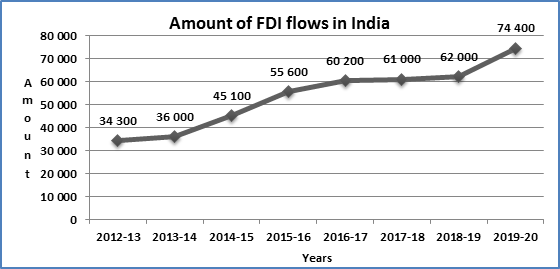

(3) The data of the amount of FDI inflows in India is taken from the RBI and is shown in Figure 7.

Figure 7. Graphical representation of the amount of FDI inflows in India (amount in US$ million)

The period used for paired sample t-test is 2016–2020 and the Table 9 is obtained.

Table 9

Paired t-test of the FDI Inflows into India from 2016–2020

|

Paired Samples Statistics

|

Variables

|

FDI Inflows

| ||

|

Pre-Test

|

Post-Test

| |||

|

Mean

|

61,110.5

|

67,682.0

| ||

|

N

|

2.0

|

2.0

| ||

|

Std. Deviation

|

1,259.4

|

9,486.5

| ||

|

Std. Error Mean

|

890.5

|

6,708.0

| ||

|

Paired Differences

|

Mean

|

-6,571.5

| ||

|

Std. Deviation

|

8,227.2

| |||

|

Std. Error Mean

|

5,817.5

| |||

|

95% C.I Difference

|

Lower

|

-80,489.8

| ||

|

Upper

|

67,346.8

| |||

|

T-test

|

-1.1

| |||

|

Sig. (2-tailed)

|

0.046

| |||

|

Tolerance Limit of Sig

|

<=0.05

| |||

The results of paired t-test show that the outcomes of the Code have been seen on analyzing the data of the Amount and Rate of Recoveries made from the insolvency cases, Rate of NPAs of the Indian banking sector and the Amount of FDI flows in India. It can be inferred conclusively through the outcome of the data analysis that the IBC has been instrumental in the Economic Development of India. Hence, the H10 – Null Hypothesis is rejected and the H11 – Alternate Hypothesis is accepted.

Table 10

Mean differences of the parameters given by the paired t-test

|

Parameters

|

Mean Difference

| |

|

FDI

|

Pre-Test

|

61,111

|

|

Post-Test

|

67,682

| |

|

Rate of NPAs

|

Pre-Test

|

0.092

|

|

Post-Test

|

0.098

| |

|

IBC Amount Received

|

Pre-Test

|

27,185

|

|

Post-Test

|

58,891

| |

Table 11

Comparison of the amount realized by 221 CIRPs yielding resolution plan and its corresponding liquidation value

(Amount in Rs. crore)

|

Years

|

Admitted

Claims of FCs

|

Amount

Realized under Resolution Plan

|

Liquidation

Value

|

Amount

realized under Resolution Plan as % of Liquidation Value

|

|

2017–2018

|

4,405

|

3,070

|

1,427

|

215 %

|

|

2018–2019

|

168,954

|

71,427

|

37,016

|

193 %

|

|

2019–2020

|

211,078

|

102,177

|

57,907

|

176 %

|

|

TOTAL

|

384,437

|

176,674

|

96,350

|

183 %

|

The analysis of the data (of 221 CIRPs yielding resolution) shows that the realization made by the FCs in the CIRPs via, resolution plan is much higher than the liquidation value. This resolution of the CIRPs is done through the tools of corporate re-engineering/re-structuring. Hence, it is conclusive that the Restructuring plans under IBC rather than Liquidation have a positive impact on the development of the Indian economy and therefore Hypothesis H2 is accepted.

In the third Section, the researcher has analyzed some important cases and this is crucial in determining the outcomes of the re-engineering and restructuring schemes under the insolvency reform on the insolvency cases, to study the impact of the Code in thwarting the epidemic of stressed assets in India, the amount realized by the creditors and in evaluating the amount recovered through the schemes in comparison to the Liquidation Value. In all the cases it is crystal clear that the value realized by the creditors through business restructuring plans under the CIRP of the IBC is approximately 200% of the liquidation value. The resolution plans under the Code have helped in maximizing the value of the stressed assets during the insolvency and bankruptcy process. The primary objective of the Code as is mentioned in its Preamble is to promote restructuring of companies over liquidation. But in practice majority of the CIRPs ended in liquidation. The main reason for liquidation is that the sick company is not fit for survival and its revival is not possible. In maximum liquidation cases it is seen that the company was sick or had stressed assets over a long period of time, hence the value of the assets got eroded. The Code tries to maximize the value of the stressed assets and not of the assets whose value is NIL. When the pressure of mounting debts becomes extremely stressful then the option of liquidation is preferred by which the assets are sold and the sale proceeds are distributed between the creditors.

Doing Business Performance

The World Bank Doing Business Report 2020 studies the time, cost and outcome of insolvency proceedings involving domestic legal entities. These variables are used to calculate the recovery rate, which is recorded as cents on the dollar recovered by secured creditors through reorganization, liquidation or debt enforcement (foreclosure or receivership) proceedings. To determine the present value of the amount recovered by creditors uses the lending rates from the International Monetary Fund, supplemented with data from central banks and the Economist Intelligence Unit. The most recent round of data collection was completed in May 2019. The ranking of economies on the ease of resolving insolvency is determined by sorting their scores for resolving insolvency. The recovery rate is calculated based on the time, cost and outcome of insolvency proceedings in each economy.Uzbekistan has the potential to become one of the strongest economies in the post-Soviet area. Uzbekistan has demonstrated stable economic development in recent years, reporting 5.6% GDP growth in 2019. The country’s leadership continues to implement large-scale economic reform policies targeted at boosting growth through modernization of state-owned monopolies and creating a supportive climate for private and foreign direct investment. During the reporting period, policy priorities were focused on improving Uzbekistan’s investment attractiveness including through adoption of a new currency regulation law to guarantee freedom of current cross-border and capital movement transactions; a new law on investment activities to guarantee foreign investors’ rights; and, a new tax code featuring lower and more equitable tax rates and simplified reporting requirements. Uzbekistan has a long entrepreneurial and trading heritage, and has the potential to become the largest economy in Central Asia. Delays in the implementation of previously announced liberalization reforms may result in a low inflow of private investments, which, combined with declining household incomes and a drop in the living standards that usually accompanies liberalization reforms, may undermine the success of the government’s economic policies. [12]

According to the Law on Bankruptcy and the Labor Code, an enterprise may claim exemption from paying property and land taxes, as well as fines and penalties for back taxes and other mandatory payments, for the entire period of the liquidation proceedings. Monetary judgments are usually made in local currency. Bankruptcy itself is not criminalized, but in August 2013, the GOU introduced new legislation on false bankruptcy, non-disclosure of bankruptcy, and premeditated bankruptcy cases.

Out of the ten factors that determine the ranking, resolving insolvency remains the only factor in Uzbekistan to not have shown any improvement or contributed to the ease in doing business in Uzbekistan.

Contrast with India, where after the introduction of IBC the rank did not only grow but also the factor of resolving insolvency has seen a more than 20 percent growth owing to stricter timelines and one uniform exit strategy for investors and lenders.

As per Doing Business Report, Uzbekistan is at rank 100 in “resolving insolvencies”.

The score is based on various parameters w.r.t. “Ease of Doing Business” which are as follows (Table 12).

Table 12

“Ease of Doing Business” parameters for Uzbekistan

|

Economy

|

Resolving

Insolvency

Score |

Recovery

rate

(cents on the dollar) |

Time

(years) |

Cost

(% of estate) |

Outcome

(0 as piecemeal sale and 1 as going concern) |

Strength

of insolvency framework index

(0–16) |

|

Uzbekistan

|

100

|

34.4

|

2.0

|

10.0

|

0

|

8.0

|

On the other hand, India’s ranking in World Economy in resolving insolvencies is 52 and scores on different variables (parameters) are as follows (Table 13).

Table 13

“Ease of Doing Business” parameters for India

|

Economy

|

Resolving

Insolvency

Score |

Recovery

rate

(cents on the dollar) |

Time

(years) |

Cost

(% of estate) |

Outcome

(0 as piecemeal sale and 1 as going concern) |

Strength

of insolvency framework index

(0–16) |

|

India

|

52

|

71.6

|

1.6

|

9.0

|

1

|

7.5

|

The World Bank measures the perception of stakeholders in respect of ‘‘resolving insolvency’’ on two sets of indicators, namely, the strength of insolvency framework and the recovery rate. The strength of insolvency framework is a function of four indices relating to commencement of proceedings, management of firm’s assets, reorganization proceedings and creditor participation. There have been improvements in all these indices since IBC was introduced in India. The recovery rate, as per the World Bank methodology, is a function of time, cost and outcome of insolvency proceedings. The IBC envisages a resolution plan for reorganization of a CD as a going concern. This gave the impression that the CD must continue to exist, post-resolution, limiting the possibilities of resolution. Though the contours of a resolution plan are left to the imagination of the market, the amendment of August 2019 makes it explicit that a resolution plan may provide for restructuring of the CD, including by way of merger, amalgamation and demerger. The purpose of an efficient insolvency regime is to release such locked capital, in the least amount of time possible.

The Ease of Doing Business is indicative of the overall economic growth as well. The easier it is to do business, the more investors will be attracted to the country in turn improving the GDP as well as the economy of the country. Reforming the insolvency laws, especially to the model adopted in India that has proved to be effective in improving FDI and GDP, would not only benefit the economy of Uzbekistan for the purpose of improving its rank, but also overall will be a step toward future liberalization and growth.

The introduction of the new legal regime – the Insolvency and Bankruptcy Code, 2016 is a revolution in India which is passed after great deliberation and in line with various committee reports. All the laws dealing with insolvency of companies in India were debtor-in-possession regime, from SICA, RDDBFI, SARFAESI, to the RBI guided CDR, S4A, and SDR and in 2016 finally the advent of the IBC brought in Creditor-in-possession regime. The aim and objective of the reform is to merge and amend the laws relating to ‘reorganization and insolvency resolution’ of partnership firms, corporate firms, LLPs and individuals in a time bound manner for maximizing the value of assets of such persons, to promote entrepreneurship, availability of credit and balance the interests of all the stakeholders including alteration in the priority of payment of liquidation proceeds regarding government dues and to establish an Insolvency and Bankruptcy Fund, and matters connected therewith or incidental thereto. This efficient and effective legal framework for the timely resolution of insolvency and bankruptcy cases supports the development of credit market and promotes entrepreneurship in India. The Code has also helped in improving the Ease of Doing Business and facilitates more investments which have led to higher economic growth and development of India.

The NCLT and DRT are designated as the Adjudicating Authorities for corporate persons and firms and individuals, respectively, for insolvency resolution, liquidation and bankruptcy under the Code. The IBC has separated the commercial aspects of insolvency and bankruptcy from the judicial aspects. The Code has brought multiple legislations under one single umbrella with the purpose of speeding up the insolvency process. The framework of the IBC provides for dealing effectively with the burgeoning menace of stressed assets. Liquidation is proposed as an option only when the stakeholders are unable to evolve a consensus for reviving the company or when the resolution plan fails. Since its enactment the professionals, judiciary, regulators, investors and the Government have played their part for the successful operation of the corporate insolvency resolutions. These efforts by all the stakeholders have resulted in the resolution of large cases (such as Binani Cement, Bhushan Steel, Essar Steel, Electrosteels Steel and Monnet Ispat, etc). Many contentious commercial and legal issues have been settled through jurisprudence under the resolution process of the Code. The reform has significant points of departure from the formerly conventional approach to management of distressed assets.

The Code is both beneficial and recovery legislation for the creditors and the various stakeholders and makes every attempt to save the life of the distressed company. When a viable firm enters the insolvency resolution process, then every attempt is made to either reorganize or re-engineer/re-structure the CD’s business. This implies that the business of the debtor continues its operations thereafter, albeit through a separate entity (via merger, amalgamation, acquisition, etc). The motto of this insolvency reform is Resolution and Reorganization of a defaulting company because under the plan of Liquidation the creditors will recover their dues and so the company will soon be finished. Therefore, it is the duty of the CoC under the IBC to rescue the viable business and if the company is unviable then the CoC should allow its closure. If the viable companies are liquidated and the unviable ones are rescued then eventually, it will be fatal to the whole economy.

This research study will help the Governments in framing effective and efficient insolvency and bankruptcy rules and laws, policy makers in making recommendations and policies, is of interest to the research community and researchers in making further studies related with this area. The research work will help the under-developed and developing nations in understanding the importance of a sound insolvency framework, studying the impact of the business re-engineering/re-structuring tools in reviving the viable sick businesses, analyzing that the option of resolution is better than liquidation (unless it the revival of the business is not possible) with the help of Case Studies and will also help in building a strong edifice of the insolvency framework. The study will play a critical role in increasing the competitiveness of the business sector and facilitating the provision of credit in the market.

The under-developed and developing countries are economically unstable. They have higher cost of credit, struggling corporate and banking sectors, more of unproductive assets and lesser chances of recovery by creditors. Hence, effective insolvency regimes will help these nations in stabilizing their corporate and banking sectors, reallocate the assets of failing businesses in a more productive manner. The rise in NPAs in Uzbekistan can be combated through reforms in restructuring loans via insolvency laws and protection to lenders as well as borrowers. Therefore, for developing a sound insolvency framework the insolvency and bankruptcy laws should seek rehabilitation of the corporate debtor, time bound resolution and recovery of stressed assets or liquidation.

Effective insolvency regime comes into play at the end of the life cycle of a business but it has an overwhelming influence on the willingness of the banks and investors to lend money, entrepreneurs to enter market and take risks at the commencement of the life of the business. A powerful insolvency regime provides procedures for the timely restructuring or liquidation of the insolvent businesses. This research exhibits the impact made by insolvency framework on the Economic Development of India and will guide other nations in implementing a robust insolvency regime for their economic growth and development. It is only when the business turns out to be unviable then it should have access to an easy exit route. This easy exit route is provided by the Insolvency, Bankruptcy and Liquidation laws. Consequently, a virtuous and efficient insolvency and bankruptcy regime is of prime importance for the under-developed and developing nations.

The study will play a critical role in increasing the competitiveness of the business sector and facilitating the provision of credit in the market. A good insolvency reform inhibits premature liquidation of viable businesses. As a result, at the time of liquidation, the creditors are able to recover a larger part of their investment, more employees are able to keep their job and the suppliers and customers are preserved. The creditors then retain their faith in making further and more reinvestments and therefore the companies continuously get access to credit without hurdles. This historic economic reform in India has given trust to the economic system and prompted economic growth for the benefit of all the stakeholders.

Recommendations to Uzbekistan for Insolvency Bankruptcy Reform

An effective and efficient insolvency regime is an important element of financial system stability. Business needs efficient and speedy procedures for exiting with ease as much as for start-up. It therefore becomes essential for providing a sound framework for restructuring and rehabilitation of companies along with a framework for their winding up and liquidation. The framework should have the following characteristics:

· to seek to preserve estate and maximize the value of assets,

· to recognize inter se rights of creditors,

· to provide equal treatment to similar creditors,

· to enable a timely and efficient resolution of re-engineering & re-structuring and

· to establish a framework for cross border insolvency.

It should strike a balance between rehabilitation and liquidation. It should provide an opportunity for exploring restructuring/rehabilitation schemes to the potentially viable businesses with the consensus of the stakeholders. Where revival/rehabilitation is not feasible then there winding up should be resorted to. The gap in the Indian insolvency framework has been plugged to an extent by way of the effective and efficient implementation of the Insolvency and Bankruptcy Code, 2016 (IBC) and its subsequent amendments. IBC is the second most crucial reform in the legal and economic development of India after the introduction of a uniform taxation system called Goods and Service Tax (GST). The Code is not only making India emphatically powerful in the field of the legal and managerial environment but has also provided a new identification and recognition at the global platform economically through enhancement of the FDI inflows in the nation, increased recovery rate of the stressed assets, decreased number of NPAs, increased M&A deals and improved India’s ease of doing business ranking, etc.

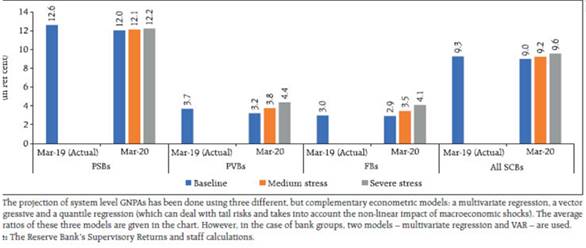

The rate of NPAs in Uzbekistan has seen a steady rise since 2010. Every year there is a higher percentage of such loans which show that the banks have difficulty in collecting principal and interest on their credits and this has resulted in fewer profits for the banks in Uzbekistan.

Figure 8. Loans dynamics and structure, UZS bn

Source: RAEX-Europe calculations based on data from CBU.

Figure 8 makes it clear that there is rise in the rate of NPAs every year in Uzbekistan. This rise in NPAs can be combated through reforms in restructuring loans via insolvency laws and protection to lenders as well as borrowers. Therefore, for developing a sound insolvency framework the insolvency and bankruptcy laws should seek rehabilitation of the corporate debtor, time bound resolution and recovery of stressed assets or liquidation.

Conclusion

The insolvency law should provide mechanisms for the debtors to meet rehabilitation, liquidation and insolvency costs. The viable businesses should be rehabilitated and provided a fair opportunity for the purpose. This may require creditors and all the stakeholders to make sacrifices. This would be the best effort in the interest of avoiding business failure and consequent business distress, wherever possible. Besides this under the insolvency framework, rehabilitation effort should be taken up in consultation with the creditors in a manner that is not open ended. Internationally, the banks have actively participated and have facilitated business revival and rehabilitation. It is time that a comprehensive and a balanced insolvency framework will be adopted in Uzbekistan as well.

A comprehensive framework dealing with the cross-border insolvency is being prepared to deal effectively with the issue of cross-border insolvency/liquidation. There are a large number of companies which have assets and creditors situated all over the world and parallel the foreign companies have their subsidiaries in India. The matters of insolvency/liquidation of Indian companies with the assets located all in jurisdictions outside India cannot be achieved without having the model like adoption of the UNCITRAL Model Law on Cross Border Insolvency. The Code recognizes cross border issues but it doesn’t contain provisions to specifically deal with them.

[1] https://pib.gov.in/newsite/PrintRelease.aspx?relid=190704

[2] https://m.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=931#C2C22A

[3] https://www.rbi.org.in/Scripts/BS_PressReleaseDisplay.aspx?prid=48982

[4] https://www.adb.org/what-we-do/economic-forecasts/september-2020

[5] https://unctad.org/system/files/official-document/poiteiipm13.en.pdf

[6] IBBI Quarterly Newsletters, April – June 2020, Vol. 15.

[7] World Bank Flagship Report, “Doing Business 2016 – Measuring Regulatory Quality and Efficiency”, 13th Ed.

[8]World Bank Flagship Report, “Doing Business 2018 Reforming to Create Jobs – Comparing Business Regulation for Domestic Firms in 190 Economies”, 15th Ed.

[9] Reserve Bank of India, Financial Stability Report, Various issues.

[10] UNCTAD, “World Investment Report 2018: Investments and New Industrial Policies” (2018)/

[11] UNCTAD, “World Investment Report 2019: Special Economic Zones”/

[12] https://www.state.gov/reports/2018-investment-climate-statements/uzbekistan/

Источники:

2. Ministry of Corporate Affairs. [Электронный ресурс]. URL: http://www.mca.gov.in/MinistryV2/restructuring+and+liquidation.html.

3. Investment Policy Review of Uzbekistan, United Nations Conference on Trade and Development, accessed at UNCTAD/ITE/IIP/MISC.13

4. Insolvency Reforms in Asia: An Assessment of the Implementation Process and the Role of Judiciary, Forum for Asian Insolvency Reform. Oecd.org. [Электронный ресурс]. URL: https://www.oecd.org/corporate/ca/corporategovernanceprinciples/1873992.pdf.

5. World Bank 2020. Doing Business Report. [Электронный ресурс]. URL: https://www.doingbusiness.org/en/data/exploreeconomies/uzbekistan#DB_ri.

6. Country Context Paper. World Bank. [Электронный ресурс]. URL: https://www.worldbank.org/en/country/uzbekistan/overview#context.

7. Law Of The Republic Of Uzbekistan. CIS Legislation database. [Электронный ресурс]. URL: https://cis-legislation.com/document.fwx?rgn=1041.

8. Uzbekistan Industry Research– Banks, RB Asia Report. Raexpert.eu. [Электронный ресурс]. URL: https://raexpert.eu/files/Industry_report_Uzbekistan_Banks_01.04.2020.pdf.

9. Statistics from Central Bank of the Republic of Uzbekistan. Cbu.uz. [Электронный ресурс]. URL: https://cbu.uz/en/statistics/bankstats/469830.

10. Data on Uzbekistan: Non-performing loans as percent of all bank loans 2010 – 2019. Theglobaleconomy.com. [Электронный ресурс]. URL: https://www.theglobaleconomy.com/Uzbekistan/nonperforming_loans.

11. Financial Development Policies in Uzbekistan. Hse.ru. [Электронный ресурс]. URL: https://www.hse.ru/data/368/111/1235/Akimov_Financial%20development%20policies%20in%20Uzbekistan_EACES.pdf.

12. Uzbekistan Economic Growth in 2020 to Slow Further, Rebound in 2021. Asian Development Bank. [Электронный ресурс]. URL: https://www.adb.org/news/uzbekistan-economic-growth-2020-slow-further-rebound-2021.

13. Guide to doing business and investing in Uzbekistan. Pwc. [Электронный ресурс]. URL: https://www.pwc.com/uz/en/assets/pdf/dbg_2016.pdf.

14. 2020 Investment Climate Statements: Uzbekistan. U.S. Embassy in Uzbekistan. [Электронный ресурс]. URL: https://uz.usembassy.gov/2020-investment-climate-statements-uzbekistan.

15. Foreign direct investment (FDI) in Uzbekistan. Nordea Trade. [Электронный ресурс]. URL: https://www.nordeatrade.com/en/explore-new-market/uzbekistan/investment.

16. COVID-19: Uzbekistan Government Financial Assistance Measures. White and Case LLP. [Электронный ресурс]. URL: https://www.whitecase.com/publications/alert/covid-19-uzbekistan-government-financial-assistance-measures.

17. Legal Framework for Insolvencies in Uzbekistan, Nodir Yuldashev and Malika Khushmatova. Emerging Markets Restructuring Journa. [Электронный ресурс]. URL: https://www.clearygottlieb.com/-/media/files/emrj-materials/issue-10-winter-2019_2020/legal-framework-for-insolvencies-in-azbekistan-pdf.pdf.

18. Commentary Bankruptcy Law of the Republic of Uzbekistan, Project on the Commentary on the Bankruptcy Law of the Republic of Uzbekistan, Supreme Economic Court the Republic of Uzbekistan. Jica.go.jp. [Электронный ресурс]. URL: https://www.jica.go.jp/uzbekistan/english/office/others/c8h0vm0000bm5e96-att/legal_01.pdf.

Страница обновлена: 14.01.2026 в 22:50:08

Download PDF | Downloads: 188

Lessons from India on insolvency and bankruptcy reforms for Uzbekistan

Binoy J.K., Islamov B.A.Journal paper

Journal of Central Asia Economy

Volume 5, Number 3 (July-september 2021)

Abstract:

The Insolvency and Bankruptcy Code (IBC) is considered as the major structural legal reform in the world. It is making a robust economy by reducing the amount of non-performing assets and improving Ease of Doing Business (EoDB) ranking. It has attracted investors from abroad because now they seek each developing nation as a legible place for investment owing to the reasons as, smaller timeframe for resolution reduces risk of losing investment and flexible exit policy, even when company becomes insolvent the IBC gears towards maximum realisation of value of assets. It has given a new identity to the developing economy on the International platform. It seeks to create a single unified law for insolvency and bankruptcy. This research empirically studies IBC as an important tool in the growth of the developing economy and analyses the impact of re-engineering or restructuring under IBC on the Central Asian economy.

Keywords: Uzbekistan, Asia, Central Asia, South Asia, non-performing assets, distressed assets, creditors, insolvency, reforms, FDI, restructuring, global, doing business

References:

2020 Investment Climate Statements: UzbekistanU.S. Embassy in Uzbekistan. Retrieved from https://uz.usembassy.gov/2020-investment-climate-statements-uzbekistan

COVID-19: Uzbekistan Government Financial Assistance MeasuresWhite and Case LLP. Retrieved from https://www.whitecase.com/publications/alert/covid-19-uzbekistan-government-financial-assistance-measures

Commentary Bankruptcy Law of the Republic of Uzbekistan, Project on the Commentary on the Bankruptcy Law of the Republic of Uzbekistan, Supreme Economic Court the Republic of UzbekistanJica.go.jp. Retrieved from https://www.jica.go.jp/uzbekistan/english/office/others/c8h0vm0000bm5e96-att/legal_01.pdf

Country Context PaperWorld Bank. Retrieved from https://www.worldbank.org/en/country/uzbekistan/overview#context

Data on Uzbekistan: Non-performing loans as percent of all bank loans 2010 – 2019Theglobaleconomy.com. Retrieved from https://www.theglobaleconomy.com/Uzbekistan/nonperforming_loans

Financial Development Policies in UzbekistanHse.ru. Retrieved from https://www.hse.ru/data/368/111/1235/Akimov_Financial%20development%20policies%20in%20Uzbekistan_EACES.pdf

Foreign direct investment (FDI) in UzbekistanNordea Trade. Retrieved from https://www.nordeatrade.com/en/explore-new-market/uzbekistan/investment

Guide to doing business and investing in UzbekistanPwc. Retrieved from https://www.pwc.com/uz/en/assets/pdf/dbg_2016.pdf

Insolvency Reforms in Asia: An Assessment of the Implementation Process and the Role of Judiciary, Forum for Asian Insolvency ReformOecd.org. Retrieved from https://www.oecd.org/corporate/ca/corporategovernanceprinciples/1873992.pdf

Law Of The Republic Of UzbekistanCIS Legislation database. Retrieved from https://cis-legislation.com/document.fwx?rgn=1041

Legal Framework for Insolvencies in Uzbekistan, Nodir Yuldashev and Malika KhushmatovaEmerging Markets Restructuring Journa. Retrieved from https://www.clearygottlieb.com/-/media/files/emrj-materials/issue-10-winter-2019_2020/legal-framework-for-insolvencies-in-azbekistan-pdf.pdf

Ministry of Corporate Affairs. Retrieved from http://www.mca.gov.in/MinistryV2/restructuring+and+liquidation.html

Reserve Bank of India. Retrieved from https://m.rbi.org.in/Scripts/PublicationReportDetails.aspx?UrlPage=&ID=931#C2C22A

Statistics from Central Bank of the Republic of UzbekistanCbu.uz. Retrieved from https://cbu.uz/en/statistics/bankstats/469830

Uzbekistan Economic Growth in 2020 to Slow Further, Rebound in 2021Asian Development Bank. Retrieved from https://www.adb.org/news/uzbekistan-economic-growth-2020-slow-further-rebound-2021

Uzbekistan Industry Research– Banks, RB Asia ReportRaexpert.eu. Retrieved from https://raexpert.eu/files/Industry_report_Uzbekistan_Banks_01.04.2020.pdf

World Bank 2020Doing Business Report. Retrieved from https://www.doingbusiness.org/en/data/exploreeconomies/uzbekistan#DB_ri