A review of theoretical approaches to financial analysis

Zeynalli Elay Jalal1

1 Azerbaijan State Agricultural University, , Гянджа

Скачать PDF | Загрузок: 44 | Цитирований: 1

Статья в журнале

Креативная экономика (РИНЦ, ВАК)

опубликовать статью | оформить подписку

Том 14, Номер 10 (Октябрь 2020)

Эта статья проиндексирована РИНЦ, см. https://elibrary.ru/item.asp?id=44385933

Цитирований: 1 по состоянию на 26.03.2022

Аннотация:

In a market economy full of uncertainties, it is not enough just to measure financial indicators such as assets, sales, or profits to assess the performance of an enterprise. Determining the efficiency of the enterprise is already possible by taking into account all the factors that make up this activity, and evaluating the specific relationship between them. In order to make the right decisions on financial management of the enterprise, it is necessary to approach different events and processes separately, evaluate the factors affecting it and interpret the results correctly, in short, use the capabilities of financial analysis. The scientific novelty of the presented article is the study of the approaches of researchers from countries with different levels of economic development, such as Azerbaijan, Turkey, Russia and the United States, on the nature, goals and objectives, types and users of financial analysis, and considers the scientific basis of their \"narrow\" and \"broad\" approach to analysis, compared by assessing the similarity with the economic conditions of the modern period. In this context, the developmental genesis of analysis, as well as financial analysis and economic analysis has been examined in general. The article may be of interest to researchers conducting research on the theoretical foundations and modern approaches of financial analysis.

Ключевые слова: economic analysis, internal and external financial analysis, users of financial analysis

JEL-классификация: G30, G39, O16

Introduction

Analysis is one of the main methods of cognition of the surrounding world. Analysis, which in Greek means “decomposition, dismemberment”, is the division of the object under study into its components and their study in context.

Analysis as a method of scientific knowledge, along with economics, is a method of researching other sciences, such as mathematics, medicine, chemistry, philosophy. From this point of view, there are different types of analysis, one of which is economic analysis.

Economic analysis is the division of economic events and processes into their components and the determination of the influence of each part on the change in the state of the object under study as a whole, as well as an understanding of connections and dependencies. That is why economic analysis provides the collection, processing, understanding, reasoning, strategic and factual decision-making, as well as regulation of information [8] (Liferenko, 2010). Thus, analysis has become a function of management as an element of economic decision-making.

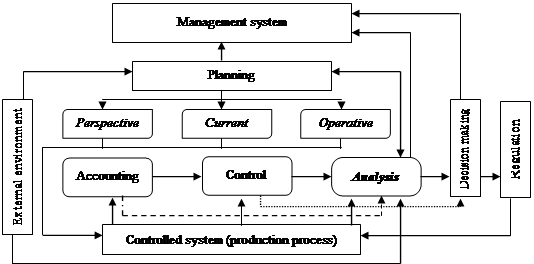

Figure 1. Relationship of management functions

Source: [13] (Selezneva, 2012)

Proper management, as shown in the figure, depends on interrelated functions. In a market economy, effective management requires effective use of the resource potential of the facility. Analysis provides an assessment of the results obtained and the identification of influencing factors, as well as the detection of errors and omissions.

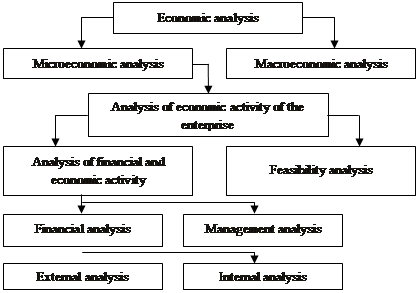

So far, there is no unified approach to the structuring and classification of types of economic analysis. However, in general, economic analysis is divided into micro- and macroeconomic analysis, depending on the level of the object under study. Modern research examines economic analysis at the microeconomic level, taking as the basis for the analysis an assessment of the activity of an economic entity. A distinction is also made between the concepts of the analysis of the financial and economic activities of the enterprise and the feasibility study. The analysis of financial and economic activities is aimed at a comprehensive assessment of all aspects of the enterprise, improving financial results and economic efficiency of production. A feasibility study is carried out by specialists of the technical service of the enterprise in order to assess the impact of technical processes on the results of the enterprise. Let’s pay attention to the Figure 2.

![]()

Figure 2. Classification of economic analysis

Source: compiled by the author.

In a market economy, economic analysis is divided into two areas: financial and management, in terms of goals and sources of information.

The work of many scientists and researchers is devoted to the theoretical and practical issues of financial analysis. Y.K.Yalkin [18] (Yalkın, 1981), the history of financial analysis and the development of financial statement analysis, K.R. Subramanyam [16] (Subramanyam, 2014)has done valuable research on modern methods and procedures of financial statement analysis. The leading representatives of the Russian school of economics have a great role in studying the theoretical foundations of financial analysis as a science. Among these, A.D. Sheremet, E.V. Negashev, R.S. Sayfulin [15] (Sheremet, Sayfulin, Negashev, 2000) approached financial analysis in a "narrow" framework and V.V. Kovalev [6] (Kovalyev, 2010) and O.V. Efimova [3] (Efimova, 2010) emphasized the importance of financial analysis in their research. Turkish researchers such as A. Çabuk, İ. Lazol [2] (Chabuk, Lazol, 2018) and N. Akdogan [11] (Akdoghan, Tenker, 2010) should also be mentioned on the subject.

The essence and purpose of financial analysis

Financial analysis is an analysis aimed at assessing the efficiency, financial condition and results of an enterprise based on financial information.

The development of financial analysis began in the 19th century, when banks operating in the United States began to require financial statements from customers.

On February 9, 1895, the New York State Banking Association decided to require "signed" financial statements to assess the demand for credit and began an analysis to "assess creditworthiness" [18] (Yalkın, 1981). From that moment, empirical pragmatists, statistical financial analyzers, multiplicative analysts and other scientific schools of financial analysis began to appear in the United States, promoting their scientific ideas.

Although it is generally accepted that the purpose of financial analysis is to assess the financial position and financial performance of an enterprise, as well as its future potential, there is no single approach to the nature of financial analysis [9] (Maslova, 2016).

Thus, some researchers view financial analysis as a type of economic analysis, some as an element of independent analysis, and others as a simple process. Let's take a look at the opinions of various financial analysis researchers in Table 1.

Table 1

Approaches of some researchers to financial analysis

|

Researcher

|

Approach

to financial analysis

|

|

A.D. Sheremet,

R S. Sayfulin, E.V. Negashev |

Financial

analysis is the analysis of financial indicators that reflect the financial

results and financial condition of an enterprise

|

|

O.V. Efimova

|

Financial

analysis is a process based on the study of the current and future financial

condition of an enterprise in order to assess its financial stability and the

effectiveness of decisions made

|

|

V.V. Kovalev

|

Financial

analysis is a set of analytical procedures based on open financial data at

the enterprise level to assess the economic potential and development

prospects of the enterprise

|

|

S.I. Krylov

|

Financial

analysis is a type of economic analysis associated with the study of the

financial results and financial condition of an organization

|

|

I.M.

Abbasov

|

Financial

analysis is a method of assessing and forecasting the financial condition of

an enterprise based on financial statements

|

|

S.Y.

Muslumov,

R.N. Kazımov |

Financial

analysis is a process based on the study of information about the current

financial condition and performance of an enterprise in order to assess the

prospects for its development

|

|

Y.B. Akhmedov,

P.E. Muxtarova |

Financial

analysis is a system for studying the financial condition of an enterprise

and the financial results of its activities, economic processes under the

influence of objective and subjective factors

|

|

N. Akdoghan,

N. Tenker,

|

The

process of analyzing and interpreting items in the financial statements of

one or more periods using various methods of analysis, depending on the

purpose of the analyst, taking into account their relationship with each

other, as well as with the relationship in general

|

|

A.

Chabuk, I. Lazol

|

This

is an assessment of the relationship between items in financial statements,

as well as dynamics over time, to assess the financial position, performance

and financial development of the company, to determine the aspects of its

development and to draw up future forecasts for the company

|

Various interpretations suggest that all authors in one or another way interpret financial analysis as an assessment of the financial position and financial performance of an organization.

In Western sources, the term "financial reporting analysis" is used more often than the term "financial analysis". Thus, financial analysis is viewed in the context of securities analysis, which distinguishes between fundamental and technical analysis. Fundamental analysis is a method of measuring the intrinsic value of a security by examining relevant economic and financial factors, the purpose of which is to determine whether the value of an investor's security is undervalued or overvalued [12] (Penman, 2013). Technical analysis is used to analyze statistical trends in prices and volumes in order to take advantage of "market opportunities".

K.R.Subramaniam characterizes the analysis of financial statements as an integral part of business analysis and views business analysis as improving business decisions by assessing the available information about the financial condition, management, plans, work environment and strategies of the company [16] (Subramanyam, 2014).

In our opinion, financial analysis can be defined in a narrow and broad sense. In a narrow sense, financial analysis refers to the analysis of the financial condition and financial results of an enterprise based on financial statements. A.D. Sheremet, S.I. Krylov, E.V. Negashe, N. Akdoghan and other scientists approach financial analysis from this direction, considering it as a part of the analysis of the economic activity of the enterprise.

In a broad sense, financial analysis is an analysis designed to assess the state and efficiency of using the economic potential of an enterprise, to identify the strengths and weaknesses of financial and economic activities, as well as to prepare management decisions to optimize results, identify, organize and analyze existing financial information. Such scientists as V.V. Kovalev, O.V. Efimova, A. Chabuk, Y.B. Akhmedov approach financial analysis from this direction. consider financial analysis not as a part of the analysis of economic activity, but as an independent element of the economic analysis of the enterprise as a whole.

According to A.D. Sheremet, the main goal of financial analysis is to obtain a small number of key parameters that give an objective and accurate picture of the financial condition of the enterprise, profit (loss), changes in the structure of assets and liabilities, settlements with debtors and creditors. He also notes that the content of the specific objectives of financial analysis depends on the responsibility of the subjects of the final analysis [15] (Sheremet, Sayfulin, Negashev, 2000).

Efimova systematized the tasks of financial analysis as follows [3] (Efimova, 2010):

• assessment of the property status of the analyzed enterprise;

• analysis of liquidity of individual active groups;

• study of the composition and structure of sources of assets formation;

• analysis of the relationship between individual groups of assets and liabilities;

• analysis of cash flows;

• preservation and assessment of capital gains .

We believe that the purpose of financial analysis is the timely identification and elimination of shortcomings in the activities of the enterprise, determination of the financial condition, stability and solvency, opportunities for improving financial performance, ensuring more flexible management by providing forecasts and information.

To achieve the goals of the analysis, a number of tasks are identified that regulate the requirements for the organization and analysis in the management system [4] (Doroshchuk, 2016).

In our opinion, we can systematize the tasks of financial analysis as follows:

· Provide information for various strategic decisions of the enterprise management.

· Identify the key factors causing changes in the financial position and financial performance of the company.

· Determination of the level of solvency and liquidity of the enterprise.

· Determination of the efficiency of the enterprise and its resources, the level of self-financing and the need for capital.

· Survey and assessment of the enterprise.

· Prepare forecasts of future activities.

· Find out to what extent the company has achieved its goals or the reasons for not achieving them.

Internal and external financial analysis

Certain approaches to financial analysis, as well as types and methods are selected in accordance with the goals and objectives of users.

In turn, financial analysis can be divided into internal and external. External financial analysis is based on the entity's published financial statements. The main purpose of this analysis is to assess the rating of the enterprise, property and financial condition, financial stability, solvency, i.e. reduce the risk of interaction between the enterprise and its partners.

The main features of external financial analysis are a large number of objects of analysis based on general principles (flexibility, science, complexity, systematic approach, objectivity, accuracy, reliability, regularity) and analytical data open to the public, limited database, retrospective or perspective.

Internal financial analysis is based on all information about the enterprise, including confidential information that is not available to external users and sometimes is not used by business owners, and is part of a comprehensive analysis of economic activities. The purpose of the analysis is to assess the state of the company's financial resources, make an internal rating assessment, analyze financial plans, investment projects and cash flows, determine the level of internal risk and thereby ensure effective liquidity management of an economic entity.

The peculiarities of internal financial analysis are a small number of data users, the use of all data sources for analysis, no regulation, maximum confidentiality of analysis results to protect trade secrets.

Since internal financial analysis is to some extent based on advances in management analysis, some researchers consider it to be an integral part of management analysis, while others consider it to be an integral part of financial analysis. In his book "Analysis of Management" H.A. Jafarli states that "management analysis" covers internal production and internal financial analysis. On the other hand, financial analysis can be both internal and external [5] (Jafarli, 2018).

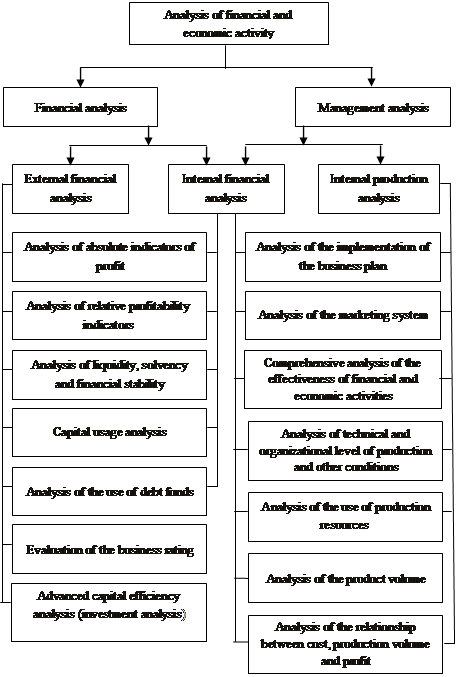

A.D. Sheremet connects the separation of financial and management analysis with the division of the accounting system, noting the possibility of deepening financial analysis through the use of management accounting data, characterizing such analysis as a full-fledged type of research and assessment [15] (Sheremet, Sayfulin, Negashev,2000). He also described the relationship between financial analysis and management analysis in a diagrammatic manner. Let's look at Figure 3.

Figure 3. Relationship between financial analysis and management analysis

Source: [14] (Shermet, 2011).

As can be seen from the figure, internal financial analysis examines not only liquidity, profit and profitability of financial relations, but also industrial relations processes such as business plan justification, comprehensive analysis of business efficiency, costs and output.

In our opinion, although internal financial analysis is closer to the methodology of financial analysis than management analysis, the users of this analysis are not subjects of financial analysis, but subjects of management analysis.

Another classification of financial analysis

In addition to internal and external analysis, we can classify modern analysis in other areas. Turkish researchers classify financial analysis according to its content, subject matter and purpose [2] (Chabuk, Lazol, 2018):

· By content, financial analysis is divided into static and dynamic. Static analysis is carried out for only one reporting year prepared on a specific date, while dynamic analysis is performed for consecutive reporting periods and by comparing data from other enterprises operating in the same sector.

· By subject, financial analysis is divided into internal and external. Analysis by employees of the enterprise is considered internal, and analysis by people working outside the enterprise is considered external.

· By its purpose, financial analysis is divided into investment, credit and management. Investment analysis is an analysis performed by potential or current investors or researchers themselves to calculate the value of an enterprise and investment. Credit analysis is carried out by specialized third-party researchers to determine the liquidity and solvency of the organization. Management analysis is a type of analysis used to guide decision making about an enterprise (optimizing the existing structure of the enterprise, determining the extent to which past decisions have served their purpose, and forecasting the future).

Depending on the object of financial analysis, the financial analysis of the enterprise as a whole is divided into the analysis of individual structural units, strategic business units and individual operations.

Retrospective, current, and prospective financial analysis differ depending on the timing. Retrospective analysis is generally associated with the study of the dynamics of financial and economic activity over several completed reporting periods. The current analysis is carried out with the aim of operatively influencing the actual results of financial and economic activities and is usually limited to a short period of time. Prospective (predictive) analysis is performed for the future period to predict the possible results of the enterprise and, as a rule, is based on the results of the retrospective analysis.

Depending on the scope of analytical research, complex and thematic financial analysis differ. A comprehensive thematic financial analysis is conducted to study all aspects of the financial and economic activities of the enterprise, and a thematic financial analysis is conducted to analyze the priority areas.

Depending on the frequency of the analysis, a one-time and regular analysis is performed. One-time financial analysis or regular financial analysis is performed to decide whether an enterprise has established or is maintaining a business relationship.

Researchers distinguish between express and detailed analysis in terms of conducting detailed financial analysis. Express analysis is aimed at obtaining a general idea of the financial condition of the enterprise based on horizontal and vertical analysis of financial reporting data, calculating a small number of financial ratios. A detailed financial analysis is carried out in order to obtain comprehensive information about the financial condition and financial results of the enterprise, as well as forecast indicators.

Users of financial analysis

The specific purpose of financial analysis in an enterprise largely depends on the users of the analysis. Analysis users are individuals or groups with an interest in the enterprise in terms of achieving its goals. Many local and Russian researchers divide the subjects of analysis into internal users with direct interest and external users with indirect interest.

In our opinion, users of analytical data should be classified as follows, depending on their direct relationship with the enterprise and access to financial and accounting information:

· Internal users – persons involved in the activities of the enterprise or working there. For example, founders, managers, employees.

· Related users – persons who do not participate in the activities of the enterprise and have a direct financial interest. For example, shareholders, suppliers, creditors, investors, as well as lawyers, auditors and professionals who provide them with consulting services.

· External users are persons who do not participate in the activities of the enterprise and have no financial interest, but can influence the activities of the enterprise. For example, the tax office, labor control and statistics bodies, courts and stock exchanges, associations and unions.

Regardless of the division, users' financial interests and analysis goals are different. Thus, an investor in the same group needs different information about the supplier. Table 2 shows the financial interests of the subjects of analysis.

Table 2

Financial interests of the subjects of analysis

|

Type

of user

|

User

|

Financial

interest

|

The

purpose of financial analysis

|

|

Internal users

|

Founder

|

Profit

growth

|

Financial

results and financial stability

|

|

Manager

|

Salary

and bonus

|

All

the information that is useful for management

| |

|

Employee

|

Salary

and social security

|

Financial

results and liquidity

| |

|

Related users

|

Shareholder

and investor

|

Dividend

|

Financial

position and financial results

|

|

Supplier

|

Debt

repayment

|

Liquidity

and solvency

| |

|

Lenders

|

İnterest

|

Solvency

and financial stability

| |

|

Customers

|

Cost

and sales price

|

Financial

position: product and commodity stocks

| |

|

External users

|

Government

|

Fulfillment

of obligations to the government

|

All

the information that is useful for government agencies

|

|

Public

organizations (associations, unions)

|

Membership

fees and donations

|

Financial

results

|

According to I.M. Abbasov, despite the fact that the auditor is an external financial user, the base of his analysis is richer than ordinary external users (specialists of investment companies, banks, etc.). In addition to the financial statements, financial and management accounting information, which is fully accessible to the auditor, includes the results of audit calculations [1] (Abbasov, 2001).

Conclusion

Since the 19th century, research in financial analysis, especially in American schools, has focused on the practical aspects of financial analysis – liquidity, solvency, forecasting financial distress, Balanced Scorecard Model, and optimal strategies for managing the risk of financial investments. At the same time, in the Soviet planned economy, economic analysis was carried out on the basis of the "plan-fact" relationship and was aimed at intensifying production.

Regardless of the form of approach to financial analysis, all researchers interviewed for the study agree that financial analysis is an important tool for predicting the financial position, financial performance and future performance of an organization. However, the spiraling development of the economy, various uncertainties and risks in business activities have created opportunities for applying financial analysis not only to financial results and financial condition, but also to new areas such as business continuity, decision making, cost-benefit ratio and organizational development strategy.

The theoretical and practical possibilities of financial analysis are being studied in all countries with market economies, including post-Soviet countries that have already completed their transition economies, and applied not only in important financial areas such as loans, investments, securities, insurance, but also as a key tool for all enterprises striving for sustainable development.

We believe that it is very important to combine both approaches on a single basis and apply a systematic approach in order to solve the conceptual problems that arise during this process.

Источники:

2. Акдоган Н., Тенкер Н., ФИНАНСОВАЯ ОТЧЕТНОСТЬ И МЕТОДЫ ФИНАНСОВОГО АНАЛИЗА - Анкара: Книжный магазин Gazi -2010 - стр. 7.

3. Джафарли Х.А. Управленческий анализ, -Баку: Издательство Экономического Университета - 2018 - стр.23

4. Дорощук А.И. Формально-логические исследования дефиниций платежеспособность и ликвидность // Экономика, предпринимательство и право. — 2016. — Том 6. — № 2. — С. 111-134. — doi: 10.18334/epp.6.2.35313

5. Ефимова О.В. Финансовый анализ: современные инструменты для принятия экономических решений - М. : Издательский дом «Омега-Л» -2010. - 24 с.

6. Ковалев В.В. Финансовый анализ: методы и процедуры - М .: Финансы и статистика, -2010. п. 27

7. Крылов С. И. Финансовый анализ: учебник - Екатеринбург: Уральское изд-во - 2016 - с. 5

8. Лиференко К.Н. Финансовый анализ предприятия - Баку: Издательство «Экономический Университет» - 2010 - 10 с.

9. Маслова Ю.Н. Влияние отличий МСФО и РСБУ на анализ финансовой отчетности организации // Экономика, предпринимательство и право. – 2016. – Том 6. – № 1. – С. 25-36. – doi: 10.18334/epp.6.1.35182.

10. Муслимов С.Ю., Кязимов Р.Н. Финансовый анализ - Баку: Азернешр -2011 -С.14.

11. Пенман С.Х. Анализ финансовой отчетности и оценка ценных бумаг NY: McGraw-Hill -2013 - p. 3

12. Селезнева Н. Н., Анализ финансовой отчетности организации - М .: ЕДИНСТВО-ДАНА-2012 - с. 10

13. Субраманьям К. Р. Анализ финансовой отчетности - Нью-Йорк: McGraw-Hill Education -2014 - стр. 4.

14. Чабук А., Лазол И. Анализ финансовой отчетности, - Бурса: Публикации Экин Китапеви –2018 - с. 152-157

15. Шеремет А.Д. Теория экономического анализа - М .: ИНФРА-М-2011 –С.98.

16. Шеремет А.Д., Сайфулин Р.С., Негашев Е.В. Методология финансового анализа - М: «ИНФРА-М» - 2000 - с. 8

17. Ю.Б. Ахмадов и др. Финансово-экономический анализ - Баку: Издательско-полиграфический центр «Мутарджим» - 2012 - с. 24

18. Ялкын Ю.К. Методы финансового анализа в бизнесе - Анкара: Издательство Университета Анкары - 1981 - с. 144–145

Страница обновлена: 27.12.2025 в 16:42:47

Download PDF | Downloads: 44 | Citations: 1

A review of theoretical approaches to financial analysis

Zeynalli E.J.Journal paper

Creative Economy

Volume 14, Number 10 (October 2020)

Abstract:

In a market economy full of uncertainties, it is not enough just to measure financial indicators such as assets, sales, or profits to assess the performance of an enterprise. Determining the efficiency of the enterprise is already possible by taking into account all the factors that make up this activity, and evaluating the specific relationship between them. In order to make the right decisions on financial management of the enterprise, it is necessary to approach different events and processes separately, evaluate the factors affecting it and interpret the results correctly, in short, use the capabilities of financial analysis. The scientific novelty of the presented article is the study of the approaches of researchers from countries with different levels of economic development, such as Azerbaijan, Turkey, Russia and the United States, on the nature, goals and objectives, types and users of financial analysis, and considers the scientific basis of their "narrow" and "broad" approach to analysis, compared by assessing the similarity with the economic conditions of the modern period. In this context, the developmental genesis of analysis, as well as financial analysis and economic analysis has been examined in general. The article may be of interest to researchers conducting research on the theoretical foundations and modern approaches of financial analysis.

Keywords: economic analysis, internal and external financial analysis, users of financial analysis

JEL-classification: G30, G39, O16

References:

Abbasov I.M. (2001). Finansovyy analiz v audite [Financial analysis in the audit] (in Russian).

Akdogan N., Tenker N. (2010). Finansovaya otchetnost i metody finansovogo analiza [Financial reporting and financial analysis methods] (in Russian).

Akhmadov Yu.B. i dr. (2012). Finansovo-ekonomicheskiy analiz [Financial and economic analysis] (in Russian).

Chabuk A., Lazol I. (2018). Analiz finansovoy otchetnosti [Financial statement analysis] (in Russian).

Doroschuk A.I. (2016). Formalno-logicheskie issledovaniya definitsiy platezhesposobnost i likvidnost [Formal and logical studies of notions "financial solvency" and "liquidity"]. Journal of Economics, Entrepreneurship and Law. (2). 111-134. (in Russian). doi: 10.18334/epp.6.2.35313.

Dzhafarli Kh.A. (2018). Upravlencheskiy analiz [Management analysis] (in Russian).

Efimova O.V. (2010). Finansovyy analiz: sovremennye instrumenty dlya prinyatiya ekonomicheskikh resheniy [Financial analysis: modern tools for making economic decisions] (in Russian).

Kovalev V.V. (2010). Finansovyy analiz: metody i protsedury [Financial analysis: methods and procedures] (in Russian).

Krylov S. I. (2016). Finansovyy analiz [Financial analysis] (in Russian).

Liferenko K.N. (2010). Finansovyy analiz predpriyatiya [Financial analysis of the company] (in Russian).

Maslova Yu.N. (2016). Vliyanie otlichiy MSFO i RSBU na analiz finansovoy otchetnosti organizatsii [The influence of differences between ifrs and ras (russian accounting standards) on the analysis of financial statements of enterprises]. Journal of Economics, Entrepreneurship and Law. (1). 25-36. (in Russian). doi: 10.18334/epp.6.1.35182.

Muslimov S.Yu., Kyazimov R.N. (2011). Finansovyy analiz [Financial analysis] (in Russian).

Penman S.H. (2013). Financial statement analysis and security valuation

Selezneva N. N. (2012). Analiz finansovoy otchetnosti organizatsii [Analysis of the organization's financial statements] (in Russian).

Sheremet A.D. (2011). Teoriya ekonomicheskogo analiza [Theory of economic analysis] (in Russian).

Sheremet A.D., Sayfulin R.S., Negashev E.V. (2000). Metodologiya finansovogo analiza [Financial analysis methodology] (in Russian).

Subramanyam K. R. (2014). Financial statement analysis

Yalkyn Yu.K. (1981). Metody finansovogo analiza v biznese [Methods of financial analysis in business] (in Russian).