Contemporary trends in investment financing in the Russian Federation

Pogosyan E.A.1![]()

1 Financial University under the Government of the Russian Federation, ,

Скачать PDF | Загрузок: 30

Статья в журнале

Экономика, предпринимательство и право (РИНЦ, ВАК)

опубликовать статью | оформить подписку

Том 14, Номер 10 (Октябрь 2024)

Эта статья проиндексирована РИНЦ, см. https://elibrary.ru/item.asp?id=75096499

Аннотация:

The study covers current trends and challenges in the investment financing market, including sources of capital such as public and private investments, and foreign direct investments. The research presents a fresh analysis of how economic instability and international sanctions have altered investment financing trends in Russia. It highlights the changing strategies of the public and private sectors in attracting and deploying capital. The research also addresses the broader issue of how international sanctions affect foreign direct investment and internal capital flows, which is a key problem for maintaining a sustainable investment climate in Russia. Emphasis is placed on the trends and challenges faced by small and medium-sized enterprises in selecting external financing sources, especially loan capital. The study analyzes the accessibility of credit in the financial market for small and medium-sized enterprises, interest rates, and the specific requirements of creditors, and offers recommendations for improving the enterprises’ access to loan resources. The problem being addressed is the systemic difficulty that small and medium-sized enterprises face in securing affordable external financing, especially under conditions of market volatility and restrictive credit environments. Scholars and professionals studying international finance, investment trends, and economic sanctions will find this research relevant, particularly given its emphasis on market adaptability and capital accessibility.

Ключевые слова: investment financing, foreign direct investments, small and medium-sized enterprises, credit markets, financial markets

JEL-классификация: G10, G30, L26

Introduction

The topic of investment financing in the Russian Federation remains highly relevant due to ongoing economic instability, persistent sanctions, and significant fluctuations in foreign direct investment. These factors impact the broader economy and the ability of both small and medium-sized enterprises (SMEs) and larger corporations to secure necessary capital for development. Given Russia’s position as a resource-rich country, analyzing the trends and challenges in attracting both domestic and foreign investment is critical for economic growth and stability. Additionally, the role of government programs and the accessibility of credit for SMEs are vital for understanding how smaller businesses, which play an essential role in the economy, can survive and thrive under current conditions.

Numerous studies have examined various aspects of the investment climate in Russia. Gorbatko and Zhadnov [1, pp. 189–191] (Gorbatko, Zhadnov, 2023, pp. 189–191) analyze the impact of sanctions on Russia’s investment policies, particularly focusing on challenges for foreign investors. Their work provides a foundation for the analysis of how geopolitical factors have led to a significant decline in foreign direct investment (FDI), framing the broader discussion on Russia's investment climate.

Prokhorova [2, pp. 46–50] (Prokhorova 2023, pp. 46–50) discusses the role of FDI in Russia’s economic development, highlighting how sanctions and economic instability have influenced investment trends. This source was essential in showing how the volatility of FDI has affected the country’s growth prospects, forming a key part of the research’s argument about the fragility of the Russian economy.

Kudryashov [4] (Kudryashov, 2023) emphasizes the importance of attracting foreign investments, especially in critical sectors like finance. His analysis provides critical insight into how the financial system has been reshaped by sanctions, which supports the study’s focus on strategic adjustments needed to maintain investment levels in key sectors such as oil and gas.

A significant focus in the literature has also been placed on the impact of sanctions and geopolitical events. Melikhova and Sigarev [5, pp. 14–20] (Melikhova, Sigarev, 2023, pp. 14–20) analyze both domestic and international approaches to improving investment attractiveness. Their work was crucial in formulating recommendations on enhancing Russia's appeal to foreign investors, suggesting regulatory reforms and incentives that could mitigate the negative effects of sanctions on investment. Antonova, Barinova, Gromov, and Zemtsov [6, p. 88] (Antonova, Barinova, Gromov, Zemtsov, 2020, p. 88) examine the development of small and medium-sized enterprises in Russia, with a particular focus on financing challenges. Their findings underscore the difficulties SMEs face in accessing credit due to restrictive lending conditions, which directly supports the research’s analysis of SME financing barriers in the current market.

Stepanenkova, Bychkov, and Burtseva [7, pp. 58–66] (Stepanenkova, Bychkov, Burtseva, 2023, pp. 58–66) provide an analysis of SME credit activity in Russia during 2023. Their work highlights systemic barriers such as high interest rates and inadequate government support, reinforcing the study’s discussion on the challenges SMEs encounter when trying to secure financing in a volatile economic environment.

Sagina [8, pp. 34–41] (Sagina, 2024, pp. 34–41) explores the financial and legal mechanisms for government support of SMEs. This resource was key in analyzing policy measures aimed at improving access to financing for small businesses, offering concrete solutions to the systemic issues highlighted throughout the research.

Gaifullina and Girfanova [9, pp. 151–153] (Gayfullina, Girfanova, 2019, pp. 151–153) assess the quality of banking products available to SMEs, focusing on the accessibility of financial services. Their work was used to reinforce the study’s critique of the lack of tailored financial products for SMEs, which limits their ability to secure necessary funding.

Kaisin [10, pp. 22–25] (Kaysin, 2023, pp. 22–25) investigates the specific challenges faced by SMEs in Russia's regions, especially under sanctions. His regional perspective was vital for understanding how geopolitical factors exacerbate financing difficulties for SMEs outside of major financial hubs, providing a more nuanced view of SME challenges.

Korobeynikov [11, pp. 79–88] (Korobeynikov D.A., 2020, pp. 79–88) discusses the role of credit guarantees in SME financing, which helps reduce the risks associated with lending to small businesses. This resource contributed to the study’s exploration of potential solutions to the credit access problems SMEs face, particularly in terms of risk mitigation strategies.

Yakupova, Teterin, Korshunov, and Saraev [12] (Yakupova, Teterin, Korshunov, Saraev, 2023) analyze the dynamics of SME lending in 2022–2023. Their insights on the significant growth in SME lending, despite economic volatility, helped frame the discussion on how government programs and concessional loans have played a role in sustaining SME financial activity.

Reshetnikov [13] (Reshetnikov, 2024) provides a forecast of Russia’s socio-economic development, with projections on investment trends and government support for SMEs. His work was used to illustrate potential future developments in Russia’s investment landscape, emphasizing the need for continued government intervention to support small businesses.

Bogomazova and Egorkin [14] (Bogomazova, Egorkin, 2023) examine how sanctions have impacted SMEs, particularly their ability to adapt to changing economic conditions. This study complements the broader analysis of how SMEs have managed to survive and grow, despite external pressures such as sanctions.

The purpose of the research is to analyze contemporary trends in investment financing in Russia with a specific focus on the trends in foreign direct investments and external financing for small and medium-sized enterprises. The study provides new insights into the interplay between geopolitical factors, sanctions, and the accessibility of investment capital for SMEs.

The methodology for the research includes both qualitative and quantitative approaches. Statistical analysis of data on foreign direct investment flows and SME lending in Russia is combined with a literature review of peer-reviewed sources to assess trends in investment financing. Additionally, the research includes case studies of specific sectors, such as the oil and gas industry, as well as SME case studies, to provide real-world examples of how credit policies affect businesses.

Current affairs and challenges in the investment financing market in Russian Federation

At present, the stability of the Russian economy remains uncertain, marked by a decade-long series of economic crises characterized by the persistent devaluation of the ruble, slow economic growth, decrease in oil prices, and substantial reduction in foreign investments [1] (Gorbatko, Zhadnov, 2023). Investment activity is an essential driver for the country's economic development. Therefore, the primary focus is attracting investments due to their crucial role in stimulating growth, establishing an advantageous financial climate, and acting as an additional source of capital for domestic production of goods, services, and infrastructure [2] (Prokhorova, 2023).Foreign investment is the process of non-domestic investors independently investing their cash directly into entrepreneurial projects inside one country, for instance, Russia. These investments include civil rights assets held by foreign investors, as long as they comply with federal rules and regulations. These assets may consist of monetary funds, securities, and other assets inside the Russian Federation.

The economic rationale for attracting foreign investment depends on the integration of novel technology, production techniques, and business models into the home economy, resulting in considerably greater economic advantages in comparison to relying solely on domestic entrepreneurship. The investment climate in Russia has evolved throughout time, shaped by major events in social, political, economic, and other sectors.

Russia's vast geography and diverse industries provide potential for diversifying investments, notwithstanding its economic challenges. Specific areas have significant investment potential as a result of the growth and diversification of many businesses. Additionally, the presence of abundant natural resources, notably in the oil and gas industry, further strengthens the attraction for investment [1] (Gorbatko, Zhadnov, 2023). Furthermore, a robust transportation infrastructure contributes to the reduction of transportation expenses, hence facilitating the inflow of foreign investment. Russia has a highly qualified workforce and engages in research and development collaborations with numerous foreign countries, which drives innovation and technical progress.

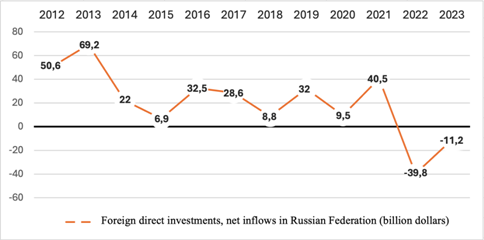

Figure 1. Dynamics of foreign direct investments in Russia, billions of USD

Source: compiled by the author in accordance with [3].

Based on the statistics provided by the Bank of Russia (Figure 1), foreign direct investment experienced a fourfold increase in 2021 compared to 2020, reaching a total of $40.45 billion. Of the whole amount, $37.6 billion represented foreign investments in Russian economic projects. Nevertheless, in the year 2022, there was a substantial decrease in direct investment from the Russian Federation, totaling -39.8 billion US dollars. The sudden decrease was attributed to the geopolitical tensions that arose in February 2022. In 2023, while there was a rise in direct investment in the country, the amount remained in the negative at -11.2 billion US dollars. In recent years, there have been significant fluctuations in the dynamics of foreign direct investment in Russia, transitioning from a period of growth to a period of decline. Furthermore, a negative balance signifies an overall rise in the foreign assets owned by residents and/or a decline in their international debts due to transactions. Conversely, a positive balance shows a drop in residents' foreign assets and/or an increase in their foreign liabilities.

In 2015, foreign investors contributed a total of $6.9 billion to the Russian economy, which was the third lowest amount of investments during that year. This decrease in investment may be attributed to the global crisis and the economic sanctions imposed on Russia. In 2013, foreign investments reached their highest point, totaling $69.2 billion [3]. The Bank of Russia obtains statistics on direct investment in the Russian Federation by economic sector as part of its yearly compilation of the balance of payments. Between 2017 and 2023, certain sectors constantly attracted foreign investment, with the wholesale and retail trade, as well as the mining and processing industries, maintaining consistently high levels during the entire period. Foreign investors showed significant interest in financial and insurance businesses in 2021. In contrast, sectors such as water collection and treatment, culture and entertainment, health and social services, hotels and restaurants, scientific research, and forestry experienced limited foreign investment, suggesting a lack of investor enthusiasm and a lack of attractive projects in these industries. The reduction in foreign investment in Russian agriculture is particularly noticeable. As a result, foreign investment is attracted to areas that provide the highest profits and the lowest chances of losing money, particularly in extractive industries that deal with raw materials [4] (Kudryashov, 2023). Nevertheless, this results in Russia's technical deficit compared to more developed countries, emphasizing the need to strengthen domestic science and attract investors.

Prior to the implementation of increased sanctions, significant investments in the Russian economy were undertaken by nations like China, Germany, the United States, Italy, and Japan. Presently, most of these countries have either ceased investing or reduced their investment levels in the Russian economy. The declining proportion of foreign investment is a notable obstacle, resulting in a lack of progress in industrial growth and worsening the overall economic condition in Russia.

In order to solve this problem, Russia should analyze the experiences of other countries to identify the areas that need improvement in order to make its economy more appealing to international investors [5] (Melikhova, Sigarev, 2023). One of the most important actions is the implementation of a system of rewards for international investors and the clear definition of property limits between economic organizations. Political and economic stability are crucial for attracting investors, requiring shifts to stabilize economic and foreign trade regulations and simplify the tax structure for simplicity.

Problems of selecting an external financing source (loan capital) for SME in Russian Federation

In the first half of 2015, there was a challenge with banks interacting with small and medium-sized firms because of the anti-Russian sanctions imposed on the import of products from European Union nations into Russia. As a result, Russia's import substitution program became crucial again. Small and medium-sized firms were chosen as the most appropriate candidates for this function due to their specialized production and ability to quickly adapt to market demands. Nevertheless, financing challenges for their operational activities, along with unfavourable conditions regarding interest rates and lending during 2015–2016, prevented SMEs from achieving desired outcomes in implementing the import substitution program [6] (Antonova, Barinova, Gromov, Zemtsov, 2020). The banks' actions to tighten borrower selection criteria could be attributed to the fact that the percentage of overdue debt from small and medium-sized enterprises grew by 0.63 percentage points in 2014, reaching 7.71% of the overall portfolio volume. By the end of 2015, this ratio had increased to 15%.The challenges associated with financing for small and medium-sized firms arise from the need of having liquid collateral, while also facing a greater risk of bankruptcy compared to larger corporations. During the period of 2015–2016, small and medium-sized enterprises faced a challenging scenario. The combination of higher bank interest rates and stricter borrower criteria made it difficult for most SMEs to get loans via conventional lending methods.

Another problem with current models regarding the way banks interact with the real economy sector is that bank loans are considered as relatively costly sources of funding for small and medium-sized enterprises, compared to other options such as borrowing from family and friends, receiving financial assistance from local authorities, attracting investments or assets from new partners, and other options. Currently, the risk of borrowers' failure to meet loan obligations remains relevant for banks, including late payments, defaults, and improperly documented submissions from SMEs [7] (Stepanenkova, Bychkov, Burtseva, 2023).

A significant mechanism for stimulating SME lending by the Central Bank of Russia is subsidizing a part of the loan interest rate [8] (Sagina, 2024). The government places a deposit in a bank under the condition that these funds will be used to lend to SMEs. The interest rate on the deposit covers a portion of the interest rate on the loan. Thus, the bank avoids risking its own or borrowed funds and gains an additional source of cheap resources until an SME requests a loan, after which these resources become free.

One of the most pressing issues for SMEs is the insufficiency of financial resources to conduct their economic activities. One way to attract additional funds is through bank lending.

Data from the Bank of Russia, rating agencies, and commercial banks allow for identifying different, often opposing factors limiting the development of SME lending in Russia by banks and business entities. The most frequently mentioned factors limiting development are presented in Table 1.

Table 1

Factors restricting the development of small and medium-sized enterprise lending in Russia

|

Creditor's

perspective

|

Borrower's

perspective

|

|

Lack

of transparency from small and medium-sized businesses, reluctance to provide

all necessary documents hindering the assessment of the creditworthiness and

solvency of potential borrowers

|

The

possibility of obtaining credit to start a business is practically impossible

as banks consider SME borrowers with skepticism

|

|

Inadequate

statistics on small and medium-sized businesses to make a quality assessment

of borrowers' creditworthiness and their development prospects

|

The

loan terms are insufficient to achieve full economic benefits from the use of

the funds acquired

|

|

High

operational costs associated with the need to monitor and evaluate each

individual loan

|

Inadequate

government support

|

|

Many

banks lack efficient risk assessment technologies for lending to small and

medium-sized enterprises

|

A

large number of documents are required, and their preparation takes a

considerable amount of time

|

|

Insufficient

human resources capacity in most Russian banks

|

A long waiting period for application review

|

.

The components listed in Table 1 are highly related. For example, the absence of transparency in small and medium-sized businesses, absence of assets for security, and expensive operating expenses for evaluation result in increased interest rates, longer processing times for loan applications, and more strict document requirements [10] (Kaysin, 2023). On the other hand, due to a lack of sufficiently trained bank staff and inadequate statistical information on small businesses in Russia, banks are unable to provide well-structured, transparent, and easily comprehensible terms for collaborating with small and medium-sized enterprises. As a result, many entrepreneurs choose to take out personal consumer loans for business growth instead [9] (Gayfullina, Girfanova, 2019).

The primary factors influencing the growth of loans to small and medium-sized enterprises in 2023–2024 will be the dynamics within this economic sector, the policies implemented by the Bank of Russia, and foreign geopolitical factors. The market experiences a decrease in investment activity due to economic uncertainty, which creates a negative pressure. Potential factors that can positively impact small business lending include government initiatives aimed at supporting small and medium-sized enterprises, measures to stabilize and reduce inflationary expectations, the implementation of the Bank of Russia's targeted financing mechanism for medium- and long-term loans to small and medium-sized businesses, and the establishment of a national guarantee system. The national guarantee system will provide standardized regulations and standards for the operation of guarantee organizations, and enhance the efficiency of existing capital, thereby alleviating the problem of access to long-term credit and allowing for more loans to be guaranteed by guarantee organizations [11] (Korobeynikov, 2020). Expanding the guarantee mechanism to all sectors of small and medium-sized business activity is essential for achieving this goal.

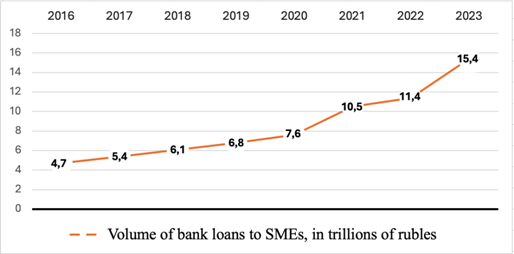

In this regard, the Central Bank of Russia has taken several effective measures aimed at improving the mechanism of lending to small and medium-sized businesses. Thanks to these measures, there has been an increase in lending volumes in the segment of small and medium-sized businesses. The volume of lending in this segment is depicted in Figure 2.

Figure 2. Dynamics of bank loans to SMEs in Russian Federation, trillions of RUB

Source: composed by the author based on [12] (Yakupova, Teterin, Korshunov, Saraev, 2023).

As depicted in Figure 2, the year 2023 proved to be highly dynamic and successful for the SME lending segment. Credit issuance continued to grow throughout the year, despite several rounds of key rate hikes. Partly, this can be explained by the attempt of small businesses to secure loans before the rate rose to a high level, expecting this cycle to continue into 2024. However, this alone does not fully explain the trend: demand for loans remained high even at elevated rates, and concessional loans and support programs became a crucial element in sustaining credit activity.

Throughout 2023, according to the Bank of Russia, SMEs received over 15 trillion rubles, which is a 35% increase compared to the same period in 2022. Such growth is driven by a combination of positive factors on both the demand and supply sides. The SME sector itself became markedly more active, demonstrating a significant and qualified, responsible demand for borrowed resources. In turn, banks finally learned to replicate previously scarce successful lending practices and client risk management within this sector.

It is worth noting that the Russian Small Business Index (RSBI) reached a historical peak (57.1) in June 2023, indicating that small business activity had reached an all-time high. This was influenced by sales, which were the highest in the last two years due to improved sales and positive market expectations. Demand in consumer segments is supported by rising household incomes, thanks to increased government spending, especially in sectors related to the military-industrial complex [13] (Reshetnikov, 2024). Demand for small business products and services from both the government and large corporations has also increased – again, a derivative of increased government spending. Roughly speaking, a significant share of the massive flow of budget spending and large orders also went to the SME segment, and quite a lot of it.

Moreover, small enterprises were able to occupy vacated niches after leaving of foreign companies and integrate into new import logistics chains. Flexibility and adaptability over these past two years have indeed helped SMEs not only survive but also develop in changing conditions [14] (Bogomazova, Egorkin, 2023). Consequently, there has been a substantial increase in demand for financing, both working capital and investment. The rejection rate for loan applications stands at 27% – the lowest in the past three years.

The positive impact of government support programs on SME financing growth should also be noted. In the first half of 2023, small and medium-sized businesses, using guarantees from the National Guarantee System (NGS), which includes the SME Corporation with SME Bank and regional guarantee organizations (RGOs), attracted 527 billion rubles in credit funds (a 74.6% increase compared to the previous year). Only through the RGOs, SMEs received 215 billion rubles, of which 34 billion were under the guarantee of the Moscow Guarantee Fund.

In addition, it is necessary to examine the structural changes that have occurred in the portfolio. For the second year in a row, among SMEs, enterprises engaged in professional, scientific, and technical activities, real estate operations, and construction have been leading. In other words, the top now includes neither trade nor services, which would seem to be ahead. Moreover, the share of these three segments in the total loan portfolio is growing and already exceeds 53%. The dynamics in the professional, scientific, and technical activities sector are partly due to strong demand in several high-tech directions and productions associated with military orders; as for the construction sector and real estate, there has been a real boom here for many years. However, there is a nuance: formally, behind the figures for these industries, small businesses are hidden, but in reality, they belong to holdings and groups. The Central Bank also notes this, proposing to change the criteria for classifying companies as SMEs to avoid errors in statistics and to ensure that genuinely small enterprises are the recipients of preferential programs [15].

It is also worth noting the leading banks lending to small and medium-sized businesses. In 2023, mainly positive trends were observed among the leading banks financing small and medium-sized businesses (Table 2).

Table 2

Ranking of banks by size of loans granted to SMEs

|

№

|

Bank

name

|

SME loan portfolio

|

Growth

rate of SME loan portfolio for 2023/2022, %

| |

|

as of 01.01.2024, million

RUB

|

as of 01.01.2023, million

RUB

| |||

|

1

|

PJSC Sberbank

|

5,471,012

|

4,303,693

|

27.1

|

|

2

|

JSC ALFA BANK

|

587,964

|

353,800

|

66.2

|

|

3

|

JSC Rosselkhozbank

|

386,873

|

313,330

|

23.5

|

|

4

|

PJSC Promsvyazbank

|

384,304

|

267,331

|

43.8

|

|

5

|

JSC Bank DOM.RF

|

102,109

|

65,188

|

56.6

|

|

6

|

JSC

MSP Bank

|

73,525

|

53,681

|

37.0

|

|

7

|

PJSC TKB BANK

|

62,175

|

44,888

|

38.5

|

|

8

|

CB Kuban Credit LLC

|

49,910

|

44,629

|

11.8

|

|

9

|

PJSC CB

Center-Invest

|

34,978

|

31,827

|

9.9

|

|

10

|

PJSC SKB Primorye

Primsotsbank

|

34,705

|

32,288

|

7.5

|

|

11

|

PJSC AKB

Metallinvestbank

|

33,199

|

25,792

|

28.7

|

|

12

|

PJSC BANK URALSIB

|

26,456

|

23,110

|

14.5

|

|

13

|

Bank Levoberezhny

(PJSC)

|

24,992

|

20,386

|

22.6

|

|

14

|

PJSC Bank ZENIT

|

22,816

|

22,126

|

3.1

|

|

15

|

Asia-Pacific Bank

(JSC)

|

20,384

|

19,294

|

5.6

|

Based on Table 2, it is evident that PJSC Sberbank granted the largest amounts of loans to SMEs in both 2022 and 2023, amounting to 4.3 billion rubles and nearly 5.5 billion rubles, respectively. These amounts significantly surpass those of Sberbank's competitors. Nevertheless, the growth rate of the SME loan portfolio increased across all banks in 2023, indicating a more flexible approach by banks in providing loans to small and medium-sized enterprises.

Conclusion

To conclusion, the instability of the Russian economy due to series of crises, geopolitical climate and sanctions has affected the investment financing market. Regarding the foreign direct investments in the country, its level has sharply decreased, indicating the unwillingness of foreigners to invest in the Russian economy, resulting in a lack of progress in industrial growth and worsening the overall economic condition. Conversely, the SME lending category experienced significant dynamism and success in the last two years. The issuance of credit demonstrated growth, despite many rounds of significant increases in key interest rates. The increase in sales, driven by stronger sales performance and optimistic market expectations, had a significant impact on this. Furthermore, SMEs were able to fill the gaps left by international corporations and seamlessly integrate into new import logistics networks. The ability to be flexible and adaptable has been crucial for small and medium-sized enterprises in the last two years, enabling them to not only survive but also prosper in shifting circumstances.

Источники:

2. Прохорова О. В. Оценка роли прямых иностранных инвестиций на экономическое развитие // Постсоветский материк. – 2023. – № 3(39). – c. 79-92. – doi: 10.48137/23116412_2023_3_79.

3. Foreign direct investment, net inflows (BoP, current US$) - Russian Federation. [Электронный ресурс]. URL: https://data.worldbank.org/indicator/BX.KLT.DINV.CD.WD (дата обращения: 24.10.2024).

4. Кудряшов А. Л. Прямые иностранные инвестиции в финансовую систему России в условиях санкционного давления // Вестник евразийской науки. – 2023. – № 1.

5. Мелихова М. Н., Сигарев А. В. Повышение инвестиционной привлекательности национальной экономики: отечественный и зарубежный опыт // Финансовые рынки и банки. – 2023. – № 5. – c. 207-213.

6. Антонова М.П., Баринова В.А., Громов В.В., Земцов С.П. Развитие малого и среднего предпринимательства в России в контексте реализации национального проекта. - Москва: ИД Дело, 2020. – 88 c.

7. Степаненкова Н.М., Бычков Н.В., Бурцева Ю.В. Анализ кредитной активности малого и среднего предпрюинимательства в россии за 2023 год // Вопросы отраслевой экономики. – 2023. – № 1(5). – c. 58–66. – doi: 10.24888/2949-2793-2024-5-58-66.

8. Сагина О. А. Государственная поддержка и правовые основы реализации государственной финансовой поддержки малого предпринимательства в Российской Федерации // Вестник евразийской науки. – 2024. – c. 18.

9. Гайфуллина С.М., Гирфанова Е.Ю. Оценка качества банковских продуктов // Стратегия социально-экономического развития общества: управление, правовые, экономические аспекты: сборник научных статей 9-й Международной научно-практической конференции: в 2 томах, Курск, 21–22 ноября 2019 года. Том 1. – Курск: Юго-Западный государственный университет. Курск, 2019. – c. 151–153.

10. Кайсин А. С. Проблемы развития малого и среднего предпринимательства в регионах России в условиях санкционного давления // Первый шаг в науку: Материалы студенческой научной конференции, Екатеринбург, 15 мая 2023 года / Редколлегия: Т.Е. Зерчанинова, Д.А. Калугина. – Екатеринбург: Уральский институт управления - филиал Федерального государственного бюджетного образовательного учреждения высшего образования \"Российская академия народного хозяйства и государственной службы при Президенте Российской Федерации\". Екатеринбург, 2023. – c. 22-25.

11. Коробейников Д.А. Кредитные гарантии для малого и среднего бизнеса // Научный вестник: финансы, банки, инвестиции. – 2020. – № 2 (51). – c. 79-88.

12. Якупова Ю., Тетерин В., Коршунов Р., Сараев А. Кредитование МСБ в 2022–2023: на максимальных оборотах. Эксперт РА. [Электронный ресурс]. URL: https://raexpert.ru/researches/banks/msb_forecast_2023/ (дата обращения: 24.10.2024).

13. Решетников М. Прогноз социально-экономического развития Российской Федерации на 2025 год и на плановый период 2026 и 2027 годов. / Министерство энергетического развития Российской Федерации: Макроэкономика. - Москва, 2024.

14. Богомазова О.И., Егоркин Г.Ю. Развитие малого и среднего бизнеса в РФ: перспективы, влияние санкционного давления // Экономика и предпринимательство. – 2023. – № 5(154). – c. 740-743. – doi: 10.34925/EIP.2023.154.5.144.

15. Эксперты: изменение критериев отнесения к МСП со стороны ЦБ является своевременной мерой. [Электронный ресурс]. URL: https://tass.ru/ekonomika/15277233 (дата обращения: 08.10.2024).

Страница обновлена: 15.11.2025 в 05:50:48

Download PDF | Downloads: 30

Современные тенденции в финансировании инвестиций в Российской Федерации

Pogosyan E.A.Journal paper

Journal of Economics, Entrepreneurship and Law

Volume 14, Number 10 (October 2024)

Abstract:

Исследование охватывает актуальные тенденции и вызовы на рынке инвестиционного финансирования, включая источники капитала, такие как государственные и частные инвестиции, прямые иностранные инвестиции. В исследовании представлен свежий анализ того, как экономическая нестабильность и международные санкции изменили тенденции финансирования инвестиций в России. Исследование подчеркивает меняющиеся стратегии государственного и частного секторов по привлечению и размещению капитала. Исследование также затрагивает более широкий вопрос о том, как международные санкции влияют на прямые иностранные инвестиции и внутреннее движение капитала, что является ключевой проблемой для поддержания устойчивого инвестиционного климата в России. Кроме того, особое внимание уделяется тенденциям и проблемам, с которыми сталкиваются малые и средние предприятия при выборе внешнего источника финансирования, особенно заемного капитала. Исследование анализирует доступность кредитов на финансовом рынке для малых и средних предприятий, процентные ставки и специфическими требованиями кредиторов, а также предлагает рекомендации по улучшению доступа к заемным ресурсам. Решаемая проблема заключается в системных трудностях, с которыми сталкиваются малые и средние предприятия при получении доступного внешнего финансирования, особенно в условиях волатильности рынка и ограничения кредитной среды. Ученые и специалисты, изучающие международные финансы, инвестиционные тенденции и экономические санкции, найдут это исследование актуальным, особенно с учетом его акцента на адаптируемость рынка и доступность капитала.

Keywords: инвестиционное финансирование, прямые иностранные инвестиции, малые и средние предприятия, кредитные рынки, финансовые рынки

JEL-classification: G10, G30, L26

References:

Antonova M.P., Barinova V.A., Gromov V.V., Zemtsov S.P. (2020). Razvitie malogo i srednego predprinimatelstva v Rossii v kontekste realizatsii natsionalnogo proekta [Development of small and medium-sized enterprises in Russia in the context of the implementation of the national project] Moskva : ID Delo. (in Russian).

Bogomazova O.I., Egorkin G.Yu. (2023). Razvitie malogo i srednego biznesa v RF: perspektivy, vliyanie sanktsionnogo davleniya [Development of small and medium-sized businesses in the Russian Federation: prospects, impact of sanctions pressure]. Journal of Economy and Entrepreneurship. (5(154)). 740-743. (in Russian). doi: 10.34925/EIP.2023.154.5.144.

Foreign direct investment, net inflows (BoP, current US$) - Russian Federation. Retrieved October 24, 2024, from https://data.worldbank.org/indicator/BX.KLT.DINV.CD.WD

Gayfullina S.M., Girfanova E.Yu. (2019). Otsenka kachestva bankovskikh produktov [Assessment of the quality of banking products] The strategy of socio-economic development of the society: management, legal, economic aspects. 151–153. (in Russian).

Gorbatko E. S., Zhadnov A. I. (2023). Investitsionnaya politika Rossiyskoy Federatsii: vliyanie sanktsiy [Investment policy of the Russian Federation: the impact of sanctions]. Vestnik evraziyskoy nauki. 15 (in Russian).

Kaysin A. S. (2023). Problemy razvitiya malogo i srednego predprinimatelstva v regionakh Rossii v usloviyakh sanktsionnogo davleniya [Problems of development of small and medium-sized enterprises in the regions of Russia under the conditions of sanctions pressure] The first step into science. 22-25. (in Russian).

Korobeynikov D.A. (2020). Kreditnye garantii dlya malogo i srednego biznesa [Credit guarantees for small and medium-sized businesses]. Scientific Herald: finance, banks, investments. (2 (51)). 79-88. (in Russian).

Kudryashov A. L. (2023). Pryamye inostrannye investitsii v finansovuyu sistemu Rossii v usloviyakh sanktsionnogo davleniya [Foreign direct investment in the Russian financial system under sanctions pressure]. Vestnik evraziyskoy nauki. 15 (1). (in Russian).

Melikhova M. N., Sigarev A. V. (2023). Povyshenie investitsionnoy privlekatelnosti natsionalnoy ekonomiki: otechestvennyy i zarubezhnyy opyt [Increasing the investment attractiveness of the national economy: domestic and foreign experience]. Finansovye rynki i banki. (5). 207-213. (in Russian).

Prokhorova O. V. (2023). Otsenka roli pryamyh inostrannyh investitsiy na ekonomicheskoe razvitie [Assessment of the role of foreign direct investments on economic development]. Postsovetskiy materik. (3(39)). 79-92. (in Russian). doi: 10.48137/23116412_2023_3_79.

Reshetnikov M. (2024). Prognoz sotsialno-ekonomicheskogo razvitiya Rossiyskoy Federatsii na 2025 god i na planovyy period 2026 i 2027 godov [Forecast of socio-economic development of the Russian Federation for 2025 and for the planning period of 2026 and 2027] Moscow: Ministerstvo Energeticheskogo Razvitiya Rossiiyskoy Federatsii. (in Russian).

Sagina O. A. (2024). Gosudarstvennaya podderzhka i pravovye osnovy realizatsii gosudarstvennoy finansovoy podderzhki malogo predprinimatelstva v Rossiyskoy Federatsii [State support and legal basis for the implementation of state financial support for small businesses in the Russian Federation]. Vestnik evraziyskoy nauki. 16 18. (in Russian).

Stepanenkova N.M., Bychkov N.V., Burtseva Yu.V. (2023). Analiz kreditnoy aktivnosti malogo i srednego predpryuinimatelstva v rossii za 2023 god [Analysis of the credit activity of small and medium-sized enterprises in Russia in 2023]. Voprosy otraslevoy ekonomiki. (1(5)). 58–66. (in Russian). doi: 10.24888/2949-2793-2024-5-58-66.