Credit rating of municipal formations: methodological approaches of international rating agencies

Vasilyev M...1, Prakhov I...2, Tuktarov Y...3

1 Guild of Investment and Financial Analysts, NPO, ,

2 Russian Presidential Academy of National Economy and Public Administration, ,

3 LEKAP legal firm, ,

Статья в журнале

Global Markets and Financial Engineering ()

Аннотация:

The paper presents a comparative review of approaches to the analysis of bond investment risk of municipal formations from the point of view of leading rating agencies. The consolidated map of municipal formations’ risks is also built.

Ключевые слова: investment risk assessment, issuer rating, municipal formation, bond loan, municipal bonds, securitization

Introduction

The municipal bond issue market in the Russian Federation was developing fast until the 2007–2008 crisis. Nowadays, there is a limited number of players present on this market. One reason for the weak development is the difficulty in evaluating credit risks for those bonds. The goal of that work is to demonstrate the review of approaches used by rating agencies (hereinafter referred to as «RA») regarding the credit risk evaluation.

Our approach is based on the primary study of the previously developed approaches to the evaluation of the municipal bond investment risk and then the transition to the analysis of municipal units (hereinafter referred to as «MU») in terms of industrial sections, their size and other characteristics. Currently, there are widely accepted methods for the MU investment risk evaluation that belong to the top-3 RA with legal credentials on the RF territory: Fitch, S&P and Moody's.

We will make a brief review of the methods used by each RA and also build up the balanced risk map based on it. This result is absolutely necessary for a further analysis of possible ways to increase the municipal loans' investment attraction, since the obtained risk map will be the basis to study the data for individual MU. There’s will be also a chance to quickly obtain the primary idea of the risk-related issuer environment.

Analysis of MU Rating Methods

In the light of the previous financial and debt crises, there was a clear mistrust to the top-3, which resulted in a renewal of the rating methods. The main amendments were made in order to increase the transparency of the rating system and also to make this system flexible enough to allow the introduction of expert corrections that don't require the metric ground.

The problem in creating rating methods for public-law entities (hereinafter referred to as «PLE») of different levels except the sovereign one, is solved in top RA on the consolidated basis, i.e. the unified rating system for the whole PLE hierarchy including MU is created. Due to the main uniformity of the information available for RA, the basics of methods used by three RA are mostly similar, which makes their comparative analysis more difficult; hence, the work also provides a general review of these RA's methods.

Methods of S&P

The key of this method is the analysis of the MU's institutional environment, as well as of the individual credit profile. These two modules constitute the primary credit score which is further corrected in accordance to the established override rules.

Analysis of the Institutional Environment

The evaluation of MU's institutional structure involves the analysis of legal and regulatory environments. The key determinants for evaluation are: 1) predictability (25%); 2) balance of income and expenditure (50%); 3) system transparency (25%).

1) Predictability mirrors the frequency and the level of changes that occurred at the time of roles and areas of responsibility distribution within the power hierarchy, as well as distribution of incomes between PLE of different levels.

2) Balance of income and expenditure is considered within the context of income sufficiency to cover the balance expenditure categories, the presence of the fiscal system that applies reasonable limits the volumes of loans and control systems, as well as the presence of the opportunity to get the non-system support from senior authorities.

3) Transparency of the system determines the level of reliability and control under the published data, transparency of the budgeting process as well as standards for disclosure of the information about public finances.

All these factors are submitted to a qualitative evaluation: each of them obtains a grade corresponding to the claimed requirements (the less the better). These grades are according to the previously mentioned scales and are translated into the discreet scale from 1 to 6.

Individual Credit Profile

PLE individual credit profile is the balanced financial metric from 7 determining factors: 1) economy (20%); 2) financial management (20%); 3) budget flexibility (10%); 4) budget sustainability (10%); 5) liquidity (20%); 6) debt load (10%); 7) contingent liabilities (10%).

1) The economy evaluation demonstrates in what way the economic factors will most likely influence the ability of MU to generate profits, as well as the need for capital during the medium-term and long-term period and, accordingly, the ability to service its debt.

2) The evaluation of financial management demonstrates what effect the financial management and the political environment will have on MU’s tendency and ability to service its debt.

3) The evaluation of the budget flexibility clarifies to what extent the incomes may be increased, or expenditure may be decreased if the issuer happen to be certainly able to service its debt.

4) The evaluation of the budget sustainability demonstrates the level and susceptibility to fluctuations of the money flows that were used to service the MU's debt from the transactional and investment activity. There’s also an estimation regarding the effectiveness of the financial policy.

5) The evaluation of liquidity reflects how both the internal and external liquidity sources influence MU’s ability to service its debt.

6) The evaluation of debt load presents the amount, structure and sustainability of MU loans within the context of the ability to service these liabilities.

7) The evaluation of contingent liabilities is the measure of non-system risk probability, exposition for these risks and the ability of MU, despite this risk realization, preserving the ability to pay its debt in medium-term and long-term periods.

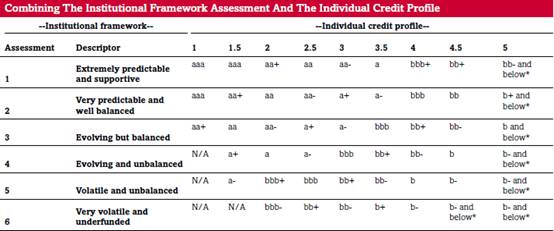

According to the scales described below, the total grade formed is the individual credit estimation for the scale from 1 (the best grade) up to 5 (the worst grade). According to the evaluation of the institutional environment and the scheme given in Figure 1, this score forms the basic rating evaluation.

Figure 1. The system of comparison of the institutional system

and the individual credit profile

The obtained basic credit rating can be amended if some indicator significantly deviates for expected levels.

Moody’s Method

Moody’s Method has a block structure and is based on two blocks: idiosyncratic risks and systematic risks. These blocks form the basic credit evaluation of the object. The basic credit evaluation is the ground for a future rating formed as a result of adding the block for the non-system support of the senior authority.

Individual Risk

The block of idiosyncratic risk forms the main idea of the risk characteristic of MU and is divided into 4 groups of MU activity indicators: 1) economic indicators (20%); 2) institutional environment (20%); 2) financial effectiveness (30%); 4) management (30%).

1) The economic indicators reflect the reliability and sustainability of the future income.

2) The institutional environment embraces intergovernmental relations and the type of authority.

3) The financial effectiveness mirrors MU’s ability to organize its policy in such way that the proper structure of income and revenue can be built upon the economic environment in which the issuer acts.

4) The metric of management is responsible for the quality of the taken financial resolutions, their execution, the financial management practice and transparency of the disclosed results.

All metrics are estimated upon the 9-ball rating scale and summed up with the previously mentioned scales. The total grade of idiosyncratic risk is the discreet grade on the scale from 1 (the smallest risk) to 9 (the greatest risk).

Systemic Risk

Systemic risk measures general risks that can belong to MU's sustainability or are related to its operational environment. This risk within the rating scale is equal to the rating of the country's sovereign bonds.

Basic Credit Risk and Its Corrections

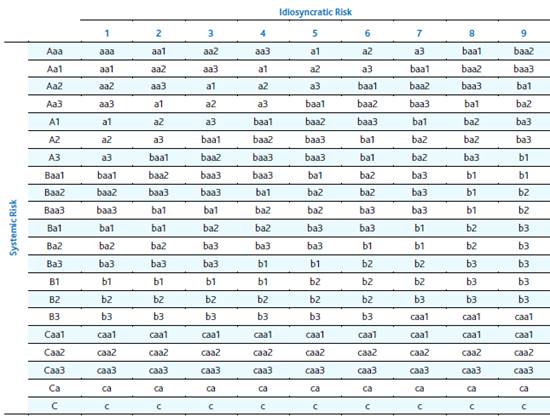

Basic credit rating is formed upon the results from the reduction of idiosyncratic and systemic risk evaluation. These two risk components are aggregated in accordance to the principle presented by Figure 2.

Figure 2. Correlation structure of idiosyncratic and systemic risks

The obtained basic MU credit rating is further amended for unaccounted special trends witnessed for MU.

Non-system Support

The total rating is created after adding the non-system support block to the corrected credit rating. Unlike standard metrics, the score for this block builds the scale of total rating values: the higher the score is, the greater the area of the total rating acceptance is, in the scale from the corrected credit rating to the sovereign rating. The choice of the total rating in this area is expert. The calculation of estimation for the support probability is meant for three categories: the institutional environment, the historical behaviour of the senior authority and individual features, at that, 60% of the absolute weight are factors of the institutional environment.

FITCH Method

Fitch method is built upon the “snowball” principle that allows to take into consideration the interconnections between different blocks of metrics and indicators. The main focus is on the block of institutional environment around which 4 remaining blocks are built: debt and long-term liabilities, economic indicators, financial/fiscal effectiveness, management and administration.

Institutional Environment

The metric of institutional environment is essential for the entire method and can have a significant impact on the internal credit profile of the issuer. This metric covers such aspects as income and expenditure profile, areas of the issuer's responsibility, the accounting policy and control, intergovernmental relations, funding and equalizing mechanisms.

Debt and Long-Term Liabilities

The debt load is the main component to evaluate the issuer's credit quality. The metric of debt and long-term liabilities stresses out the current liabilities and their acceptability within the context of the development strategy and expected future trends, as well as their permissibility and flexibility.

Economic Indicators

The economic markers are used to reflect the general sufficiency of the issuer's economic base, in order to support equation of transactions, debt repayment and also to estimate the need for capital expenditures.

Financial/Fiscal Effectiveness

Fiscal results will most likely reflect the funding sources of capital expenditures and the need for extra loans.

Management and Administration

The metric of management and administration can be viewed as the linking and correcting element of the previously mentioned metrics. The highlighting of estimation is made on the correspondence of the existing resources to the management practices and the issuer's environment.

Distribution of weights for blocks in the Fitch Method is not detected. On the basis of the method's structure, the block of institutional environment will possess a major weight. All the remaining blocks presumably have almost similar weights.

Consolidated Figure of MU Risk Map

Primary Analysis of RA Top-3 Methods

The brief review of PLE rating methods used by the top 3 RA that was previously provided allows to carry on to the analysis of MU’s risk environment, on its basis. The subjects of this analysis will be the risk factors that constitute this or that credit rating. Moreover, it’s necessary to stress more significant determinants in RA methods for the narrow determination of the credit support programs’ priorities, in order to increase the chances for their implementation. To achieve this goal, it’s necessary to create a solid map of credit results.

Due to several issues, like the absence of some factor scales, etc., it’s necessary to develop methods for the rating consolidation process as the list of principles.

The Method of Consolidated Score

The Principles of crediting rating consolidation:

· Block-based approach.

· For the Fitch Method, the following weight subdivision of blocks is applicable: 40%–15%–15%–15%–15%.

· Within all blocks in the Fitch Method, we assume that the share division of risk factors is proportional.

· RA weights in the consolidated rating system: S&P=40%, Moody's=34% and Fitch=26%.

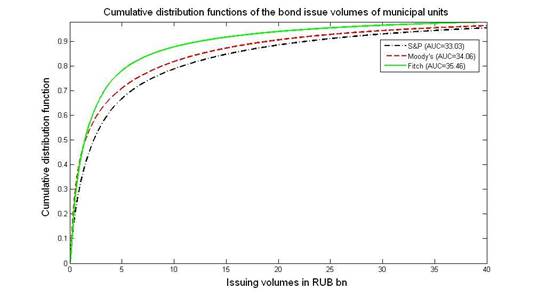

Within the analysis of RA's activity on the RF market, we have taken the historical data for issues of municipal bonds up to May 2015, further formed in the target sample and including the data reflecting the fact of rating.

The result of the analysis is the diagram (Figure 3) that reflects the distribution of RA's activity.

Figure 3. Cumulative distribution functions of the bond issue volumes of municipal units

As demonstrated by the diagram, while cumulative distribution functions for Moody's and S&P can be called close, the distribution for Fitch deviates significantly. As it can be seen in the diagram, the S&P curve is strictly more preferable to the first stochastic dominance (the diagram is below the rest).

· We don’t take in consideration the difference in credit scales, because the Protocol of Meeting of Expert Board for RA Activity dating from November 25, 2011, established the precise correlation of rating evaluations and, in case it’s linear, the linear operations that we carry with the ratings won’t cause the shift.

· We don’t consider the difference within evaluating qualitative facts. The main point here is the monotony related to the improvement of the issuer's credit environment.

· We reserve the right of aggregating individual risk factors. For the correlation of methods, the related concepts will be aggregated, allowing to create the general Figure of the risk environment.

· The big blocks are completed mostly in accordance to the majority principle (present in at least 2 methods), as well as to the principle of scale specification. The risk factors that don't belong to any big block, will be included in the block named «Other Risks».

· The block of non-system support will be fully borrowed from Moody's method. It’s also true of the method of its accounting in the consolidated rating. The single Moody's method contains accurate guidelines for the evaluation of the non-system support.

· Scenarios of ratings higher than the sovereign one aren’t included.

· The systematic risk in Moody's method is taken into consideration with the weight of 70%. The weight of the institutional environment in the S&P method is 15%. These weights have been acquired upon studying of rating correlation tables previously provided.

· The Mutual influence of risk factors is obviously not taken into consideration.

· All expert corrections are formed on the basis of the non-system support block. We assume that expert corrections will be in the direct and immediate dependence on the score for this block.

Formation of Consolidated Risk Blocks

Global blocks in methods of the top-3 RA:

Table 1

Grouping of global blocks of risk factors

|

S&P

|

Moody’s

|

Fitch

|

|

Institutional

environment (weight 15%)

|

Economic

indicators (weight 6%)

|

Institutional

environment (weight 40%)

|

|

Economy

(weight 17%)

|

Institutional

environment (weight 6%)

|

Debt

and long-term liabilities (weight 15%)

|

|

Financial

management (weight 17%)

|

Financial

effectiveness (weight 9%)

|

Economic

indicators (weight 15%)

|

|

Budget

flexibility

(weight 8.5%) |

Management

(weight 9%)

|

Financial/fiscal

effectiveness (weight 15%)

|

|

Budget

sustainability (weight 8.5%)

|

Systematic risk (weight 70%)

|

Management

and administration

(weight 15%) |

|

Debt

load

(weight 8.5%) |

Non-system

support

|

–

|

|

Contingent

liabilities (weight 8.5%)

|

–

|

–

|

|

Liquidity

(weight 17%)

|

–

|

–

|

The Table 1 shows groups of risk factors blocks to build a consolidated rating system. The rating described above will presumably set up the basic credit rating that will be further corrected – this considering the score of non-system support.

Institutional Environment. Within this block, let's stress three main risk factors: the predictability of roles and the area under the issuer's responsibility, sufficiency of income and expenditure balance, and system transparency.

Economic Indicators. The main factor for all methods is the regional level of GDP per capita.

The Block of Financial Effectiveness. This block is constituted in the most integral way. While regarding the S&P method, it simultaneously includes blocks of budget flexibility and sustainability, the debt load, liquidity, contingent liabilities. In the other hand, regarding the Fitch method, it also includes two blocks at once: financial/fiscal effectiveness and debt/long-term liabilities.

The Block of Financial Management. Regarding this block of risk factors, only a long-term planning is indicated in all methods.

The “Other Risks” Block. The block of other risks consists of the systematic risk for Moody's method. It allow us to be aware of this individual factor, which has a rather significant weight.

The Block of Non-System Support. According to our method, this block doesn't possess its own isolated rating, but it does carry an important role. The setting-up of the rating acceptance area mirrors our approach to expert corrections, their significance and probability.

Consolidated Map of MU Risks

We present the entire structure of the formed risk map in the following table (Table 2).

Table 2

Consolidated Risk Map

|

Risk

Determinates

|

Weight

of S&P

|

Weight

of Moody’s

|

Weight

of Fitch

|

Consolidated

weight

|

|

Block

of Institutional Environment

|

15%

|

8.25%

|

40%

|

19.21%

|

|

· Predictability

of roles

and areas of responsibility |

3.75%

|

2%

|

16%

|

6.34%

|

|

· Sufficiency

of income

and expenditure balance |

7.5%

|

2%

|

8%

|

5.76%

|

|

· Transparency

of the system

|

3.75%

|

4.25%

|

16%

|

6.34%

|

|

Block

of Economic Indicators

|

17%

|

6%

|

15%

|

12.74%

|

|

· GDP

per capita in the region

|

4.25%

|

4.2%

|

3.75%

|

4.10%

|

|

· Evenness

of employment

in the region |

4.25%

|

1.8%

|

–

|

2.31%

|

|

· Growth

prospects

|

4.25%

|

–

|

3.75%

|

2.68%

|

|

· Socioeconomic/demographic

profile

|

4.25%

|

–

|

3.75%

|

2.68%

|

|

· Tax

burden of the population

|

–

|

–

|

3.75%

|

0.97%

|

|

Block

of Financial Effectiveness

|

51%

|

9%

|

30%

|

31.26%

|

|

· Market

risks

|

8.5%

|

1.125%

|

3.75%

|

4.76%

|

|

· Performance

margin

|

8.5%

|

1.125%

|

5%

|

5.08%

|

|

· Debt

load/flexibility

|

–

|

2.25%

|

5%

|

2.07%

|

|

· Liquidity

|

17%

|

2.25%

|

3.75%

|

8.54%

|

|

· Debt

structure (Refinance risk)

|

8.5%

|

2.25%

|

3.75%

|

5.14%

|

|

· Contingent

liabilities

|

8.5%

|

–

|

3.75%

|

4.38%

|

|

· Periodicity

of income

|

–

|

–

|

5%

|

1.3%

|

|

Block

of Financial Management

|

17%

|

6.75%

|

15%

|

12.99%

|

|

· Political

and management power

|

5.1%

|

–

|

5%

|

3.34%

|

|

· Long-term

planning

|

3.4%

|

2.25%

|

5%

|

3.43%

|

|

· Income

and expenditure management

|

3.4%

|

–

|

5%

|

2.66%

|

|

· Debt

and liquidity management

|

3.4%

|

2.25%

|

–

|

2.13%

|

|

· Management

of municipal units

|

1.7%

|

–

|

–

|

0.68%

|

|

· Internal

control

|

–

|

2.25%

|

–

|

0.76%

|

|

Other

Risks

|

–

|

70%

|

–

|

23.8%

|

|

· Systematic

risk

|

–

|

70%

|

–

|

23.8%

|

|

Block

of Non-System Support

| ||||

|

Total

|

100%

|

100%

|

100%

|

100%

|

Conclusion

Based on this review, the consolidated risk map that has been built will allow to obtain the primary approach to the analysis of the data for individual MU. This risk map also provides the primary approach to the areas of MU's activity for which the credit support program will be most effective. We also must state that there are rating areas which cannot be covered by the credit support program and that their weight is rather significant (for instance, the systematic risk).

Страница обновлена: 22.01.2024 в 18:53:34