The applicability of CDS for assessing the solvency of financial institutions in the Russian Federation

Ageev V...1

1 Lomonosov Moscow State University, ,

Скачать PDF | Загрузок: 29

Статья в журнале

Global Markets and Financial Engineering ()

Аннотация:

Quantitative risk measurement is an important part of the process of risk management at commercial banks. Over the last few years, counterparty risk has become one of the most significant factors influencing financial markets. An important aspect in counterparty risk assessment is using estimated spreads of credit default swaps (CDS) for one’s counterparties.

This article considers the possibility of using CDSes for assessing the solvency of financial institutions in Russia. It also provides the definition of CDS and describes the characteristic features of the Russian CDS market.

Ключевые слова: risk management, credit risk assessment models, default, derivative, credit default swap, solvency

Introduction

Credit risk is the risk that a debt securities issuer or a borrower will fail to fulfill their obligations, or that the payments will not be made in compliance with the terms of the agreement. One of the types of credit risk faced by banks every day is counterparty risk. Counterparty risk is the risk that a legal entity with which a financial contract was concluded (i. e. the counterparty) will fail to fulfill its obligations under the contract [1]. The term “default risk” [2] is often used as a synonym of credit risk.

Over the last few years, counterparty risk has become one of the most significant factors influencing financial markets and largely caused the spread of the global financial instability. The growth of its impact is explained by the aggravating crisis of confidence and inadequate risk assessment system.

The traditional methods of counterparty risk assessment in the interbank lending market involve construction of various credit and rating models, as well as using ratings assigned by international rating agencies. An important aspect in counterparty risk assessment for a bank is using the information about the dynamics of credit default swap (CDS) trades for its counterparties.

The main advantage of using CDS is that this instrument is simultaneously and continuously estimated by market participants who pay attention not only to financial statements of a bank, its credit ratings, and other fundamental assessments, but to all the incoming data in a real-time mode. This significantly promotes the opportunities in counterparty risk assessment. This method of assessment with the use of the dynamics of changes of CDS value for one’s counterparties is quite popular in developed markets, and there is very reason to presuppose the growth in popularity of its application on emerging markets, including the Russian one.

This article is structurised as follows: the first section demonstrates that rating assessments are not able to cope with the task of preventing defaults, the second section includes definitions of CDS and specific features of the Russian CDS market; the third section provides a brief analysis of the benefits of using CDS spreads to assess the solvency of financial institutions; and the final section presents the conclusions on the conducted research.

Rating Models do not Work

There is a common practice that the main source of information for any investor are credit ratings assigned by international rating agencies, the best known among which are the three American ones: Standard & Poor’s, Moody’s Investors Service, and Fitch Ratings. The ratings they assign are intended to answer the question, to what extend the rated issuer or instrument is reliable.

Using rating assessment is encouraged by many regulators for assessing credit risks by financial institutions in different countries, including Russia. Thus, for example, according to Basel II (the document issued by the Basel Committee on Banking Supervision which contains recommendations on banking regulations), the standardised approach to credit risk assessment is based on calculating the value of credit requirements by the index assigned to a certain borrower depending on the external credit rating. Much attention is paid to ratings and Basel III.

However, experience has proven that such dependence on external ratings can be dangerous. This is due to political concerns – after all, the three leading rating agencies are American, but we will not consider political risks in detail in this article – and economic ones. The key drawback of ratings is that they are not able to react promptly enough to the change in the financial standing of the issuer or counterparty.

There are real examples when top-rated companies turned out to be on the edge of bankruptcy, but rating agencies reacted only after the event had already happened. The starkest example is, of course, the failure of the Lehman Brothers bank in 2008.

Thus, at the moment of filing a bankruptcy petition by the financial institution to the court – September 15, 2008 – it had been ranked by all the three agencies as follows: “A+” by Standard & Poor’s, “A1” by Moody’s Investors Service, and “A+” by Fitch Ratings. Notably, these ratings were confirmed shortly before it: September 12, 11 and 10, 2008. However, such high rating marks did not save the company from bankruptcy, and its investors – from severe financial losses.

If we talk about such examples in Russia, the most typical one is the history of bankruptcy of the Master Bank (JSB), the banking license of which was revoked on November 20, 2013. At that moment, the bank had quite a high rating – “A” assigned by the Russian rating agency Expert RA recognised by the Central Bank of Russia.

Thus, unfortunately, credit rating agencies are not always able to predict the possibility of crisis situation. Credit ratings must satisfy such important requirements as responsiveness and comprehensiveness of assessment. However, it is not easy to reach a simultaneous satisfaction of these requirements: agencies rarely revise their ratings (averagely, once a year), as the analysis involves not only financial indicators, but also a large amount of non-financial information concerning functioning of the organisation, which demands considerable time expenditures.

Inasmuch as there is a certain time lag between the process of analysing financial data and the moment of rating assignment, the data are likely to get partially outdated. This stresses the importance of an expeditious distance analysis of credit organisations and construction by banks of their own models for expeditious assessment of their counterparties’ financial sustainability.

It is also necessary to mention that by far not all the financial institutions have been assigned credit ratings. Each agency has assigned credit ratings to about a thousand banks. However, given the number of financial institutions in Russia and around the world, it turns out that only the minority of existing banks have been assigned ratings [3].

Thus, there are 875 banks in the Russian banking system, but only 144 of them have a rating mark of at least one international rating agency (Standard & Poor’s, Moody’s Investors Service, or Fitch Ratings) [4]. So, the rating of international agencies is assigned to 16.5 % of Russian banks.

The financial world is on the threshold of appearance of a new paradigm. Nowadays, leading rating agencies offer models that would allow assessing credit risks (in our case, counterparty risks) on everyday basis. The basis of such models is neither corporate shares which 1) are usually not linked to the company itself, but depend on its perception by investors; 2) exist in a relatively limited amount (they do not have so many parameters and expiring date); nor corporate bonds (which act as debt instruments), but credit default swaps, CDS, representing a market instrument of near real-time credit risk assessment.

A significant advantage of CDS is that they are simultaneously and continuously estimated by hundreds of market participants, who pay attention not only to a company’s financial statement, credit ratings, and other fundamental assessments, but to all the newly incoming information. This significantly increases the flexibility in the assessment of credit risks against using ratings and statements.

Thus, we can say that the basic modern methods of credit risk assessment in the interbank lending market consist in constructing various models and using ratings assigned by international credit rating agencies. An important aspect in counterparty risk assessment for a bank is using the information about the dynamics of credit default swap (CDS) trades for its counterparties.

CDS: Definition and Benefits

Credit default swap is (CDS) is a credit derivative represented by a contract under which one party – protection seller or buyer of potential losses – receives periodic payments (fee) from the other party – protection buyer or seller of potential losses – and pays a previously agreed lump-sum (usually quarterly) on occurrence of the credit event upon which the contract was made. The protection seller shall compensate the difference between the nominal debt value and its market value after the credit event to the buyer.

Using CDS, a bank can insure its credit risks without selling its credit portfolio and issuing additional bonds. This explains the main and most important feature of credit derivatives, which consists in isolating credit risk from changes in interest and exchange rates. There are also benefits for protection sellers. They have an opportunity to set the requirements on necessary credits at their own discretion. Therefore, they are able to establish credit requirements which are difficult to access because of, for example, legal restraints or other regulatory aspects.

Certain debt instruments issued by a bank, company or state can be the insurable interest. An insured event for implementing CDS is usually a default on obligations or debt restructuring. If an insured event occurs, a physical settlement takes place (the protection buyer transfers the defaulted asset to the buyer and receives compensation for it) or a monetary one (the protection seller pays the difference between the market value of the defaulted asset and its nominal value to the buyer) [5].

It is worth noting, that CDS are not necessarily created for existing instruments; CDS contracts on Russian Eurobonds, the terms of execution of which are not linked to certain issues, are traded in the over-the-counter market.

Many economists claim credit derivatives to be the most significant aspect of financial risk trade [6]. It is exactly derivatives that help to make an important step to the “perfect” market and effective risk sharing [7].

Russian CDS Market

In Russia, there is a CDS market of corporate and bank debt instruments; there are also Russian sovereign debt CDS market and regional debt market (at the moment, only Moscow is presented in this sector). However, the CDS market is predominantly represented by foreign investors. Currently, there are CDSes on those Russian companies only, which issue Eurobonds. Moreover, CDSes exist only on 20 such companies out of about 150.

Among the companies, debt CDSes of the following issuers are the foremost: Oil Transporting Joint-Stock Company Transneft, OJSC ALROSA, OJSC Gazprom, OJSC Lukoil, JSC Russian Railways, Severstal, Alfa Bank JSC, The Bank of Moscow (CJSC), Gazprombank (JSC), JSC VTB Bank, OJSC Russian Agricultural Bank, Sberbank of Russia OJSC, and Vnesheconombank.

The point needs to be made, that despite the fact that the Russian market falls behind the global derivatives market almost in all parameters, it still demonstrates one of the highest growth rates at the global level.

Though, for all its growth, the market is still structurally undeveloped – the lion’s share of its volume consists of simplest instruments. The market has significant growth potential; however, to ensure its development, a qualitative change of the situation in the stock market is needed, so that the traded instruments be in high demand. In addition, large limits between counterparty banks are necessary, but currently they are absent due to the lack of confidence and adequate methods for counterparty analysis and risk assessment.

Successful development of the derivatives market in Russia requires a more flexible regulation complying with international standards. The Repository and central counterparty newly available in the Russian market are important steps towards the progressive development; they will allow to register all derivatives transactions and to ensure payments. The Russian derivatives market should continue its integration in the global one.

The dynamics of CDS spread changes in Russia and in the world

Let us look at the dynamics of CDS spread changes in some financial institutions and countries and compare it with how the ratings of international rating agencies changed at the same time. It should be noted, that since CDSes are traded in the over the counter market, there are several specialised agencies providing information on the dynamics of CDS spread changes. In our case, we will use the data provided by the Thomson Reuters agency.

First, let us look at the changes in 5-10-year CDS spreads on Russian debt. The analysed period is the year from August 2013 to August 2014.

Figure 1. The dynamics of changes in 5-10-year CDS spreads on Russian debt.

Source: Thomson Reuters

It must be specified, that the political factor plays a significant role in risk assessment with regard to the Russian Federation; it also influences the macroeconomic prospects of the country, and the whole dynamics of CDS spread changes reflects the assessment of risks for Russia made by investors with due account of the political factor. The diagram shows that CDS spreads and, hence, the risk assessment reached the maximum value at the end of the first quarter of 2014. Then, after a short period of time when the value of CDS spreads decreased, an upward trend can be observed again. The maximum value of CDS spreads fell on March 21, 2014 when the 5-year CDS spread amounted to 283.35 basis points, and the spread of the 10-year CDS – 388.07 basis points.

While the rating marks of international rating agencies remained unchanged on March 21, 2014, and the S&P and Fitch agencies validated their marks on March 20 and 21 respectively – “BBB” from S&P, “Baa1” from Moody’s, and “BBB” from Fitch – we see a significant reassessment of risks by investors.

On the other hand, it is worth noting, that when the rating changed after all – on April 25 the S&P agency downgraded Russia’s rating to “BBB-” – CDS spread reacted on this event as follows: the value of 5-year CDS changed by 17.45 basis points (+6.6 % growth), and the value of 10-year CDS – by 15.91 basis points (5,1 %). Notably, spreads did not change so significantly before or after that date, but the trend to considerable growth started some time before S&P downgraded the rating.

As we can see, despite the fact that the ratings have not changed significantly during the given period (only one rating mark has been changed), the overall risk assessment by investors related to Russia has changed considerably: the 5-year CDS spread increased by 66.7 basis points (33.6%) over the year, 10-year 5-year CDS spread – by 159.5 basis points (86.2 %). Note that the 10-year spread changed more substantially.

As a comparison, look at the dynamics of changes of the 10-year spread on the debt of another country within the BRICS group – Brazil, the economic status of which is often compared with Russia’s.

Figure 2. The dynamics of changes in 10-year CDS spread on Brazilian debt.

Source: Thomson Reuters

First of all, it is to be noted that the level of risk assessment for Brazil is lower, as compared to Russia. The value of 10-year spread as of July 31, 2014 amounted to 214.91 basis points (Russia had 344.5 basis points), while a year earlier – on August 2, 2013 – it had been higher than the similar indicator of Russia: 220.93 basis points for Brazil against 185 basis points for Russia. The maximum value of CDS spread on Brazilian debt for the specified period (August 2013-August 2014) fell on January 27, 2014 – 264.67 basis points.

During the period under consideration, the rating of Brazil had been changed once. On March 24, 2014 S&P downgraded it by one step to “BBB-”. However, the response of CDS spread was opposite – it continued decreasing: -5.92 basis points (2.5 %). It is to be reminded that after Russia’s rating had been changed, CDS spread increased substantially.

Thus, the value of CDS spread on Brazilian debt did not changed significantly over the year: -6.02 basis points (2.7 %). The probability of default decreases, which is especially noticeable against the background of its growth relative to Russia. Perhaps, an important role in this was played by the success of the football FIFA World Cup held in Brazil. The deliberate increase in the probability of default in late July – early August 2014 can be explained by default in the neighbouring Argentina, which cannot escape the attention of investors.

Let us now turn to comparing the dynamics of changes in CDS spreads on Russian and European financial institutions depending on revision of their ratings by international rating agencies. But first, it should be said that there is a high level of correlation between the dynamics of CDSes values for Russia and Russian financial institutions. Coefficients of this correlation for the two largest Russian banks – Sberbank of Russia OJSC and JSC VTB Bank – are presented in Table 1.

Table 1

Coefficients of the correlation between CDS spreads on Russian sovereign debt and spreads on Sberbank of Russia and VTB Bank

|

CDS pairs

|

Correlation coefficient, %

|

|

Russia – Sberbank of

Russia

|

98.99%

|

|

Russia – VTB

Bank

|

96.73%

|

As far as Russian financial institutions are concerned, VTB Bank is of main interest for our analysis, since, firstly, CDSes on its debt are one of few liquid ones among Russian companies, and, secondly, its ratings have been downgraded by all the three international agencies over the last year.

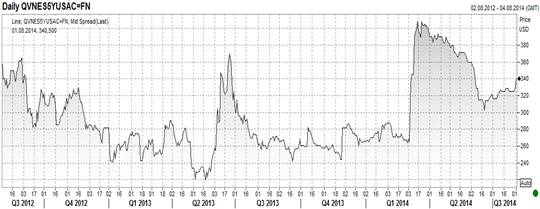

Let us consider the dynamics of 5-year CDS spread changes for the period from August 2012 to August 2014.

Figure 3. The dynamics of changes in 5-year CDS spread on the debt of JSC VTB Bank

Source: Thomson Reuters

The CDS spread on VTB Bank reached its maximum value on March 14, 2014 – 430.46 basis points. Let us now look at how it changed after the bank’s rating had been revised. On January 10, 2014 the Fitch agency downgraded the rating of VTB Bank to “BBB-” – a slight increase of spreads (less than one basis point); on April 28, 2014 S&P did the same – spreads grew by 21.36 basis points (5.3 %); finally, on July 5, 2014 Moody’s downgraded the bank’s rating to “Baa2” – a slight decrease of spreads (less than one basis point).

Some time before the decision to change the ratings was announced, spreads had been rapidly growing. This may indicate, on the one hand, that the reaction of rating agencies is somehow late, and on the other hand, that investors expected a downgrade in the rating when assessing CDSes, as such a scenario was predictable.

Note that the most rapid growth was observed in early March (63.61 basis points a week, 21.6%), in the mid of April (51.96 basis points, 14.1%), and in late July (73.8 basis points, 21.7%); and this growth was not directly linked to revision of the ratings. It means that the rating agencies reacted to the development of the situation and the increase of the probability of default of VTB Bank significantly slower than CDS spreads.

Let us see how rating changes are interconnected with CDS spreads in countries with a stable economy. Below is the dynamics of CDS spreads on large European banks BNP Paribas S.A. and UniCredit S.p.A.

Figure 4. The dynamics of changes in 5-year CDS spread on the debt of BNP Paribas

Source: Thomson Reuters

Figure 5. The dynamics of changes in 5-year CDS spread on the debt of UniCredit

Source: Thomson Reuters

The dynamics of CDS spread changes for these two financial institutions is similar. The ratings of BNP Paribas were revised on July 17, 2013, when the Fitch agency downgraded the bank’s rating to “A+”. It is to be mentioned that by that date, CDS spreads had already been decreasing during some period, and on the date of the rating downgrade spreads slightly increased by 2.31 basis points and then continued falling. Thus, from the investors’ point of view the probability of default decreased.

In case of UniCredit, the rating changed on March 21, 2014; it was downgraded by the Moody’s agency to “Baa1”. The situation is absolutely identical to that of BNP Paribas: on the date of announcement of the decision to downgrade the rating, spreads marginally grew by 4.96 basis points (3.3 %) and then continued decreasing.

Thus we can say that firstly, the impact of ratings on Russian financial institutions and sovereign Russian debt is more significant than the impact on European financial institutions. Secondly, ratings do not reflect the whole picture of risk assessment; and the dynamics of changes in the value of CDS spreads allows to track investors’ assessment of risks for a country or financial institution timelier. Arguably, rating agencies react to changes of the situation with some delay.

So, when assessing one’s counterparty, it seems useful and appropriate to use information on the dynamics of CDS trade for this counterparty. These data can be helpful and will allow for a quick response to the situation of occurrence of problems he may experience or substantial aggravation of the state of affairs. And of course, we should not reject the traditional methods of risk assessment including ratings assigned by international rating agencies.

Conclusions

For any financial institution or company it is important to assess the risks of their counterparties as accurately and effectively as possible in order to minimise the risk undertaken and increase the profitability of transactions conducted. Unfortunately, external ratings assigned by international rating agencies are not always able to predict the possibility of crisis situation. Inasmuch as there is a certain time lag between the process of analysing financial data and the moment of rating assignment, the data are likely to get partially outdated. This stresses the importance of an expeditious distance analysis of credit organisations.

For these purposes, it is effective to use data on the dynamics of CDS spreads on one’s counterparties. The advantage of CDSes is that they are simultaneously and continuously assessed by hundreds of market participants, who take account of all the relevant information available. The results of using the data on CDS spread dynamics will allow to raise the effectiveness of determining the reliability of one’s counterparties.

External credit ratings are traditionally based on fundamental indicators taken from financial statements of companies and banks, while the data on CDS are market indicators in their pure form. Further studies imply an attempt of combining the fundamental assessment with the market one. Models based on the data of financial statements and everyday changes of existing CDS spreads will allow for construction of theoretical spreads on the financial institutions, CDSes on the debt of which are not traded in the market.

The construction of such models will contribute to improving the existing risk assessment models and allow to answer the questions about the conformity of market data on CDS with the fundamental indicators and the applicability of CDS data for assessing risks related to all one’s counterparties.

With due account of all necessary corrections, this will allow to cover almost all Russian banks. This model will timely response to all significant changes, since it will be recalculated every day. Its purpose is the same as that of rating models: to assess the probability of default of one or another counterparty.

The results of the model constructed will help to increase the effectiveness of determining the reliability of counterparties of Russian financial institutions and companies.

[1] Farlex Financial Dictionary. 2012 Farlex, Inc.

[2] Dictionary of Financial Terms. 2008 Lightbulb Press, Inc.

[3] Standard & Poor's: http://www.standardandpoors.com/ru; Moody’s: https://www.moodys.com; Fitch Ratings: http://www.fitchratings.ru/ru.

[4] Data as at July 1, 2014.

[5] http://www.econorus.org.

[6] Cossin D., Pirotte H., Advanced credit risk analysis, JOHN WILEY & SONS, LTD, Wiley Series in Financial Engineering, 2001.

[7] Abid F., Naifar N., The determinants of credit default swap rates: An explanatory study, University of Sfax, UR, YieldCurve.com e-Journal, 2005.

Страница обновлена: 18.02.2026 в 22:44:30

Download PDF | Downloads: 29

.

. ....Journal paper

Global Markets and Financial Engineering

Abstract:

.

Keywords: .