Assessment of position of the People’s Republic of China in the world nuclear power plants’ construction market

Горемышев А.В.1 ![]()

1 Санкт-Петербургский государственный университет, Санкт-Петербург, Россия

Скачать PDF | Загрузок: 9

Статья в журнале

Экономика, предпринимательство и право (РИНЦ, ВАК)

опубликовать статью | оформить подписку

Том 15, Номер 10 (Октябрь 2025)

Эта статья проиндексирована РИНЦ, см. https://elibrary.ru/item.asp?id=84001680

Аннотация:

В данной статье дается оценка позиции Китайской Народной Республики на мировом рынке сооружения атомных электрических станций. Автор рассматривает ключевые аспекты национальной стратегии Китайской Народной Республики, дает оценку текущему состоянию и перспективам развития Китайской Народной Республики на мировом рынке сооружения атомных электрических станций (с учетом построения прогноза на среднесрочную перспективу).

В статье рассмотрены особенности мирового рынка сооружения атомных электрических станций, такие как капитальные вложения, новые реакторные технологии, энергетическая политика и экономические факторы. Особое внимание уделяется сравнительному анализу Китайской Народной Республики с другими ведущими игроками на мировом рынке атомной энергетики. Исследование показывает, что Китай активно развивает свою атомную энергетику, стремясь к лидерству в этой области. Это достигается за счет значительных инвестиций в исследования и разработки, а также через экспансию с помощью значительного объема инвестиций и развитие экспорта атомных технологий и сооружения новых энергоблоков

Ключевые слова: атомная энергетика, мировая экономика, мировой рынок, атомная электрическая станция, мировая энергетическая система, Китайская Народная Республика, АЭС

JEL-классификация: R11, R12, R13, R58

Introduction

In today's world, where energy security and sustainable development issues are becoming more and more topical, nuclear power plays the key role in ensuring energy independence and reducing the carbon footprint for a number of countries and regions of the world. Being one of the leading players in the world energy arena, China is actively developing its nuclear energy industry, striving to become a world leader in nuclear power plant (NPP) construction as well.

In 2020, Beijing made a strategic shift, proclaiming a new paradigm of the country’s economic growth and prioritizing domestic demand, that is now known as the “dual circulation” strategy (双循环, shuāng xún huán) [12, 2023]. The key idea of the said national strategy is to shift the development focus from the traditional orientation on international trade, or “international circulation” (内循环, nèi xún huán), towards “domestic circulation” (内循环, nèi xún huán). The “international circulation” is focused on expanding exports, strengthening international cooperation in the field of energy, including development of joint projects with partner countries for the extraction and transportation of energy resources, investments in foreign energy projects and participation in international initiatives to reduce greenhouse gas emissions. At the same time, the “domestic circulation” focuses on the internal development of China’s energy system, including an increase in the share of renewable energy sources (RES) and nuclear energy in the country’s energy balance, and also ensures development of infrastructure for energy storage and transmission and increased energy efficiency in industry and the residential sector. It is noteworthy that the shift in focus does not entail a total re-orientation of financial flows from foreign to domestic markets, but means a shift towards a balance between development of the national market and expansion of presence in foreign and the global energy markets. Taking into account the given circumstances and the transformation of the national strategy of the PRC, the topic of assessing the country’s position in the world NPP construction market determines the relevance of the topic of this study.

Modern scientific publications pay significant attention to China’s role in the global nuclear energy market and its role in the global energy space. These issues are considered in the works of mainly Chinese and foreign scientists: Zhou Sheng and Xiliang Zhang [42, 2010], Yu, Sha, et al. [39, 2020], Ming, Zeng, [29, 2016] and Andrews-Speed, Philip [13, 2023].

The development of nuclear energy in the PRC, as well as the development and implementation of the country's nuclear energy strategy are covered in the works of Riqiang, Wu. [32, 2013, P. 579-614], Glaser, Charles L., and Steve Fetter. [20, 2016, 49-98], Wang, Qiang. [35, 2009, 2487-2491], Douglas, Jason, and John Doyle. [17, 2014, 73-88] and Wu, Yican, [37, 2016, 511-516].

The specifics of assessing the position of the People’s Republic of China (PRC) in the global market of construction of large and small modular reactors (SMR) are covered in the works of such scientists as Guo X., Guo X. [22, 2016 P. 999-1007], Zhou S., Zhang X. [42, 2010, 4282-4288], Zeng M. et al. [40, 2016. P. 1369-1383] and Zhang T. et al. [41, 2022 P. 7557216] and a number of others, according to which the issues of positioning and evaluating countries’ strategies in world energy markets are fundamental for the development of the global energy economy and energy industries of individual countries and regions of the world.

At the same time, research works display a significant scientific gap in assessing the current position of the PRC in the world NPP construction market in terms of a medium-term forecast based on the above assessment, due to lack of comprehensive studies that take into account both current successes in the field of nuclear energy technologies and potential challenges related to environmental standards and international competition.

With this article, the author pursues a goal to assess the current position of the PRC in the world NPP construction market, taking into account the key aspects of the national strategy, and to provide a medium-term forecast for PRC’s position.

The scientific novelty of the study consists in identifying and systematizing the prerequisites that form the current position of the PRC in the world NPP construction market, assessing the current state, as well as provision of a medium-term (5–7 years) forecast.

The presented study is based on the analysis of a hypothesis that in the medium term (5–7 years) the PRC will strengthen its position in the world NPP construction market and become the undisputed leader in the NPP construction market in terms of the number of power units simultaneously under construction.

The research methodology is based on a systematic approach to the analysis of complex economic systems. The analysis employs both qualitative and quantitative empirical methods, including procedures for comparing and clustering data using experimental-theoretical methods (inductive and deductive approaches, as well as statistical modeling to formalize results). The justification of the results is based on a comprehensive analysis and synthesis of statistics obtained from authoritative sources, such as the International Atomic Energy Agency (IAEA), the International Energy Agency (IEA), the World Nuclear Industry Status Report (WNISR) and other similar organizations.

Main processes of the world NPP construction market

In 2024, the global nuclear energy market continued to show significant changes and development due to both internal and external factors. One of the key processes having effect on the market is the gradual recovery from the COVID-19 pandemic, which led to an increase in electricity demand and, as a result, to an increased interest in nuclear energy as a sustainable source of energy in the long term. This recovery is also accompanied by a change in many countries' energy policies aimed at reducing reliance on fossil fuels and reducing greenhouse gas emissions as part of the fight against climate change.

The global nuclear energy market in 2023 and 2024 is characterized by a number of key processes. While nuclear power is one way to generate low-greenhouse-gas electricity, it also faces a number of challenges, including new technologies, waste management and competition from renewable energy sources.

1. Development of new reactor technologies (small modular reactors). One of the most important processes is development of new reactor technologies, especially such as small modular reactors (SMR) and reactors with liquid metal coolants. These technologies promise to improve safety, reduce costs and increase the efficiency of energy production, according to [7] “The volume of the available global OFPU market in the base version is estimated at 4.1 GW, the potential volume of the available global market for LPNPP (ground version) in the base version is estimated from 20.3 GW to 83.0 GW in the optimistic scenario”. It is noteworthy that the mentioned value is about 5 % of the volume of the global market of high-power NPPs, which is 441.5 GW, according to consulting company Mordor Intelligence [9].

It is also important that tech giants such as Google, Microsoft and Amazon show increased interest in SMR projects. Google has signed an agreement with nuclear company Kairos Power to build 6-7 SMR with a total capacity of 500 MW to power artificial intelligence bases, the IT company said. The first SMR will be completed in 2030, the rest are expected to start operation by 2035 [11].

2. Development of new reactor technologies (Sodium-cooled fast reactors). Liquid metal coolant reactors are a type of nuclear reactors, in which the coolant is a liquid metal, usually sodium or lead. These reactors have several advantages, including high heat transfer, low pressure and ability to operate at higher temperatures than traditional pressurized water reactors. In Russia and in the world, several types of reactors with liquid metal coolant have been built. Here are some of them:

BN-1200 (Russia) is a design of a sodium-cooled fast neutron reactor that was proposed for construction at the South Ural NPP. However, the project was put on hold due to economic and environmental considerations.

Superfénix (France) is a sodium-cooled fast neutron reactor that was launched in 1985 but was shut down in 1997 due to technical problems and protests of environmentalists.

BN-350 (Russia/Kazakhstan) is a sodium-cooled fast neutron reactor that was launched in 1973 at the Mangyshlak NPP in Kazakhstan. It was shut down in 1999 due to environmental and economic concerns.

Lead-cooled Fast Reactor (LFR) (Europe) is a concept of a fast neutron reactor with lead-bismuth coolant that is a joint international development. The design is under development and has not yet been implemented on an industrial scale.

Sodium-cooled fast reactor (SFR) (International project) is a concept of a sodium-cooled fast neutron reactor that is a joint international development. The design is also under development and has not yet been implemented on an industrial scale.

3. Construction of new power units of high-power NPPs (HP NPP). Although some countries such as Germany announced plans to abandon use of nuclear power, others, such as China, Russia and India, continue to actively develop their nuclear programs. This is due to the need to reduce greenhouse gas emissions, ensure energy security and meet the growing demand for electricity. One of the main lines of development of nuclear power industry is construction of new HP NPPs. Several major projects around the world were launched in 2024, including in Russia, China, the United States and the European Union countries. These projects will be implemented using modern technologies that ensure increased safety and efficiency of electricity production. In addition, another important aspect of nuclear power industry development is fostering efficiency and safety of the existing nuclear power plants.

4. Modernization and service life extension of the existing NPPs, NPP decommissioning. In 2024, work was continued to modernize and extend the service life of the existing reactors [2], which will increase their efficiency and reduce the risk of accidents. It is also noteworthy that NPP modernization and service life extension is more cost-effective than construction of new power units. The upward trend of NPP decommissioning deserves special attention. According to the IAEA Bulletin [3], more than 200 nuclear power reactors around the world have been shut down for decommissioning, and hundreds of reactors that are currently under operation are expected to be shut down and decommissioned in the coming decades. The closed-cycle economy involves reducing waste and the associated pollution. This economic model of production and consumption is aimed primarily at ensuring that resources are used for as long as possible by their saving, reusing and recycling.

5. NPP competition with renewable energy sources. Development of renewable energy sources such as solar and wind power creates competition for nuclear power. However, nuclear power can play an important role in ensuring the base load and stability of the energy system. According to the International Energy Agency (IEA), the share of RES in the global electricity production in 2022 was already about 30 % [26]. This is due both to technological progress that reduces the cost of producing electricity from renewable sources and to policies of states to reduce greenhouse gas emissions and transition to a more sustainable energy system. To maintain the competitive ability of NPPs, many countries are developing various strategies, including modernization of the existing plants, development of new technologies and creation of hybrid energy systems that combine NPP and RES [26, 30].

In conclusion of the chapter on the main processes in the global nuclear energy market, several key conclusions can be drawn. The modern world is witnessing an active development of new reactor technologies, which is one of the main trends in the nuclear energy industry. Particular attention is paid to small modular reactors (SMRs) and Sodium-cooled fast reactors that feature a number of advantages over traditional reactors, including increased safety, less capital investment and the ability of more flexible scaling. It is also interesting that today’s global NPP construction market is demonstrating stable growth in contrast to the situation in 2018-2019 [33] when temporary stagnation of the global NPP construction market could be observed, which, in turn, led to slowdown in the development of the global nuclear energy industry as a whole.

In parallel with development of new technologies, construction of new HP NPP power units continues, which provides for increase of the total capacity of the nuclear power industry and ensures more stable energy supply. Simultaneously, modernization and extension of service life of the NPPs under operation also plays an important role in maintaining and increasing the production of nuclear energy.

However, the nuclear power industry is facing growing competition from RES, such as solar and wind power. This requires the nuclear power industry to continuously improve technologies and optimize processes to maintain its competitive ability.

In general, the global NPP construction market is characterized by dynamic development and continuous improvement of the existing and research of new reactor technologies. The leadership of certain countries in this sphere will depend on the ability of nuclear industries to adapt to the changing conditions and needs of the global market, as well as on efficient cooperation with RES to ensure sustainable and environmentally friendly energy supply, effective cost and time management systems for the facilities under construction.

People’s Republic of China in the world NPP construction market

Based on the provisions of the PRC social and economic development strategy during the 14th Five-Year Plan period [34], it can be concluded that the Communist Party of China (CCP) has set a course for reorientation of the country’s economy by giving priority to domestic consumption and development of the so-called “life-line facilities” (生命线, shēng mìng xiàn). In China, such facilities include the critical infrastructure that provides basic vital needs for the population, such as electricity, water, food, health care, education and others. The life-line facilities play the key role in maintaining the stable functioning of society and the economy and ensure the possibility of their development in the future. The central among the mentioned facilities are nuclear power plants, which today are a new export product for the PRC [5].

China is leading in certain areas of the global nuclear energy market, such as the number of HP NPP power units simultaneously under construction, demonstrating rapid growth and ambitious development plans in this sphere. According to IAEA data for 2024, China ranks second in the world in terms of the number of operating nuclear power plants, second only to the United States of America [16]. This achievement is the result of the PRC government proactive policy aimed at reducing dependence on fossil fuels and reducing greenhouse gas emissions.

The assessment of the PRC activities in the world NPP construction market, proposed by the authors, is given by the five main processes mentioned in this article.

1. Development of new reactor technologies (small modular reactors). The pie chart (Figure 1) below shows the number of low-power reactor projects by countries of the world.

Figure 1. Number of low-power NPP projects in the world by countries in 2025

Source: [14]

In general, two leaders can be distinguished in the chart – the United States and Russia, followed by Japan and France. The third place is shared by South Korea and the PRC. Today, the United States is the absolute market leader in the number of low-power NPP projects (30 projects), ahead of its closest competitors, such as Russia (22 projects), France (13 projects) and Japan (13 projects) by 8 and 17 points, respectively.

At the same time, the PRC ranks 6th, with 8 projects at different stages of the life cycle, losing by 1 point to South Korea and ahead of India by 4 points, of Canada and Great Britain by 5 points, respectively.

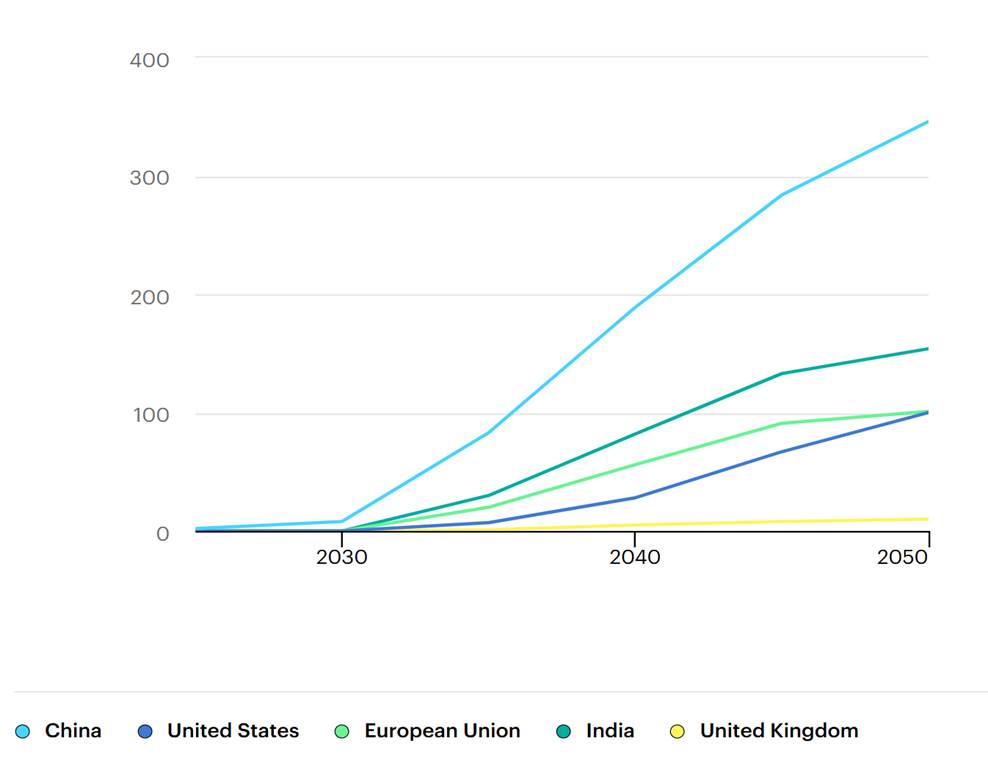

According to the data of consulting company Precedence Research [33], the volume of the global SMR market was 6.32 billion US dollars in 2023, 6.88 billion US dollars in 2024, and is expected to reach approximately 16.13 billion US dollars by 2034, with an average increase of 8.9 % per year in the period from 2024 to 2034; and the PRC has a huge potential in this market that is based both on the SMR design and construction experience and on its export ambitions. The basic forecast of the IEA [28] notes the following: China will be the leading SMR market till 2050, with several SMRs expected to start operation in the late 2020s and the total installed capacity expected to reach about 35 GW by 2050 (Figure 2).

Figure 2. Forecast power generation by NPP with SMR, Megawatt (MW)

Source: [28]

China’s first Generation IV High Temperature Gas-Cooled SMR (HTR-PM) was successfully commissioned in 2023, with several more units of the same design planned, along with several larger reactors. Two other projects, ACP100 (commissioned in 2021) and NHR200, are also being developed in China.

.

2. Development of new reactor technologies (Sodium-cooled fast reactors). As of 2025, there are several fast reactors operating in China, including the experimental fast reactor (SFR) in Zhongwei City, Gansu Province. The SFR is the world’s first sodium-cooled fast reactor that was launched in 2021. With a power capacity of 600 MW, the reactor is the key project within the framework of the Chinese nuclear energy development program. China is investing billions of dollars in development of fast reactors. According to Atominfo [1], more than 3 billion US dollars were invested in construction of the SFR alone. This indicates a significant interest of the Chinese government in developing nuclear energy and reducing dependence on fossil fuels.

The forecast growth of the number of fast reactors in the PRC is based on large-scale strategic initiatives of the country’s government aimed at intensive development of the nuclear energy industry [25].

3. Construction of new power units of high-power NPPs (HP NPP). According to the IAEA PRIS database [24], China has become the world leader in the field of nuclear energy, driven by advanced technologies, strong government support and strategic international partnerships. With 57 operating reactors generating 55 762 MW and another 30 under construction to produce 31 953 MW, the country considers nuclear power as a key element of its national strategy.

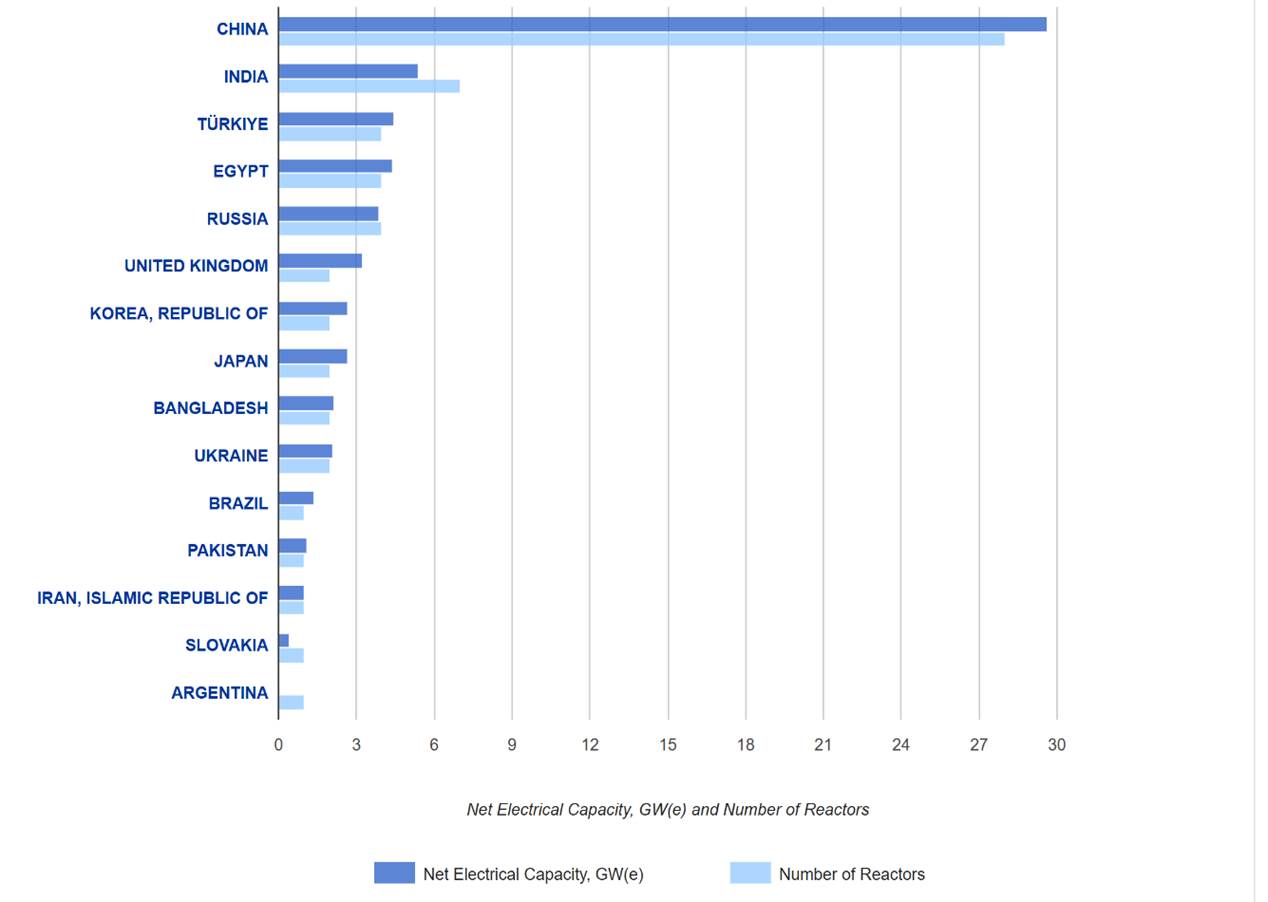

The chart in Figure 3 demonstrates the number of HP NPP power units simultaneously under construction in pieces and the net electrical capacity in megawatts in 2024 in this generation segment.

Figure 3. Number of HP NPP power units under construction and net electrical capacity in 2025, MW

Source: [24]

China is the undisputed leader in the number of HP NPP power units simultaneously under construction and in the generated electric power, India ranks second with a small margin from Russia, Egypt and Turkey.

It is noteworthy that according to WNISR data [36], Russia remains the main competitor for China: “Russia also started four of the 20 latest building sites in China and has thus turned into the leading global nuclear vendor with 24 active construction projects in eight countries (including Russia) versus 22 for China (all in China)”.

According to the latest report of the Information Technology and Innovation Foundation (ITIF) [23], China is rapidly expanding its nuclear power capacity by constructing 30 reactors, and is planning to add 5 to 8 new reactors annually, increasing the capacity by 5000–8000 MW each year. Notably, almost all Chinese nuclear projects since 2010 have been completed in seven years or less. Five reactors have been put into operation since 2022, with construction times ranging from just under five to just over seven years. The government’s commitments were bolstered by the 14th Five-Year Plan (2021–2025), which aims to build 150 new reactors over the next 15 years, reaching 200 GW of nuclear power by 2035, which is enough to provide electricity to more than a dozen cities the size of Beijing. Analysts estimated that this would require an investment of 370–440 billion US dollars. By 2050, China intends to ensure the share of nuclear energy in its energy balance in an amount of at least 15 % of the country’s total energy balance, making it the third largest energy source after wind and solar generation. Over the past decade, China has almost tripled its nuclear capacity, reaching in 10 years what it took the United States almost 40 years.

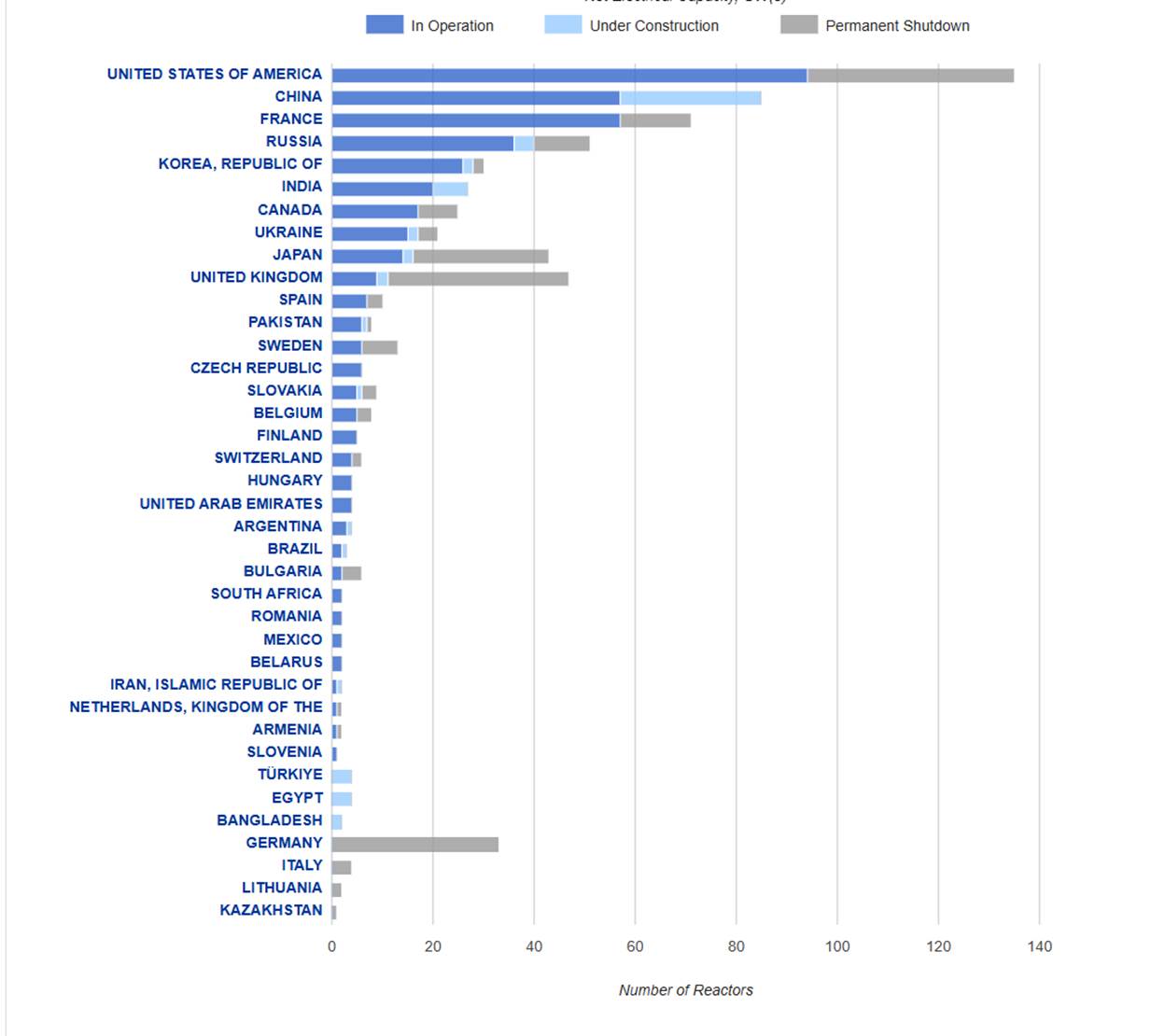

4. Modernization and service life extension of the existing NPPs, NPP decommissioning. Most of the nuclear industry leader countries prefer to follow the principle of modernization and service life extension of the existing NPPs (Figure 4). For example in France, the share of nuclear power plants in the country’s energy balance reaches almost 70 %, however more than 71 % of the reactors have long been worn out. In December 2024, the French EDF [19] announced that Flamanville 3 – the first nuclear reactor over the past 25 years – was connected to the grid, which was 12 years behind the schedule. A similar situation is observed in the United States that has more reactors than any other country. The average reactor age is 42 years as of 2023 [31].

Figure 4. Number of NPP power units at stages: «in operation», «under construction», «permanent shutdown» in 2025

Source: [24]

Overall, the U.S. leads in the total number of nuclear power plant (NPP) units "in operation" and "permanently shut down," followed closely by China, which has no permanently shut-down units among its operational fleet. The U.S. boasts a 33% larger operational fleet compared to China, while China leads in construction with 28 more units under construction than the U.S. and France combined. India's NPP statistics resemble China's, lacking any permanently shut-down units but trailing by 58 units overall and 21 under construction.

Japan, the UK, and Sweden show a trend towards "permanent shutdown," with Japan having 17 such units—two more than operational and 15 more than under construction. The UK's 17 units include 8 permanently shut down, 3 under construction, and 6 operational. Germany, Lithuania, and Italy are notable for their high ratios of permanently shut-down units, with Germany leading at 26 units.

This analysis highlights significant differences in NPP development and decommissioning strategies across major nuclear powers.

5. NPP competition with renewable energy sources. The competition between nuclear energy and renewable energy sources in the PRC is one of the key topics in the country’s modern energy policy. China, being one of the largest energy consumers in the world, seeks to diversify its energy balance, reduce dependence on fossil fuels and greenhouse gas emissions. According to the World Economic Forum [15], the PRC, in addition to the active development of nuclear energy industry, was one of the leading countries developing capture, use and storage of carbon (CCUS) and sustainable aviation fuel.

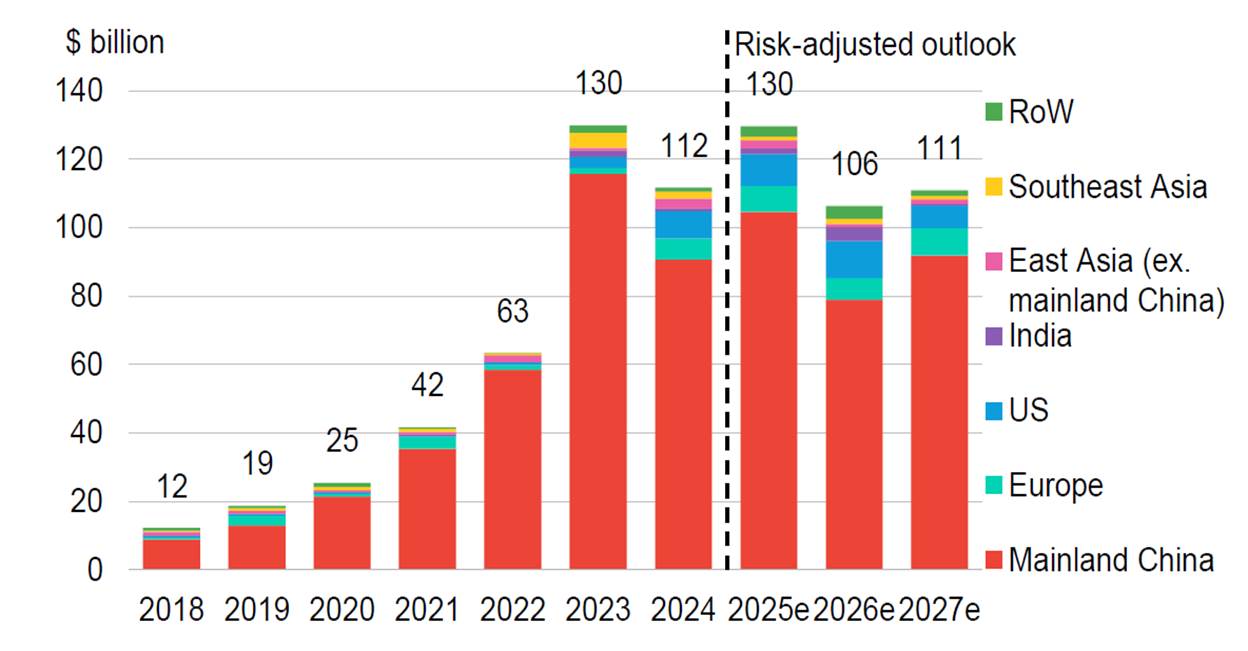

Figure 5. Global investment in clean energy plants by geography

Source: [18]

In 2024, China's clean energy investments outpaced the combined total of ten other leading nations, with over 60% allocated to renewable energy sources (RES) and electric transportation. This investment pattern is reflected in Figure 5, which projects global investment trends from 2018 to 2027, highlighting China as the dominant player, consistently holding around 80% of the market share.

From 2018 to 2020, investments grew from $7 billion to $17 billion annually. A significant spike occurred in 2023, reaching $130 billion, before declining by $18 billion in 2024. Southeast Asia maintained a notable 5% share, while Europe and the USA collectively contributed about 10%.

Forecasts indicate that 2025 will see a resurgence to the 2023 level of $130 billion, with slightly increased participation from the USA and Europe to 12%. However, a decline in investment is projected for 2026 and 2027 by $24 billion and $19 billion, respectively, with the USA's share stabilizing in 2026 and then aligning with Europe's in 2027.

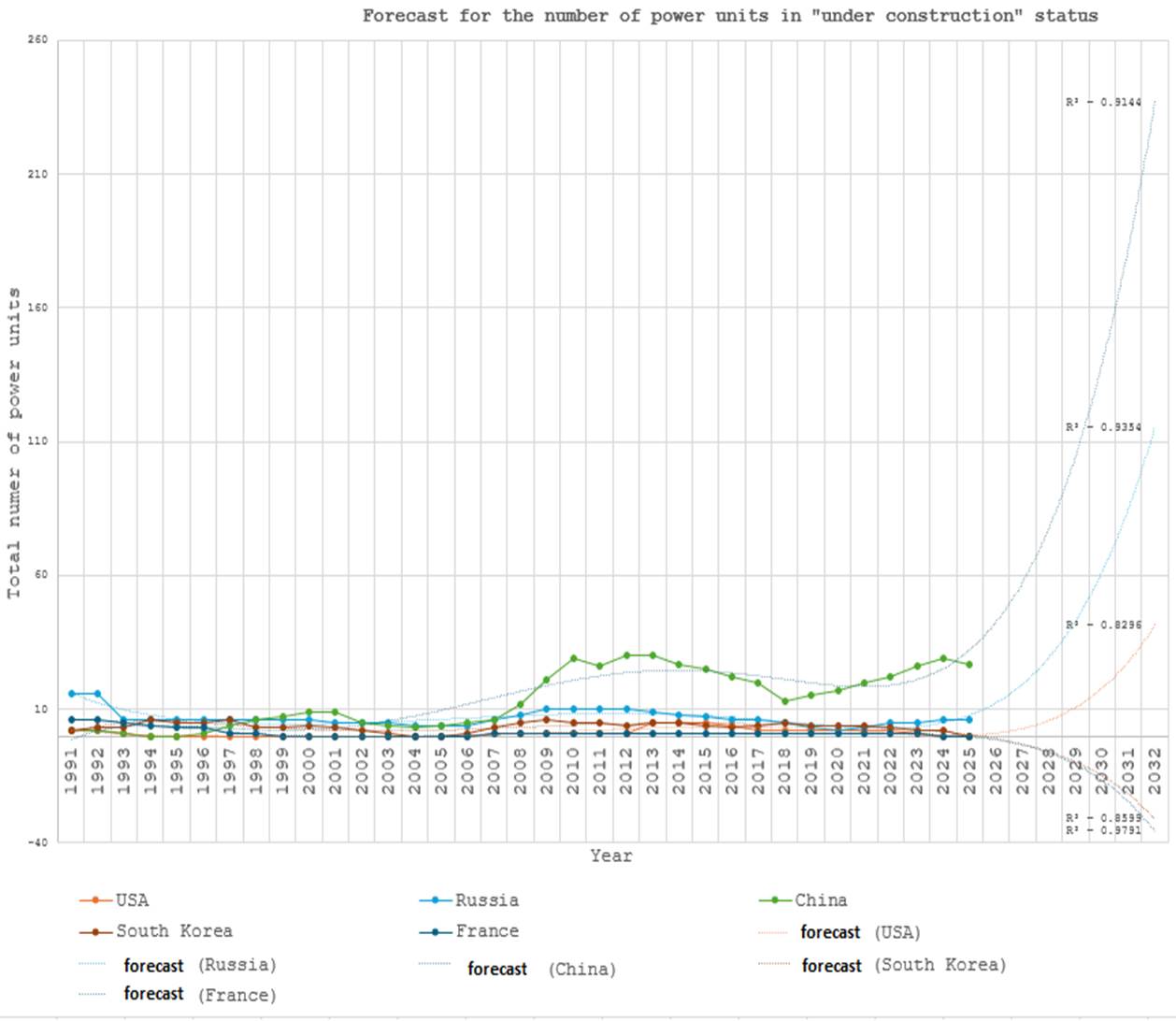

The most interesting set of data to forecast a leader of the world NPP construction market in the medium term (5–7 years) is the number of HP NPP power units that are simultaneously under construction. The corresponding statistics reflecting the number of HP NPP power units under construction during the period of 1991 to 2025 by key participants of the world NPP construction market (USA, Russia, China, South Korea and France) is shown in the diagram below (Figure 6).

Figure 6. Number of HP NPP power units under construction by key participants of the world NPP construction market from 1991 to 2025

Compiled by the author on the basis of data: [36]

In general, the undisputed leader of the world HP NPP construction market is China, ranking first by the number of power units simultaneously under construction since 2007, and having lost the lead periodically only to Russia during the entire period.

Russia takes a solid second place during the period, showing leadership at the beginning of the period and a slight decline in the units under construction near the end of the period, behind South Korea for a short period of time.

Since 2007, the PRC has shown rapid growth in the HP NPP power units simultaneously under construction and by 2011 it has reached the maximum number of 30 power units. Russia and South Korea are demonstrating similar dynamics, but at a lower scale. By 2008, Russia has reached a value of 10 power units against 28 in China and 6 in South Korea.

The USA and France show minimum values in comparison with the PRC, Russia and South Korea. The USA reach its maximum of 5 power units in 2012, matching South Korea, but is significantly below Russia (by 4 power units) and China (by 25 power units). It is noteworthy that by the end of the period, the USA and France exhibit a smooth downtrend to zero.

Figure 7. Number of HP NPP power units under construction by key participants of the world NPP construction market Forecast till 2032

Compiled by the author on the basis of data: [36]

Figure 7 illustrates the construction of HP NPP power units by leading global market participants (Russia, USA, South Korea, China, and France) from 1991 to 2032, focusing on the 2025-2032 period with a coefficient of determination.

China leads in both current and forecasted construction, aiming to significantly increase its nuclear capacity. By 2031-2032, China is projected to have over 200 new units, reducing reliance on carbon sources. The forecast's coefficient of determination is 0.91, indicating high accuracy.

Russia ranks second, with approximately 110 units under construction by 2032. Russia is expected to maintain active involvement in international NPP projects, both domestically and internationally. The forecast for Russia has a coefficient of determination of 0.93, suggesting reliable and accurate predictions. The USA ranks third in terms of construction of new HP NPP power units, however, such forecast is more due to renewal of the existing domestic NPP fleet than to expansion on the world market. During the period of 2031 to 2032, the USA demonstrates an uptrend, the forecast value is about 40 power units. It is noteworthy that the coefficient of determination for the forecast is about 0.82, which implies the high quality of modeling and reliability of the forecast data. At the same time, France and South Korea demonstrate downward trends with a coefficient of determination of 0.85–0.97.

Therefore, the analysis of the current data can yield a forecast that the growing attention to nuclear energy in countries such as China and Russia will have a significant impact on the world NPP construction market with a potential increase in the share of new power units to be commissioned over the next ten years. This will have an impact not only on the energy sector of these countries, but also on global efforts to reduce carbon emissions and transition to more sustainable energy sources, which, in turn, can contribute to international efforts to combat climate change and ensure energy security.

Having considered the data and conclusions presented in [38], it is argued that the PRC is proactive in the global nuclear energy sphere, which is accompanies by an increase in demand for uranium due to the extension of nuclear facilities. The study [21] also states that China seeks to become one of the leading players in the global nuclear energy market, focusing on modernization of domestic energy technologies and expansion of export opportunities. At the same time, the study [10] states that the PRC is planning to increase the share of renewable sources (including nuclear) in the country’s energy balance to 20–25 % by 2030. Moreover, according to information in [4], China aspires to increase the number of operating reactors to 100 by 2030.

Based on the above data and analysis of the chart, we can conclude that by 2026-2027 the PRC will become the undisputed leader in the world NPP construction market in terms of the number of power units simultaneously under construction, surpassing its competitors, and by 2030 it will become almost unequaled, surpassing the closest competitor by about twice as many units. Therefore, we adopt the hypothesis that in the medium term (5-7 years) the PRC will strengthen its position in the world NPP construction market and become the undisputed market leader in terms of the number of power units simultaneously under construction.

Conclusion

Based on the conducted research, it can be concluded that the proposed goal of this work – position of the PRC in the world NPP construction market, taking into account the key aspects of the national strategy, and to provide a medium-term forecast for PRC’s position – has been successfully achieved.

The study demonstrated that the PRC is developing its nuclear energy industry complex taking into account the global market development trends, as well as the key aspects of the dual circulation strategy. This is achieved through significant investment in the industry, a fairly “young” fleet of operating NPPs, expansion and fostering of export of nuclear products, development of technologies (including SMR reactors), as well as through gradual departure from use of fossil fuels in favor of RES and nuclear energy.

Consideration of the current trends and data from the referenced sources makes it obvious that in the period from 2026 to 2032, China will become practically out of reach for its competitors in terms of the number of HP NPP power units simultaneously under construction and will occupy the leading position in the world NPP construction market.

These conclusions allow a statement that the position of the People’s Republic of China in the world NPP construction market is assessed as undoubtedly leading.

Источники:

2. Атомный ренессанс заставляет энергетические компании продлевать сроки работы старых АЭС. [Электронный ресурс]. URL: https://globalenergyprize.org/ru/2024/12/18/atomnyj-renessans-zastavljaet-jenergeticheskie-kompanii-prodlevat-sroki-raboty-staryh-ajes/ (дата обращения: 24.05.2025).

3. Вывод из эксплуатации ядерных объектов. Бюллетень МАГАТЭ. [Электронный ресурс]. URL: https://www.iaea.org/sites/default/files/6411819ru.pdf (дата обращения: 20.04.2025).

4. Горемышев А. В., Капусткин В. И. Оценка роли и тенденций развития атомной энергетики в глобальной системе обеспечения энергоресурсами // Экономика, предпринимательство и право. – 2025. – № 8.

5. Китайское атомное наступление началось, Лондон уже сдался. [Электронный ресурс]. URL: https://ria.ru/20220211/atom-1772150109.html (дата обращения: 20.04.2025).

6. ПАТЭС на экспорт: зачем «Росатом» строит плавучие энергоблоки. [Электронный ресурс]. URL: https://strana-rosatom.ru/2024/12/01/pates-na-eksport-zachem-rosatom-stro/ (дата обращения: 25.05.2025).

7. Петрунин В. В. Реакторные установки для атомных станций малой мощности // Академия наук и атомная отрасль. – 2021. – № 6. – c. 213-231.

8. От первой арктической — к первой тропической: эволюция плавучих АЭС. [Электронный ресурс]. URL: https://e-plus.media/technologies/plavuchie-aes/ (дата обращения: 25.05.2025).

9. Отчет о рынке атомной энергетики Mordorintelligence. [Электронный ресурс]. URL: https://www.mordorintelligence.com/ru/industry-reports/nuclear-power-market (дата обращения: 31.05.2025).

10. Телегина Е. А., Халова Г. О. Мировая экономика и энергетика на переломе: поиски альтернативной модели развития // Мировая экономика и международные отношения. – 2020. – № 3. – c. 5-11.

11. EnergyGoogle договаривается о строительстве 6-7 малых АЭС для энергообеспечения систем ИИ. [Электронный ресурс]. URL: https://energypolicy.ru/google-dogovarivaetsya-o-stroitelstve-6-7-malyh-aes-dlya-energoobespecheniya-sistem-ii/novosti/2024/13/15/ (дата обращения: 20.04.2025).

12. Aijian, W. A. N. G., and F. A. N. G. Yunlong. “Development Reorientation of China’s Free Trade Zones under the New Development Paradigm of Dual Circulation: On the Reform Path of Free Trade Zones for the High-Quality Development of China’s Economy.” China Economic Transition (CET) 6.2 (2023)

13. Andrews-Speed, Philip. Nuclear power in China: Its role in national energy policy. Oxford Institute for Energy Studies, 2023

14. Thermal Capacity. Aris. [Электронный ресурс]. URL: https://aris.iaea.org/Characteristics/ (дата обращения: 31.05.2025).

15. China is driving the world’s advanced energy solutions deployments. Here’s how. [Electronic resource]. URL: https://www.weforum.org/stories/2025/01/china-driving-advanced-energy-solutions-deployments/#:~:text=China%20has%20been%20the%20leading,)%2C%20and%20sustainable%20aviation%20fuels (date of request 31.05.2025)

16. China’s Nuclear Power Program: A Blueprint for Global Competitiveness. [Электронный ресурс]. URL: https://www.nuclearbusiness-platform.com/media/insights/chinas-nuclear-power-program-a-blueprint-for-global-competitiveness (дата обращения: 30.05.2025).

17. Douglas, Jason, and John Doyle. “China and India’s nuclear strategies.” Irish Studies in International Affairs 25.1 (2014): 73–88

18. Energy Transition Investment Trends. January 30, 2025 BloombergNEF. [Электронный ресурс]. URL: https://assets.bbhub.io/professional/sites/24/951623_BNEF-Energy-Transition-Trends-2025-Abridged.pdf (дата обращения: 20.04.2025).

19. EPR Flamanville 3, the most-powerful generating unit in France. [Электронный ресурс]. URL: https://www.egis-group.com/projects/epr-flamanville-3-the-most-powerful-generating-unit-in-france (дата обращения: 18.07.2025).

20. Glaser, Charles L., and Steve Fetter. “Should the United States reject MAD? Damage limitation and US nuclear strategy toward China.” International Security 41.1 (2016): 49–98

21. Goremyshev A., Kapustkin V. World nuclear energy development trends and Russia’s competitiveness at the global nuclear market // Third International Economic Symposium (IES 2018). – 2019. – p. 57-67.

22. Guo X., Guo X. Nuclear power development in China after the restart of new nuclear construction and approval: A system dynamics analysis // Renewable and Sustainable Energy Reviews. – 2016. – p. 999-1007.

23. How Innovative Is China in Nuclear Power?. [Электронный ресурс]. URL: https://itif.org/publications/2024/06/17/how-innovative-is-china-in-nuclear-power/ (дата обращения: 18.07.2025).

24. Iaea pris. [Электронный ресурс]. URL: https://pris.iaea.org/pris/home.aspx (дата обращения: 14.05.2025).

25. Status and prospects of China sodium-cooled fast reactor. Iaea. [Электронный ресурс]. URL: https://inis.iaea.org/records/4jvr8-tj624 (дата обращения: 20.04.2025).

26. Energy system of China. Iea. [Электронный ресурс]. URL: https://www.iea.org/countries/china (дата обращения: 20.04.2025).

27. The Path to a New Era for Nuclear Energy. Iea. [Электронный ресурс]. URL: https://www.iea.org/reports/the-path-to-a-new-era-for-nuclear-energy (дата обращения: 18.07.2025).

28. World Energy Outlook 2023. Iea. [Электронный ресурс]. URL: https://www.iea.org/reports/world-energy-outlook-2023 (дата обращения: 18.07.2025).

29. Ming, Zeng, et al. “Nuclear energy in the Post-Fukushima Era: Research on the developments of the Chinese and worldwide nuclear power industries.” Renewable and Sustainable Energy Reviews 58 (2016): 147–156

30. Ministry of New and Renewable Energy (MNRE). Annual Report 2022-23. [Электронный ресурс]. URL: https://mnre.gov.in/file-upload/category-wise-annual-reports/annual-report-2022-23.pdf (дата обращения: 16.05.2025).

31. Why the lifetime of nuclear plants is getting longer?. MIT technology review. [Электронный ресурс]. URL: https://www.technologyreview.com/2024/04/04/1090630/old-nuclear-plants (дата обращения: 18.07.2025).

32. Riqiang, Wu. “Certainty of uncertainty: Nuclear strategy with Chinese characteristics.” // Journal of Strategic Studies. – 2013. – № 36.4. – p. 579–614.

33. Small Modular Reactor Market Size, Share, and Trends 2025 to 2034. [Электронный ресурс]. URL: https://www.precedenceresearch.com/small-modular-reactor-market (дата обращения: 31.05.2025).

34. The State Council of the People’s Republic of China. [Электронный ресурс]. URL: https://www.gov.cn/xinwen/2021-03/13/content_5592681 (дата обращения: 18.07.2025).

35. Wang, Qiang. “China needing a cautious approach to nuclear power strategy.” Energy Policy 37.7 (2009): 2487–2491

36. WNISR – Nuclear Power 2023 Updates! Nuclear Reactor Construction‑Starts Drop Again in the World. [Электронный ресурс]. URL: https://www.worldnuclearreport.org/Nuclear-Reactor-Construction-Starts-Drop-Again-in-the-World (дата обращения: 18.07.2025).

37. Wu Y., Bai Y., Song Y., Huang Q., Zhao Z., Hu L. Development strategy and conceptual design of China lead-based research reactor // Annals of Nuclear Energy. – 2016. – № 87. – p. 511-516.

38. Yan Q. Nuclear power development in China and uranium demand forecast: Based on analysis of global current situation // Progress in Nuclear Energy. – 2011. – № 6. – p. 742-747.

39. Yu Sh., Yarlagadda B., Siegel J.E., Zhou Sh., Kim S. The role of nuclear in China\'s energy future: Insights from integrated assessment // Energy Policy. – 2020. – p. 111344.

40. Zeng M. Review of nuclear power development in China: Environment analysis, historical stages, development status, problems and countermeasures // Renewable and Sustainable Energy Reviews. – 2016. – p. 1369-1383.

41. Zhang T. Nuclear power sustainability path for China from the perspective of operations // Science and Technology of Nuclear Installations. – 2022. – № 1. – p. 7557216.

42. Zhou, Sheng, and Xiliang Zhang. “Nuclear energy development in China: a study of opportunities and challenges.” Energy 35.11 (2010): 4282–4288

Страница обновлена: 23.02.2026 в 13:37:57

Download PDF | Downloads: 9

Оценка позиции Китайской Народной Республики на мировом рынке сооружения атомных электрических станций

Goremyshev A.V.Journal paper

Journal of Economics, Entrepreneurship and Law

Volume 15, Number 10 (October 2025)

Abstract:

The article assesses the position of the People’s Republic of China in the world nuclear power plant construction market. The author considers the key aspects of the national strategy of the People’s Republic of China, gives an assessment of the current state and prospects for development of the People’s Republic of China in the world nuclear power plant construction market (medium-term forecast).

The article discusses features of the global nuclear power plant construction market, such as capital investments, new reactor technologies, energy policy and economic factors. Special attention is paid to comparative analysis of the People’s Republic of China with other leading players in the global nuclear energy market. The study shows that China is actively developing its nuclear power industry, striving for leadership in this sphere. This is achieved by means of significant investment in research and development, as well as by means of expansion through extensive investment and by promotion of nuclear technology export and construction of new power units

Keywords: nuclear energy, world economy, world market, nuclear power plant, world energy system, People's Republic of China, NPP

JEL-classification: R11, R12, R13, R58

References:

Aijian, W. A. N. G., and F. A. N. G. Yunlong. “Development Reorientation of China’s Free Trade Zones under the New Development Paradigm of Dual Circulation: On the Reform Path of Free Trade Zones for the High-Quality Development of China’s Economy.” China Economic Transition (CET) 6.2 (2023)

Andrews-Speed, Philip. Nuclear power in China: Its role in national energy policy. Oxford Institute for Energy Studies, 2023

China is driving the world’s advanced energy solutions deployments. Here’s how. [Electronic resource]. URL: https://www.weforum.org/stories/2025/01/china-driving-advanced-energy-solutions-deployments/#:~:text=China%20has%20been%20the%20leading,)%2C%20and%20sustainable%20aviation%20fuels (date of request 31.05.2025)

China’s Nuclear Power Program: A Blueprint for Global Competitiveness. Retrieved May 30, 2025, from https://www.nuclearbusiness-platform.com/media/insights/chinas-nuclear-power-program-a-blueprint-for-global-competitiveness

Douglas, Jason, and John Doyle. “China and India’s nuclear strategies.” Irish Studies in International Affairs 25.1 (2014): 73–88

EPR Flamanville 3, the most-powerful generating unit in France. Retrieved July 18, 2025, from https://www.egis-group.com/projects/epr-flamanville-3-the-most-powerful-generating-unit-in-france

Energy Transition Investment TrendsJanuary 30, 2025 BloombergNEF. Retrieved April 20, 2025, from https://assets.bbhub.io/professional/sites/24/951623_BNEF-Energy-Transition-Trends-2025-Abridged.pdf

Energy system of ChinaIea. Retrieved April 20, 2025, from https://www.iea.org/countries/china

Glaser, Charles L., and Steve Fetter. “Should the United States reject MAD? Damage limitation and US nuclear strategy toward China.” International Security 41.1 (2016): 49–98

Goremyshev A. V., Kapustkin V. I. (2025). Assessment of the role and development trends of nuclear energy in the global energy supply system. Journal of Economics, Entrepreneurship and Law. 15 (8).

Goremyshev A., Kapustkin V. (2019). World nuclear energy development trends and Russia’s competitiveness at the global nuclear market Third International Economic Symposium (IES 2018). 57-67.

Guo X., Guo X. (2016). Nuclear power development in China after the restart of new nuclear construction and approval: A system dynamics analysis Renewable and Sustainable Energy Reviews. 57 999-1007.

How Innovative Is China in Nuclear Power?. Retrieved July 18, 2025, from https://itif.org/publications/2024/06/17/how-innovative-is-china-in-nuclear-power/

Iaea pris. Retrieved May 14, 2025, from https://pris.iaea.org/pris/home.aspx

Ming, Zeng, et al. “Nuclear energy in the Post-Fukushima Era: Research on the developments of the Chinese and worldwide nuclear power industries.” Renewable and Sustainable Energy Reviews 58 (2016): 147–156

Ministry of New and Renewable Energy (MNRE)Annual Report 2022-23. Retrieved May 16, 2025, from https://mnre.gov.in/file-upload/category-wise-annual-reports/annual-report-2022-23.pdf

Petrunin V. V. (2021). Reactor units for small nuclear power plants. Akademiya nauk i atomnaya otrasl. (6). 213-231.

Riqiang, Wu. (2013). “Certainty of uncertainty: Nuclear strategy with Chinese characteristics.” Journal of Strategic Studies. (36.4). 579–614.

Small Modular Reactor Market Size, Share, and Trends 2025 to 2034. Retrieved May 31, 2025, from https://www.precedenceresearch.com/small-modular-reactor-market

Status and prospects of China sodium-cooled fast reactorIaea. Retrieved April 20, 2025, from https://inis.iaea.org/records/4jvr8-tj624

Telegina E. A., Khalova G. O. (2020). World economy and energy at the turn: search for an alternative development model. World Economy and International Relations. 64 (3). 5-11.

The Path to a New Era for Nuclear EnergyIea. Retrieved July 18, 2025, from https://www.iea.org/reports/the-path-to-a-new-era-for-nuclear-energy

The State Council of the People’s Republic of China. Retrieved July 18, 2025, from https://www.gov.cn/xinwen/2021-03/13/content_5592681

Thermal CapacityAris. Retrieved May 31, 2025, from https://aris.iaea.org/Characteristics/

WNISR – Nuclear Power 2023 Updates! Nuclear Reactor Construction‑Starts Drop Again in the World. Retrieved July 18, 2025, from https://www.worldnuclearreport.org/Nuclear-Reactor-Construction-Starts-Drop-Again-in-the-World

Wang, Qiang. “China needing a cautious approach to nuclear power strategy.” Energy Policy 37.7 (2009): 2487–2491

Why the lifetime of nuclear plants is getting longer?MIT technology review. Retrieved July 18, 2025, from https://www.technologyreview.com/2024/04/04/1090630/old-nuclear-plants

World Energy Outlook 2023Iea. Retrieved July 18, 2025, from https://www.iea.org/reports/world-energy-outlook-2023

Wu Y., Bai Y., Song Y., Huang Q., Zhao Z., Hu L. (2016). Development strategy and conceptual design of China lead-based research reactor Annals of Nuclear Energy. (87). 511-516.

Yan Q. (2011). Nuclear power development in China and uranium demand forecast: Based on analysis of global current situation Progress in Nuclear Energy. (6). 742-747.

Yu Sh., Yarlagadda B., Siegel J.E., Zhou Sh., Kim S. (2020). The role of nuclear in China\'s energy future: Insights from integrated assessment Energy Policy. 139 111344.

Zeng M. (2016). Review of nuclear power development in China: Environment analysis, historical stages, development status, problems and countermeasures Renewable and Sustainable Energy Reviews. 59 1369-1383.

Zhang T. (2022). Nuclear power sustainability path for China from the perspective of operations Science and Technology of Nuclear Installations. 2022 (1). 7557216.

Zhou, Sheng, and Xiliang Zhang. “Nuclear energy development in China: a study of opportunities and challenges.” Energy 35.11 (2010): 4282–4288